1/27 1st day of the month.. #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> market analysis time!

https://abs.twimg.com/hashflags... draggable="false" alt=""> market analysis time!  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥳" title="Partying face" aria-label="Emoji: Partying face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥳" title="Partying face" aria-label="Emoji: Partying face">

This edition, I& #39;ll look at 3 questions:

- Why did we dip (again)?

- Is there still demand?

- Is there still room for growth?

A relatively long https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> this time, but I think you may just like it

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> this time, but I think you may just like it  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤫" title="Schh!-Gesicht" aria-label="Emoji: Schh!-Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤫" title="Schh!-Gesicht" aria-label="Emoji: Schh!-Gesicht">

This edition, I& #39;ll look at 3 questions:

- Why did we dip (again)?

- Is there still demand?

- Is there still room for growth?

A relatively long

2/27 Alright, lets first just look at the price chart

#bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> started the month strong, rallying to a new ATH at ~$64.9k, but then dropped to ~$47.0k (-27.56%), where it found a lot of confluence for support (e.g., Fibonacci, UTXO realized price, whale inflows, NVT Price)

https://abs.twimg.com/hashflags... draggable="false" alt=""> started the month strong, rallying to a new ATH at ~$64.9k, but then dropped to ~$47.0k (-27.56%), where it found a lot of confluence for support (e.g., Fibonacci, UTXO realized price, whale inflows, NVT Price)

#bitcoin

3/27 Upon writing these monthly analyses, I& #39;m spotting a trend: I& #39;m writing about a dip each month  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Lächelndes Gesicht mit offenem Mund und Angstschweiß" aria-label="Emoji: Lächelndes Gesicht mit offenem Mund und Angstschweiß">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Lächelndes Gesicht mit offenem Mund und Angstschweiß" aria-label="Emoji: Lächelndes Gesicht mit offenem Mund und Angstschweiß">

If anyone has an explanation for why the #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> price dips near the end of each month, I& #39;m all ears

https://abs.twimg.com/hashflags... draggable="false" alt=""> price dips near the end of each month, I& #39;m all ears  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👂" title="Ohr" aria-label="Emoji: Ohr">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👂" title="Ohr" aria-label="Emoji: Ohr">

@WClementeIII also noticed this: https://twitter.com/WClementeIII/status/1385332498608046082">https://twitter.com/WClemente...

If anyone has an explanation for why the #bitcoin

@WClementeIII also noticed this: https://twitter.com/WClementeIII/status/1385332498608046082">https://twitter.com/WClemente...

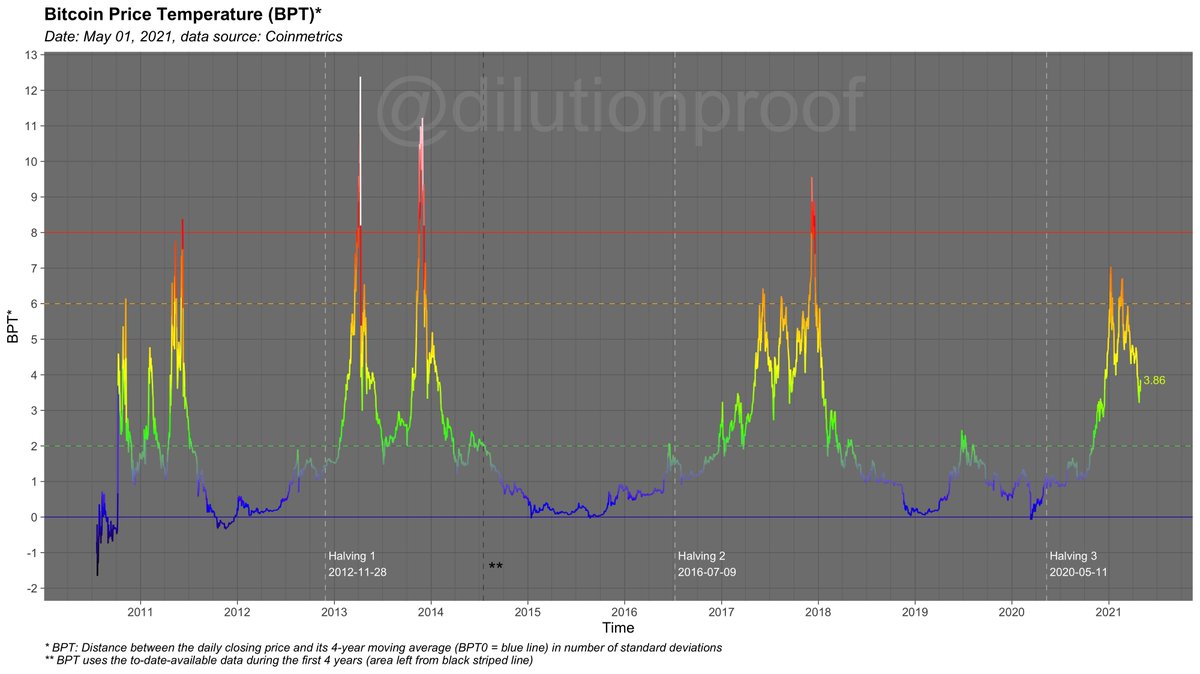

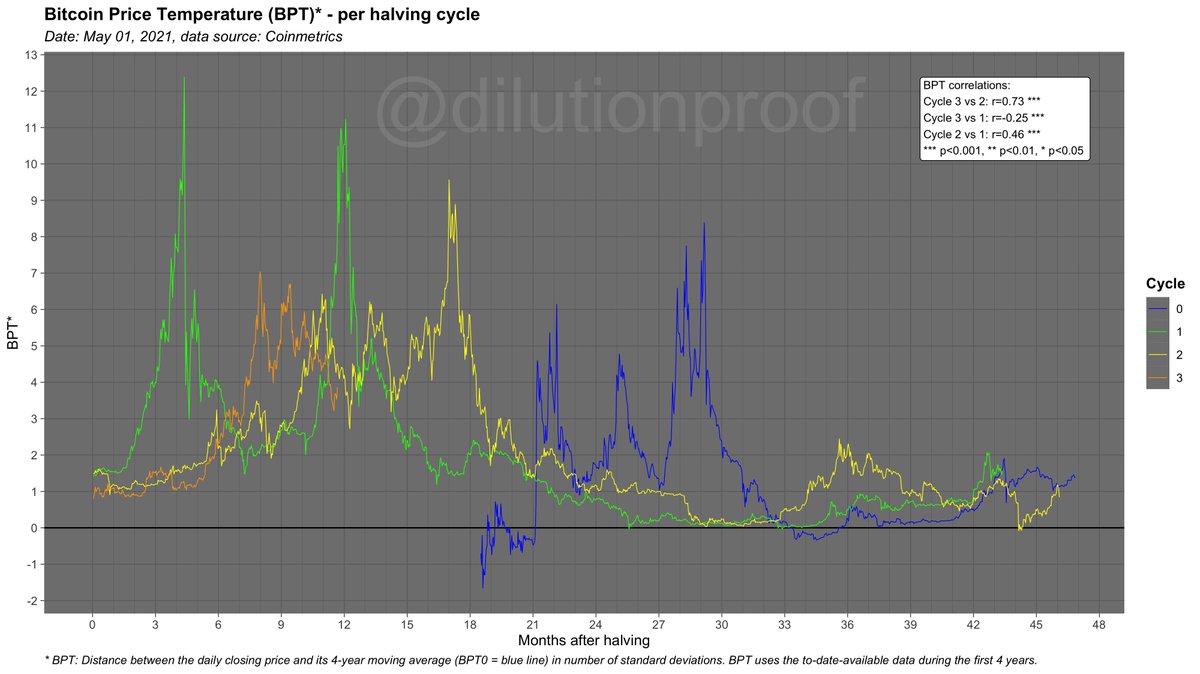

4/27 So why these dips? Multiple angles to take.

First: Price ramped up FAST this cycle in comparison to 2017

#Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Price Temperature (BPT) reached a

https://abs.twimg.com/hashflags... draggable="false" alt=""> Price Temperature (BPT) reached a  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> of 6 multiple times at an earlier post-halving date than the previous cycle

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> of 6 multiple times at an earlier post-halving date than the previous cycle

Some price exhaustion could be expected https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥵" title="Hot face" aria-label="Emoji: Hot face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥵" title="Hot face" aria-label="Emoji: Hot face">

First: Price ramped up FAST this cycle in comparison to 2017

#Bitcoin

Some price exhaustion could be expected

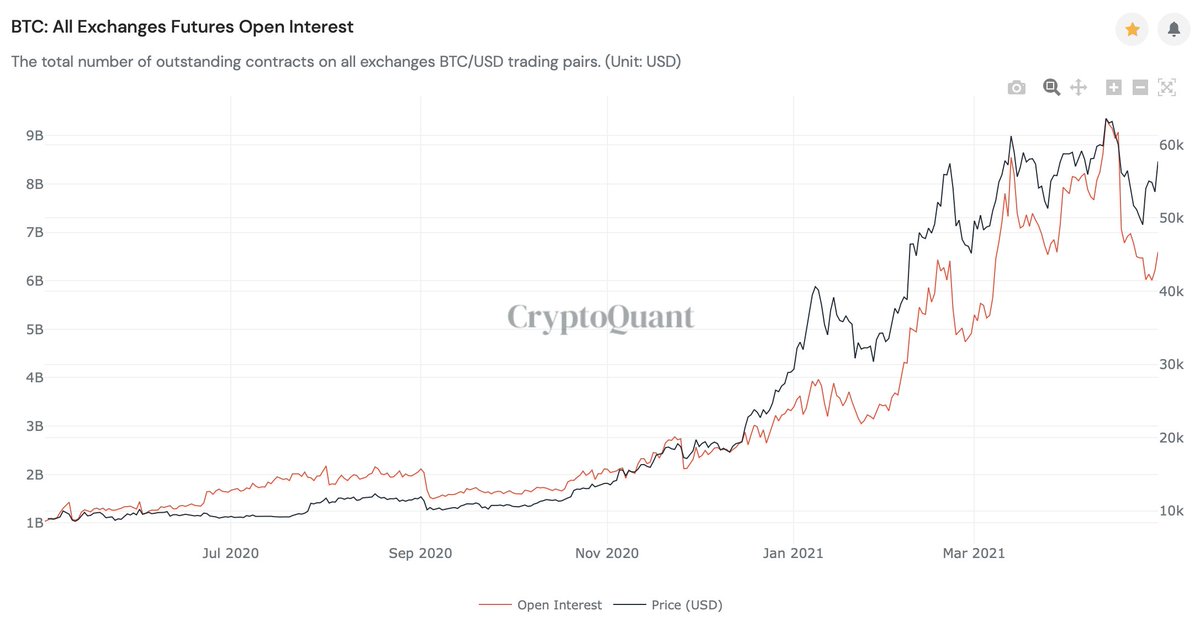

5/27 As price ran up, more market participants became excited about #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> and took on leveraged bets at an increasing rate, causing open interest on futures to skyrocket

https://abs.twimg.com/hashflags... draggable="false" alt=""> and took on leveraged bets at an increasing rate, causing open interest on futures to skyrocket

Not just the #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> price (&

https://abs.twimg.com/hashflags... draggable="false" alt=""> price (&  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer">) needed to cool off - so did the leverage in the system (which it has)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer">) needed to cool off - so did the leverage in the system (which it has)

Not just the #Bitcoin

6/27 The amount of pain of those degenerate gamblers that aped long on leverage during this parabolic rise is visualized in this long liquidations chart

Lesson: when everyone & their mom is long, it pays to be short - especially if you& #39;re a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> that can help push the price down

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> that can help push the price down

Lesson: when everyone & their mom is long, it pays to be short - especially if you& #39;re a

7/27 ..which is exactly what happened  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">

I wrote a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> about it using @whale_map data, to show that the dip started with a large, somewhat old (Aug & #39;20) whale taking profits, creating a cascading effect of profit taking towards younger whales that even capitulated at a loss

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> about it using @whale_map data, to show that the dip started with a large, somewhat old (Aug & #39;20) whale taking profits, creating a cascading effect of profit taking towards younger whales that even capitulated at a loss

I wrote a

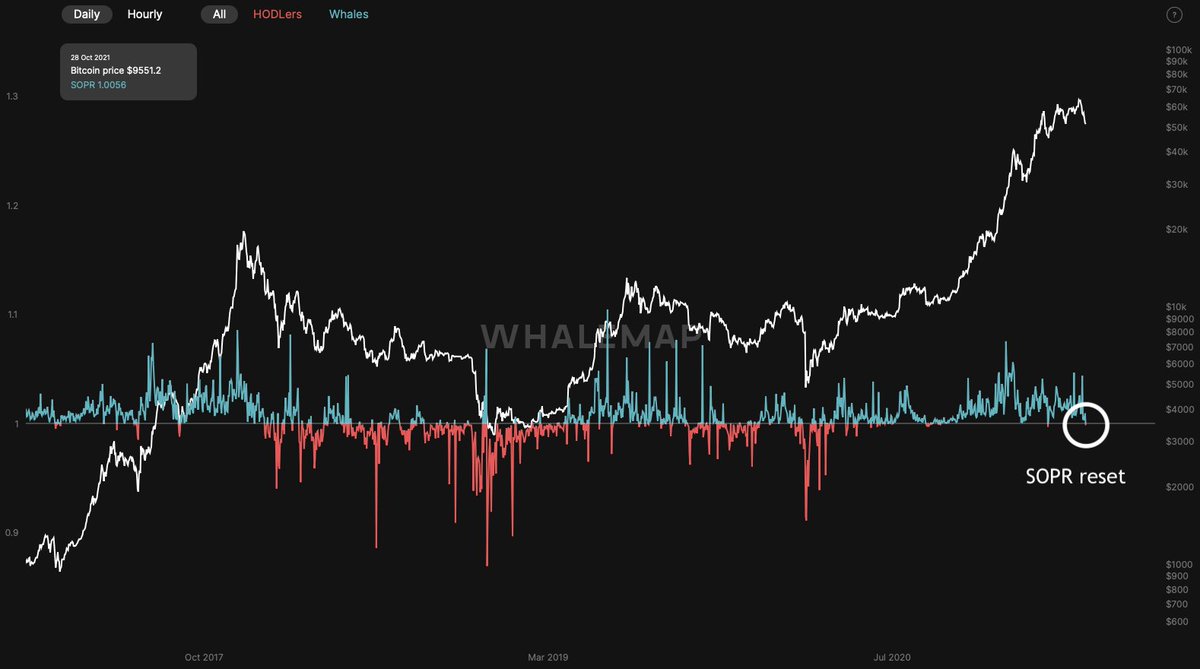

8/27 I concluded that thread with a chart of the Spent Output Profit Ratio (SOPR), that had just reset back to 1

This means that on average, the last sold coins were neither in profit nor at a loss - an indication that the & #39;profit taking potential& #39; turned neutral (which is good)

This means that on average, the last sold coins were neither in profit nor at a loss - an indication that the & #39;profit taking potential& #39; turned neutral (which is good)

9/27 Around that same time, the #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> price was touching @woonomic& #39;s NVT price model, which had worked as a support during the previous bull runs as well https://twitter.com/dilutionproof/status/1386272877255839744">https://twitter.com/dilutionp...

https://abs.twimg.com/hashflags... draggable="false" alt=""> price was touching @woonomic& #39;s NVT price model, which had worked as a support during the previous bull runs as well https://twitter.com/dilutionproof/status/1386272877255839744">https://twitter.com/dilutionp...

10/27 There was also a large drop in hash power on the network due to power problems in China, that caused the @woonomic& #39;s hash ribbons to compress, creating a miner capitulation signal on @caprioleio& #39;s indicator - which also is bullish https://twitter.com/dilutionproof/status/1386709488443576325">https://twitter.com/dilutionp...

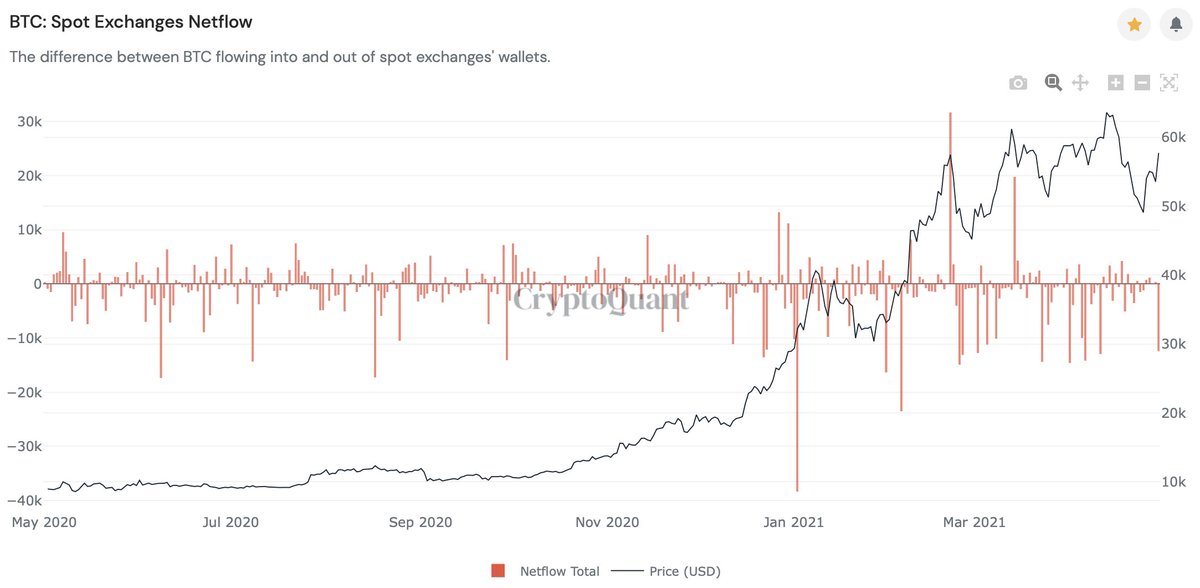

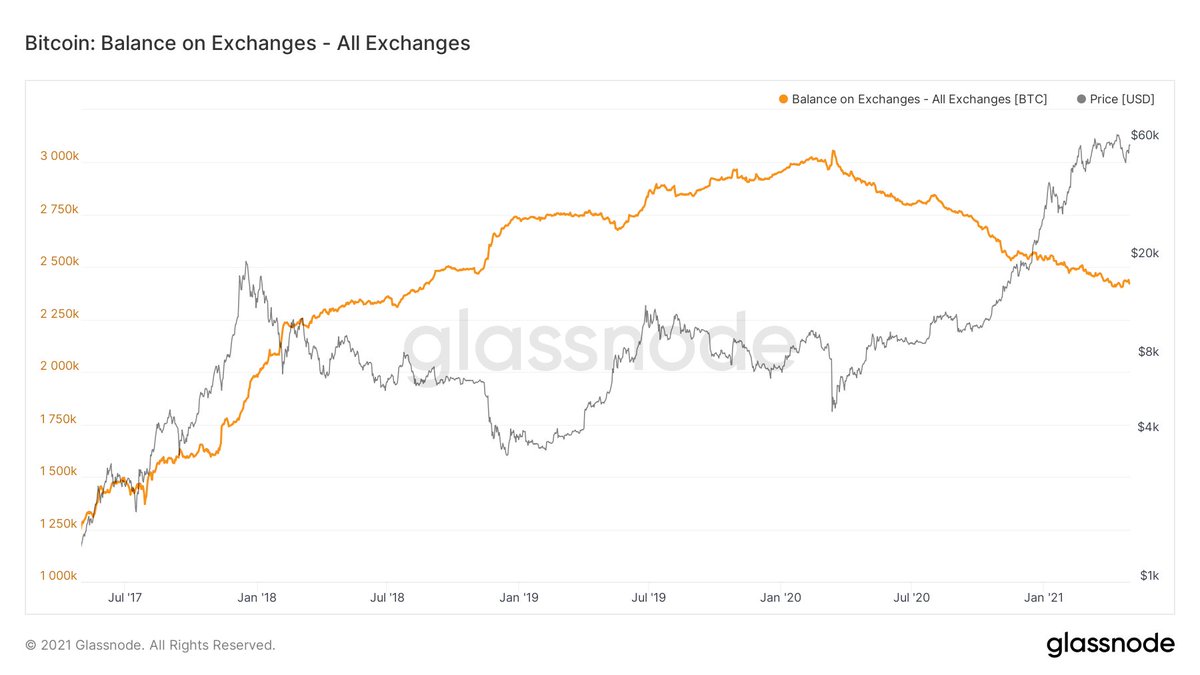

11/27 Since then, the #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> price bounced back resiliently, even closing the month off at ~$57.8k, which is barely even a red candle (-1.7%)

https://abs.twimg.com/hashflags... draggable="false" alt=""> price bounced back resiliently, even closing the month off at ~$57.8k, which is barely even a red candle (-1.7%)

What is encouraging, is that this rise was accompanied by large exchange withdrawals - the big boys are buying right now https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

What is encouraging, is that this rise was accompanied by large exchange withdrawals - the big boys are buying right now

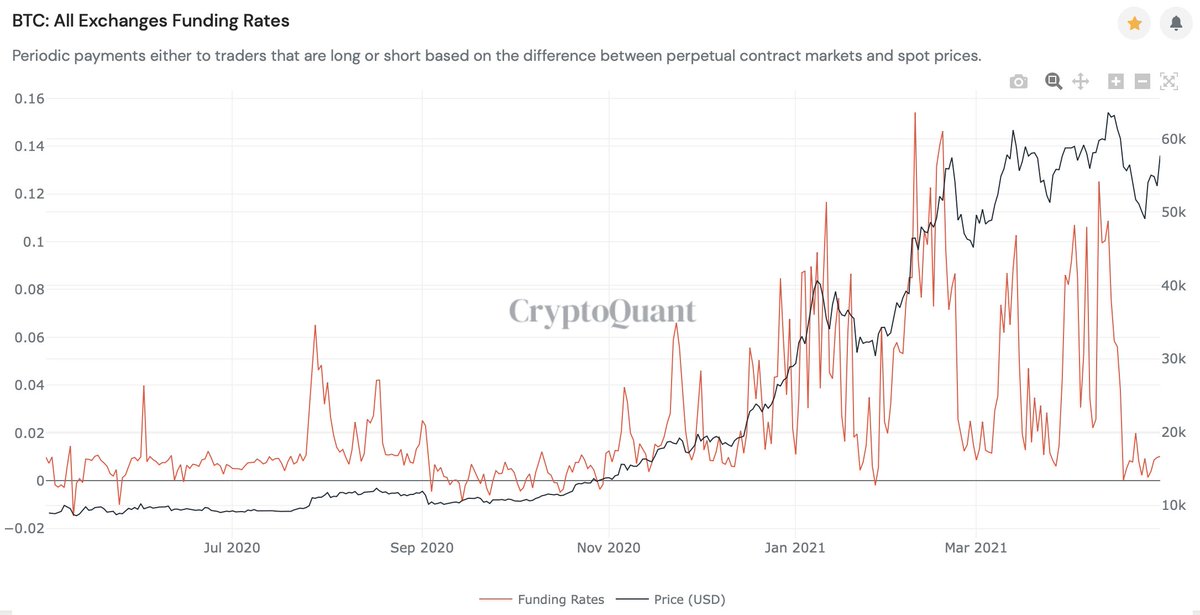

12/27 Perhaps an even more comforting thought; this last price rise was not accompanied by a rise in funding rates, which is a sign that it was spot-markets driven

The apes that went long & got rekt are now either on the sidelines or learned their lesson and bought spot https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧠" title="Gehirn" aria-label="Emoji: Gehirn">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧠" title="Gehirn" aria-label="Emoji: Gehirn">

The apes that went long & got rekt are now either on the sidelines or learned their lesson and bought spot

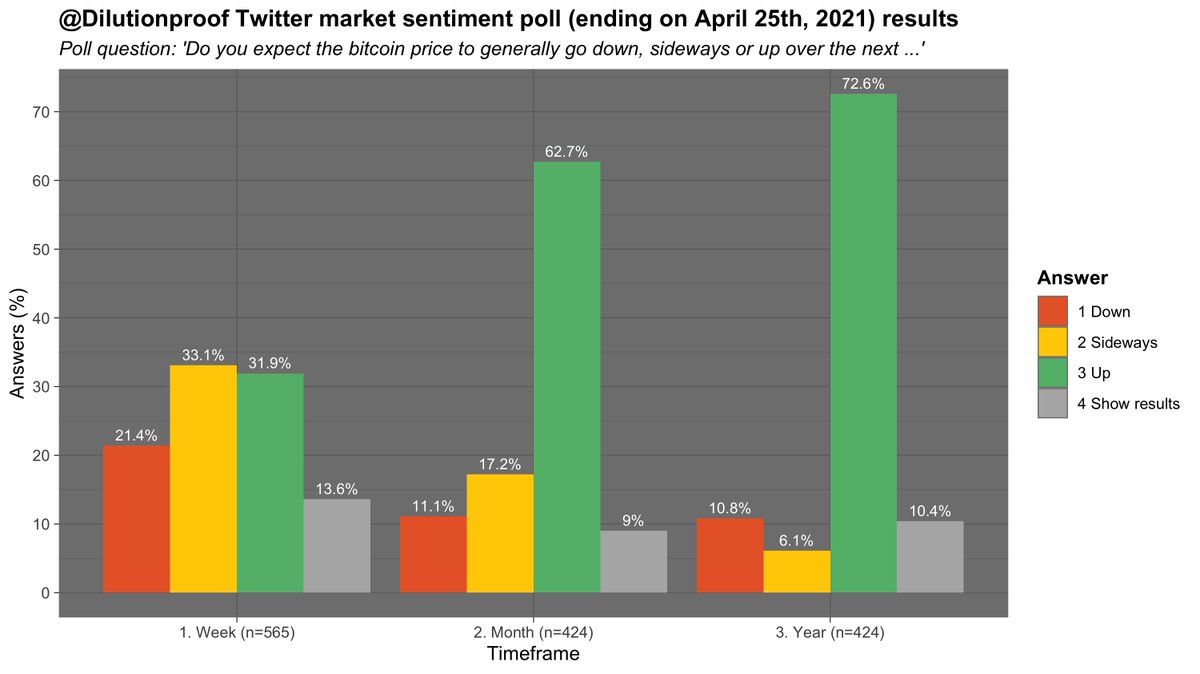

13/27 So what is the market sentiment like, currently?

I held a Twitter poll last week and the results were clear; respondents were indifferent short-term, but very much bullish on #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> mid- to long-term

https://abs.twimg.com/hashflags... draggable="false" alt=""> mid- to long-term  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">

https://twitter.com/dilutionproof/status/1386280911755481094">https://twitter.com/dilutionp...

I held a Twitter poll last week and the results were clear; respondents were indifferent short-term, but very much bullish on #Bitcoin

https://twitter.com/dilutionproof/status/1386280911755481094">https://twitter.com/dilutionp...

14/27 So is there still demand for #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> then?

https://abs.twimg.com/hashflags... draggable="false" alt=""> then?

Short answer: yes

Slightly longer answer: lets look at some trends

The declining exchange balances since last year& #39;s COVID-19 market panic is perhaps the most famous one, and overall still is intact https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤩" title="Vom Star geblendet" aria-label="Emoji: Vom Star geblendet">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤩" title="Vom Star geblendet" aria-label="Emoji: Vom Star geblendet">

Short answer: yes

Slightly longer answer: lets look at some trends

The declining exchange balances since last year& #39;s COVID-19 market panic is perhaps the most famous one, and overall still is intact

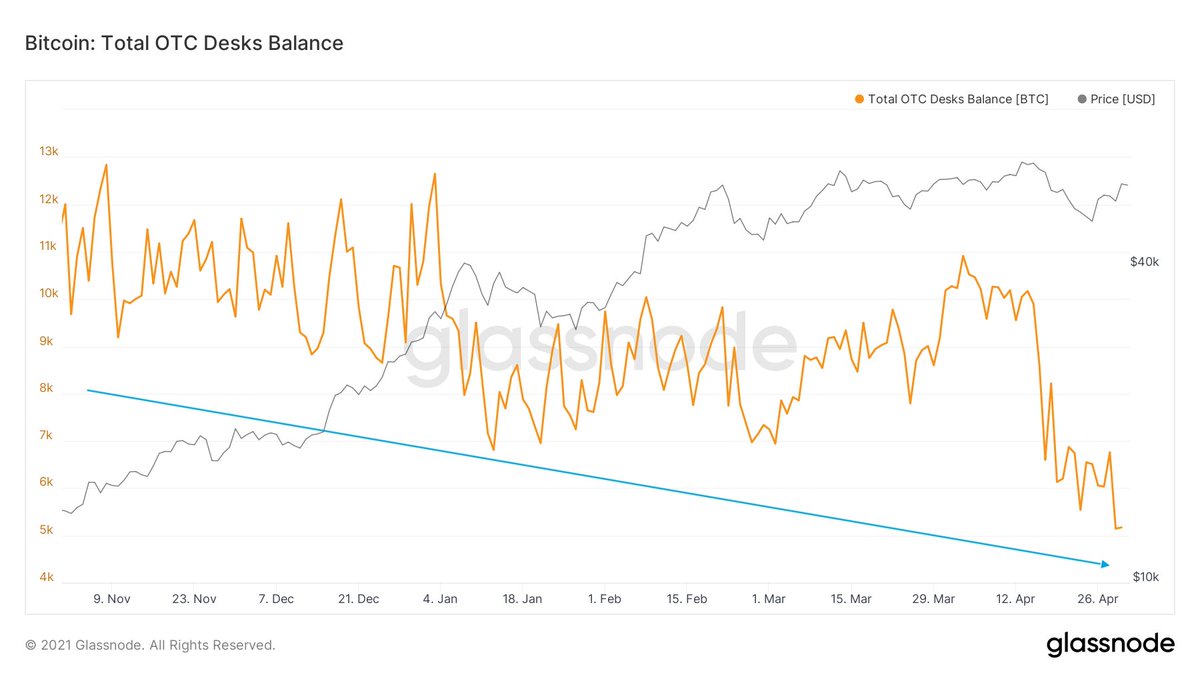

15/27 A similar pattern can be witnessed at the balances of Over The Counter (OTC) trading desks

The supply shortage is real; there is a decreasing amount of coins circulating on the market, which means that price must go up to entice HODL& #39;ers to sell

Chart via @mskvsk https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">

The supply shortage is real; there is a decreasing amount of coins circulating on the market, which means that price must go up to entice HODL& #39;ers to sell

Chart via @mskvsk

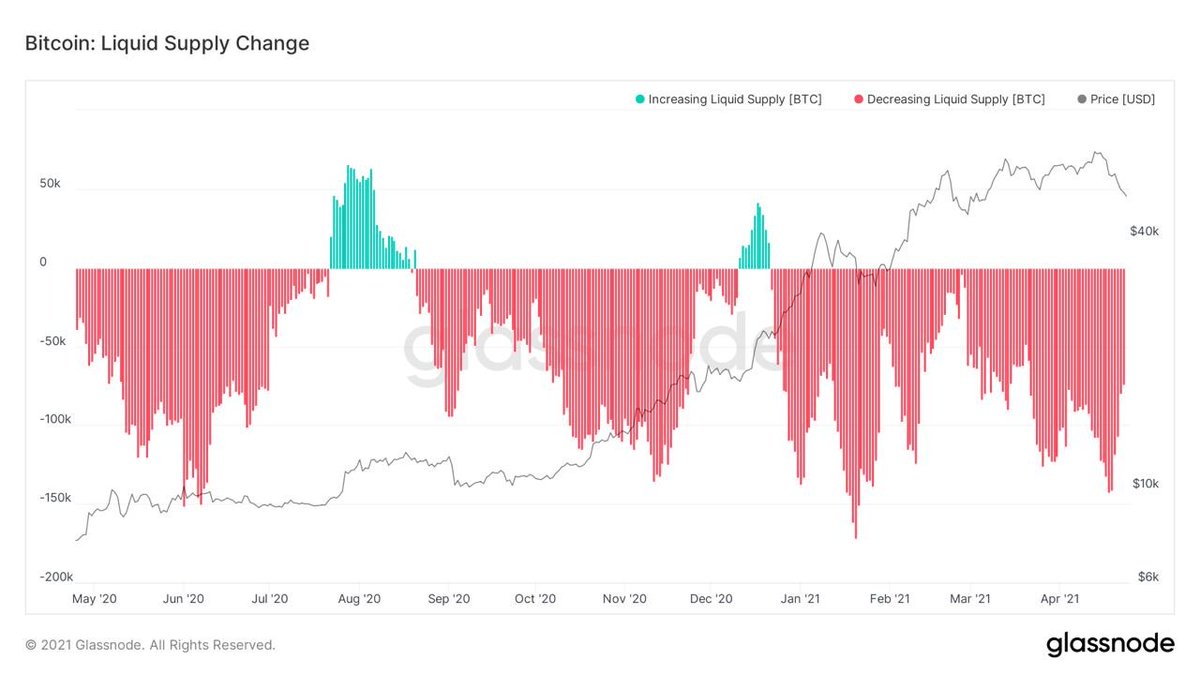

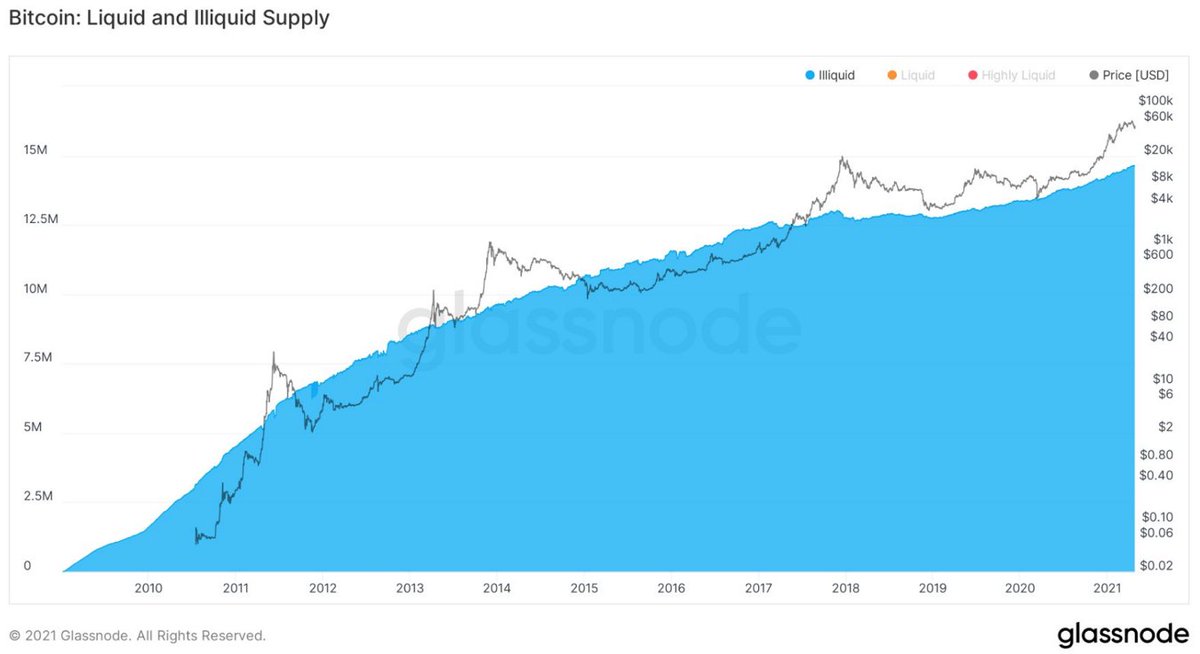

16/27 That trend becomes even more clear when you see that the liquid market supply has decreased on a daily basis all year so far, and thus the illiquid supply (coins in the hands of HODL& #39;ers with no history of selling) keeps growing

Charts via @WClementeIII https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">

Charts via @WClementeIII

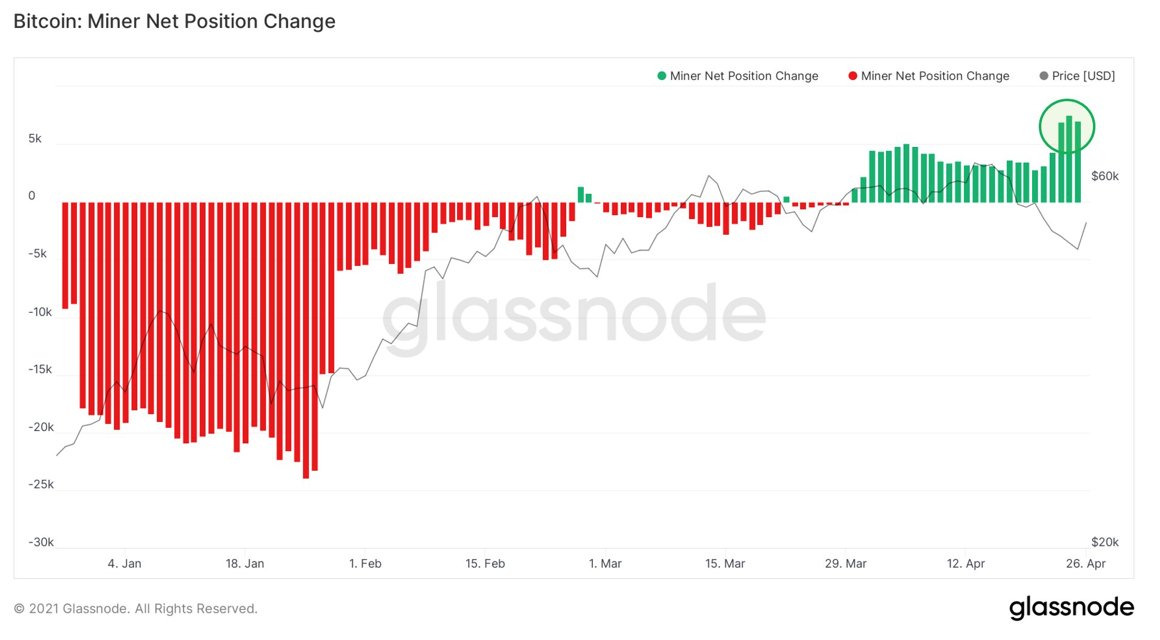

17/27 A similar pattern can be witnessed with miners, that were taking profits in January but have stopped doing so since late March - and have been accumulating ever since

If these guys aren& #39;t taking care of the supply shortage, who will? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

Chart via @WClementeIII https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">

If these guys aren& #39;t taking care of the supply shortage, who will?

Chart via @WClementeIII

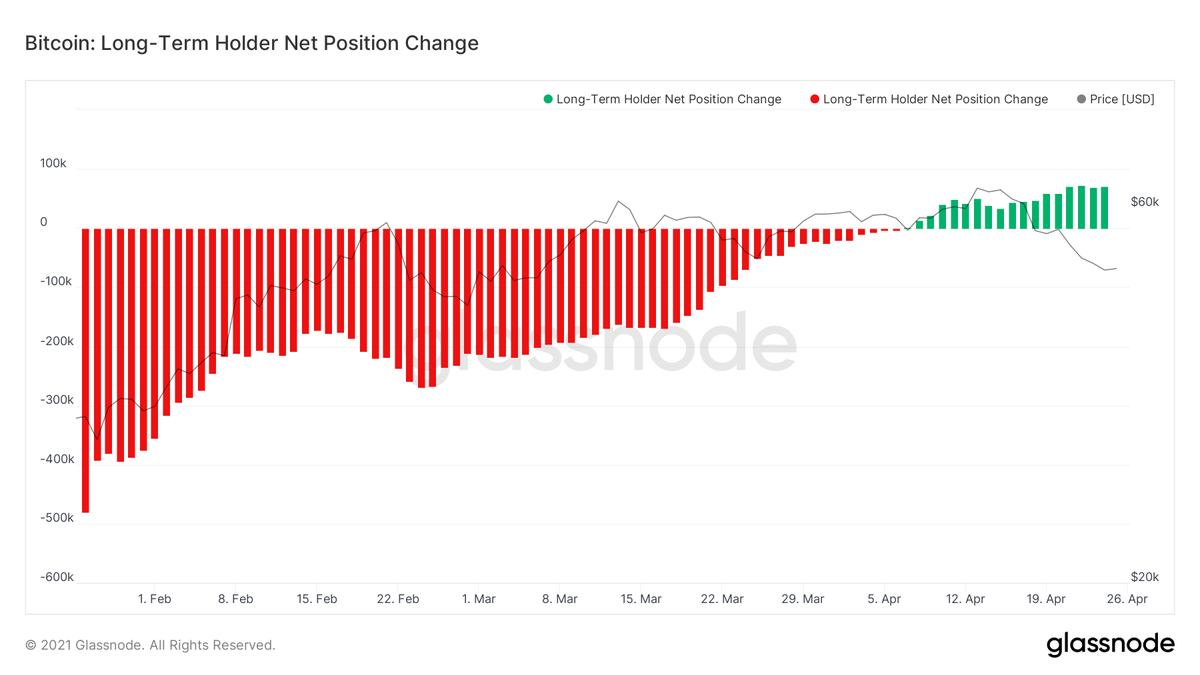

18/27 The answer is clear; if not for newly created #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">, existing coins need to become available to the market to meet the new demand

https://abs.twimg.com/hashflags... draggable="false" alt="">, existing coins need to become available to the market to meet the new demand

The problem is with that is that HODL& #39;ers are not selling - they are buying https://abs.twimg.com/emoji/v2/... draggable="false" alt="😯" title="Schweigendes Gesicht" aria-label="Emoji: Schweigendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😯" title="Schweigendes Gesicht" aria-label="Emoji: Schweigendes Gesicht">

Again, chart via @WClementeIII https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍺" title="Bierkrug" aria-label="Emoji: Bierkrug">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍺" title="Bierkrug" aria-label="Emoji: Bierkrug">

The problem is with that is that HODL& #39;ers are not selling - they are buying

Again, chart via @WClementeIII

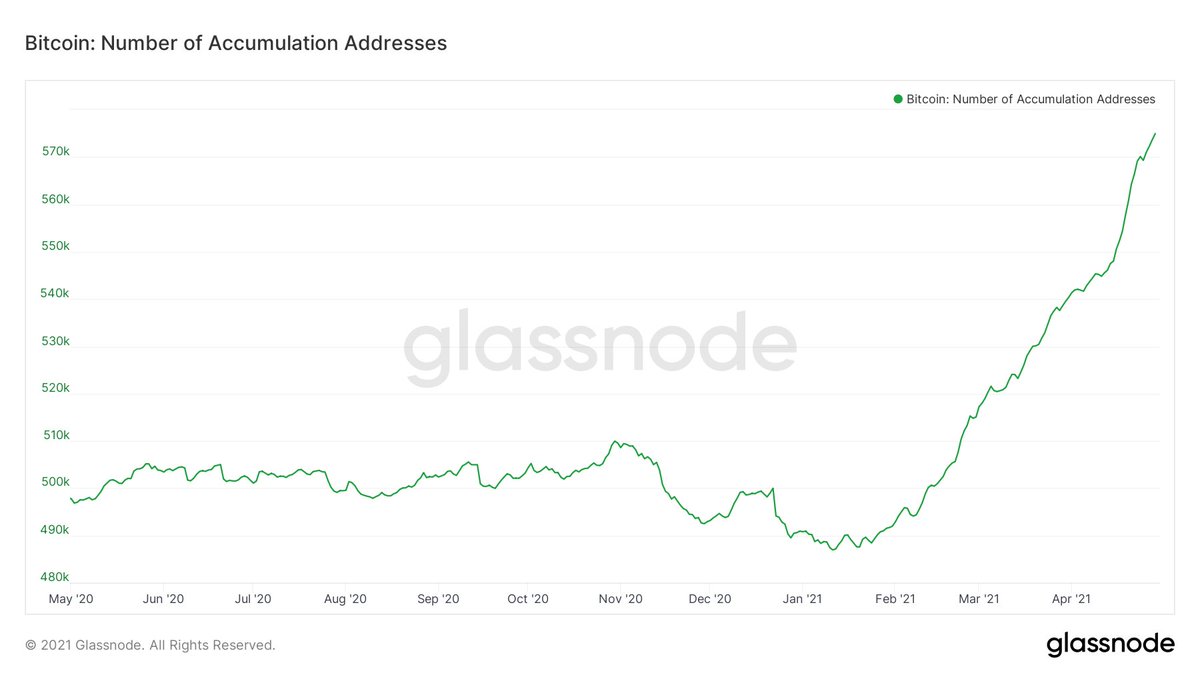

19/27 So that must mean that an increasing number of addresses are accumulating right now, right?

Corrrrectemundo! https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">

Again chart via @WClementeIII https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder"> (if you are not already following him at this point, you& #39;re doing it wrong)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder"> (if you are not already following him at this point, you& #39;re doing it wrong)

Corrrrectemundo!

Again chart via @WClementeIII

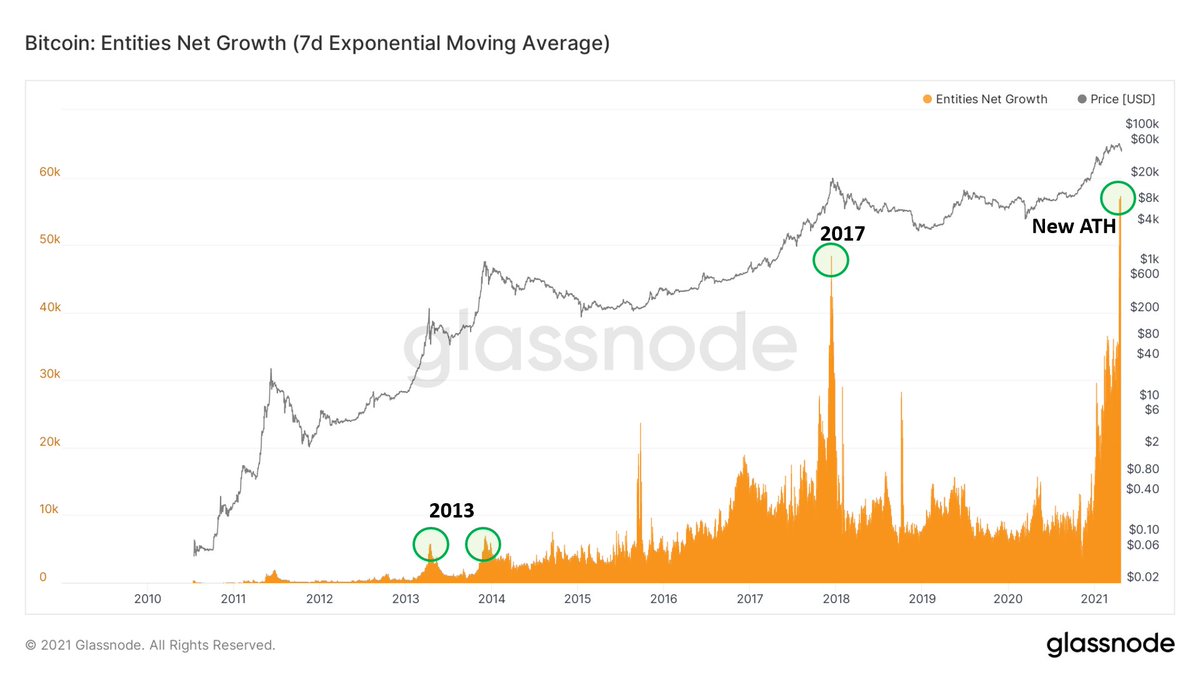

20/27 Right, but those addresses can all belong to a single  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">. Are there actually new entities coming to the network?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">. Are there actually new entities coming to the network?

Yup - more than ever https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

Chart via.. ah you know who https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht"> (last one for now, I promise!)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht"> (last one for now, I promise!)

Yup - more than ever

Chart via.. ah you know who

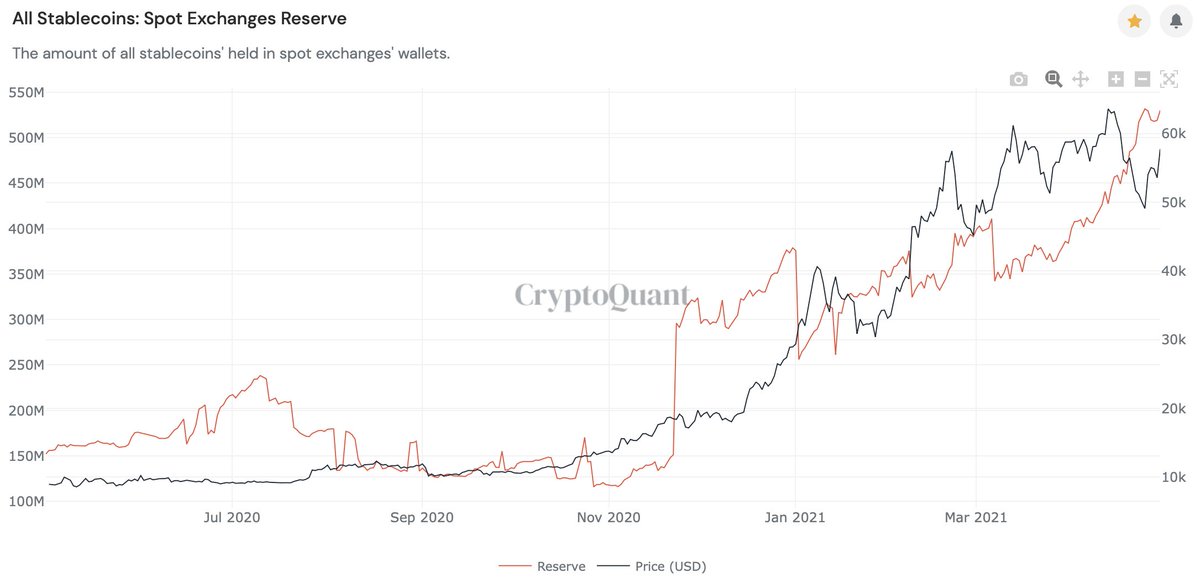

21/27 Another encouraging signal that demand is lining up: the stablecoin reserves on spot exchanges are currently relatively high, which is potentially a signal that dry powder is ready to buy the next dip - or perhaps FOMO in if price runs away from them  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">

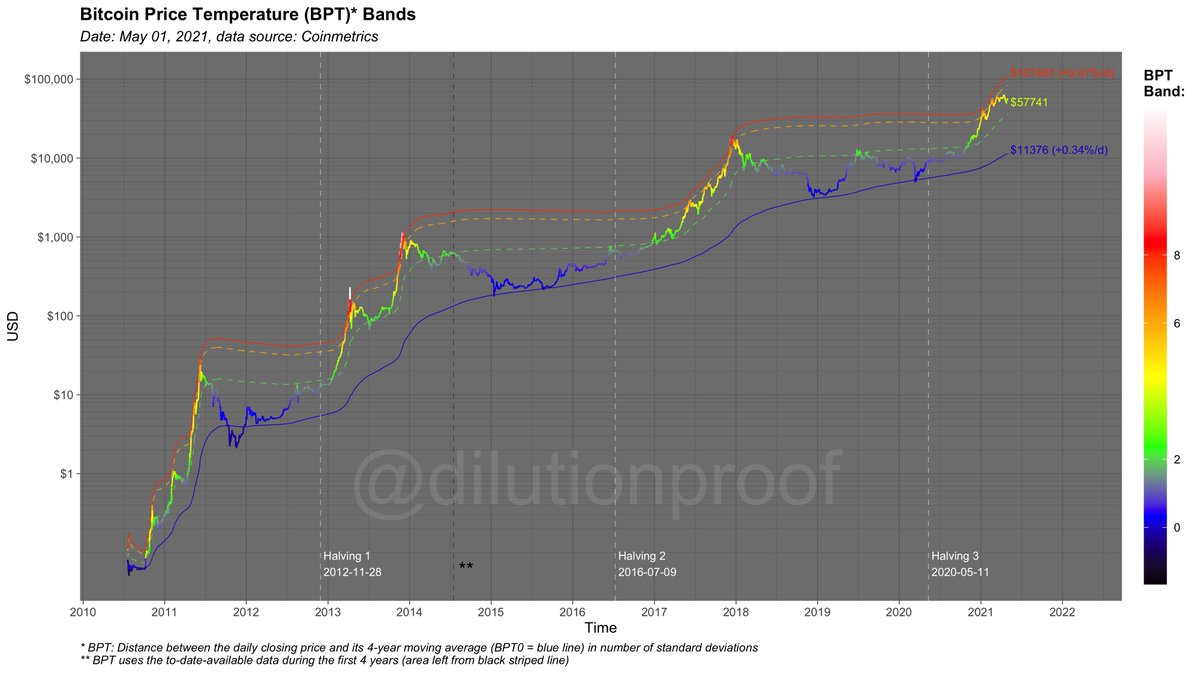

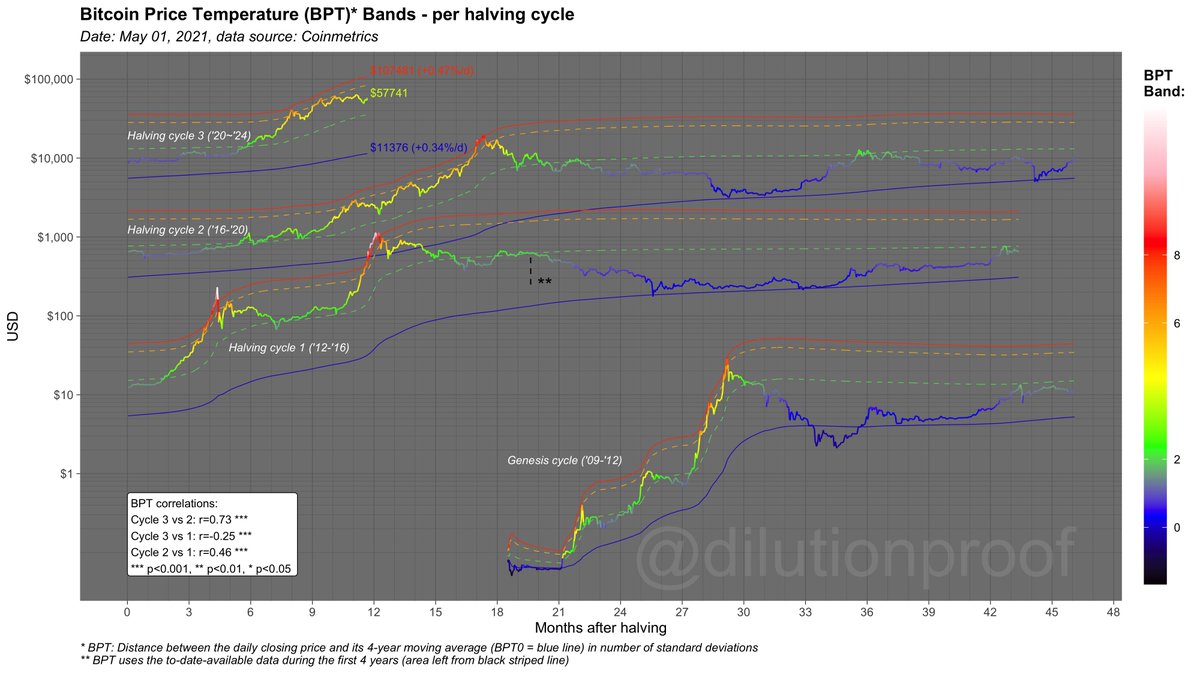

22/27 What about the room for growth?

Like we saw with the BPT, the Market Value to Realized Value (MVRV) Z-score recently reached relatively high levels, but has dropped, after #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s realized value itself went up

https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s realized value itself went up

If this cycle is like the previous ones, there is room left

Like we saw with the BPT, the Market Value to Realized Value (MVRV) Z-score recently reached relatively high levels, but has dropped, after #Bitcoin

If this cycle is like the previous ones, there is room left

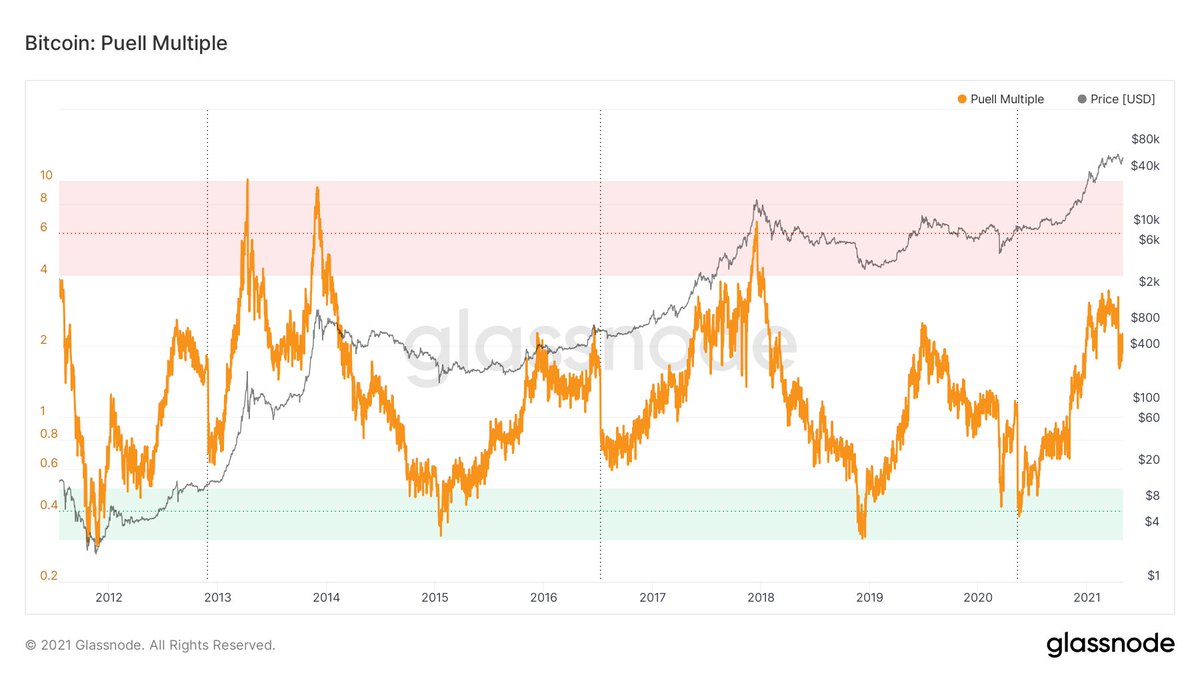

23/27 Similarly, the Puell Multiple - a metric that quantifies to what extent the daily coin issuance is increased in comparison to its 1-year moving average - was at relatively high levels, but recently dropped after the hash rate drop on the network

24/27 Less convincing is the status of @hansthered& #39;s Reserve Risk that quantifies to what extent long-term holders are selling

Some HODL& #39;ers were taking profits during this run but in comparison to previous cycles, HODL& #39;er conviction is still high (waiting for higher prices?)

Some HODL& #39;ers were taking profits during this run but in comparison to previous cycles, HODL& #39;er conviction is still high (waiting for higher prices?)

25/27 @PositiveCrypto& #39;s Realized HODL Ratio uses a different approach to actually tackle that same angle - HODL& #39;er confidence

As expected, the RHODL Ratio paints a similar picture - still room for growth in comparison to previous cycles

Click below to read the last 2 tweets https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

As expected, the RHODL Ratio paints a similar picture - still room for growth in comparison to previous cycles

Click below to read the last 2 tweets

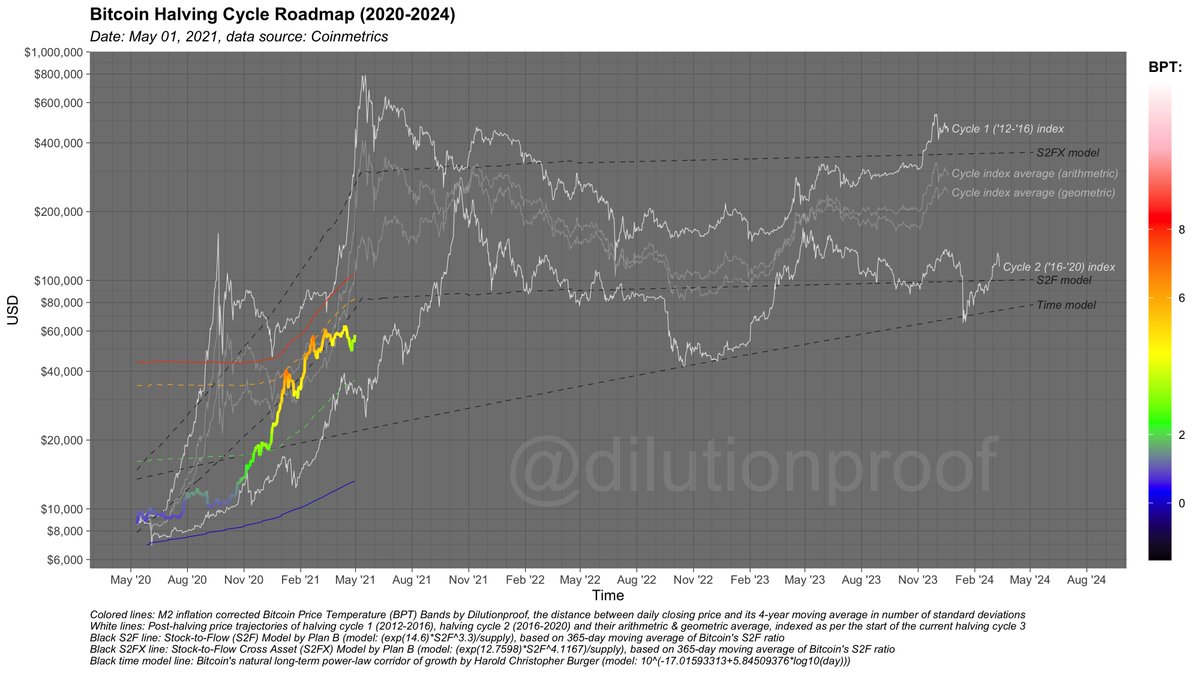

26/27 To close off my monthly analysis thread, I like to use my #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> Halving Cycle Roadmap chart

https://abs.twimg.com/hashflags... draggable="false" alt=""> Halving Cycle Roadmap chart

As the #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Price Temperature

https://abs.twimg.com/hashflags... draggable="false" alt=""> Price Temperature  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> cooled off towards green, it is now lagging behind most of the other price models that are visualized here

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> cooled off towards green, it is now lagging behind most of the other price models that are visualized here

(When) will it catch up...? https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

As the #Bitcoin

(When) will it catch up...?

27/27 To conclude:

- Compared to 2017, the bull run was intense; some exhaustion was normal

- The market was (over)leveraged, but now less so

- The demand for #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> appears strong as ever

https://abs.twimg.com/hashflags... draggable="false" alt=""> appears strong as ever

- If this cycle is like the others there is room for growth on most market cycle metrics

- Compared to 2017, the bull run was intense; some exhaustion was normal

- The market was (over)leveraged, but now less so

- The demand for #bitcoin

- If this cycle is like the others there is room for growth on most market cycle metrics

Read on Twitter

Read on Twitter started the month strong, rallying to a new ATH at ~$64.9k, but then dropped to ~$47.0k (-27.56%), where it found a lot of confluence for support (e.g., Fibonacci, UTXO realized price, whale inflows, NVT Price)" title="2/27 Alright, lets first just look at the price chart #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> started the month strong, rallying to a new ATH at ~$64.9k, but then dropped to ~$47.0k (-27.56%), where it found a lot of confluence for support (e.g., Fibonacci, UTXO realized price, whale inflows, NVT Price)" class="img-responsive" style="max-width:100%;"/>

started the month strong, rallying to a new ATH at ~$64.9k, but then dropped to ~$47.0k (-27.56%), where it found a lot of confluence for support (e.g., Fibonacci, UTXO realized price, whale inflows, NVT Price)" title="2/27 Alright, lets first just look at the price chart #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> started the month strong, rallying to a new ATH at ~$64.9k, but then dropped to ~$47.0k (-27.56%), where it found a lot of confluence for support (e.g., Fibonacci, UTXO realized price, whale inflows, NVT Price)" class="img-responsive" style="max-width:100%;"/>

Price Temperature (BPT) reached a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> of 6 multiple times at an earlier post-halving date than the previous cycleSome price exhaustion could be expected https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥵" title="Hot face" aria-label="Emoji: Hot face">" title="4/27 So why these dips? Multiple angles to take.First: Price ramped up FAST this cycle in comparison to 2017 #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Price Temperature (BPT) reached a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> of 6 multiple times at an earlier post-halving date than the previous cycleSome price exhaustion could be expected https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥵" title="Hot face" aria-label="Emoji: Hot face">">

Price Temperature (BPT) reached a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> of 6 multiple times at an earlier post-halving date than the previous cycleSome price exhaustion could be expected https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥵" title="Hot face" aria-label="Emoji: Hot face">" title="4/27 So why these dips? Multiple angles to take.First: Price ramped up FAST this cycle in comparison to 2017 #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Price Temperature (BPT) reached a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> of 6 multiple times at an earlier post-halving date than the previous cycleSome price exhaustion could be expected https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥵" title="Hot face" aria-label="Emoji: Hot face">">

Price Temperature (BPT) reached a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> of 6 multiple times at an earlier post-halving date than the previous cycleSome price exhaustion could be expected https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥵" title="Hot face" aria-label="Emoji: Hot face">" title="4/27 So why these dips? Multiple angles to take.First: Price ramped up FAST this cycle in comparison to 2017 #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Price Temperature (BPT) reached a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> of 6 multiple times at an earlier post-halving date than the previous cycleSome price exhaustion could be expected https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥵" title="Hot face" aria-label="Emoji: Hot face">">

Price Temperature (BPT) reached a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> of 6 multiple times at an earlier post-halving date than the previous cycleSome price exhaustion could be expected https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥵" title="Hot face" aria-label="Emoji: Hot face">" title="4/27 So why these dips? Multiple angles to take.First: Price ramped up FAST this cycle in comparison to 2017 #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Price Temperature (BPT) reached a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> of 6 multiple times at an earlier post-halving date than the previous cycleSome price exhaustion could be expected https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥵" title="Hot face" aria-label="Emoji: Hot face">">

Price Temperature (BPT) reached a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> of 6 multiple times at an earlier post-halving date than the previous cycleSome price exhaustion could be expected https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥵" title="Hot face" aria-label="Emoji: Hot face">" title="4/27 So why these dips? Multiple angles to take.First: Price ramped up FAST this cycle in comparison to 2017 #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Price Temperature (BPT) reached a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> of 6 multiple times at an earlier post-halving date than the previous cycleSome price exhaustion could be expected https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥵" title="Hot face" aria-label="Emoji: Hot face">">

Price Temperature (BPT) reached a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> of 6 multiple times at an earlier post-halving date than the previous cycleSome price exhaustion could be expected https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥵" title="Hot face" aria-label="Emoji: Hot face">" title="4/27 So why these dips? Multiple angles to take.First: Price ramped up FAST this cycle in comparison to 2017 #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Price Temperature (BPT) reached a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> of 6 multiple times at an earlier post-halving date than the previous cycleSome price exhaustion could be expected https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥵" title="Hot face" aria-label="Emoji: Hot face">">

Price Temperature (BPT) reached a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> of 6 multiple times at an earlier post-halving date than the previous cycleSome price exhaustion could be expected https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥵" title="Hot face" aria-label="Emoji: Hot face">" title="4/27 So why these dips? Multiple angles to take.First: Price ramped up FAST this cycle in comparison to 2017 #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Price Temperature (BPT) reached a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> of 6 multiple times at an earlier post-halving date than the previous cycleSome price exhaustion could be expected https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥵" title="Hot face" aria-label="Emoji: Hot face">">

Price Temperature (BPT) reached a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> of 6 multiple times at an earlier post-halving date than the previous cycleSome price exhaustion could be expected https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥵" title="Hot face" aria-label="Emoji: Hot face">" title="4/27 So why these dips? Multiple angles to take.First: Price ramped up FAST this cycle in comparison to 2017 #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Price Temperature (BPT) reached a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> of 6 multiple times at an earlier post-halving date than the previous cycleSome price exhaustion could be expected https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥵" title="Hot face" aria-label="Emoji: Hot face">">

and took on leveraged bets at an increasing rate, causing open interest on futures to skyrocketNot just the #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> price (& https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer">) needed to cool off - so did the leverage in the system (which it has)" title="5/27 As price ran up, more market participants became excited about #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> and took on leveraged bets at an increasing rate, causing open interest on futures to skyrocketNot just the #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> price (& https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer">) needed to cool off - so did the leverage in the system (which it has)" class="img-responsive" style="max-width:100%;"/>

and took on leveraged bets at an increasing rate, causing open interest on futures to skyrocketNot just the #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> price (& https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer">) needed to cool off - so did the leverage in the system (which it has)" title="5/27 As price ran up, more market participants became excited about #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> and took on leveraged bets at an increasing rate, causing open interest on futures to skyrocketNot just the #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> price (& https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer">) needed to cool off - so did the leverage in the system (which it has)" class="img-responsive" style="max-width:100%;"/>

that can help push the price down" title="6/27 The amount of pain of those degenerate gamblers that aped long on leverage during this parabolic rise is visualized in this long liquidations chartLesson: when everyone & their mom is long, it pays to be short - especially if you& #39;re a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> that can help push the price down" class="img-responsive" style="max-width:100%;"/>

that can help push the price down" title="6/27 The amount of pain of those degenerate gamblers that aped long on leverage during this parabolic rise is visualized in this long liquidations chartLesson: when everyone & their mom is long, it pays to be short - especially if you& #39;re a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> that can help push the price down" class="img-responsive" style="max-width:100%;"/>

I wrote a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> about it using @whale_map data, to show that the dip started with a large, somewhat old (Aug & #39;20) whale taking profits, creating a cascading effect of profit taking towards younger whales that even capitulated at a loss" title="7/27 ..which is exactly what happened https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">I wrote a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> about it using @whale_map data, to show that the dip started with a large, somewhat old (Aug & #39;20) whale taking profits, creating a cascading effect of profit taking towards younger whales that even capitulated at a loss">

I wrote a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> about it using @whale_map data, to show that the dip started with a large, somewhat old (Aug & #39;20) whale taking profits, creating a cascading effect of profit taking towards younger whales that even capitulated at a loss" title="7/27 ..which is exactly what happened https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">I wrote a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> about it using @whale_map data, to show that the dip started with a large, somewhat old (Aug & #39;20) whale taking profits, creating a cascading effect of profit taking towards younger whales that even capitulated at a loss">

I wrote a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> about it using @whale_map data, to show that the dip started with a large, somewhat old (Aug & #39;20) whale taking profits, creating a cascading effect of profit taking towards younger whales that even capitulated at a loss" title="7/27 ..which is exactly what happened https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">I wrote a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> about it using @whale_map data, to show that the dip started with a large, somewhat old (Aug & #39;20) whale taking profits, creating a cascading effect of profit taking towards younger whales that even capitulated at a loss">

I wrote a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> about it using @whale_map data, to show that the dip started with a large, somewhat old (Aug & #39;20) whale taking profits, creating a cascading effect of profit taking towards younger whales that even capitulated at a loss" title="7/27 ..which is exactly what happened https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">I wrote a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> about it using @whale_map data, to show that the dip started with a large, somewhat old (Aug & #39;20) whale taking profits, creating a cascading effect of profit taking towards younger whales that even capitulated at a loss">

I wrote a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> about it using @whale_map data, to show that the dip started with a large, somewhat old (Aug & #39;20) whale taking profits, creating a cascading effect of profit taking towards younger whales that even capitulated at a loss" title="7/27 ..which is exactly what happened https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">I wrote a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> about it using @whale_map data, to show that the dip started with a large, somewhat old (Aug & #39;20) whale taking profits, creating a cascading effect of profit taking towards younger whales that even capitulated at a loss">

I wrote a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> about it using @whale_map data, to show that the dip started with a large, somewhat old (Aug & #39;20) whale taking profits, creating a cascading effect of profit taking towards younger whales that even capitulated at a loss" title="7/27 ..which is exactly what happened https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">I wrote a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> about it using @whale_map data, to show that the dip started with a large, somewhat old (Aug & #39;20) whale taking profits, creating a cascading effect of profit taking towards younger whales that even capitulated at a loss">

I wrote a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> about it using @whale_map data, to show that the dip started with a large, somewhat old (Aug & #39;20) whale taking profits, creating a cascading effect of profit taking towards younger whales that even capitulated at a loss" title="7/27 ..which is exactly what happened https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">I wrote a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> about it using @whale_map data, to show that the dip started with a large, somewhat old (Aug & #39;20) whale taking profits, creating a cascading effect of profit taking towards younger whales that even capitulated at a loss">

I wrote a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> about it using @whale_map data, to show that the dip started with a large, somewhat old (Aug & #39;20) whale taking profits, creating a cascading effect of profit taking towards younger whales that even capitulated at a loss" title="7/27 ..which is exactly what happened https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">I wrote a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> about it using @whale_map data, to show that the dip started with a large, somewhat old (Aug & #39;20) whale taking profits, creating a cascading effect of profit taking towards younger whales that even capitulated at a loss">

price bounced back resiliently, even closing the month off at ~$57.8k, which is barely even a red candle (-1.7%)What is encouraging, is that this rise was accompanied by large exchange withdrawals - the big boys are buying right now https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">" title="11/27 Since then, the #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> price bounced back resiliently, even closing the month off at ~$57.8k, which is barely even a red candle (-1.7%)What is encouraging, is that this rise was accompanied by large exchange withdrawals - the big boys are buying right now https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">" class="img-responsive" style="max-width:100%;"/>

price bounced back resiliently, even closing the month off at ~$57.8k, which is barely even a red candle (-1.7%)What is encouraging, is that this rise was accompanied by large exchange withdrawals - the big boys are buying right now https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">" title="11/27 Since then, the #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> price bounced back resiliently, even closing the month off at ~$57.8k, which is barely even a red candle (-1.7%)What is encouraging, is that this rise was accompanied by large exchange withdrawals - the big boys are buying right now https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">" class="img-responsive" style="max-width:100%;"/>

" title="12/27 Perhaps an even more comforting thought; this last price rise was not accompanied by a rise in funding rates, which is a sign that it was spot-markets drivenThe apes that went long & got rekt are now either on the sidelines or learned their lesson and bought spot https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧠" title="Gehirn" aria-label="Emoji: Gehirn">" class="img-responsive" style="max-width:100%;"/>

" title="12/27 Perhaps an even more comforting thought; this last price rise was not accompanied by a rise in funding rates, which is a sign that it was spot-markets drivenThe apes that went long & got rekt are now either on the sidelines or learned their lesson and bought spot https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧠" title="Gehirn" aria-label="Emoji: Gehirn">" class="img-responsive" style="max-width:100%;"/>

mid- to long-term https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse"> https://twitter.com/dilutionp..." title="13/27 So what is the market sentiment like, currently?I held a Twitter poll last week and the results were clear; respondents were indifferent short-term, but very much bullish on #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> mid- to long-term https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse"> https://twitter.com/dilutionp..." class="img-responsive" style="max-width:100%;"/>

mid- to long-term https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse"> https://twitter.com/dilutionp..." title="13/27 So what is the market sentiment like, currently?I held a Twitter poll last week and the results were clear; respondents were indifferent short-term, but very much bullish on #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> mid- to long-term https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse"> https://twitter.com/dilutionp..." class="img-responsive" style="max-width:100%;"/>

then?Short answer: yesSlightly longer answer: lets look at some trendsThe declining exchange balances since last year& #39;s COVID-19 market panic is perhaps the most famous one, and overall still is intact https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤩" title="Vom Star geblendet" aria-label="Emoji: Vom Star geblendet">" title="14/27 So is there still demand for #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> then?Short answer: yesSlightly longer answer: lets look at some trendsThe declining exchange balances since last year& #39;s COVID-19 market panic is perhaps the most famous one, and overall still is intact https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤩" title="Vom Star geblendet" aria-label="Emoji: Vom Star geblendet">" class="img-responsive" style="max-width:100%;"/>

then?Short answer: yesSlightly longer answer: lets look at some trendsThe declining exchange balances since last year& #39;s COVID-19 market panic is perhaps the most famous one, and overall still is intact https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤩" title="Vom Star geblendet" aria-label="Emoji: Vom Star geblendet">" title="14/27 So is there still demand for #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> then?Short answer: yesSlightly longer answer: lets look at some trendsThe declining exchange balances since last year& #39;s COVID-19 market panic is perhaps the most famous one, and overall still is intact https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤩" title="Vom Star geblendet" aria-label="Emoji: Vom Star geblendet">" class="img-responsive" style="max-width:100%;"/>

" title="15/27 A similar pattern can be witnessed at the balances of Over The Counter (OTC) trading desksThe supply shortage is real; there is a decreasing amount of coins circulating on the market, which means that price must go up to entice HODL& #39;ers to sellChart via @mskvsk https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">" class="img-responsive" style="max-width:100%;"/>

" title="15/27 A similar pattern can be witnessed at the balances of Over The Counter (OTC) trading desksThe supply shortage is real; there is a decreasing amount of coins circulating on the market, which means that price must go up to entice HODL& #39;ers to sellChart via @mskvsk https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">" class="img-responsive" style="max-width:100%;"/>

" title="16/27 That trend becomes even more clear when you see that the liquid market supply has decreased on a daily basis all year so far, and thus the illiquid supply (coins in the hands of HODL& #39;ers with no history of selling) keeps growingCharts via @WClementeIII https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">">

" title="16/27 That trend becomes even more clear when you see that the liquid market supply has decreased on a daily basis all year so far, and thus the illiquid supply (coins in the hands of HODL& #39;ers with no history of selling) keeps growingCharts via @WClementeIII https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">">

" title="16/27 That trend becomes even more clear when you see that the liquid market supply has decreased on a daily basis all year so far, and thus the illiquid supply (coins in the hands of HODL& #39;ers with no history of selling) keeps growingCharts via @WClementeIII https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">">

" title="16/27 That trend becomes even more clear when you see that the liquid market supply has decreased on a daily basis all year so far, and thus the illiquid supply (coins in the hands of HODL& #39;ers with no history of selling) keeps growingCharts via @WClementeIII https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">">

Chart via @WClementeIII https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">" title="17/27 A similar pattern can be witnessed with miners, that were taking profits in January but have stopped doing so since late March - and have been accumulating ever sinceIf these guys aren& #39;t taking care of the supply shortage, who will? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">Chart via @WClementeIII https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">" class="img-responsive" style="max-width:100%;"/>

Chart via @WClementeIII https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">" title="17/27 A similar pattern can be witnessed with miners, that were taking profits in January but have stopped doing so since late March - and have been accumulating ever sinceIf these guys aren& #39;t taking care of the supply shortage, who will? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">Chart via @WClementeIII https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">" class="img-responsive" style="max-width:100%;"/>

, existing coins need to become available to the market to meet the new demandThe problem is with that is that HODL& #39;ers are not selling - they are buying https://abs.twimg.com/emoji/v2/... draggable="false" alt="😯" title="Schweigendes Gesicht" aria-label="Emoji: Schweigendes Gesicht">Again, chart via @WClementeIII https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍺" title="Bierkrug" aria-label="Emoji: Bierkrug">" title="18/27 The answer is clear; if not for newly created #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt="">, existing coins need to become available to the market to meet the new demandThe problem is with that is that HODL& #39;ers are not selling - they are buying https://abs.twimg.com/emoji/v2/... draggable="false" alt="😯" title="Schweigendes Gesicht" aria-label="Emoji: Schweigendes Gesicht">Again, chart via @WClementeIII https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍺" title="Bierkrug" aria-label="Emoji: Bierkrug">" class="img-responsive" style="max-width:100%;"/>

, existing coins need to become available to the market to meet the new demandThe problem is with that is that HODL& #39;ers are not selling - they are buying https://abs.twimg.com/emoji/v2/... draggable="false" alt="😯" title="Schweigendes Gesicht" aria-label="Emoji: Schweigendes Gesicht">Again, chart via @WClementeIII https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍺" title="Bierkrug" aria-label="Emoji: Bierkrug">" title="18/27 The answer is clear; if not for newly created #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt="">, existing coins need to become available to the market to meet the new demandThe problem is with that is that HODL& #39;ers are not selling - they are buying https://abs.twimg.com/emoji/v2/... draggable="false" alt="😯" title="Schweigendes Gesicht" aria-label="Emoji: Schweigendes Gesicht">Again, chart via @WClementeIII https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍺" title="Bierkrug" aria-label="Emoji: Bierkrug">" class="img-responsive" style="max-width:100%;"/>

Again chart via @WClementeIII https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder"> (if you are not already following him at this point, you& #39;re doing it wrong)" title="19/27 So that must mean that an increasing number of addresses are accumulating right now, right?Corrrrectemundo! https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Again chart via @WClementeIII https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder"> (if you are not already following him at this point, you& #39;re doing it wrong)" class="img-responsive" style="max-width:100%;"/>

Again chart via @WClementeIII https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder"> (if you are not already following him at this point, you& #39;re doing it wrong)" title="19/27 So that must mean that an increasing number of addresses are accumulating right now, right?Corrrrectemundo! https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Again chart via @WClementeIII https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder"> (if you are not already following him at this point, you& #39;re doing it wrong)" class="img-responsive" style="max-width:100%;"/>

. Are there actually new entities coming to the network?Yup - more than ever https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">Chart via.. ah you know who https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht"> (last one for now, I promise!)" title="20/27 Right, but those addresses can all belong to a single https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">. Are there actually new entities coming to the network?Yup - more than ever https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">Chart via.. ah you know who https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht"> (last one for now, I promise!)" class="img-responsive" style="max-width:100%;"/>

. Are there actually new entities coming to the network?Yup - more than ever https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">Chart via.. ah you know who https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht"> (last one for now, I promise!)" title="20/27 Right, but those addresses can all belong to a single https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">. Are there actually new entities coming to the network?Yup - more than ever https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">Chart via.. ah you know who https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht"> (last one for now, I promise!)" class="img-responsive" style="max-width:100%;"/>

" title="21/27 Another encouraging signal that demand is lining up: the stablecoin reserves on spot exchanges are currently relatively high, which is potentially a signal that dry powder is ready to buy the next dip - or perhaps FOMO in if price runs away from them https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">" class="img-responsive" style="max-width:100%;"/>

" title="21/27 Another encouraging signal that demand is lining up: the stablecoin reserves on spot exchanges are currently relatively high, which is potentially a signal that dry powder is ready to buy the next dip - or perhaps FOMO in if price runs away from them https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">" class="img-responsive" style="max-width:100%;"/>

& #39;s realized value itself went upIf this cycle is like the previous ones, there is room left" title="22/27 What about the room for growth?Like we saw with the BPT, the Market Value to Realized Value (MVRV) Z-score recently reached relatively high levels, but has dropped, after #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s realized value itself went upIf this cycle is like the previous ones, there is room left" class="img-responsive" style="max-width:100%;"/>

& #39;s realized value itself went upIf this cycle is like the previous ones, there is room left" title="22/27 What about the room for growth?Like we saw with the BPT, the Market Value to Realized Value (MVRV) Z-score recently reached relatively high levels, but has dropped, after #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s realized value itself went upIf this cycle is like the previous ones, there is room left" class="img-responsive" style="max-width:100%;"/>

" title="25/27 @PositiveCrypto& #39;s Realized HODL Ratio uses a different approach to actually tackle that same angle - HODL& #39;er confidenceAs expected, the RHODL Ratio paints a similar picture - still room for growth in comparison to previous cyclesClick below to read the last 2 tweets https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="25/27 @PositiveCrypto& #39;s Realized HODL Ratio uses a different approach to actually tackle that same angle - HODL& #39;er confidenceAs expected, the RHODL Ratio paints a similar picture - still room for growth in comparison to previous cyclesClick below to read the last 2 tweets https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

Halving Cycle Roadmap chartAs the #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Price Temperature https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> cooled off towards green, it is now lagging behind most of the other price models that are visualized here(When) will it catch up...? https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">" title="26/27 To close off my monthly analysis thread, I like to use my #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Halving Cycle Roadmap chartAs the #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Price Temperature https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> cooled off towards green, it is now lagging behind most of the other price models that are visualized here(When) will it catch up...? https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">" class="img-responsive" style="max-width:100%;"/>

Halving Cycle Roadmap chartAs the #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Price Temperature https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> cooled off towards green, it is now lagging behind most of the other price models that are visualized here(When) will it catch up...? https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">" title="26/27 To close off my monthly analysis thread, I like to use my #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Halving Cycle Roadmap chartAs the #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Price Temperature https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌡️" title="Thermometer" aria-label="Emoji: Thermometer"> cooled off towards green, it is now lagging behind most of the other price models that are visualized here(When) will it catch up...? https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">" class="img-responsive" style="max-width:100%;"/>