1) Let& #39;s kick off May Chinese tech threads.

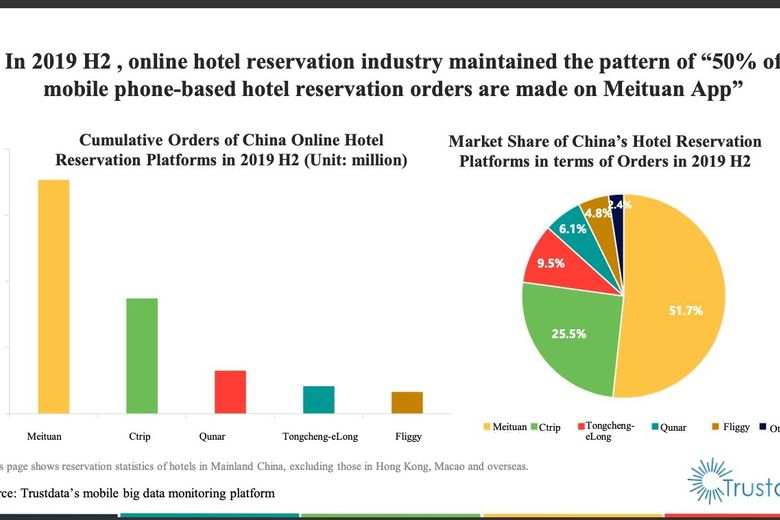

In 2017, Ctrip was the undisputed OTA market leader with ~50% of China& #39;s online hotel bookings. They quashed competitors and lead a consolidation of the OTA market.

By 2018, they had lost all of that to Meituan.

Wtf happened?

In 2017, Ctrip was the undisputed OTA market leader with ~50% of China& #39;s online hotel bookings. They quashed competitors and lead a consolidation of the OTA market.

By 2018, they had lost all of that to Meituan.

Wtf happened?

2) The one KPI that rules Chinese consumer super apps - Meituan& #39;s secret sauce and their reason for all in on Community Group Buying (CGB)

It& #39;s not DAU, it& #39;s not AOV, it& #39;s not GMV

It& #39;s the frequency of use per day

It& #39;s not DAU, it& #39;s not AOV, it& #39;s not GMV

It& #39;s the frequency of use per day

3) I& #39;ve said this many times, relative to western consumer tech companies, who tend to focus on “serving a function” as their core mission, Chinese companies tend to focus on “owning the user” as their core mission.

4) Owning the end-user and their attention is what led to the rise of the super apps Chinese tech firms (though the initial wedge into the consumer is always through a function - Meituan through group buying, Wechat through messaging etc.)

5) Why is this - China is mobile-first rather than websites first. A customer will only use the handful of apps on their phone rather than continues to download new ones. This has lead to walled gardens in Chinese tech which means CAC is extremely high.

6) Trying to keep acquire customers from other apps is costly, better to make sure the user keeps coming back to you. More on this below https://lillianli.substack.com/p/owning-the-funnel">https://lillianli.substack.com/p/owning-...

7) Owning the user means you want high-frequency users who habitually use you for all of their needs. This means massing a portfolio of high use services that makes you top of mind for your users.

This is the reason for why bike-sharing was so hot in 2015 and why CGB is hot now

This is the reason for why bike-sharing was so hot in 2015 and why CGB is hot now

8) Both of these are high-frequency usage services that prompt the user to open the app at least once or twice a day, forming an app checking habit.

A habit, once formed, is hard to break. No one knows this better than Chinese super apps.

A habit, once formed, is hard to break. No one knows this better than Chinese super apps.

9) So this is what happened with Ctrip and Meituan.

Meituan& #39;s meteoric rise in hotel bookings started in 2015, the same year it merged with Dianping and acquired http://Kuxun.com"> http://Kuxun.com from Tripadvisor.

Meituan& #39;s meteoric rise in hotel bookings started in 2015, the same year it merged with Dianping and acquired http://Kuxun.com"> http://Kuxun.com from Tripadvisor.

10) It channelled it& #39;s 600m DAU who were used to opening the app daily for their food needs into their new hotel booking segment.

It was also shrewdly gone after lower end hotels that Ctrip with their high-end branding did not engage with.

It was also shrewdly gone after lower end hotels that Ctrip with their high-end branding did not engage with.

11) Meituan a battle-hardened field sales team that had were just as capable of signing up hotels as restaurants to the platform

Coupled with no hotel cancellation fees, Meituan had a clear proposition for consumers. Cheap hotels anywhere. https://twitter.com/lillianmli/status/1370327366829027328?s=20">https://twitter.com/lillianml...

Coupled with no hotel cancellation fees, Meituan had a clear proposition for consumers. Cheap hotels anywhere. https://twitter.com/lillianmli/status/1370327366829027328?s=20">https://twitter.com/lillianml...

12) By 2018, Meituan had surpassed Ctrip by a huge margin in terms of the number of hotel nights booked, today it leads the hotel booking market in China.

13) While this can be a story of counter-positioning, most folks in Chinese tech sees it as a war between high-frequency usage versus low-frequency usage. With high-frequency usage winning by a landslide.

14) People don& #39;t use a hotel that often, they do frequent restaurant and get food deliveries almost every day. If their food delivery apps offer hotel, the convenience and familiarity is already there, why leave for another platform?

Other superapps took careful notes.

Other superapps took careful notes.

15) Fast forward to today, the need to maintain a high-frequency touchpoint is what drives Meituan, Alibaba, PDD and Didi to compete fiercely in CGB. They are there fore the user usage habits as much as the favourable economics https://lillianli.substack.com/p/the-hottest-and-least-understood">https://lillianli.substack.com/p/the-hot...

16) So next time your favourite super app, be it Meituan or Taobao, Grab or Rappi, is moving into a new and seemingly unrelated area. Ask yourself, how is this improving their frequency of usage? How is this helping them own the user through cross-selling?

Read on Twitter

Read on Twitter