Stocks move on earnings, so execs will manipulate earnings. How can u spot their accounting gimmicks ahead of time?

Here’s a rundown of top shenanigans execs use(d) to cook their books. Case studies included.

1/ Using SPVs to hide bad debts

case: Enron created multiple SPVs, then gave them $ENRN stock while the SPVs gave back case. The SPVs then used Enron stock to hedge assets on Enron& #39;s balance sheet.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Enron got to reduce write-offs & report “improved” debt-to-equity.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Enron got to reduce write-offs & report “improved” debt-to-equity.

case: Enron created multiple SPVs, then gave them $ENRN stock while the SPVs gave back case. The SPVs then used Enron stock to hedge assets on Enron& #39;s balance sheet.

2/ Reporting bogus revenue

case: In 2008 Lehman Bros “sold” $50B of https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen"> garbage loans to Cayman Island banks under the promise to buy them back after the fiscal/quarter ends.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen"> garbage loans to Cayman Island banks under the promise to buy them back after the fiscal/quarter ends.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> This created the impression to wall street that Lehman had $50B more cash than it actually did.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> This created the impression to wall street that Lehman had $50B more cash than it actually did.

case: In 2008 Lehman Bros “sold” $50B of

3/ Round-tripping

(when 2 companies buy/sell repeatedly to inflate sales)

case i: Valeant sold Philidor (which it had the option to buy) inflated shipments of a toenail fungus drug https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍄" title="Pilz" aria-label="Emoji: Pilz">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍄" title="Pilz" aria-label="Emoji: Pilz">

case ii: Dynegy& #39;s energy trading biz pre-arranging many buy-sells w/ an ally at designated price

(when 2 companies buy/sell repeatedly to inflate sales)

case i: Valeant sold Philidor (which it had the option to buy) inflated shipments of a toenail fungus drug

case ii: Dynegy& #39;s energy trading biz pre-arranging many buy-sells w/ an ally at designated price

4/ Recording revenues too soon

GAAP says revenue is recognized when a good/service is delivered, not on cash payment/upfront.

case: Xerox "accelerated" $3B in service fees, boosting EBIT by $1.5B.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Top execs rewarded themselves $35M in RSUs for hitting earnings targets.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Top execs rewarded themselves $35M in RSUs for hitting earnings targets.

GAAP says revenue is recognized when a good/service is delivered, not on cash payment/upfront.

case: Xerox "accelerated" $3B in service fees, boosting EBIT by $1.5B.

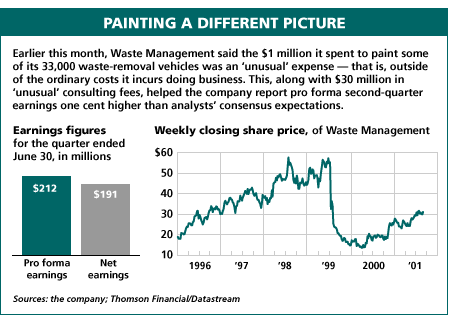

5/ “Mucking” w/ depreciation to understate expenses

case: literal muck-handler https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen">Waste Management Inc. avoided depreciation expenses by inflating salvage value & extending the useful lives of its garbage trucks.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen">Waste Management Inc. avoided depreciation expenses by inflating salvage value & extending the useful lives of its garbage trucks.

case: literal muck-handler

6/ Recording expenses too late

GAAP says expenses are recognized when incurred, not when paid in cash.

case: Nut-seller Diamond wanted to acq Pringles from P&G w/ stock. DMND had to boost its share price.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Screws walnut growers by delaying payments to offset other FY& #39;11 costs.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Screws walnut growers by delaying payments to offset other FY& #39;11 costs.

GAAP says expenses are recognized when incurred, not when paid in cash.

case: Nut-seller Diamond wanted to acq Pringles from P&G w/ stock. DMND had to boost its share price.

7/ Booking opex as capex

case: WorldCom used its cash flows statement to hide expenses by marking operating costs, which should have been opex, as capex.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">WorldCom inflated cash flow by $3.8 billion and posted quarters of positive performance when it really lost money.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">WorldCom inflated cash flow by $3.8 billion and posted quarters of positive performance when it really lost money.

case: WorldCom used its cash flows statement to hide expenses by marking operating costs, which should have been opex, as capex.

8/ Channel stuffing

when a company ships customers excess goods that were not ordered to temporarily inflate accounts receivable

case: Krispy Kreme allegedly sent franchises 2x usual shipments at the end of financial quarters so the company could meet Wall Street forecasts

when a company ships customers excess goods that were not ordered to temporarily inflate accounts receivable

case: Krispy Kreme allegedly sent franchises 2x usual shipments at the end of financial quarters so the company could meet Wall Street forecasts

9/ Boosting income with 1-time gains

This one not illegal.

case: At quarter ends, Lehman Bros sometimes used “repo 105” an accounting trick that defines a short term loan as a sale.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Cash from sales gave the appearance of lowered reported liabilities.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Cash from sales gave the appearance of lowered reported liabilities.

This one not illegal.

case: At quarter ends, Lehman Bros sometimes used “repo 105” an accounting trick that defines a short term loan as a sale.

10/ "Big baths"

Also not illegal.

When a new exec steps in, s/he may write off all losses possible to blame previous management. This makes the company look worse than it is, giving the new exec a low starting bar on which to build future cred

Also not illegal.

When a new exec steps in, s/he may write off all losses possible to blame previous management. This makes the company look worse than it is, giving the new exec a low starting bar on which to build future cred

11/ Hiding losses in acquisitions:

I-bankers charge stupidly high fees… how can CEOs use that to their advantage?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">"those

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">"those  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👠" title="High Heels" aria-label="Emoji: High Heels">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👠" title="High Heels" aria-label="Emoji: High Heels"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👜" title="Handtasche" aria-label="Emoji: Handtasche"> for my wife last quarter… advisory expense!"

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👜" title="Handtasche" aria-label="Emoji: Handtasche"> for my wife last quarter… advisory expense!"

ex: Tech giant Olympus hid losses on securities investments for years under the cover of acquisitions.

I-bankers charge stupidly high fees… how can CEOs use that to their advantage?

ex: Tech giant Olympus hid losses on securities investments for years under the cover of acquisitions.

Read on Twitter

Read on Twitter 12 Ways to Spot a Lying CFOhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👺" title="Japanischer Kobold" aria-label="Emoji: Japanischer Kobold">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤝" title="Handschlag" aria-label="Emoji: Handschlag">collaboration w/ @goodalexander Stocks move on earnings, so execs will manipulate earnings. How can u spot their accounting gimmicks ahead of time?Here’s a rundown of top shenanigans execs use(d) to cook their books. Case studies included.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="👺" title="Japanischer Kobold" aria-label="Emoji: Japanischer Kobold">12 Ways to Spot a Lying CFOhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👺" title="Japanischer Kobold" aria-label="Emoji: Japanischer Kobold">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤝" title="Handschlag" aria-label="Emoji: Handschlag">collaboration w/ @goodalexander Stocks move on earnings, so execs will manipulate earnings. How can u spot their accounting gimmicks ahead of time?Here’s a rundown of top shenanigans execs use(d) to cook their books. Case studies included.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

12 Ways to Spot a Lying CFOhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👺" title="Japanischer Kobold" aria-label="Emoji: Japanischer Kobold">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤝" title="Handschlag" aria-label="Emoji: Handschlag">collaboration w/ @goodalexander Stocks move on earnings, so execs will manipulate earnings. How can u spot their accounting gimmicks ahead of time?Here’s a rundown of top shenanigans execs use(d) to cook their books. Case studies included.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="👺" title="Japanischer Kobold" aria-label="Emoji: Japanischer Kobold">12 Ways to Spot a Lying CFOhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👺" title="Japanischer Kobold" aria-label="Emoji: Japanischer Kobold">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤝" title="Handschlag" aria-label="Emoji: Handschlag">collaboration w/ @goodalexander Stocks move on earnings, so execs will manipulate earnings. How can u spot their accounting gimmicks ahead of time?Here’s a rundown of top shenanigans execs use(d) to cook their books. Case studies included.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

Enron got to reduce write-offs & report “improved” debt-to-equity." title="1/ Using SPVs to hide bad debtscase: Enron created multiple SPVs, then gave them $ENRN stock while the SPVs gave back case. The SPVs then used Enron stock to hedge assets on Enron& #39;s balance sheet.https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Enron got to reduce write-offs & report “improved” debt-to-equity.">

Enron got to reduce write-offs & report “improved” debt-to-equity." title="1/ Using SPVs to hide bad debtscase: Enron created multiple SPVs, then gave them $ENRN stock while the SPVs gave back case. The SPVs then used Enron stock to hedge assets on Enron& #39;s balance sheet.https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Enron got to reduce write-offs & report “improved” debt-to-equity.">

Enron got to reduce write-offs & report “improved” debt-to-equity." title="1/ Using SPVs to hide bad debtscase: Enron created multiple SPVs, then gave them $ENRN stock while the SPVs gave back case. The SPVs then used Enron stock to hedge assets on Enron& #39;s balance sheet.https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Enron got to reduce write-offs & report “improved” debt-to-equity.">

Enron got to reduce write-offs & report “improved” debt-to-equity." title="1/ Using SPVs to hide bad debtscase: Enron created multiple SPVs, then gave them $ENRN stock while the SPVs gave back case. The SPVs then used Enron stock to hedge assets on Enron& #39;s balance sheet.https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Enron got to reduce write-offs & report “improved” debt-to-equity.">

garbage loans to Cayman Island banks under the promise to buy them back after the fiscal/quarter ends.https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> This created the impression to wall street that Lehman had $50B more cash than it actually did." title="2/ Reporting bogus revenuecase: In 2008 Lehman Bros “sold” $50B of https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen"> garbage loans to Cayman Island banks under the promise to buy them back after the fiscal/quarter ends.https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> This created the impression to wall street that Lehman had $50B more cash than it actually did." class="img-responsive" style="max-width:100%;"/>

garbage loans to Cayman Island banks under the promise to buy them back after the fiscal/quarter ends.https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> This created the impression to wall street that Lehman had $50B more cash than it actually did." title="2/ Reporting bogus revenuecase: In 2008 Lehman Bros “sold” $50B of https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen"> garbage loans to Cayman Island banks under the promise to buy them back after the fiscal/quarter ends.https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> This created the impression to wall street that Lehman had $50B more cash than it actually did." class="img-responsive" style="max-width:100%;"/>

case ii: Dynegy& #39;s energy trading biz pre-arranging many buy-sells w/ an ally at designated price" title="3/ Round-tripping(when 2 companies buy/sell repeatedly to inflate sales)case i: Valeant sold Philidor (which it had the option to buy) inflated shipments of a toenail fungus drughttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🍄" title="Pilz" aria-label="Emoji: Pilz">case ii: Dynegy& #39;s energy trading biz pre-arranging many buy-sells w/ an ally at designated price" class="img-responsive" style="max-width:100%;"/>

case ii: Dynegy& #39;s energy trading biz pre-arranging many buy-sells w/ an ally at designated price" title="3/ Round-tripping(when 2 companies buy/sell repeatedly to inflate sales)case i: Valeant sold Philidor (which it had the option to buy) inflated shipments of a toenail fungus drughttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🍄" title="Pilz" aria-label="Emoji: Pilz">case ii: Dynegy& #39;s energy trading biz pre-arranging many buy-sells w/ an ally at designated price" class="img-responsive" style="max-width:100%;"/>

Top execs rewarded themselves $35M in RSUs for hitting earnings targets." title="4/ Recording revenues too soonGAAP says revenue is recognized when a good/service is delivered, not on cash payment/upfront.case: Xerox "accelerated" $3B in service fees, boosting EBIT by $1.5B.https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Top execs rewarded themselves $35M in RSUs for hitting earnings targets." class="img-responsive" style="max-width:100%;"/>

Top execs rewarded themselves $35M in RSUs for hitting earnings targets." title="4/ Recording revenues too soonGAAP says revenue is recognized when a good/service is delivered, not on cash payment/upfront.case: Xerox "accelerated" $3B in service fees, boosting EBIT by $1.5B.https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Top execs rewarded themselves $35M in RSUs for hitting earnings targets." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen">Waste Management Inc. avoided depreciation expenses by inflating salvage value & extending the useful lives of its garbage trucks." title="5/ “Mucking” w/ depreciation to understate expensescase: literal muck-handler https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen">Waste Management Inc. avoided depreciation expenses by inflating salvage value & extending the useful lives of its garbage trucks." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen">Waste Management Inc. avoided depreciation expenses by inflating salvage value & extending the useful lives of its garbage trucks." title="5/ “Mucking” w/ depreciation to understate expensescase: literal muck-handler https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen">Waste Management Inc. avoided depreciation expenses by inflating salvage value & extending the useful lives of its garbage trucks." class="img-responsive" style="max-width:100%;"/>

Screws walnut growers by delaying payments to offset other FY& #39;11 costs." title="6/ Recording expenses too lateGAAP says expenses are recognized when incurred, not when paid in cash. case: Nut-seller Diamond wanted to acq Pringles from P&G w/ stock. DMND had to boost its share price.https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Screws walnut growers by delaying payments to offset other FY& #39;11 costs." class="img-responsive" style="max-width:100%;"/>

Screws walnut growers by delaying payments to offset other FY& #39;11 costs." title="6/ Recording expenses too lateGAAP says expenses are recognized when incurred, not when paid in cash. case: Nut-seller Diamond wanted to acq Pringles from P&G w/ stock. DMND had to boost its share price.https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Screws walnut growers by delaying payments to offset other FY& #39;11 costs." class="img-responsive" style="max-width:100%;"/>