1/  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> I spent the last week looking into the BTC futures basis trade (on the unregulated exchanges).

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> I spent the last week looking into the BTC futures basis trade (on the unregulated exchanges).

I thought I& #39;d share some thoughts as to my findings...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

(Did I do that right?)

I thought I& #39;d share some thoughts as to my findings...

(Did I do that right?)

2/  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Tabelle mit Abwärtstrend" aria-label="Emoji: Tabelle mit Abwärtstrend"> First, what is it?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Tabelle mit Abwärtstrend" aria-label="Emoji: Tabelle mit Abwärtstrend"> First, what is it?

On FTX, the June 25th BTC futures contract (BTC-0625) is trading for $60,168. The underlying index price is $57,895.

The trade is to put up 1 BTC as collateral and short the futures contract, waiting for the spread to converge at expiration.

On FTX, the June 25th BTC futures contract (BTC-0625) is trading for $60,168. The underlying index price is $57,895.

The trade is to put up 1 BTC as collateral and short the futures contract, waiting for the spread to converge at expiration.

3/ And the annualized return of this trade is surprisingly juicy. Approximately:

(60,168 / 57,895) ^ (365.25 / 55) - 1 ≈ 29%

So juicy, you have to ask: "wait, why aren& #39;t more people doing this?"

(60,168 / 57,895) ^ (365.25 / 55) - 1 ≈ 29%

So juicy, you have to ask: "wait, why aren& #39;t more people doing this?"

4/ The first reason is that this isn& #39;t a riskless trade.

There is exchange risk (e.g. FTX could get hacked or they could mismanage collateral risk).

But this can be semi-managed via diversification (e.g. do this on FTX, Kraken, Deribit, Binance, etc)

There is exchange risk (e.g. FTX could get hacked or they could mismanage collateral risk).

But this can be semi-managed via diversification (e.g. do this on FTX, Kraken, Deribit, Binance, etc)

5/ The second reason is that the FTX futures contract actually settles to a last hour TWAP.

So 1 BTC isn& #39;t perfect collateral, because the price could plunge in the last minute of trading and you& #39;d "owe" a higher value on the futures contract.

So 1 BTC isn& #39;t perfect collateral, because the price could plunge in the last minute of trading and you& #39;d "owe" a higher value on the futures contract.

6/ But even this can be solved fairly trivially. Either just roll early (and take some risk that the premium might not have come in all the way) or just exit the position evenly over the last hour of trading.

7/ So why aren& #39;t more people doing this? We& #39;re talking 30% annualized here!

Well, limits to arbitrage might be one answer.

Well, limits to arbitrage might be one answer.

8/ These are unregulated exchanges and therefore won& #39;t cater to U.S. residents (and a few other jurisdictions).

So if you want to play, you need to live outside the U.S. and be able to prove it.

So if you want to play, you need to live outside the U.S. and be able to prove it.

9/ U.S. residents can do some squirrely stuff to get around this, but without going through the KYC, you& #39;ll be prohibited by how much USD-value you can take off the exchange each day (e.g. $2-9k).

So your money will be stuck. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln">

So your money will be stuck.

10/ But there are plenty of brilliant international investors. Why aren& #39;t they doing this trade?

In briefly surveying investors, one answer seems to be behavioral.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙈" title="Nichts sehen-Affe" aria-label="Emoji: Nichts sehen-Affe">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙈" title="Nichts sehen-Affe" aria-label="Emoji: Nichts sehen-Affe"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙊" title="Nichts sagen-Affe" aria-label="Emoji: Nichts sagen-Affe">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙊" title="Nichts sagen-Affe" aria-label="Emoji: Nichts sagen-Affe"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙉" title="Nichts hören-Affe" aria-label="Emoji: Nichts hören-Affe">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙉" title="Nichts hören-Affe" aria-label="Emoji: Nichts hören-Affe">

In briefly surveying investors, one answer seems to be behavioral.

11/ For a lot of people playing in the crypto ecosystem, a 30% return seems quaint.

Especially for smaller investors who might be playing with less money. With $5k, would you rather earn a near "riskless" $1.5k, or do a 3x ETH trade?

Especially for smaller investors who might be playing with less money. With $5k, would you rather earn a near "riskless" $1.5k, or do a 3x ETH trade?

12/ And this demand for leverage may be precisely *why* the premium exists in the first place.

It seems to coincide with retail demand for leverage.

(I think this line of thinking is wrong; this is an arbitrage trade, not a crypto trade. But I digress...)

It seems to coincide with retail demand for leverage.

(I think this line of thinking is wrong; this is an arbitrage trade, not a crypto trade. But I digress...)

13/ This also means that the premium ebbs and flows. So, you have to consider how much capital you want to get tied up in a trade that might disappear a month later.

And then you need to off-ramp all your capital. (Or leave it in stable coins.)

And then you need to off-ramp all your capital. (Or leave it in stable coins.)

14/ Then there& #39;s the costs to consider. There& #39;s operational burden, transaction costs, and taxes that need to be accounted for.

Again, all solvable, but a burden for someone entering the space.

Again, all solvable, but a burden for someone entering the space.

15/ BUT EVEN AFTER ALL THIS, CAN WE JUSTIFY 30%?!

This isn& #39;t the CME futures. We don& #39;t have to put up cash collateral.

We just need to put up 1 BTC and it& #39;s a near-perfect arbitrage!

This isn& #39;t the CME futures. We don& #39;t have to put up cash collateral.

We just need to put up 1 BTC and it& #39;s a near-perfect arbitrage!

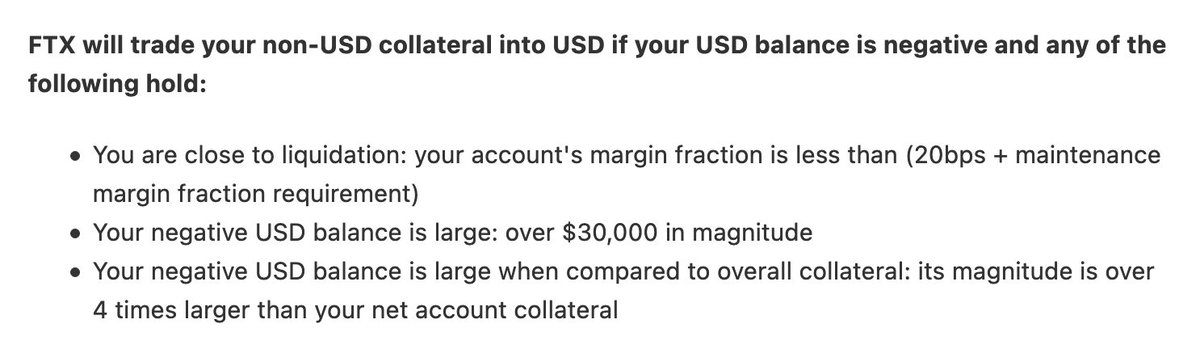

16/ That is, until you read the non-USD margin rules.

In particular, the policy on liquidation.

https://help.ftx.com/hc/en-us/articles/360031149632-Non-USD-Collateral">https://help.ftx.com/hc/en-us/...

In particular, the policy on liquidation.

https://help.ftx.com/hc/en-us/articles/360031149632-Non-USD-Collateral">https://help.ftx.com/hc/en-us/...

17/ That 2nd bullet, in particular, is key.

If you put up 1 BTC and short 1 futures contract and both go up $30k (a ~50% move for BTC today), you& #39;ll get liquidated.

If you put up 1 BTC and short 1 futures contract and both go up $30k (a ~50% move for BTC today), you& #39;ll get liquidated.

18/ "Corey, that can& #39;t be right! Surely it& #39;s not the PnL on the futures contract, but the PnL on the total position, right?"

Nope. I confirmed with FTX.

Nope. I confirmed with FTX.

19/ So if you want to do this trade with $1mm, you& #39;d get liquidated after a 3% move in BTC.

And THERE& #39;S your limit to arbitrage.

And THERE& #39;S your limit to arbitrage.

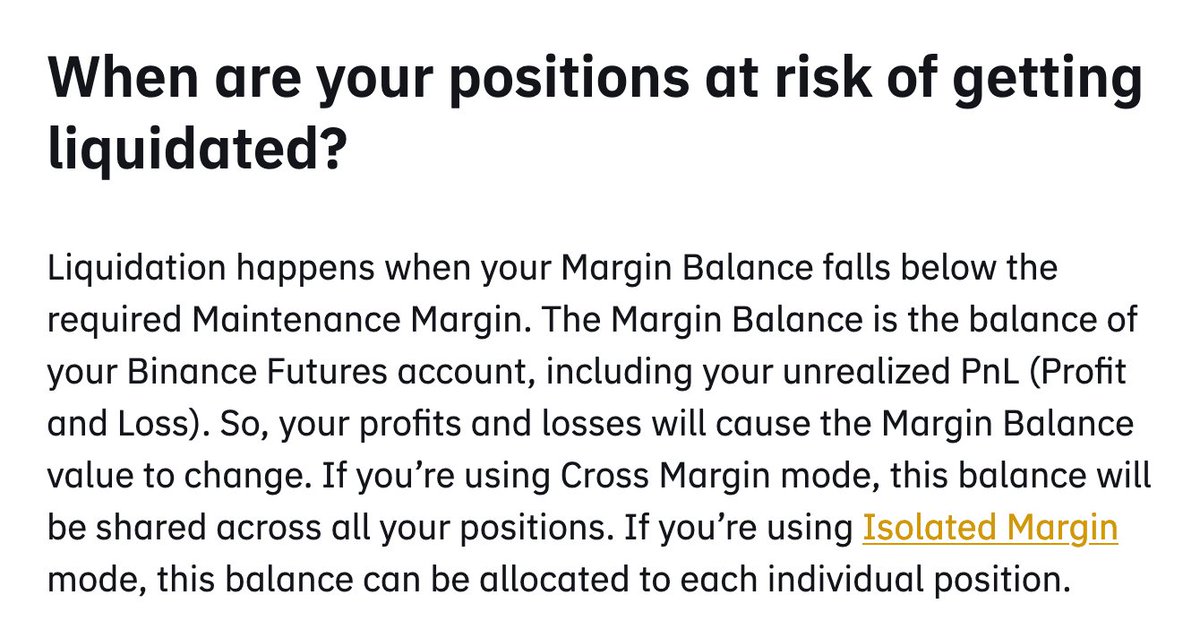

20/ What about the other exchanges?

I haven’t found hard dollar liquidation levels, but it does look like margin balance doesn’t account for coin-margin.

(Though Kraken’s inverse futures might be different.)

I haven’t found hard dollar liquidation levels, but it does look like margin balance doesn’t account for coin-margin.

(Though Kraken’s inverse futures might be different.)

21/ Important re-reading here!

So if BTC + futures go up $30k, you’d have part of your BTC position liquidated into cash to reset the margin to $0.

But now the “arbitrage” has been unwound. https://twitter.com/RetailMoney1/status/1388489491388805121">https://twitter.com/RetailMon...

So if BTC + futures go up $30k, you’d have part of your BTC position liquidated into cash to reset the margin to $0.

But now the “arbitrage” has been unwound. https://twitter.com/RetailMoney1/status/1388489491388805121">https://twitter.com/RetailMon...

22/ So let’s say we want to put a $1mm trade on.

If we think BTC can quickly move +50% over the life of the trade, we’d probably need to be ready to move ~$500k in collateral in at any time.

If we think BTC can quickly move +50% over the life of the trade, we’d probably need to be ready to move ~$500k in collateral in at any time.

23/ So instead of a 30%, we’re probably talking a 20% return with more conservative collateral usage.

Still juicy enough?

Still juicy enough?

Read on Twitter

Read on Twitter First, what is it?On FTX, the June 25th BTC futures contract (BTC-0625) is trading for $60,168. The underlying index price is $57,895.The trade is to put up 1 BTC as collateral and short the futures contract, waiting for the spread to converge at expiration." title="2/ https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Tabelle mit Abwärtstrend" aria-label="Emoji: Tabelle mit Abwärtstrend"> First, what is it?On FTX, the June 25th BTC futures contract (BTC-0625) is trading for $60,168. The underlying index price is $57,895.The trade is to put up 1 BTC as collateral and short the futures contract, waiting for the spread to converge at expiration." class="img-responsive" style="max-width:100%;"/>

First, what is it?On FTX, the June 25th BTC futures contract (BTC-0625) is trading for $60,168. The underlying index price is $57,895.The trade is to put up 1 BTC as collateral and short the futures contract, waiting for the spread to converge at expiration." title="2/ https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Tabelle mit Abwärtstrend" aria-label="Emoji: Tabelle mit Abwärtstrend"> First, what is it?On FTX, the June 25th BTC futures contract (BTC-0625) is trading for $60,168. The underlying index price is $57,895.The trade is to put up 1 BTC as collateral and short the futures contract, waiting for the spread to converge at expiration." class="img-responsive" style="max-width:100%;"/>