1) Portfolio update Apr-end -

$ADYEY $AFTPY $AGC $CPNG $CRWD $CURI $DKNG $DOCU $GHVI $IPOE $MELI $OPEN $OZON $PATH $PINS $PLTR $ROKU $RTP $SE $SHOP $SFTW $SKLZ $SNAP $SNOW $TWLO $UPST

Portfolio is currently hedged

Short $ARKK

Contd...

$ADYEY $AFTPY $AGC $CPNG $CRWD $CURI $DKNG $DOCU $GHVI $IPOE $MELI $OPEN $OZON $PATH $PINS $PLTR $ROKU $RTP $SE $SHOP $SFTW $SKLZ $SNAP $SNOW $TWLO $UPST

Portfolio is currently hedged

Short $ARKK

Contd...

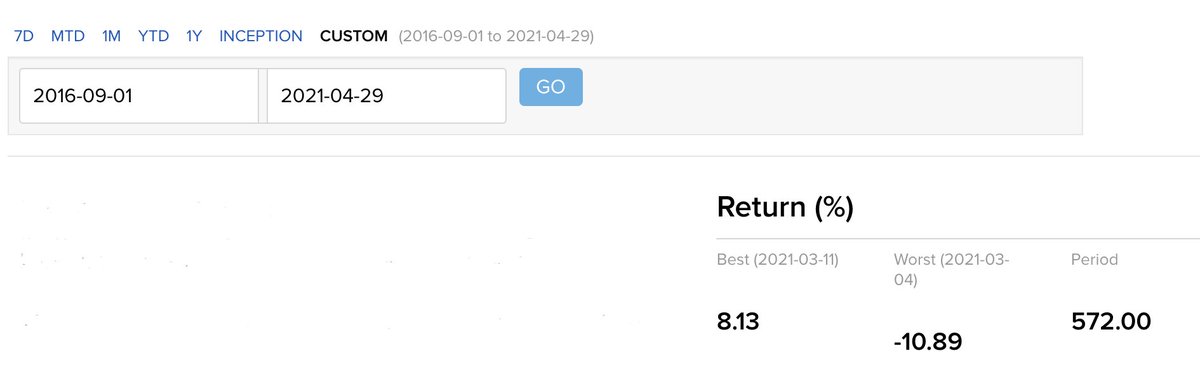

2) Return since 1 Sept 2016 -

Portfolio +572.00%

$ACWI +69.66%

$SPX +92.60%

CAGR since 1 Sept 2016 -

Portfolio +50.37%

$ACWI +11.99%

$SPX +15.07%

Contd...

Portfolio +572.00%

$ACWI +69.66%

$SPX +92.60%

CAGR since 1 Sept 2016 -

Portfolio +50.37%

$ACWI +11.99%

$SPX +15.07%

Contd...

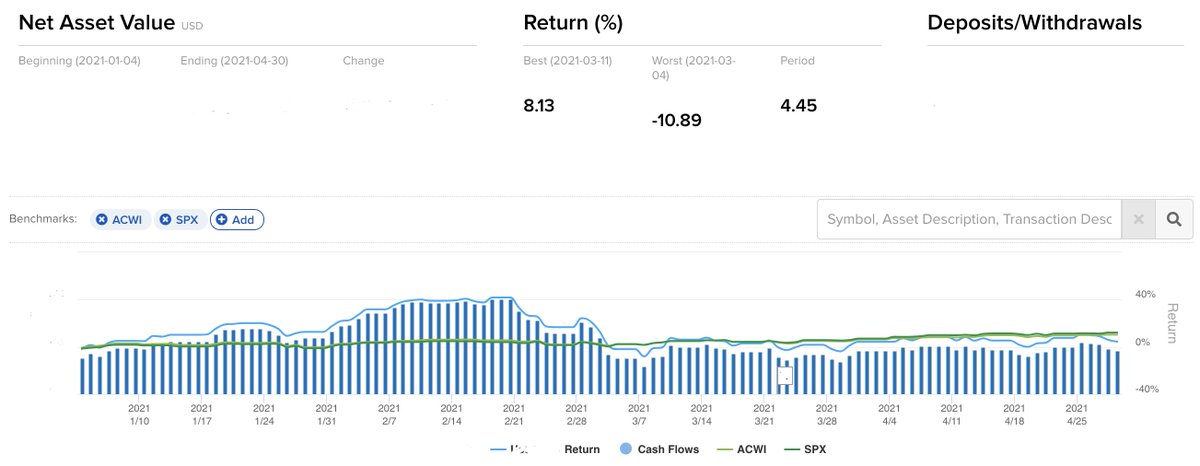

3) YTD return -

Portfolio +4.45%

$ACWI +8.6%

$SPX +11.32%

Biggest positions -

1) $MELI 2) $SE 3) $SNOW 4) $SNAP 5) $AGC

Contd....

Portfolio +4.45%

$ACWI +8.6%

$SPX +11.32%

Biggest positions -

1) $MELI 2) $SE 3) $SNOW 4) $SNAP 5) $AGC

Contd....

4) Commentary -

After a brutal March, April was a lot calmer as growth stocks stabilised due to a pullback in long dated interest rates.

During the month, I made some changes to my portfolio - namely, I invested in super exciting & #39;moaty& #39; hyper-growth businesses $AGC $PATH ...

After a brutal March, April was a lot calmer as growth stocks stabilised due to a pullback in long dated interest rates.

During the month, I made some changes to my portfolio - namely, I invested in super exciting & #39;moaty& #39; hyper-growth businesses $AGC $PATH ...

5) ... and after booking gains earlier in the year, also re-invested in $AFTPY and $SHOP.

In order to raise cash for the above investments, I sold some of my more cyclical lower-conviction stocks with high capex and lower margins.

Those businesses from the EV space might...

In order to raise cash for the above investments, I sold some of my more cyclical lower-conviction stocks with high capex and lower margins.

Those businesses from the EV space might...

6)...might still do well but the recent volatility in the markets made me realise that I prefer to own (sleep better) with less cyclical, high margin and platform type (sticky) businesses.

During the month, I also realised that the frenzy in Jan/Feb also caused me...

During the month, I also realised that the frenzy in Jan/Feb also caused me...

7)...to somewhat lose sight of the important stuff and I inadvertently got caught up in the hype (cyclical SPACs).

I& #39;ve now rectified those errors and hopefully brought my ship back on course.

Look. There is no doubt in my mind that EVs will boom but auto-manufacturing...

I& #39;ve now rectified those errors and hopefully brought my ship back on course.

Look. There is no doubt in my mind that EVs will boom but auto-manufacturing...

8)...is a very tough (high capex + low margin) business and I had no business investing in $ACTC or $CCIV

These businesses may do exceedingly well but they didn& #39;t really fit into my usual criteria of stock selection, which is why I sold my positions at a loss.

Elsewhere....

These businesses may do exceedingly well but they didn& #39;t really fit into my usual criteria of stock selection, which is why I sold my positions at a loss.

Elsewhere....

9) ...during the past month, after reviewing the revenue growth estimates, I also disposed off my position in $RBLX (which appears to be a more mature, slow growth company especially when compared to my other holdings). I also booked my gain in #NQ_F

Last but not least, a few...

Last but not least, a few...

10)...days ago, I went short #ZB_F as a trade but realised didn& #39;t want the hassle so covered it yesterday at a small loss.

In terms of the trend for growth stocks, my trend following indicators flashed downtrend on Thursday so I hedged my entire portfolio by shorting $ARKK ...

In terms of the trend for growth stocks, my trend following indicators flashed downtrend on Thursday so I hedged my entire portfolio by shorting $ARKK ...

11)...I have no idea what the stock market will do next week or next month but if long dated rates pick up and put pressure on growth stocks, my hedged position will mitigate my downside.

Conversely, if growth stocks zip higher, I& #39;ll end up removing my hedges with a small...

Conversely, if growth stocks zip higher, I& #39;ll end up removing my hedges with a small...

12)...loss and enjoy the next uptrend.

As far as my portfolio goes, it is my belief that I own shares of mostly world-class, innovative companies which are quite sticky and growing like weeds. Therefore, sooner or later, their business fundamentals will catch up...

As far as my portfolio goes, it is my belief that I own shares of mostly world-class, innovative companies which are quite sticky and growing like weeds. Therefore, sooner or later, their business fundamentals will catch up...

13)...with their market caps.

You& #39;ll recall that at the end of last year, I told you that 2020 was an anomaly and my future returns were going to be lower. Well, I got that one absolutely right and so far this year, I& #39;m trailing both the $ACWI and $SPX.

The short-term...

You& #39;ll recall that at the end of last year, I told you that 2020 was an anomaly and my future returns were going to be lower. Well, I got that one absolutely right and so far this year, I& #39;m trailing both the $ACWI and $SPX.

The short-term...

14)...underperformance notwithstanding, I& #39;m of the view that my portfolio should be able to outperform the broad indices over the next 4-5 years.

After all, business compounding is the 8th wonder of the world, so we& #39;ll see.

Hope this has been helpful.

After all, business compounding is the 8th wonder of the world, so we& #39;ll see.

Hope this has been helpful.

15) Word of caution -

I& #39;m a full-time investor and actively manage my portfolio and nowadays, don& #39;t report changes until month-end. Therefore, NOBODY should blindly follow me - please do your own homework/due diligence - it is YOUR money.

All the best!

I& #39;m a full-time investor and actively manage my portfolio and nowadays, don& #39;t report changes until month-end. Therefore, NOBODY should blindly follow me - please do your own homework/due diligence - it is YOUR money.

All the best!

16) Two more trades during the month -

Bought starter position in $FUBO on dip, but sold after stock went below its recent low and hit my GTC sell stop (very small loss)

Sold Bitcoin futures, covered after my GTC buy stop was hit (small loss)

- END of update -

Bought starter position in $FUBO on dip, but sold after stock went below its recent low and hit my GTC sell stop (very small loss)

Sold Bitcoin futures, covered after my GTC buy stop was hit (small loss)

- END of update -

Read on Twitter

Read on Twitter