It’s time to revisit an e-commerce giant. Here is the break down on $AMZN, otherwise known as Amazon.

Current Price: $3,467.89

52/Wk High: $3,552.25

52/Wk Low: $2,256.38

Market Cap: $1.7 Trillion

Read below for the breakdown! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

Current Price: $3,467.89

52/Wk High: $3,552.25

52/Wk Low: $2,256.38

Market Cap: $1.7 Trillion

Read below for the breakdown!

Amazon ( $AMZN ) is a major diversified retail company with key areas of focus including e-commerce, web services, streaming, AI, healthcare, and so much more.

Sifting through Amazon’s stock price according to TREFIS ( @trefis), 46.3% of the stock price is based on Amazon Web Services.

Furthermore, the Amazon North America segment represents 33.1%, Amazon International 18.1%, and 2.6% is based on cash and or net of debt.

Furthermore, the Amazon North America segment represents 33.1%, Amazon International 18.1%, and 2.6% is based on cash and or net of debt.

In recent news CEO Jeff Bezos announced his stepping down as CEO after 25 years with long time executive Andy Jassy taking the spot.

Taking a brief look at the past of the newly appointed CEO, Jassy joined Amazon in the late 1990’s, eventually working his way from Bezos’s first shadow advisor to assisting in founding AWS and then heading Amazon’s cloud services division.

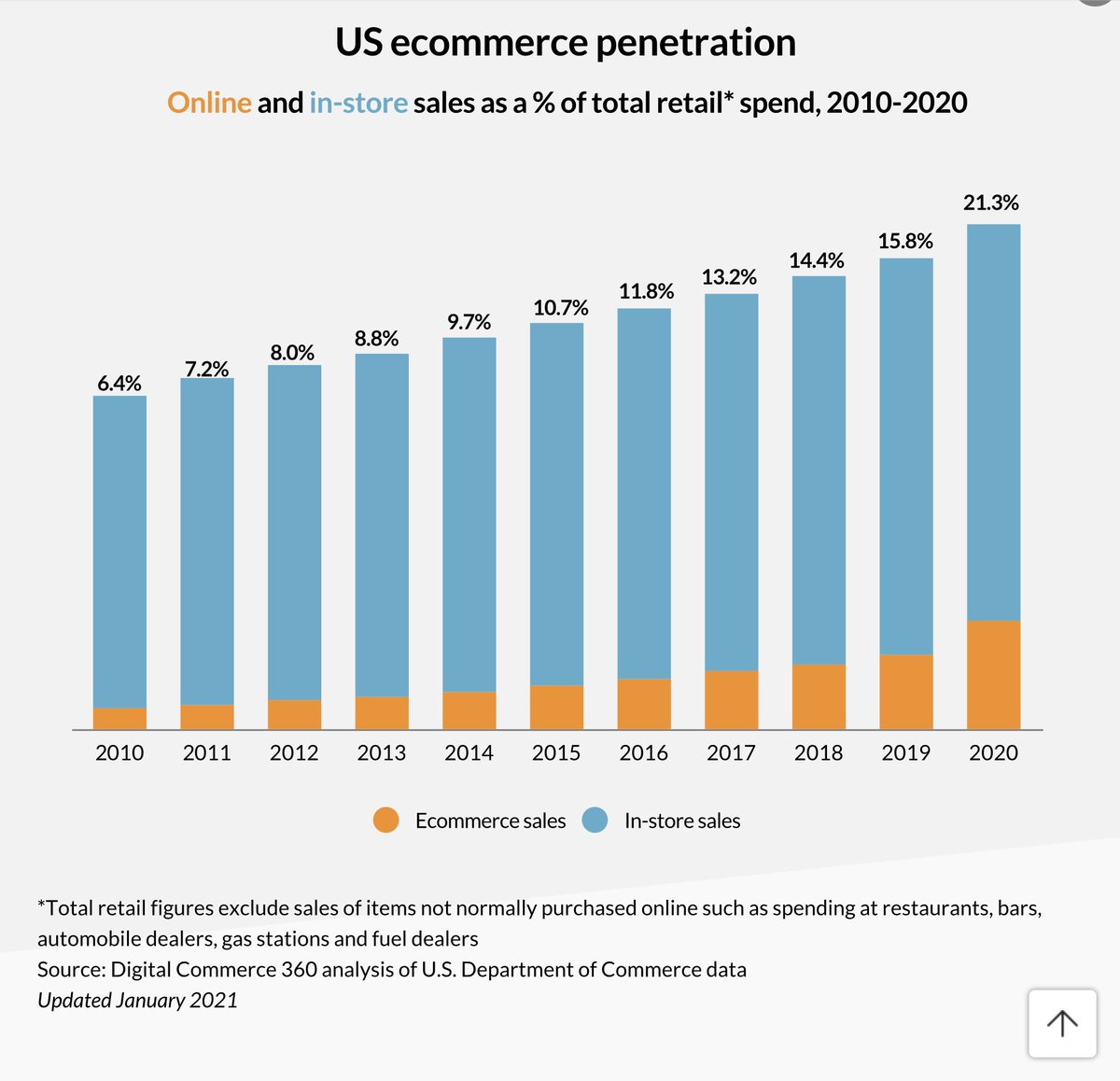

Focusing on the e-commerce industry, US e-commerce penetration totaled just 21.3% in 2020. Given that Amazon when last recorded maintained 31.4% of all US e-commerce sales, it is safe to say steady growth is ahead as e-commerce penetration increases.

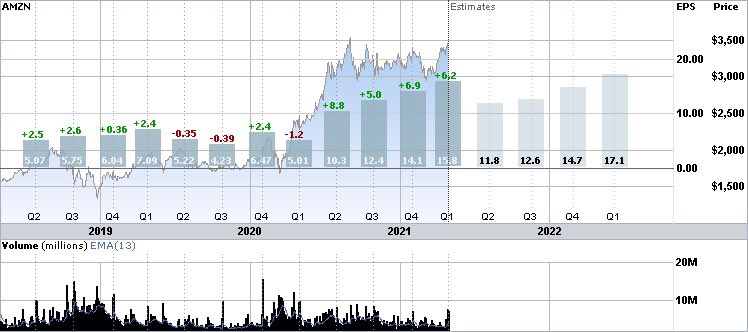

Digging into the numbers Amazon beat Q1 2021 expectations with an EPS of $15.79, much better than the analyst’s EPS consensus estimate of $9.54. On a year-over-year basis, EPS improved by 215.17%.

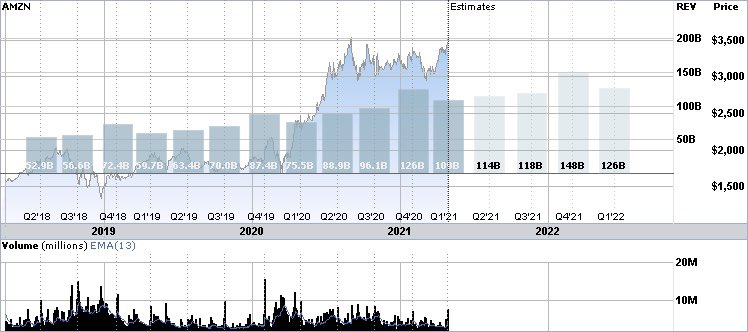

Sales improved significantly, with net sales jumping by 44% year-over-year to a strong $108.5 billion for the quarter. For reference, Q1 2020 net sales totaled $75.5 billion.

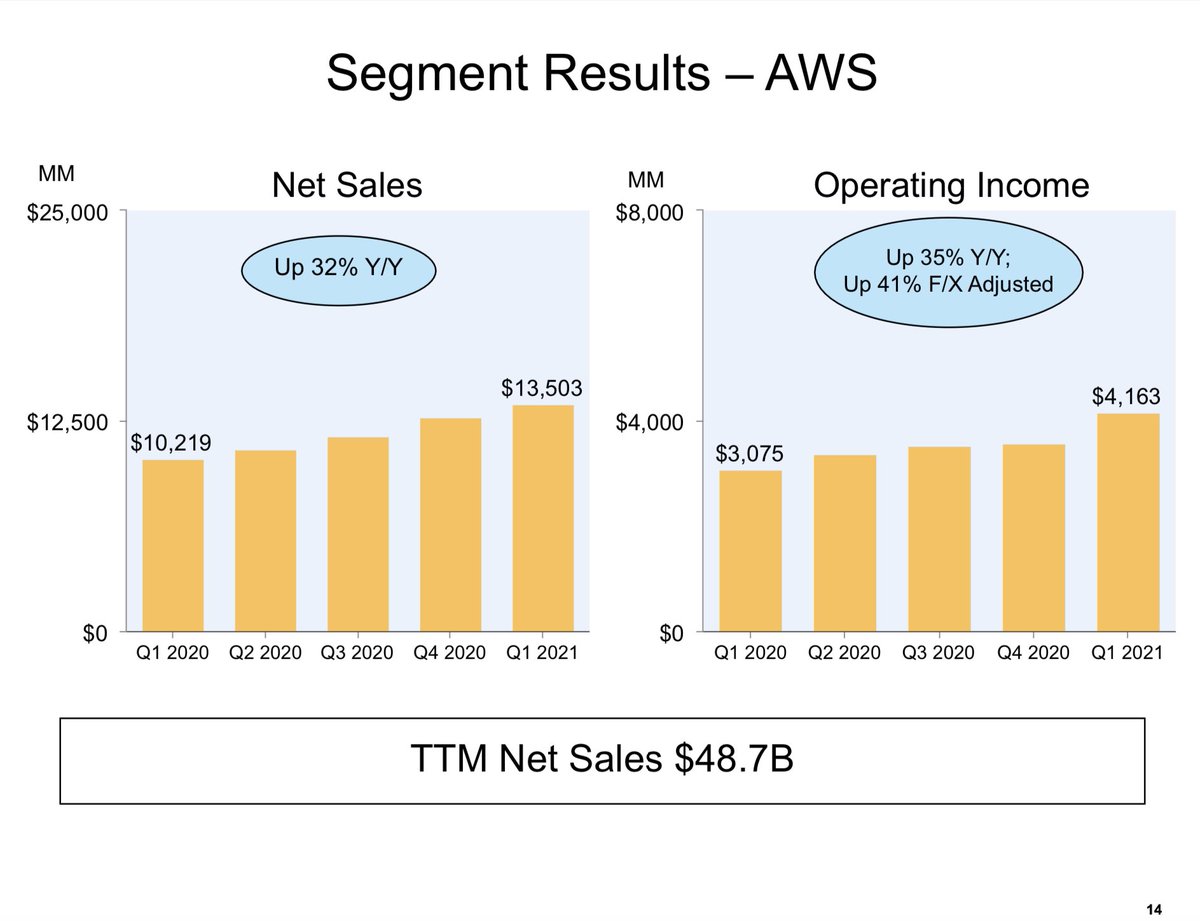

Breaking down sales, Amazon Web Services net sales totaled $13.501 billion for the quarter, representing 32% growth year-over-year.

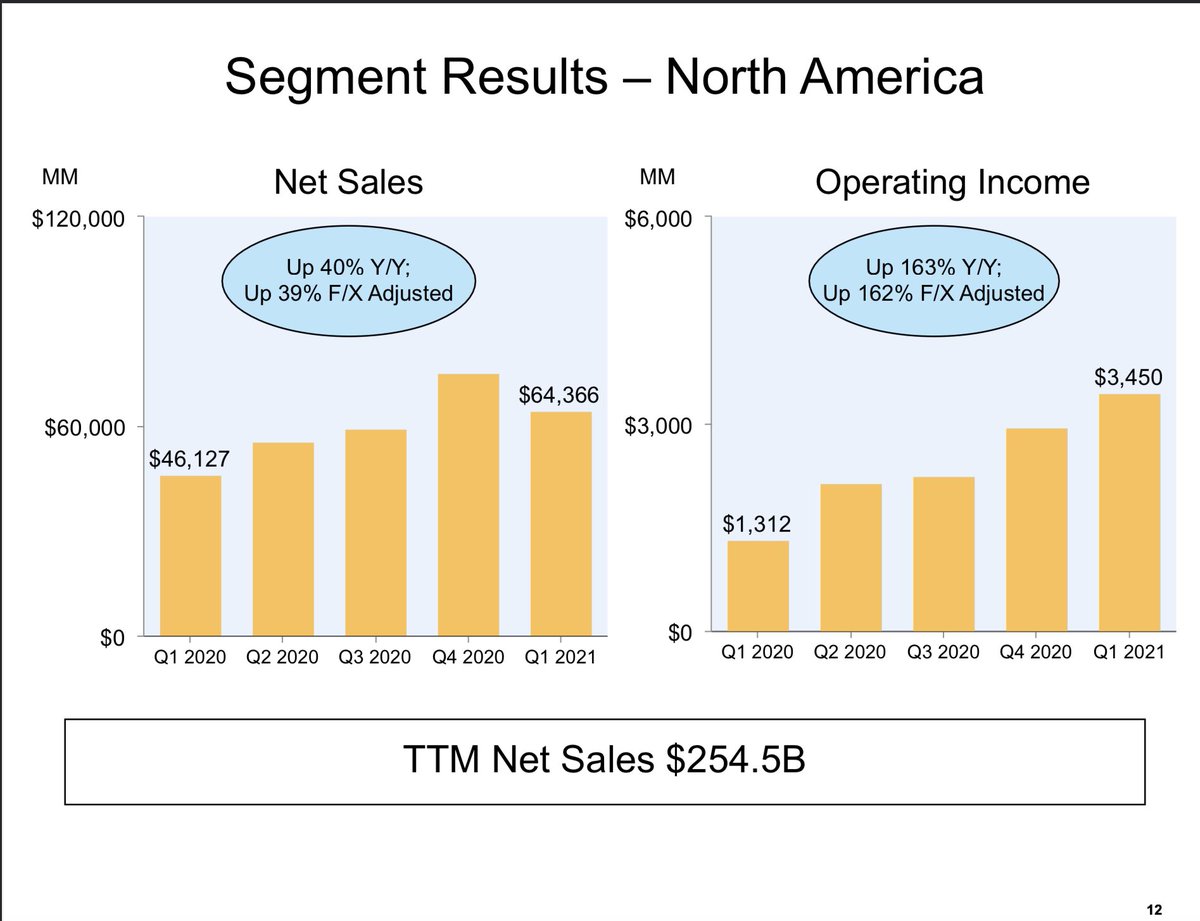

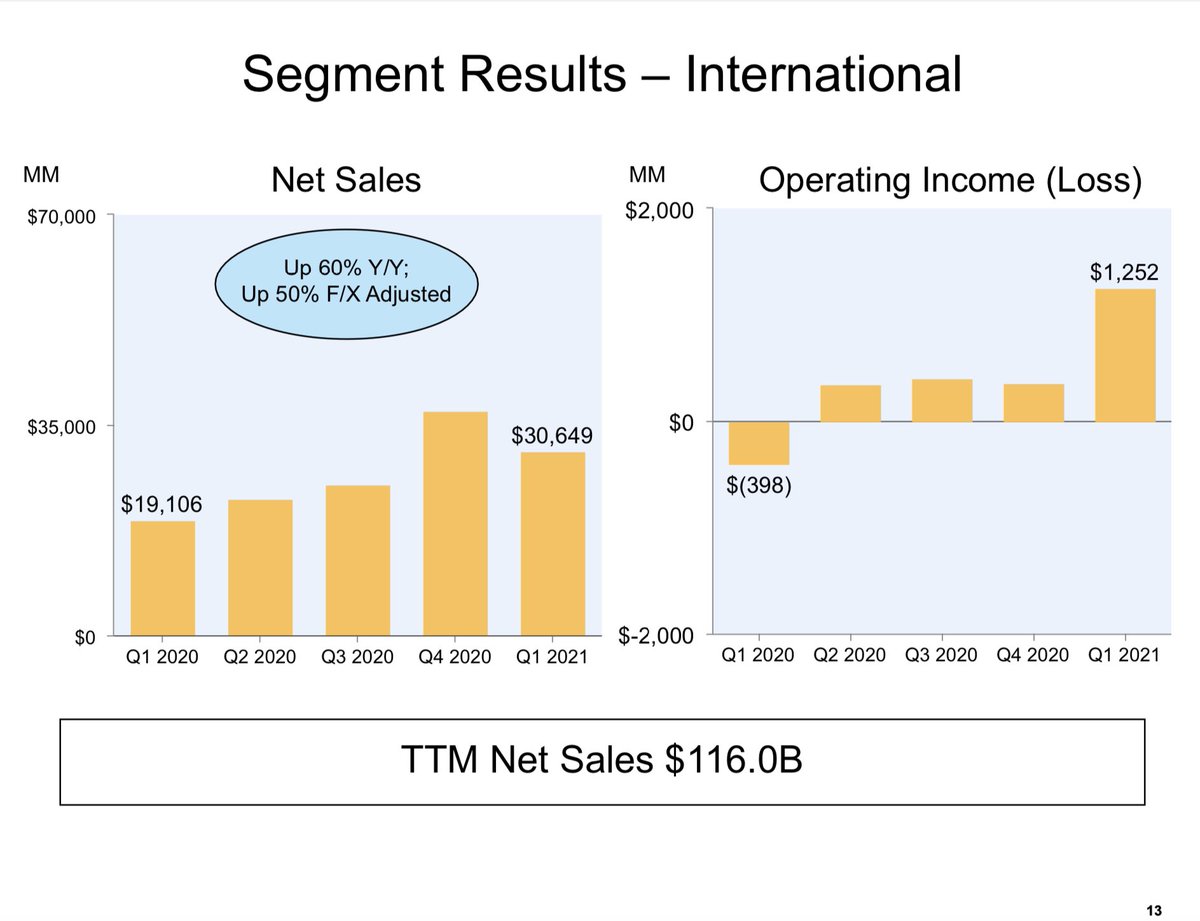

Furthermore, North America net sales increased by a strong 40% to $64.366 billion while International net sales increased by 60% year-over-year to $30.649 million.

Shifting into cash flows, operating cash flow improved by a strong 69% year-over-year to $67.2 billion. For comparison the Q2 2020 operating cash flows level totaled $39.7 billion.

As for free cash flow, Amazon reported a solid increase, with Q1 2021 free cash flow totaling $26.4 billion compared to the $24.3 billion in Q1 2020.

On the income front, Amazon reported a Q1 2021 operating income of $8.9 billion, more than doubling the Q1 2020 level of $4 billion.

Net income significantly improved as well, with net income more than doubling to $8.1 billion from the Q1 2020 level of $2.5 billion.

Net income significantly improved as well, with net income more than doubling to $8.1 billion from the Q1 2020 level of $2.5 billion.

Amazon Prime Video was also of focus.

“As Prime Video turns 10, over 175 million Prime members have streamed shows and movies in the past year, and streaming hours are up more than 70% year over year,” CEO Jeff Bezos said.

“As Prime Video turns 10, over 175 million Prime members have streamed shows and movies in the past year, and streaming hours are up more than 70% year over year,” CEO Jeff Bezos said.

Looking ahead, Amazon provided solid guidance expecting Q2 2021 net sales to land within a range of $110 billion to $116 billion, representing 24% to 30% growth on a year-over-year basis.

Furthermore, leadership expects operating income to land within a range of $4.5 billion to $8 billion, higher than the Q2 2020 operating income level of $5.8 billion.

Shifting into the balance sheet the numbers are solid.

Total Debt: $51.031 Billion

Total Liabilities: $227.791 Billion

Total Assets: $321.195 Billion

Cash & Short Term Inv: $84.396 Billion

Total Debt: $51.031 Billion

Total Liabilities: $227.791 Billion

Total Assets: $321.195 Billion

Cash & Short Term Inv: $84.396 Billion

On a valuation basis, Amazon does trade at a premium.

Price to Earnings: 83.04x

Forward Price to Earnings: 52.43x

Price to Sales: 4.48x

Price to Book: 18.56x

Price to Cash Flow: 27.93x

Price to Earnings: 83.04x

Forward Price to Earnings: 52.43x

Price to Sales: 4.48x

Price to Book: 18.56x

Price to Cash Flow: 27.93x

Management has been effective.

Return on Equity: 31.91%

Return on Assets: 9.84%

Return on Invested Capital: 15.34%

Return on Equity: 31.91%

Return on Assets: 9.84%

Return on Invested Capital: 15.34%

Given the numbers the analysts are bullish with a mean price target of $4,302/share, representing a 24.06% upside.

The high price target is $5,500/share, representing a 58.62% gain, while the low price target is $3,750/share, representing a minimal 8.15% upside.

The high price target is $5,500/share, representing a 58.62% gain, while the low price target is $3,750/share, representing a minimal 8.15% upside.

The big money is quite involved as well with 56.85% of Amazon being owned by institutions. Top holders include The Vanguard Group, BlackRock Institutional Trust, and State Street Global Advisors.

On a technical basis Amazon is solid. According to the six-month charts the MACD is moving with upside momentum within a tight range around 64.39.

The six-month charts are also indicating an RSI of 66.48 and CCI of 162.94, both of which are on the high end.

The six-month charts are also indicating an RSI of 66.48 and CCI of 162.94, both of which are on the high end.

In short, Amazon ( $AMZN ) is a sure fire bet with an expanding cloud business, growing e-commerce segment, a loyal customer base, and reliable management team.

EAT - SLEEP - PROFIT  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

Disclaimer: This is not direct financial advice, simply an opinion based on independent research.

Disclaimer: This is not direct financial advice, simply an opinion based on independent research.

Read on Twitter

Read on Twitter " title="It’s time to revisit an e-commerce giant. Here is the break down on $AMZN, otherwise known as Amazon.Current Price: $3,467.8952/Wk High: $3,552.2552/Wk Low: $2,256.38Market Cap: $1.7 TrillionRead below for the breakdown! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">" class="img-responsive" style="max-width:100%;"/>

" title="It’s time to revisit an e-commerce giant. Here is the break down on $AMZN, otherwise known as Amazon.Current Price: $3,467.8952/Wk High: $3,552.2552/Wk Low: $2,256.38Market Cap: $1.7 TrillionRead below for the breakdown! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">" class="img-responsive" style="max-width:100%;"/>