Real Estate Investors pay no taxes on property sales.

This is because of the 1031 Exchange. It& #39;s been around since 1921. And now it& #39;s going to be eliminated.

Here& #39;s why it& #39;s a TERRIBLE idea and why you should care (even if you& #39;re not in Real Estate):

This is because of the 1031 Exchange. It& #39;s been around since 1921. And now it& #39;s going to be eliminated.

Here& #39;s why it& #39;s a TERRIBLE idea and why you should care (even if you& #39;re not in Real Estate):

1031 is when you sell a property and then reinvest your profits into another property, deferring taxes.

You have 6 months to acquire a new property after you sell.

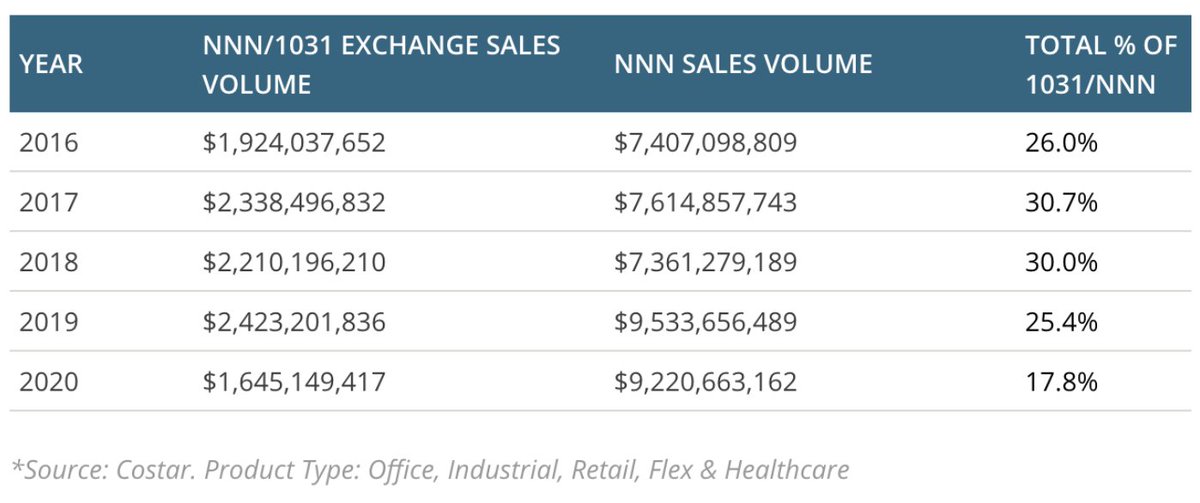

The market is $2 Billion+ of Sales Volume every year. (doesn& #39;t include multifamily)

You have 6 months to acquire a new property after you sell.

The market is $2 Billion+ of Sales Volume every year. (doesn& #39;t include multifamily)

1031 Proponents will say this is a fundamental part of the American Dream.

Anyone can grow up poor, buy a small property, and keep trading up and build a large portfolio from nothing.

While at the same time investing and upgrading in U.S. Real Estate.

Anyone can grow up poor, buy a small property, and keep trading up and build a large portfolio from nothing.

While at the same time investing and upgrading in U.S. Real Estate.

The anti-1031 crowd will say this is just another tax break for wealthy Real Estate investors.

They& #39;ll also say this drives up pricing of properties because investors are willing to pay higher amounts because of the tax benefits + short 6-month timeframe of needing to re-invest.

They& #39;ll also say this drives up pricing of properties because investors are willing to pay higher amounts because of the tax benefits + short 6-month timeframe of needing to re-invest.

The White House wants to eliminate the 1031 exchange for gains larger than $500k.

They also want to increase the capital gains tax to ~40% for people making over $1M. So when you sell a property, you pay double the tax rate.

This ultimately harms smaller Real Estate investors.

They also want to increase the capital gains tax to ~40% for people making over $1M. So when you sell a property, you pay double the tax rate.

This ultimately harms smaller Real Estate investors.

Real Estate owners will be incentivized to hold on to their properties longer so they don& #39;t have to take these tax hits.

This means less properties available for sale. Less opportunity for people to allocate risk capital, improve properties, and generate compounding returns.

This means less properties available for sale. Less opportunity for people to allocate risk capital, improve properties, and generate compounding returns.

@jayvasdigital lives in Canada where they don& #39;t have 1031.

Owners in Canada don& #39;t sell because of the taxes.

This discourages younger people from investing in Real Estate. He says tax-free exchanges convert "asleep capital" to"risk capital". https://twitter.com/jayvasdigital/status/1323261148653850624?s=20">https://twitter.com/jayvasdig...

Owners in Canada don& #39;t sell because of the taxes.

This discourages younger people from investing in Real Estate. He says tax-free exchanges convert "asleep capital" to"risk capital". https://twitter.com/jayvasdigital/status/1323261148653850624?s=20">https://twitter.com/jayvasdig...

The $500k limit doesn& #39;t help first time investors and homebuyers.

It increases the amount of investors going into these smaller deals as @realMeetKevin points out: https://twitter.com/realMeetKevin/status/1387414898351624202?s=20">https://twitter.com/realMeetK...

It increases the amount of investors going into these smaller deals as @realMeetKevin points out: https://twitter.com/realMeetKevin/status/1387414898351624202?s=20">https://twitter.com/realMeetK...

The 1031 exchange improves the living conditions of buildings.

When a new investor buys a deal they need to improve the condition of the building to get a higher return on their money. This creates nicer places to live.

Generational holders do not do this. There& #39;s no incentive.

When a new investor buys a deal they need to improve the condition of the building to get a higher return on their money. This creates nicer places to live.

Generational holders do not do this. There& #39;s no incentive.

People think this is another version of "tax the rich!" but similar to @SRuhle they haven& #39;t thought about the 2nd & 3rd order effects and how eliminating 1031 actually harms early investors, younger people, and renters the most. https://twitter.com/SRuhle/status/1385945235839242241?s=20">https://twitter.com/SRuhle/st...

Eliminating the 1031 will result in wealthy Real Estate families hoarding wealth because they& #39;ll never want to sell.

1031 elimination may have good intentions but the consequences hurt small RE investors, renters, and the overall Real Estate property conditions in the U.S.

1031 elimination may have good intentions but the consequences hurt small RE investors, renters, and the overall Real Estate property conditions in the U.S.

Do not punish people for keeping their money in the market and re-investing.

This is long-term risk capital that continues to improve & upgrade the infrastructure & living conditions in the U.S.

Tax short-term non-value add capital, not long-term value creating capital.

This is long-term risk capital that continues to improve & upgrade the infrastructure & living conditions in the U.S.

Tax short-term non-value add capital, not long-term value creating capital.

Read on Twitter

Read on Twitter