Also available on:

Medium ( https://sinoglobalcap.medium.com/why-we-invested-in-cope-8dc920caeffe)">https://sinoglobalcap.medium.com/why-we-in...

Github ( https://github.com/sinoglobalcap/investment-theses/blob/main/cope.md)

Research">https://github.com/sinogloba... by @vinerstein

Medium ( https://sinoglobalcap.medium.com/why-we-invested-in-cope-8dc920caeffe)">https://sinoglobalcap.medium.com/why-we-in...

Github ( https://github.com/sinoglobalcap/investment-theses/blob/main/cope.md)

Research">https://github.com/sinogloba... by @vinerstein

1. Introduction

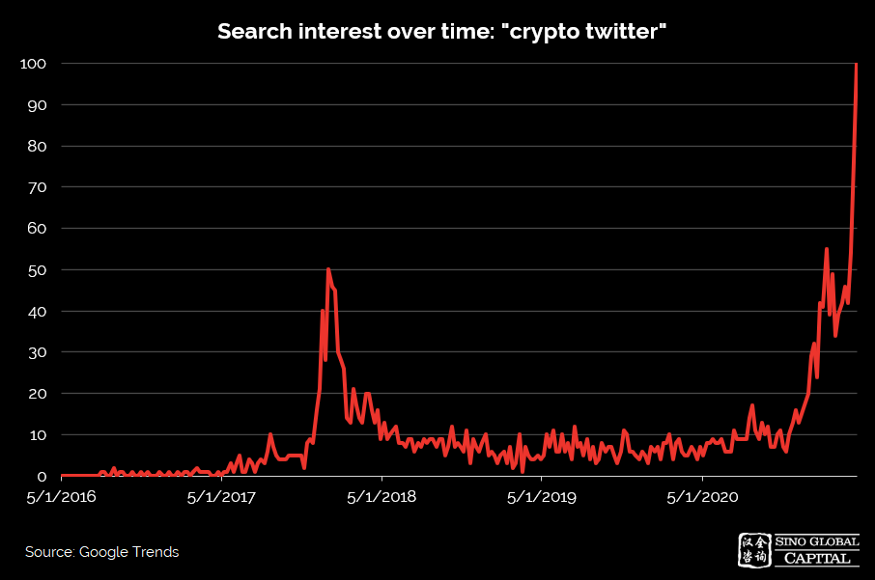

1.1. As the crypto ecosystem has exploded in popularity, there are new projects every day, podcasts, research reports, data analysis tools, Substacks, and Telegram groups all spewing information like a fire hose. Twitter has emerged as the leading platform..

1.1. As the crypto ecosystem has exploded in popularity, there are new projects every day, podcasts, research reports, data analysis tools, Substacks, and Telegram groups all spewing information like a fire hose. Twitter has emerged as the leading platform..

..for seeking alpha in the crypto ecosystem. The importance of Twitter to crypto can not be overstated; many careers have been made, projects launched/discovered, partnerships formed, and trends catalyzed by crypto Twitter. However, it still remains difficult to separate the..

..signal from the noise and follower count alone does not correlate with the quality of the user’s insights (especially because shitposting tends to yield more engagement). Cope changes this by offering the ultimate signal filter. In its simplest form, Cope is a way to measure..

..the quality of a Twitter user’s “market calls”, and makes it as easy as possible to deploy your capital behind these Twitter users.

1.2. Key reasons Cope will thrive

1.2.1. Organically growing grassroots community

1.2.2. Viral adoption is inherent to the protocol’s design

1.2.3. Sound tokenomics ensure supply decreases as Cope utility and adoption increase

1.2.1. Organically growing grassroots community

1.2.2. Viral adoption is inherent to the protocol’s design

1.2.3. Sound tokenomics ensure supply decreases as Cope utility and adoption increase

1.2.4. Positioned to thrive as social media influence and financial advice continue to converge

1.2.5. Highly engaged, the fast-moving founding team

1.2.5. Highly engaged, the fast-moving founding team

2. Products

2.1. Cope Score - Quantitative performance measurement of market calls made by Twitter accounts

2.2. Cope Leader Board - Ranking of Twitter-based call makers

2.3. Cope trading pools - Bot-operated decentralized trading pools that copy trade top call makers

2.1. Cope Score - Quantitative performance measurement of market calls made by Twitter accounts

2.2. Cope Leader Board - Ranking of Twitter-based call makers

2.3. Cope trading pools - Bot-operated decentralized trading pools that copy trade top call makers

2.4. Cope Index - An Index of twenty tokens selected based on the recommendations of the top 100 call makers, rebalanced every 48 hours

3. Cope score

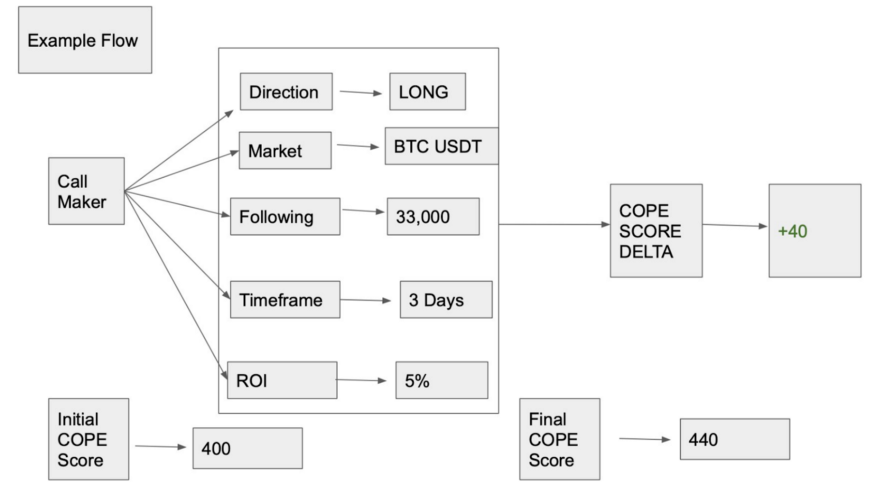

3.1. Cope Scores range from 0 to 1000, but start at 400, and represent a quantitative metric used to measure the accuracy of Twitter accounts market calls. Once a Cope report is generated, Twitter bots begin crawling the account and monitoring all subsequent..

3.1. Cope Scores range from 0 to 1000, but start at 400, and represent a quantitative metric used to measure the accuracy of Twitter accounts market calls. Once a Cope report is generated, Twitter bots begin crawling the account and monitoring all subsequent..

..tweets. Every two weeks the system will adjust the Cope Score of all accounts based on the quality of their market calls. The Cope Score utilizes the following variables to evaluate performance:

3.2.1. ROI

Most crucial to the formula is the return on investment (ROI) — If you followed this advice ROI would be what your return would be. Based on a historical analysis of the call maker’s calls — an investment timeframe is associated with the account (could be 1 min..

Most crucial to the formula is the return on investment (ROI) — If you followed this advice ROI would be what your return would be. Based on a historical analysis of the call maker’s calls — an investment timeframe is associated with the account (could be 1 min..

..scalping, 5-hour momentum trades, or month/year-long thesis-driven trades). This timeframe variable creates the period, starting at the moment of the call, for which the direction and size of the market price change will be used to calculate the ROI of the call.

3.2.2. Size of Audience

This factor is used as a proxy for a user’s authority. A good call from an account with lots of followers is of more interest to the community and thus it will have a bigger impact on their score than the same call from a smaller account. However, this..

This factor is used as a proxy for a user’s authority. A good call from an account with lots of followers is of more interest to the community and thus it will have a bigger impact on their score than the same call from a smaller account. However, this..

..works both ways, as they will also be more heavily penalized for bad calls than smaller accounts.

3.2.3. 24 Hour trading volume delta

3.2.3. 24 Hour trading volume delta

A spike in trading volume often comes with increased volatility and uncertainty, call makers are rewarded more for making the right calls on days with heightened trading activity, and conversely, they are penalized more for making the wrong calls on those days.

3.3. The final score is then subject to a discount based on the user’s previous Cope Score, this is designed so that accounts with higher Cope Scores are penalized more severely for wrong calls.

3.4. Beyond bragging rights and validation, maintaining good standing on the Cope Leaderboard can earn top call makers significant Cope. Initially, 4000 Cope will be distributed progressively every 2 weeks score. This amount will be subject to review by the community once live.

3.5. More info on Cope tokenomics can be found here ( https://www.unlimitedcope.com/assets/COPE_Tokenomics_0.pdf).">https://www.unlimitedcope.com/assets/CO...

4. Examples of Twitter market calls

Using data analysis bots to crawl through Twitter accounts, Cope generates an ongoing Cope Score that quantifies the performance and accuracy of a Twitter user’s market calls. Examples:

Using data analysis bots to crawl through Twitter accounts, Cope generates an ongoing Cope Score that quantifies the performance and accuracy of a Twitter user’s market calls. Examples:

4.1. Increase Cope score

4.1.1 Recommends new projects that go on to 10X:

https://twitter.com/scupytrooples/status/1284847048559230982?s=20

https://twitter.com/scupytroo... href="https://twitter.com/scupytrooples">@scupytrooples

4.1.1 Recommends new projects that go on to 10X:

https://twitter.com/scupytrooples/status/1284847048559230982?s=20

4.1.2. Calls the bottom/top of a token, at the actual bottom/top:

https://twitter.com/tayvano_/status/1379879536377036803?s=20

https://twitter.com/tayvano_/... href="https://twitter.com/tayvano_">@tayvano_

https://twitter.com/tayvano_/status/1379879536377036803?s=20

4.1.3. Criticizes projects that end up declining in value:

https://twitter.com/novogratz/status/948901960132038656?s=20

https://twitter.com/novogratz... href="https://twitter.com/novogratz">@novogratz

https://twitter.com/novogratz/status/948901960132038656?s=20

4.2. Decrease Cope score

- Recommends new projects that go on to decline in value

- Makes inaccurate top/bottom calls

- Criticizes projects that go on to 5X

- Recommends new projects that go on to decline in value

- Makes inaccurate top/bottom calls

- Criticizes projects that go on to 5X

4.3. Cope offers an evidence-based (past performance) approach to evaluating the quality of twitter signals. We do have PnL leaderboards on Binance and FTX and those do point you towards quality traders, but not necessarily to quality advice; as there is no accountability..

..between what someone tweets and what trades they make that determine their PnL. Cope fixes this, for the first time we can get closer to an information market that is based exclusively on the merit of the insights. If you make high-quality “calls” you will..

..be recognized (no pedigree or “shitposting” required). Cope is the democratization of the social media market call maker.

5. Cope trading pools

5.1. Cope Trading pools offer a passive way to copy the trades of any call maker on the Cope Leaderboard. While in the past you might have used tweet notifications to quickly trade the latest call from your favorite account, Cope Trading Pools automates..

5.1. Cope Trading pools offer a passive way to copy the trades of any call maker on the Cope Leaderboard. While in the past you might have used tweet notifications to quickly trade the latest call from your favorite account, Cope Trading Pools automates..

..this in a very elegant manner. Simply deposit USDC into your favorite call maker’s non-custodial trading pool and the bot will trade into whatever asset was most recently recommended by the call maker. As new calls are made, your assets move and are..

..adjusted accordingly. Profits are automatically harvested every 48 hours:

5.1.1. 65% of profits are returned to the investor

5.1.2. 20% of profits go to the call makers wallet

5.1.3. 10% of profits are will be used to buy and burn Cope

5.1.1. 65% of profits are returned to the investor

5.1.2. 20% of profits go to the call makers wallet

5.1.3. 10% of profits are will be used to buy and burn Cope

5.1.4. 5% go to the community grants program (Decided by Cope holders)

5.2. Robo trading/asset management in crypto has yet to take off in the crypto ecosystem. This is partly due to the complexity of such a project which becomes prohibitively expensive when launching on..

5.2. Robo trading/asset management in crypto has yet to take off in the crypto ecosystem. This is partly due to the complexity of such a project which becomes prohibitively expensive when launching on..

..Ethereum. By utilizing Solana, the tx fees become negligible and the use case becomes feasible. Furthermore, call makers don’t need to adopt new tech or change their behavior to participate and earn fees — they just need to keep tweeting (and activate their report).

6. Cope index

6.1. Going beyond pointing you towards the best Twitter accounts to follow or deploy capital behind, Cope is building a dynamic index of 20 tokens based on the calls made by the Cope Leaderboard. The Cope Index provides a low maintenance option for allocating..

6.1. Going beyond pointing you towards the best Twitter accounts to follow or deploy capital behind, Cope is building a dynamic index of 20 tokens based on the calls made by the Cope Leaderboard. The Cope Index provides a low maintenance option for allocating..

..capital into a diverse set of tokens determined by the Cope Leaderboard call makers. Tokens included in the index are subject to reasonably strict eligibility requirements including average market cap/trading volume over the last 30 days, liquidity, and an active USDC trading..

..pair on the Serum Dex. The index will be rebalanced every few days to provide adequate time for the call makers’ calls to take place.

6.2. Similar to the Cope Trading Pools, profits from the Cope Index are harvested every 48 hours:

6.2. Similar to the Cope Trading Pools, profits from the Cope Index are harvested every 48 hours:

6.2.1. 80% of profits are returned to the investor

6.2.2. 15% of profits are will be used to buy and burn Cope

6.2.3. 5% go to the community grants program (Decided by Cope holders)

6.2.2. 15% of profits are will be used to buy and burn Cope

6.2.3. 5% go to the community grants program (Decided by Cope holders)

6.3. Notably, the Cope index fees are substantially lower than the Cope Trading pools - 20% of profits rather than 35% of profits. Additionally, there is no profit sharing with the call makers, so a larger share of the profits are used for Cope burning and community development.

7. Token Supply Sinks

7.1.1. 15% of profits from the Cope index will be used to buy and burn Cope every 48 hours.

7.1.2. 0.5% withdrawal fee is applied to the Cope Index, this we will be used to buy and burn Cope.

7.1.1. 15% of profits from the Cope index will be used to buy and burn Cope every 48 hours.

7.1.2. 0.5% withdrawal fee is applied to the Cope Index, this we will be used to buy and burn Cope.

7.1.3. 10% of profits from Cope trading pools will be used to buy and burn Cope every 48 hours.

7.1.4. To unlock your Cope report or others, it cost 10 Cope. 75% of this Cope will be burned.

7.1.4. To unlock your Cope report or others, it cost 10 Cope. 75% of this Cope will be burned.

7.1.5. To unlock unlimited Cope reports a user must stake 1000 Cope LP tokens (LP tokens can be for Cope/Sol, Cope/USDC, or Cope/Ray).

7.1.6. The SPL token distributor can also be used by third-party projects for a 200 Cope fee which will then be burned.

7.1.6. The SPL token distributor can also be used by third-party projects for a 200 Cope fee which will then be burned.

7.2. It is estimated that in the first year, 400K Cope will be burned. As adoption and demand for Cope products grow, the amount of Cope burned annually will continue to increase.

7.3. The COPE circulating supply will gradually increase from Cope rewards minted and distributed to the leaderboard (4000 bi-weekly), COPE liquidity mining and other pool incentives (5% of supply), and Cope tokens allocated to early investors and founding team ( 10% linearly..

..vested over 1–3 years). This puts the current circulating supply at 16.7 M with 90% held by the community. At current Cope price levels, the circulating token supply in 4 years implies a liquid market cap of less than $100M.

8. Team

8.1. The people behind Cope exhibit some of our favorite founder qualities. @cyrii_MM and the team are hustlers. They bring extensive crypto developer experience from APEX:E3 - an institutional-grade crypto data platform.

8.1. The people behind Cope exhibit some of our favorite founder qualities. @cyrii_MM and the team are hustlers. They bring extensive crypto developer experience from APEX:E3 - an institutional-grade crypto data platform.

8.2. When building a new product in crypto — founders are often met with unexpected roadblocks due to missing infrastructure. When Cryii and the team realized there was no tool on Solana for bulk transactions (airdrop distribution), they simply built one from..

..scratch; demonstrating, both their project commitment and aptitude for shipping high-quality code — fast. The scrappy dedication of these founders was a great signal.

Read on Twitter

Read on Twitter