Thread for beginners on Index funds for Long duration

#StockMarket #MutualFund #IndexFund #ETF

Index funds are diversified in nature which minimise risk

#StockMarket #MutualFund #IndexFund #ETF

Index funds are diversified in nature which minimise risk

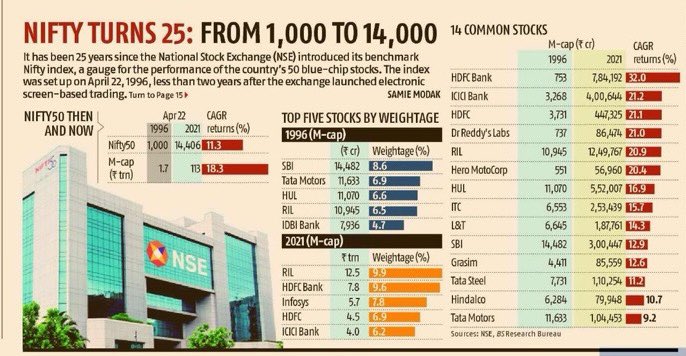

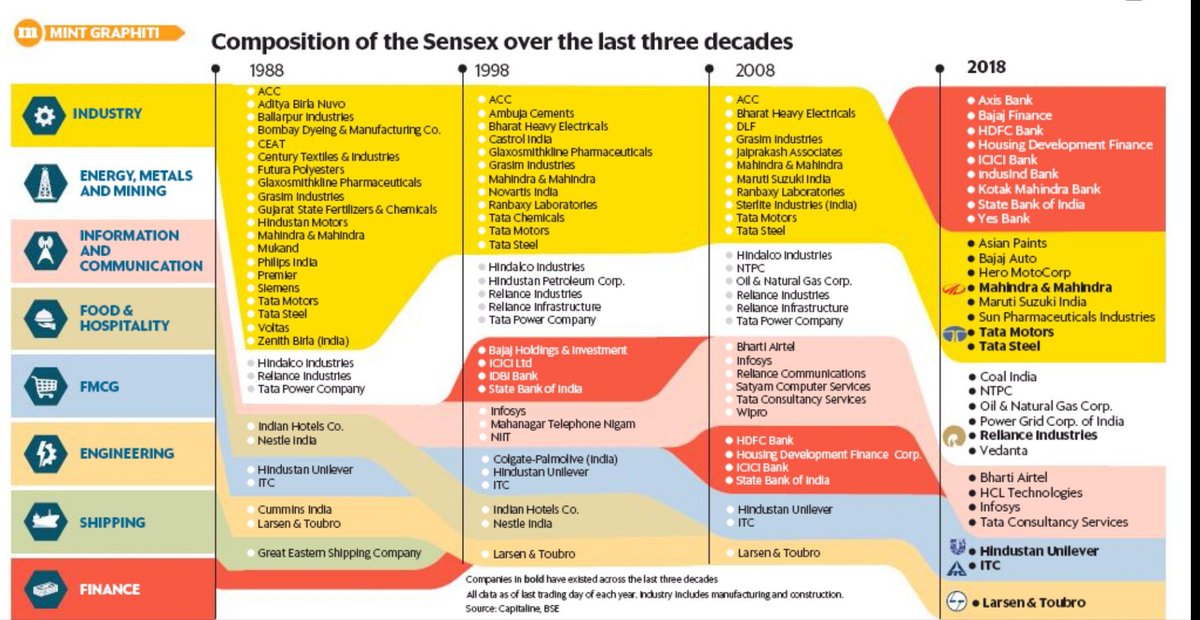

All stocks won’t perform for long durations, stocks in index managed based on stock performances in regular basis.

Picture shows Nifty50 stocks are not standard, list altered based on performance

Picture shows Nifty50 stocks are not standard, list altered based on performance

Good current performing stocks will turn to penny stocks in future, Index funds minimise risk in this criteria

Non performing stocks will be moved away from index by SEBI & next performing stocks will b included

Non performing stocks will be moved away from index by SEBI & next performing stocks will b included

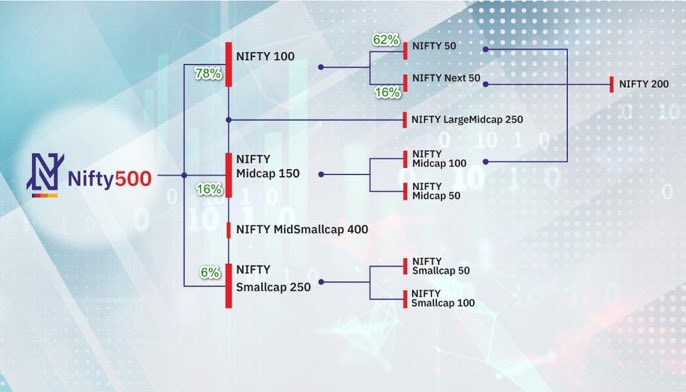

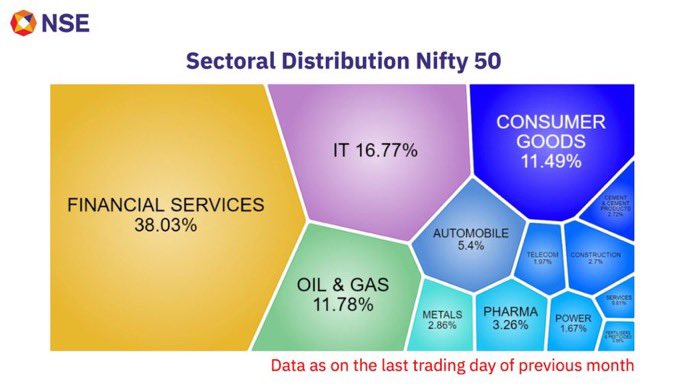

Index funds distribution & listed stocks contributions in high level. Moderate to high risk stocks based on different index lists

Portfolio with max Five Funds based on needs & capacity.

Large cap - N50 Index ETF Fund

Midcap - Mid cap 150 ETF Fund

Smallcap - Smallcap 250 ETF Fund

Intl - Nasdaq 100 / SPX500 Fund

ELSS / Hybrid Fund

Large cap - N50 Index ETF Fund

Midcap - Mid cap 150 ETF Fund

Smallcap - Smallcap 250 ETF Fund

Intl - Nasdaq 100 / SPX500 Fund

ELSS / Hybrid Fund

Index Funds initial purchase varies amount from 1000 to 5000 max.

SIP available minimum 500 with weekly monthly yearly.

Daily also possible as 5 weekly SIP added on each weekday.

SIP to be increased 10% on each year to match inflation

SIP available minimum 500 with weekly monthly yearly.

Daily also possible as 5 weekly SIP added on each weekday.

SIP to be increased 10% on each year to match inflation

Midcap 150 consists of Micap stocks including Nifty next 50 stocks

This is higher risk compared to Nifty50 index funds

This is higher risk compared to Nifty50 index funds

Smallcap 250

High risk High rewards which is purely preferred for longer durations

High risk compared with Midcap stocks

High risk High rewards which is purely preferred for longer durations

High risk compared with Midcap stocks

International Funds

Nasdaq 100 High Risk High Returns

SPX500 Moderate Risk Moderate Returns

We have also

China 101 FoF

S&P Euro 350 Index Fund

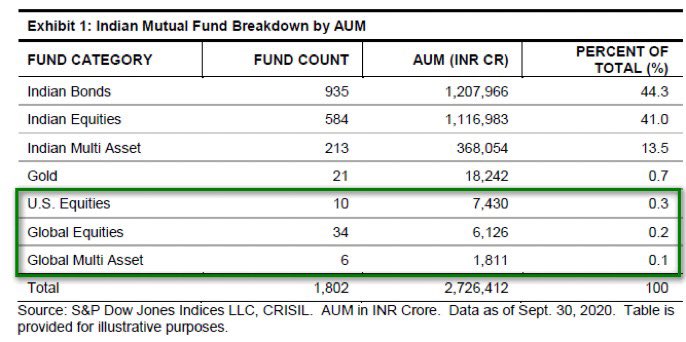

From India investing in Intl funds are less

Nasdaq 100 High Risk High Returns

SPX500 Moderate Risk Moderate Returns

We have also

China 101 FoF

S&P Euro 350 Index Fund

From India investing in Intl funds are less

ELSS Equity Linked Savings Scheme

Perfect for long duration planning like Child higher education, Child marriage

Fund is 3 years lock period & can be used for 80C Tax rebate

This is not an index fund

Perfect for long duration planning like Child higher education, Child marriage

Fund is 3 years lock period & can be used for 80C Tax rebate

This is not an index fund

Hybrid fund

Consist of different combinations with mix of Equity / Debt / Gold / Bond / Liquid Cash / Infra bonds

This fund helps to hedge your portfolio when Equity market is in correction

This is not Index fund

Consist of different combinations with mix of Equity / Debt / Gold / Bond / Liquid Cash / Infra bonds

This fund helps to hedge your portfolio when Equity market is in correction

This is not Index fund

Now after selecting type of fund, identifying which AMC / Fund house.

Main criteria which fund holds higher AUM money needs to be selected, higher liquidity fund helps during market crash.

Less expense Ratio.

Fund performance vs Index performance.

Main criteria which fund holds higher AUM money needs to be selected, higher liquidity fund helps during market crash.

Less expense Ratio.

Fund performance vs Index performance.

Always revisit MF portfolio, avoid duplication of funds & select suitable index fund.

Always close fund 6 months prior to the event fund was planned

Index funds complete details are in @NSEIndia & @ValueResearch sites

Follow @IndiaEtfs for index fund updates

Happy investment https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏🏾" title="Gefaltete Hände (durchschnittlich dunkler Hautton)" aria-label="Emoji: Gefaltete Hände (durchschnittlich dunkler Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏🏾" title="Gefaltete Hände (durchschnittlich dunkler Hautton)" aria-label="Emoji: Gefaltete Hände (durchschnittlich dunkler Hautton)">

Always close fund 6 months prior to the event fund was planned

Index funds complete details are in @NSEIndia & @ValueResearch sites

Follow @IndiaEtfs for index fund updates

Happy investment

Read on Twitter

Read on Twitter