14 Reasons $ETH is a higher upside treasury reserve asset than #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

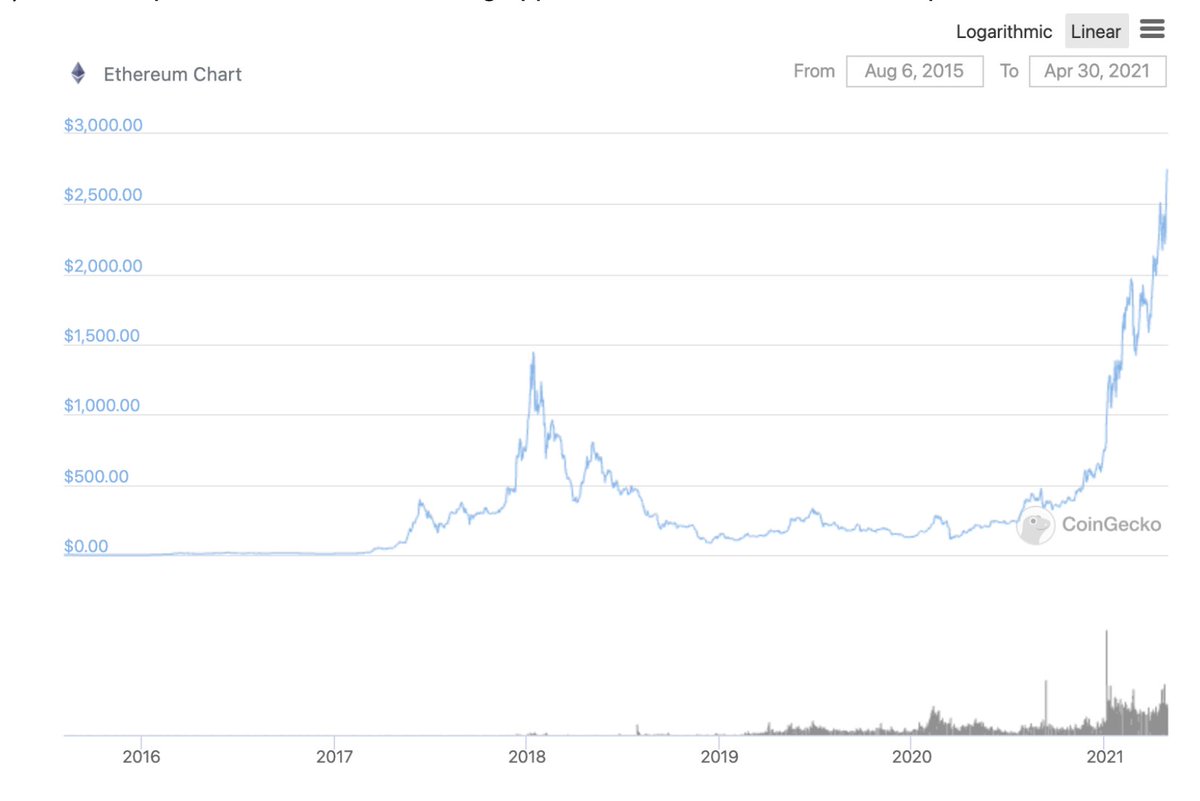

1) $ETH is a proven store of value, having appreciated 85,587% since its inception in 2015

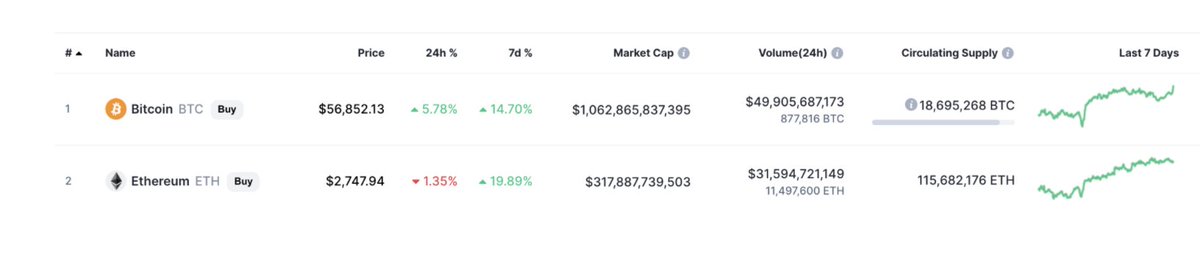

2) $ETH is only 25% the market of Bitcoin $1,062,865,837,395 vs $317,887,739,503

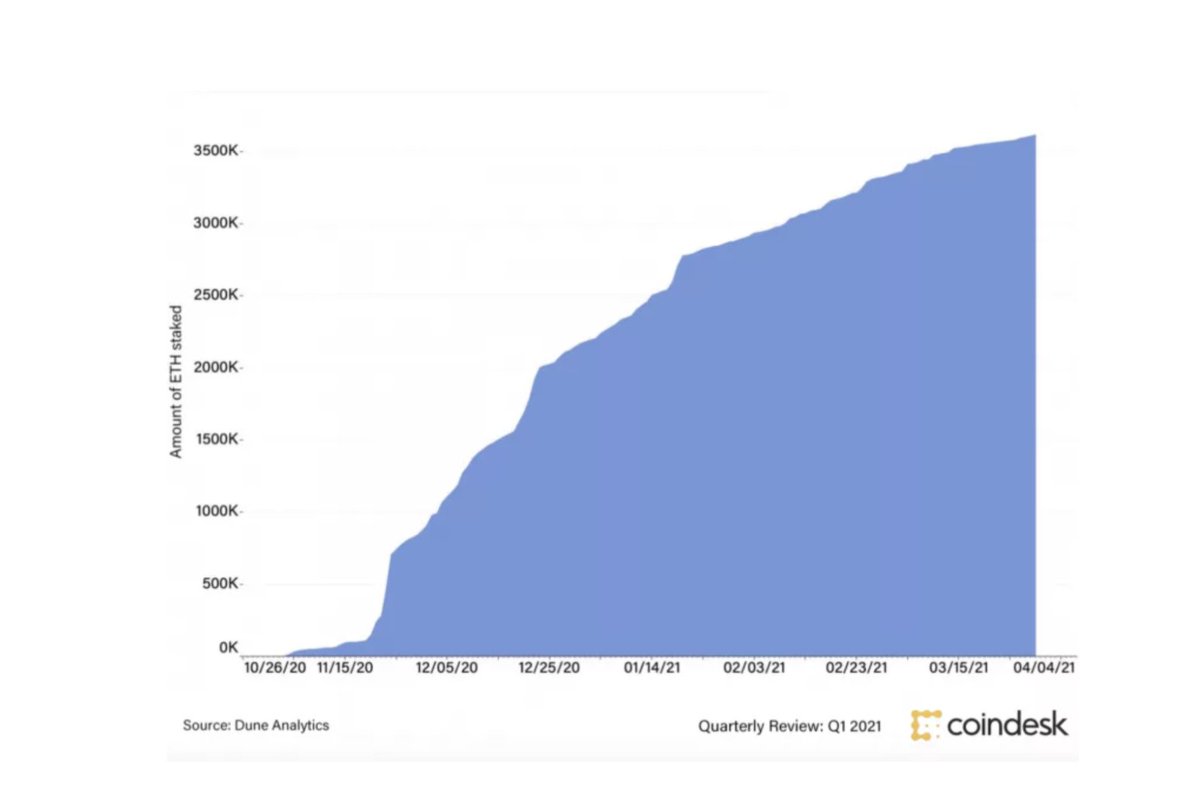

3) ETH’s Staked Value now exceeds $9 Billion, which is 3.26% of $ETH supply

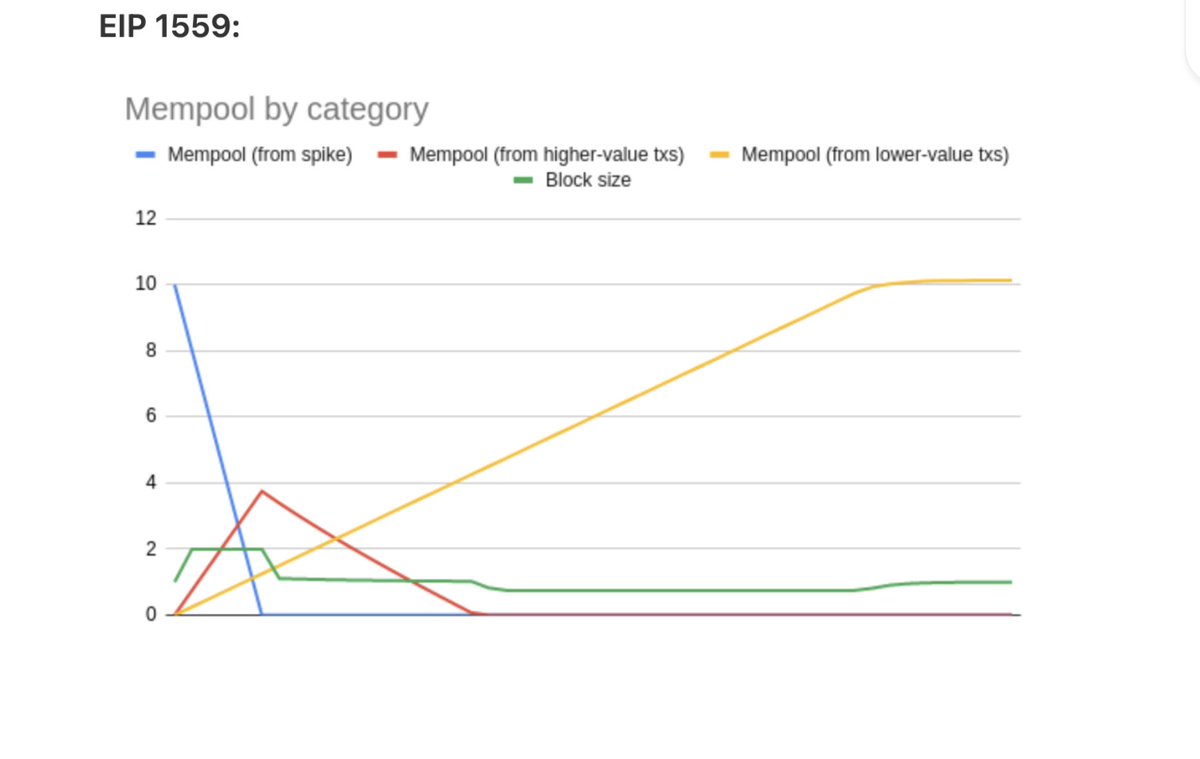

4) Scarcity is Here – EIP 1559 effectively cancels out ETH’s inflation rate of 4.37% decreasing total supply

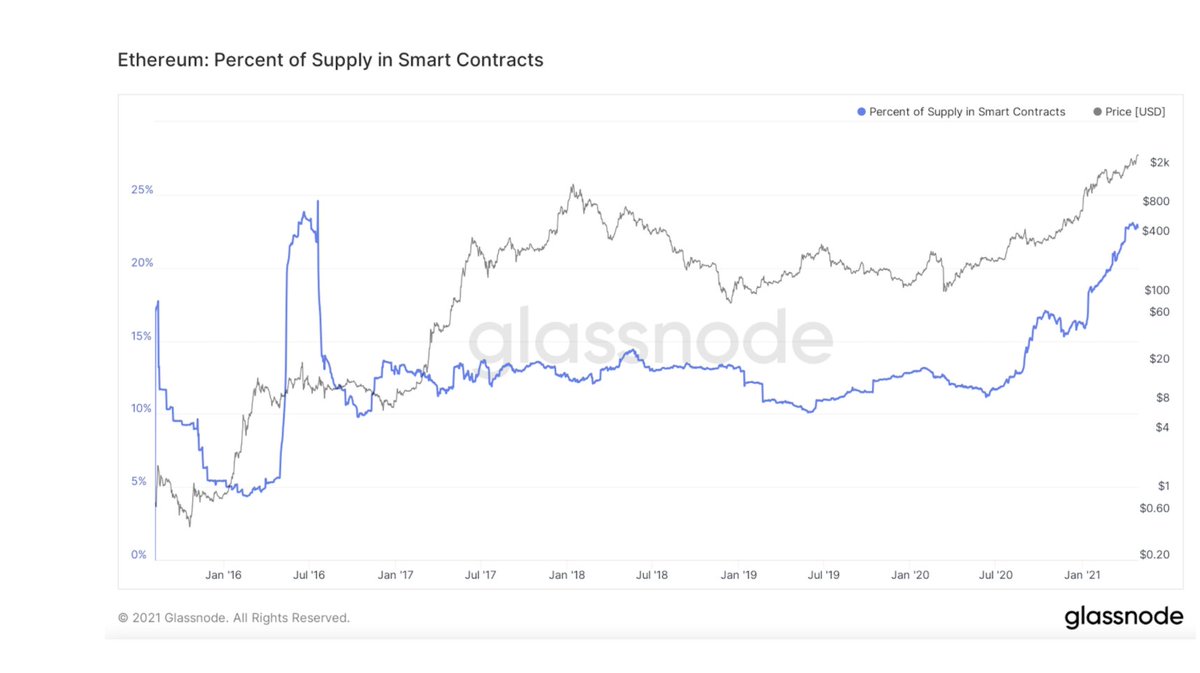

5) 22.5% of $ETH supply is illiquid locked up in smart contracts, and this number will only grow over time as use cases accelerate

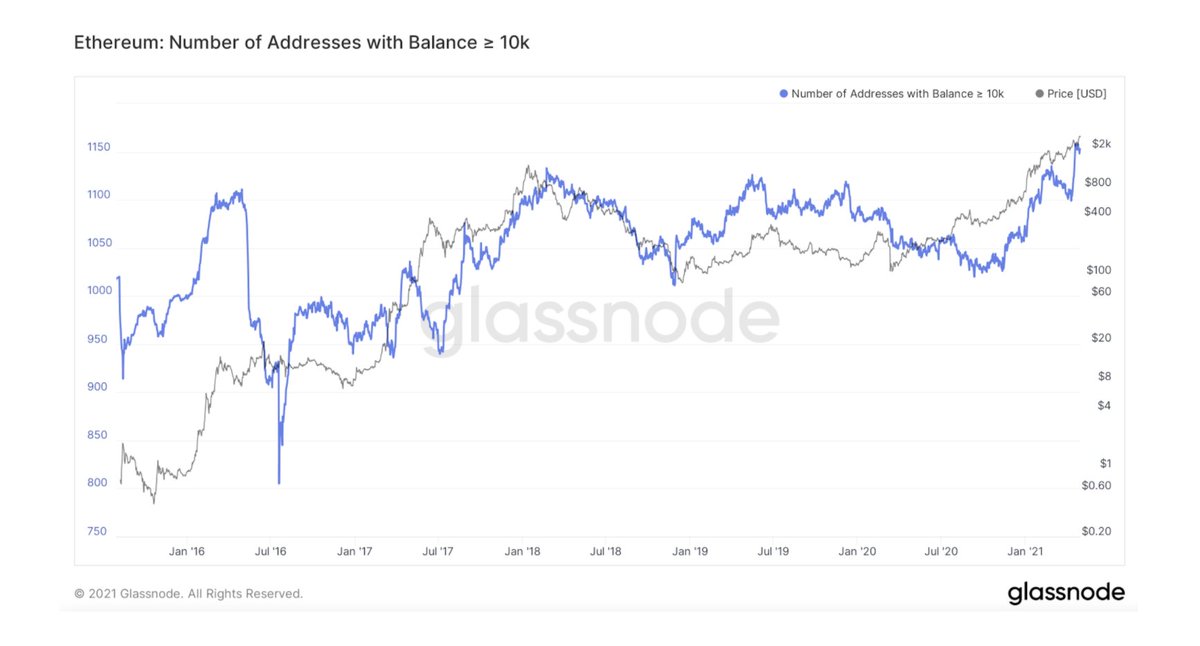

6) Whale Wallets are growing (Wallets with more than 10,000 $ETH)

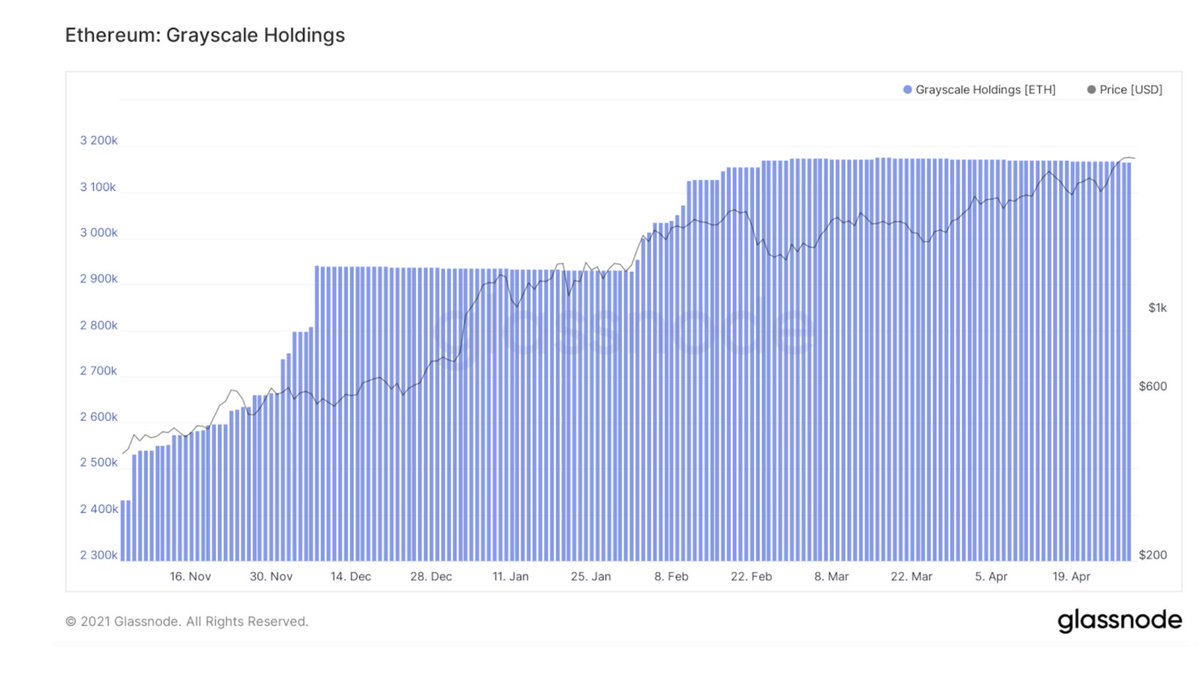

8) Grayscale holds roughly 3% of $ETH supply, which won’t be sold anytime soon

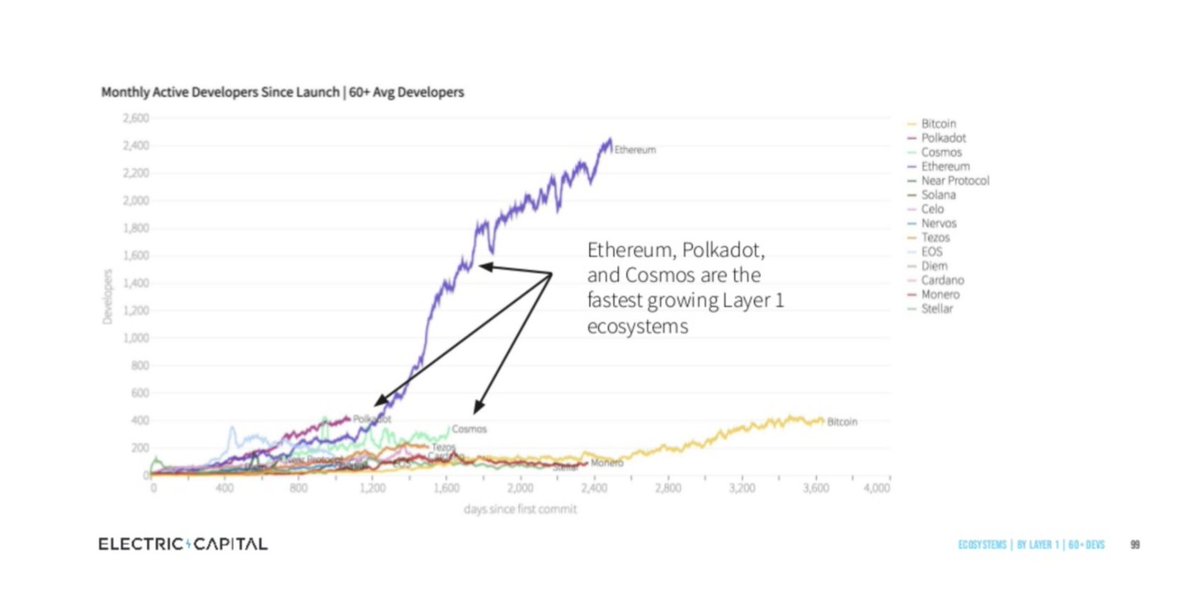

9) Ethereum has 2,325 active monthly developers compared to #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> 361 – Development leads to more Dapps, more innovation, more disruption, more mass adoption, and higher $ETH prices

https://abs.twimg.com/hashflags... draggable="false" alt=""> 361 – Development leads to more Dapps, more innovation, more disruption, more mass adoption, and higher $ETH prices

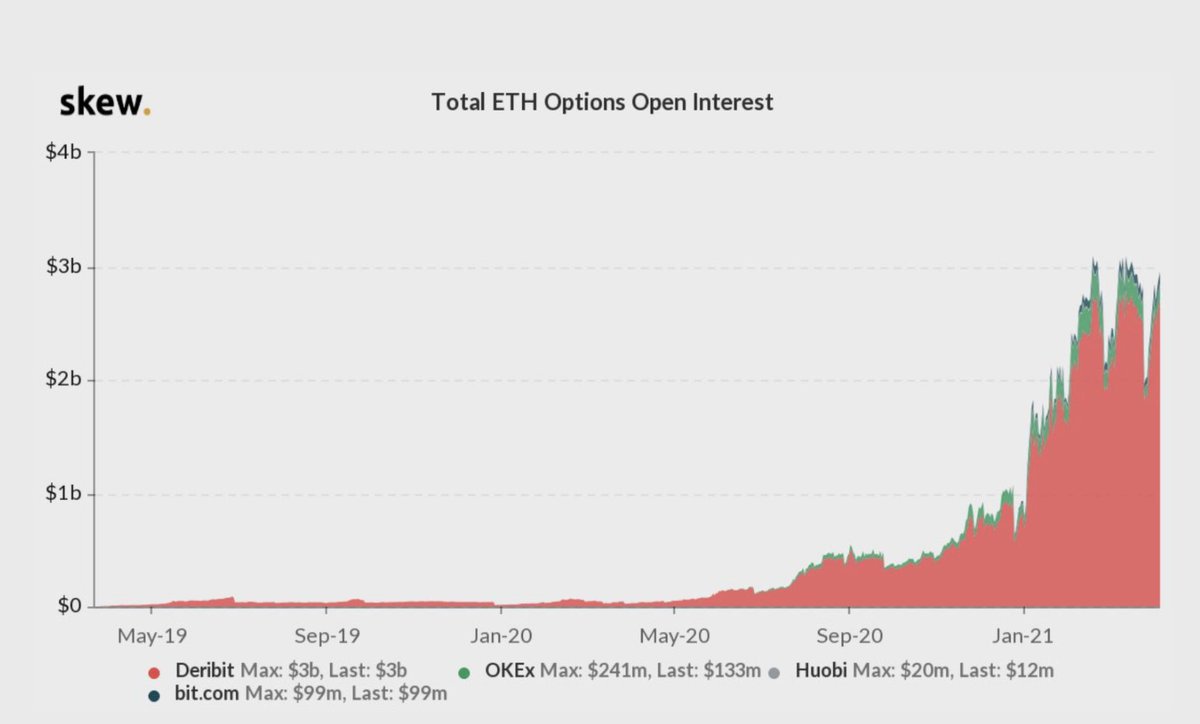

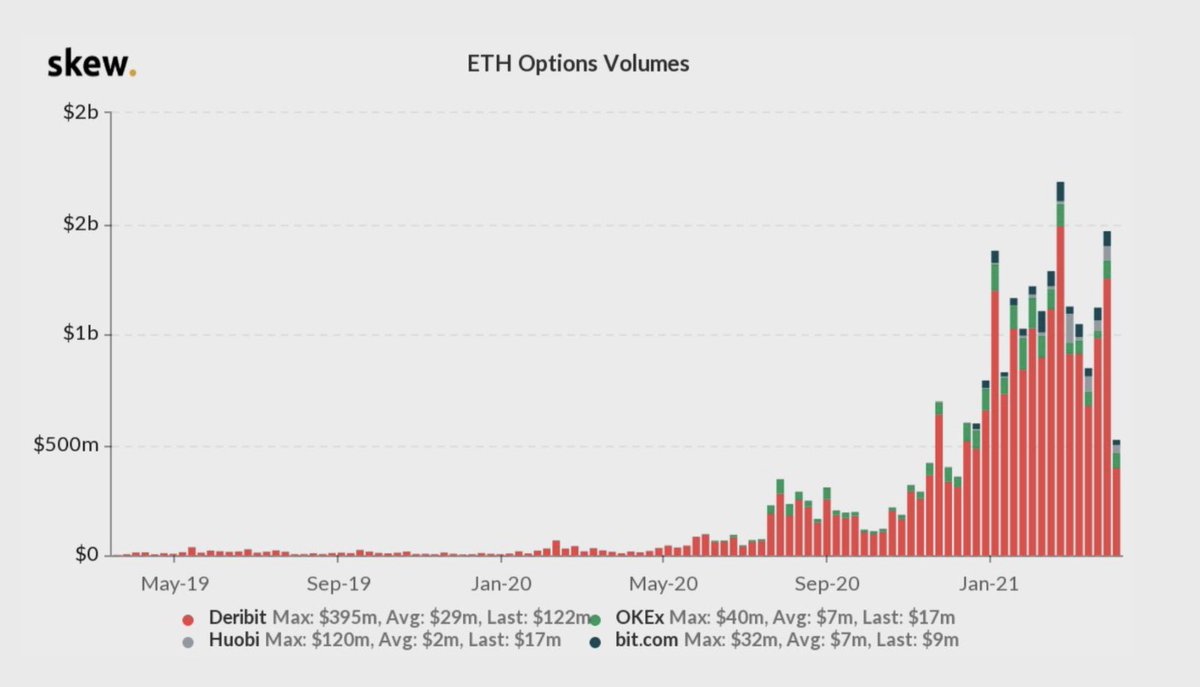

10) $ETH derivatives have gone from $50mm in April 2020 to $3 billion in total open interest– institutional adoption signal

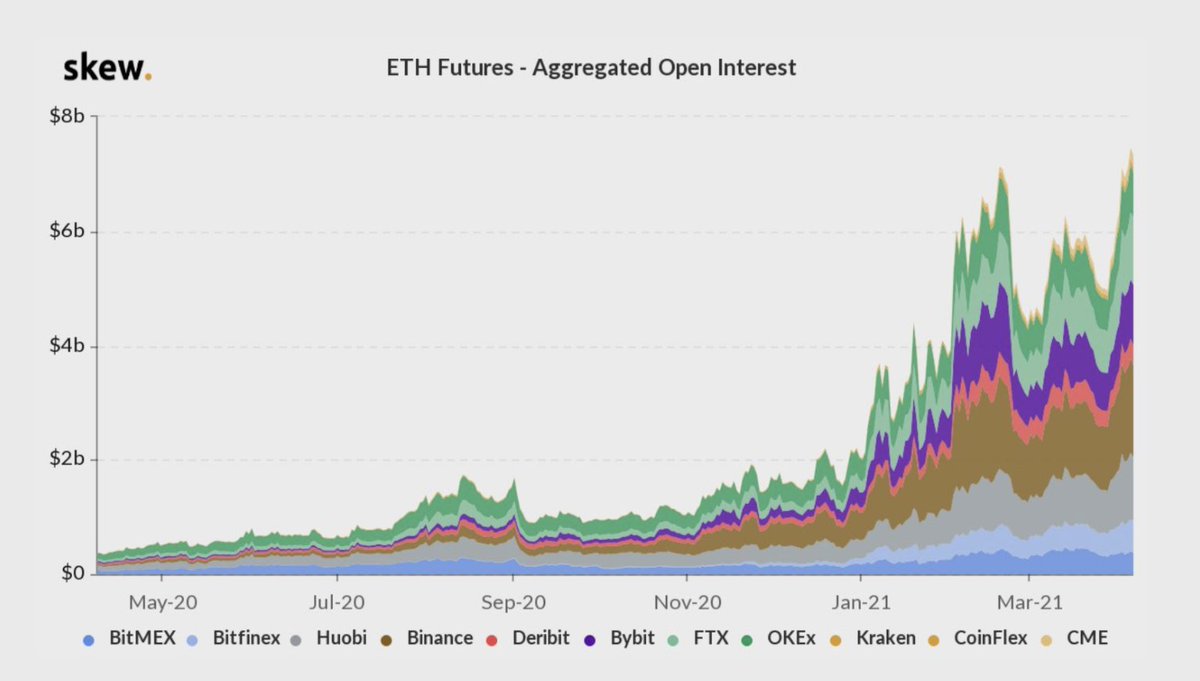

11) $ETH Futures Positions have seen a 20x increase and now sits at $7.5 billion open interest – institutional adoption signal

12) 24-hour $ETH options trading volumes have gone from USD 1MM in May 2019 to exceed $1 Billion in daily open interest – institutional adoption signal

13) 3 #Ethereum ETFs recently approved in Canada, and CME futures began trading earlier this year signals maturing asset with lots of upside to go – institutional adoption signal

@CoinDesk https://www.coindesk.com/purpose-investments-gets-approval-to-launch-first-ether-etf-in-canada">https://www.coindesk.com/purpose-i...

@CoinDesk https://www.coindesk.com/purpose-investments-gets-approval-to-launch-first-ether-etf-in-canada">https://www.coindesk.com/purpose-i...

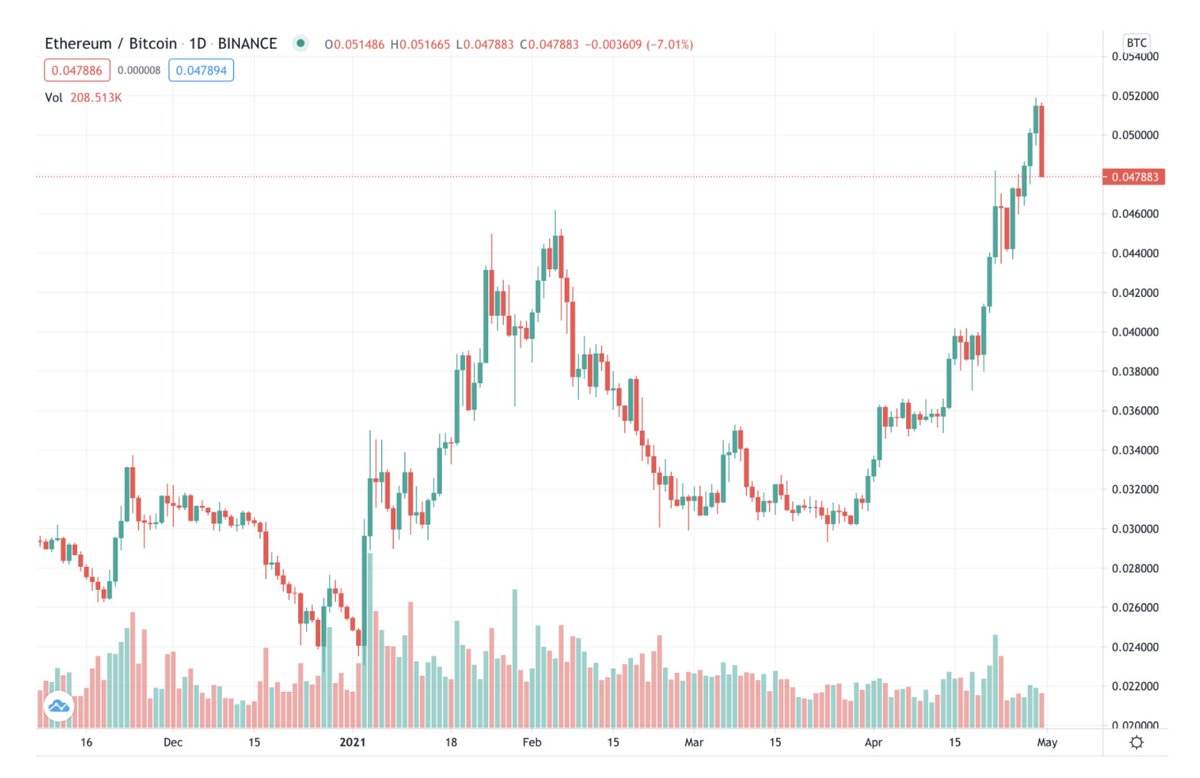

14) $ETH is starting to gain and decorrelate with #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">, and this will continue as developer activity rises and more use cases are created

https://abs.twimg.com/hashflags... draggable="false" alt="">, and this will continue as developer activity rises and more use cases are created

Price projections for $ETH currently range from $10,000 (inevitable) - $100,000 (best case scenario)

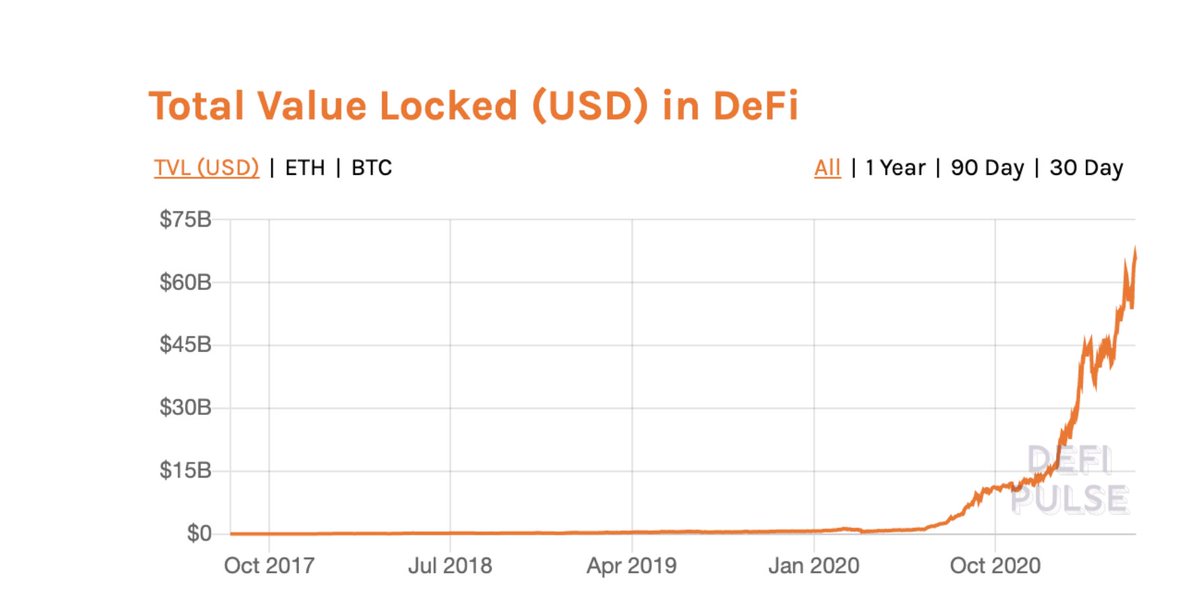

There is more incentive to hold $ETH than Bitcoin due to Ethereum’s growing use cases

Ethereum leads all innovation and disruption in digital assets and is responsible for igniting the most mass adoption of any other network

When you buy $ETH for your treasury reserve you have exposure to the upside of innovation and disruption that comes from the Ethereum network

Instead of having to gamble on individual projects, you can buy ETH and have exposure to them all https://twoprime.io/insights/ethereum-treasury-reserve-asset/">https://twoprime.io/insights/...

Based on @two_prime analysis of ETH’s price performance, derivatives markets, and on-chain data, we believe that $ETH has earned a place, alongside BTC, as an institutional-grade investment, store of value, and treasury reserve asset. https://twoprime.io/the-rise-of-institutional-ethereum-investors/">https://twoprime.io/the-rise-...

Read on Twitter

Read on Twitter

361 – Development leads to more Dapps, more innovation, more disruption, more mass adoption, and higher $ETH prices" title="9) Ethereum has 2,325 active monthly developers compared to #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> 361 – Development leads to more Dapps, more innovation, more disruption, more mass adoption, and higher $ETH prices" class="img-responsive" style="max-width:100%;"/>

361 – Development leads to more Dapps, more innovation, more disruption, more mass adoption, and higher $ETH prices" title="9) Ethereum has 2,325 active monthly developers compared to #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> 361 – Development leads to more Dapps, more innovation, more disruption, more mass adoption, and higher $ETH prices" class="img-responsive" style="max-width:100%;"/>

, and this will continue as developer activity rises and more use cases are created" title="14) $ETH is starting to gain and decorrelate with #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt="">, and this will continue as developer activity rises and more use cases are created" class="img-responsive" style="max-width:100%;"/>

, and this will continue as developer activity rises and more use cases are created" title="14) $ETH is starting to gain and decorrelate with #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt="">, and this will continue as developer activity rises and more use cases are created" class="img-responsive" style="max-width:100%;"/>