Thread: IT’S STORYTIME  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">

Exactly a year ago, it was time to rescue the country, the cabinet proposed its last financial recovery draft plan, which was prepared with Lazard, a leading financial advisory firm

But what they did not know, was the side they would be confronting

Exactly a year ago, it was time to rescue the country, the cabinet proposed its last financial recovery draft plan, which was prepared with Lazard, a leading financial advisory firm

But what they did not know, was the side they would be confronting

The plan was the first official report revealing colossal losses worth LL241 trillion in the financial sector:

- LL177 trillion in BDL’s balance sheet

- LL64 trillion in commercial banks’ balance sheets

The solution was plain: clean up public finances and the financial sector

- LL177 trillion in BDL’s balance sheet

- LL64 trillion in commercial banks’ balance sheets

The solution was plain: clean up public finances and the financial sector

Banks’ shares would be absorbed by losses, a haircut on large deposits, a recovery of a portion of the revenues resulting from financial engineering.

The state, to a lesser level, would cover a share of the losses as part of a fund in which certain state assets would be placed

The state, to a lesser level, would cover a share of the losses as part of a fund in which certain state assets would be placed

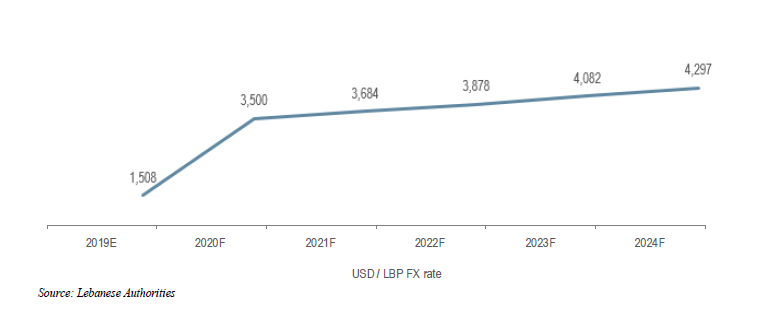

Some attacked the plan that set the Lira at LL3,500 per dollar and depreciates it toward LL4,300 in 2024. Now the lira trades at LL12,500

Some criticized it because it had no economic vision, but that was not the purpose of the plan. An economic plan was actually being prepared

Some criticized it because it had no economic vision, but that was not the purpose of the plan. An economic plan was actually being prepared

But it was the process of cleaning up the commercial banks and BDL& #39;s losses that was met with a fulmination.

The "bank party," mainly represented by the Finance & Budget Committee, the Association of Banks and BDL Gov. Riad Salameh, launched its campaign: the war of numbers

The "bank party," mainly represented by the Finance & Budget Committee, the Association of Banks and BDL Gov. Riad Salameh, launched its campaign: the war of numbers

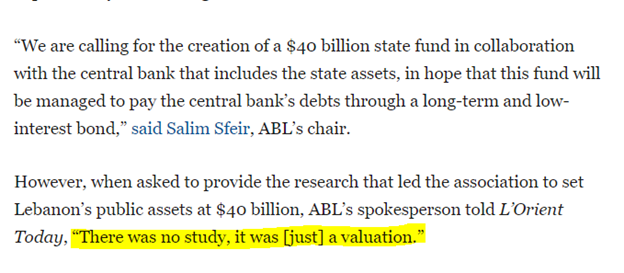

ABL outcried the plan and prepared its own that included a fund in which $40 billion state assets were placed.

How they came out with that number remains mysterious as even ABL’s spokesperson told me that they did not even conduct a study.

A plan that makes no sense.

How they came out with that number remains mysterious as even ABL’s spokesperson told me that they did not even conduct a study.

A plan that makes no sense.

The attack did not end there, it moved to Parliament. The Finance & Budget Committee formed a subcommittee (لجنة تقصي الحقائق) tasked to assess the amount of losses

Ibrahim Kanaan, the chair of both committees, opted to “reduce losses from LL240 billion to around LL80 billion.”

Ibrahim Kanaan, the chair of both committees, opted to “reduce losses from LL240 billion to around LL80 billion.”

He was joined by the mouthpiece of the Bank Party, holder of 391,699 shares in IBL Bank, Elie Ferzli, one of the most vocal against the government recovery plan and severely criticized the Lebanese negotiating team and doubted Lazard& #39;s "intentions"

Ferzli claimed that “the calculation of losses was inaccurate and overestimated” and only served “to justify the bankruptcy of banks”

Salameh denied the losses at the central bank and said that they can write them off using future Seigniorage - printing money in the future (lol)

Salameh denied the losses at the central bank and said that they can write them off using future Seigniorage - printing money in the future (lol)

Kanaan’s committee’s job was to “unify the losses” and decrease them (pic 1)

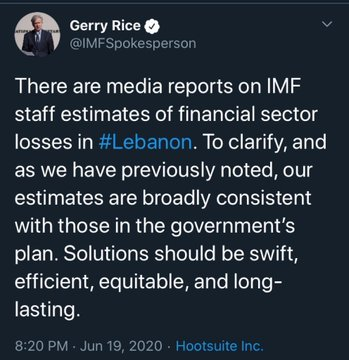

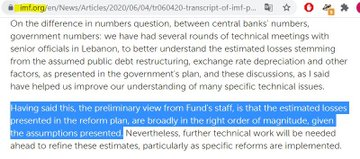

In reality, the plan& #39;s losses were on point. The IMF made it clear several times that the cabinet& #39;s numbers were generally accurate (pic 2,3) but that did not stop the "bank party" from sabotaging it

In reality, the plan& #39;s losses were on point. The IMF made it clear several times that the cabinet& #39;s numbers were generally accurate (pic 2,3) but that did not stop the "bank party" from sabotaging it

Also, Nicolas Chammas, the head of Beirut Traders Association, & vice president of Cedrus Bank called it a “financial bankruptcy plan.” A title echoed by Ferzli

The plan almost had no friends. It was vandalized by MPs, bankers & “experts” almost everywhere in the media

The plan almost had no friends. It was vandalized by MPs, bankers & “experts” almost everywhere in the media

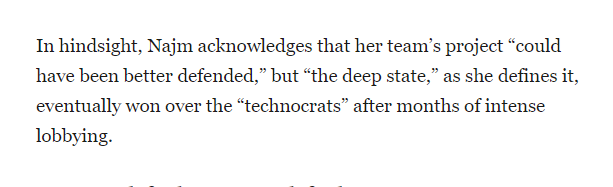

But the cabinet should also receive the blame, as they barely defended it. A point acknowledged by the Justice Minister.

Even the caretaker finance minister Ghazi Wazni, who present a draft capital control law, suddenly withdrew it, after giving in to pressure from Nabih Berri

Even the caretaker finance minister Ghazi Wazni, who present a draft capital control law, suddenly withdrew it, after giving in to pressure from Nabih Berri

The IMF negotiations came to an end in July after disputes over the size of the country’s financial losses

The cabinet& #39;s reported losses, which were endorsed by the IMF, were met with pushback from the central bank, commercial banks and the Finance & Budget Committee

The cabinet& #39;s reported losses, which were endorsed by the IMF, were met with pushback from the central bank, commercial banks and the Finance & Budget Committee

End result:

1- @henrichaoul, a government advisor, resigned. Others followed him thereafter

2- The IMF negotiations halted after being sabotaged

3- The plan collapsed

4- No capital control, no forensic audit, no reforms, nothing

5- The lira lost about 90% of its value...

1- @henrichaoul, a government advisor, resigned. Others followed him thereafter

2- The IMF negotiations halted after being sabotaged

3- The plan collapsed

4- No capital control, no forensic audit, no reforms, nothing

5- The lira lost about 90% of its value...

Read on Twitter

Read on Twitter Exactly a year ago, it was time to rescue the country, the cabinet proposed its last financial recovery draft plan, which was prepared with Lazard, a leading financial advisory firmBut what they did not know, was the side they would be confronting" title="Thread: IT’S STORYTIME https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">Exactly a year ago, it was time to rescue the country, the cabinet proposed its last financial recovery draft plan, which was prepared with Lazard, a leading financial advisory firmBut what they did not know, was the side they would be confronting" class="img-responsive" style="max-width:100%;"/>

Exactly a year ago, it was time to rescue the country, the cabinet proposed its last financial recovery draft plan, which was prepared with Lazard, a leading financial advisory firmBut what they did not know, was the side they would be confronting" title="Thread: IT’S STORYTIME https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">Exactly a year ago, it was time to rescue the country, the cabinet proposed its last financial recovery draft plan, which was prepared with Lazard, a leading financial advisory firmBut what they did not know, was the side they would be confronting" class="img-responsive" style="max-width:100%;"/>