Here are 7 reasons I am not optimistic about Ethereum’s long-term future.

#1. It is not immutable and can be censored. The developers can roll back transactions and change the rules whenever they want. They can also be pressured by others – such as governments.

#1. It is not immutable and can be censored. The developers can roll back transactions and change the rules whenever they want. They can also be pressured by others – such as governments.

#2. ETH& #39;s scarcity is artificial. The developers – who prefer inflation – control its monetary policy, which is arbitrary, uncapped, and challenging to audit.

What will the ETH supply be in 5 years?

It could be 120 million, 500 million, 200 billion, 2 trillion... nobody knows.

What will the ETH supply be in 5 years?

It could be 120 million, 500 million, 200 billion, 2 trillion... nobody knows.

#3. Ethereum’s large premine created ownership centralization and legal risk as the US government may consider it the sale of an unregistered security. With so much dependent on Vitalik Buterin and others, there is also significant leadership risk.

#4. Ethereum’s network infrastructure is not decentralized. Infura, which relies on Amazon, could be a single point of failure.

If Ethereum ultimately depends on Amazon, why not just use a faster and more efficient centralized database system like AWS?

If Ethereum ultimately depends on Amazon, why not just use a faster and more efficient centralized database system like AWS?

#5. There is an unclear use case. What real-world problems does Ethereum solve to provide economic value?

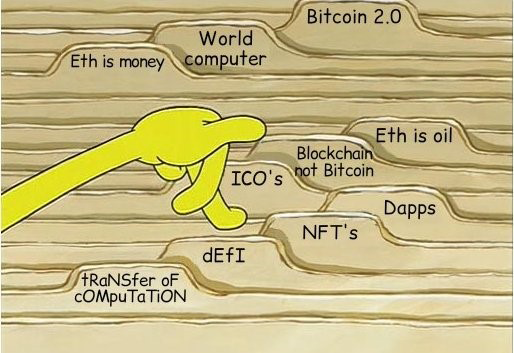

Instead, ETH tends to latch on to ever-changing use cases, mostly centered around hype cycles, buzzwords, and narratives that come and go.

Instead, ETH tends to latch on to ever-changing use cases, mostly centered around hype cycles, buzzwords, and narratives that come and go.

#6. The economics of the token model are not appealing.

Many people who buy crypto tokens are confused. They think they own some sort of scarce asset or ownership stake. That would be similar to mistaking Chuck E. Cheese arcade tokens for shares in Chuck E. Cheese the company.

Many people who buy crypto tokens are confused. They think they own some sort of scarce asset or ownership stake. That would be similar to mistaking Chuck E. Cheese arcade tokens for shares in Chuck E. Cheese the company.

#7. Ethereum is an early-stage experiment and has enormous implementation risk.

The Ethereum ecosystem was not built upon a workable finished product, but rather the ever-changing theories and promises of an alpha-stage experiment. I don’t believe this is a stable foundation.

The Ethereum ecosystem was not built upon a workable finished product, but rather the ever-changing theories and promises of an alpha-stage experiment. I don’t believe this is a stable foundation.

Describing Ethereum as “decentralized” is misleading because every aspect of it is centralized.

When it comes to decentralization, it& #39;s black and white. There are no shades of gray. That becomes crystal clear when something goes wrong.

When it comes to decentralization, it& #39;s black and white. There are no shades of gray. That becomes crystal clear when something goes wrong.

By contrast, Bitcoin has a crystal clear use case. It’s a hard money monetary system that is accessible to anybody and controlled by nobody. It works in the real world and it solves probably mankind’s biggest problem which is storing and exchanging value reliably.

Read on Twitter

Read on Twitter