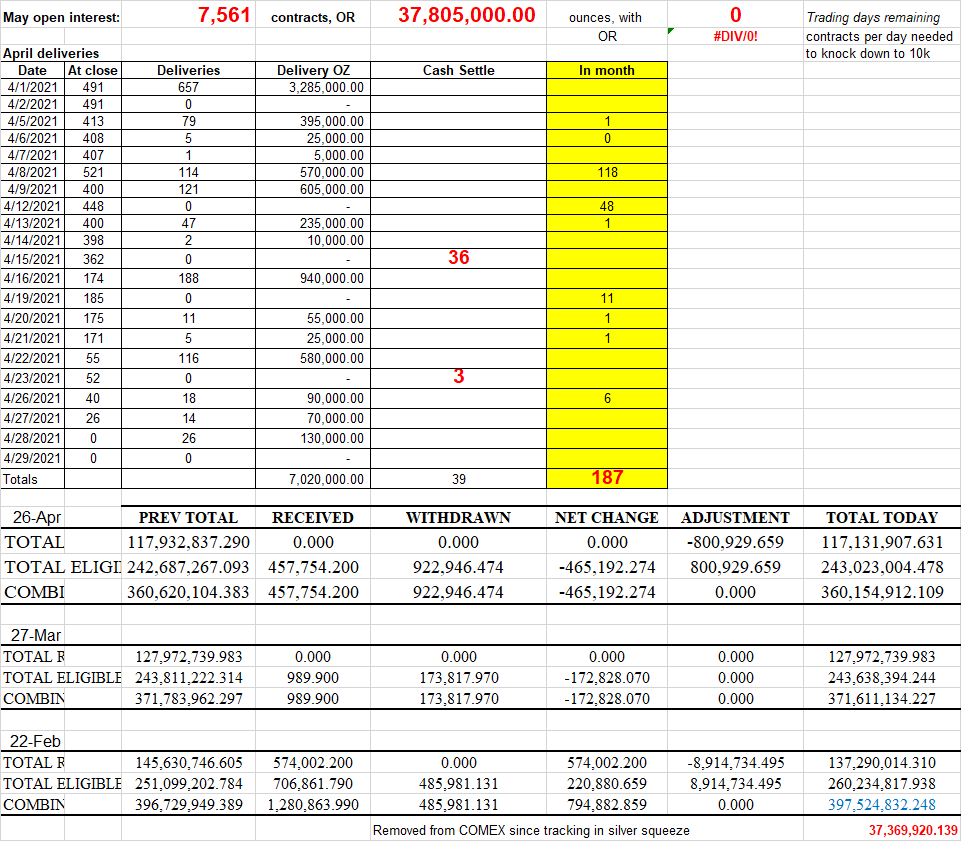

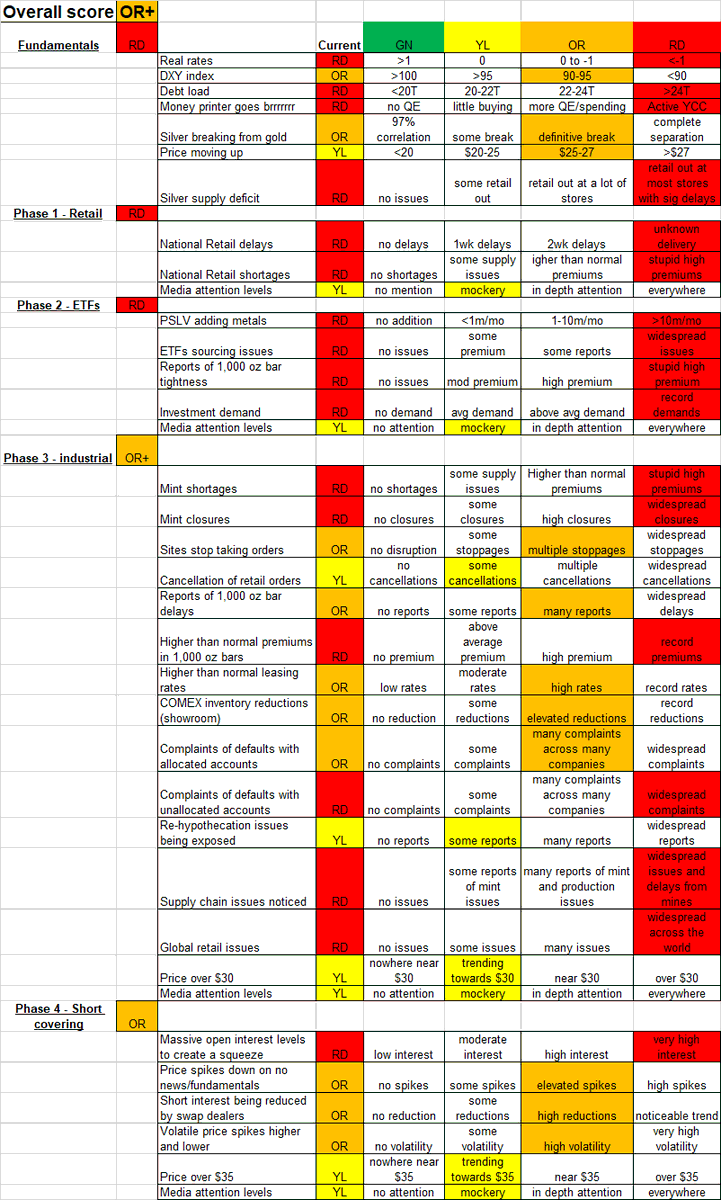

1/6 COMEX update - they were able to knock down 3500 contracts yesterday with another $.90 cliff drop. I& #39;m expecting a lot of that to get bought back in the coming days. 37m to stand for delivery. March had 11m ounces "in month" and that could take us to 50m for the month.

2/6 You don& #39;t need 200m deliveries to "break" this thing. They will continue to try and source outside of the showroom floor by knocking prices down, again. However, you consistently are seeing a drain of about 500k ounces per trading day.

3/6 This isn& #39;t about "taking it to zero", it& #39;s about the consistent removal of physical into your own possession. At some point, those who hold it who are being drained of it at these prices will cry mercy. They do NOT want to hand this over. Easy. Stop selling paper.

4/6 One day, at some point, a switch will be flipped. Where is that point they no longer wish to be relieved of what they are pretending to sell? Many believe it is around the corner. Others think it is way far out. Evidence is in front of you.

5/6 So in May, perhaps expect another 20-25m removed from the COMEX unless powers that be decide that they no longer want to give it up. When that happens, price moves up rapidly to assist with more supply from eligible. We will gladly take that too.

6/6 This will take price over $30 and get some more of my friends involved. If you are selling, we are buying. If you do not want to sell, do not write the paper. Very simple. All of this madness is from too many fake sales. That& #39;s the root issue. Crisis averted.

Read on Twitter

Read on Twitter