1/ This thread is going to expose the biggest lie of 2021 in the blockchain space thus far - and that is the claim that a "coal mine explosion" was the cause of the decrease in hash rate earlier this month ( April 17th-18th).

2/ 1st, coal mine explosion occurred on April 10th (source - https://www.globaltimes.cn/page/202104/1220859.shtml)">https://www.globaltimes.cn/page/2021...

The explosion is the cause for troubles in that region, but the actual & #39;effect& #39; that led to the alleged outage of several miners was the "coal mine flooding" that ensued.

The explosion is the cause for troubles in that region, but the actual & #39;effect& #39; that led to the alleged outage of several miners was the "coal mine flooding" that ensued.

3/ Despite that information above, several outlets did not report anything about the coal mine explosion until April 16th, 2021 (curiously, this is the date that & #39; @DoveyWan& #39; made her claim that a coal mine explosion dropped "30% of hashrate" https://twitter.com/DoveyWan/status/1382912887535005701?s=20">https://twitter.com/DoveyWan/...

3a/ Here are screenshots + links from some additional outlets that reported this on April 16th (earliest date that anyone started publishing such information)

1. https://cointelegraph.com/news/chinese-mining-pools-hash-power-plummets-amid-regional-blackouts">https://cointelegraph.com/news/chin...

2. https://www.nasdaq.com/articles/bitcoin-mining-hash-rate-drops-as-blackouts-instituted-in-china-2021-04-16

3.">https://www.nasdaq.com/articles/... https://www.theblockcrypto.com/linked/101866/xinjiang-coal-mine-bitcoins-hash-rateG">https://www.theblockcrypto.com/linked/10...

1. https://cointelegraph.com/news/chinese-mining-pools-hash-power-plummets-amid-regional-blackouts">https://cointelegraph.com/news/chin...

2. https://www.nasdaq.com/articles/bitcoin-mining-hash-rate-drops-as-blackouts-instituted-in-china-2021-04-16

3.">https://www.nasdaq.com/articles/... https://www.theblockcrypto.com/linked/101866/xinjiang-coal-mine-bitcoins-hash-rateG">https://www.theblockcrypto.com/linked/10...

4/ Yet, as we just discovered above, the coal mine explosion / flooding occurred on April 10th (not the 16th). So why were outlets claiming that the #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> $BTC hashrate was impacted on the 16th?

https://abs.twimg.com/hashflags... draggable="false" alt=""> $BTC hashrate was impacted on the 16th?

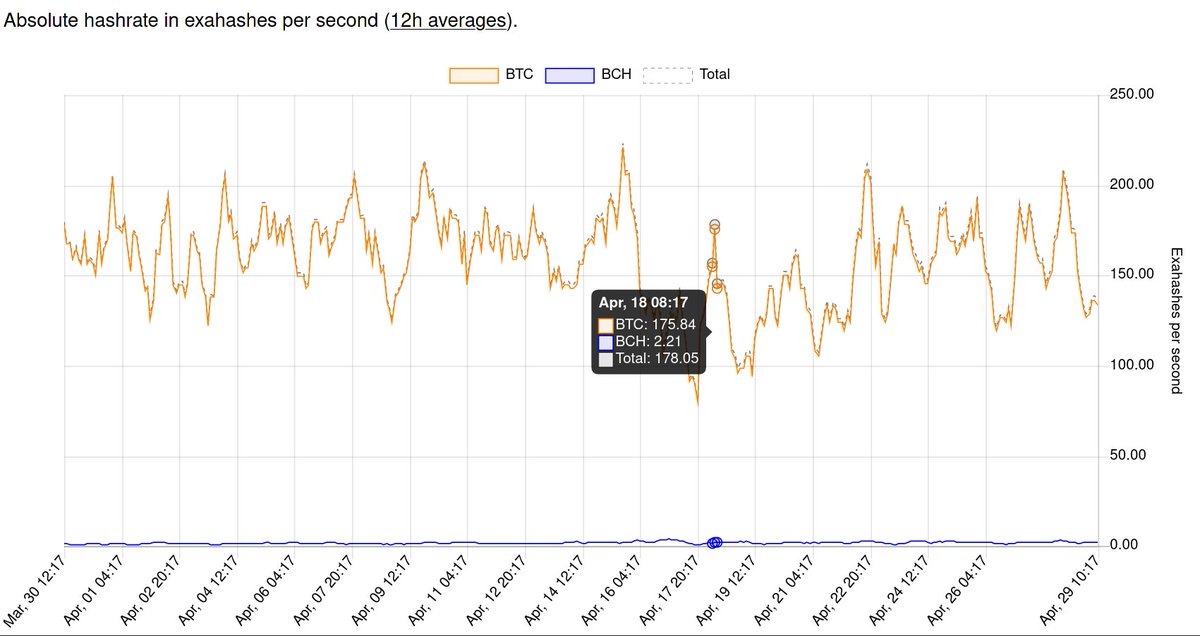

Before we answer that, let& #39;s at least get a look at what the hashrate was, first

Before we answer that, let& #39;s at least get a look at what the hashrate was, first

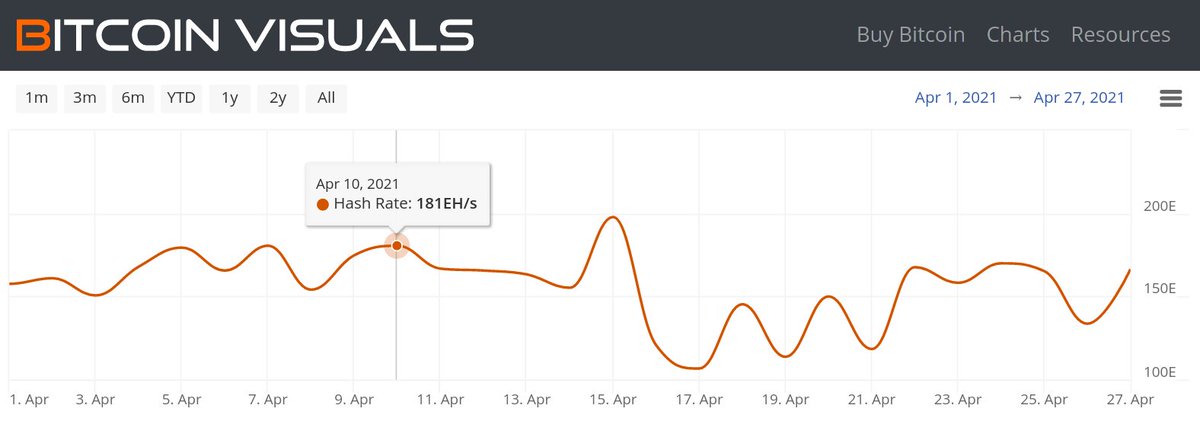

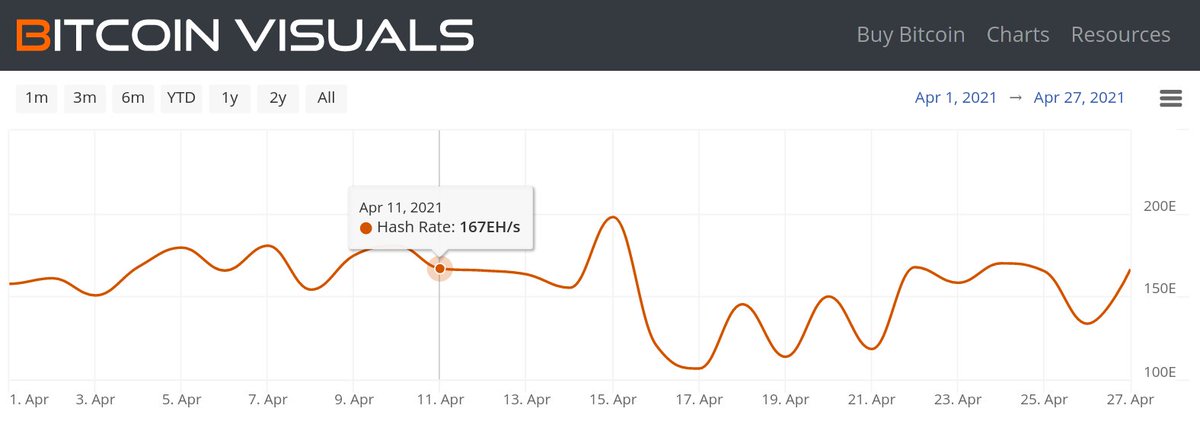

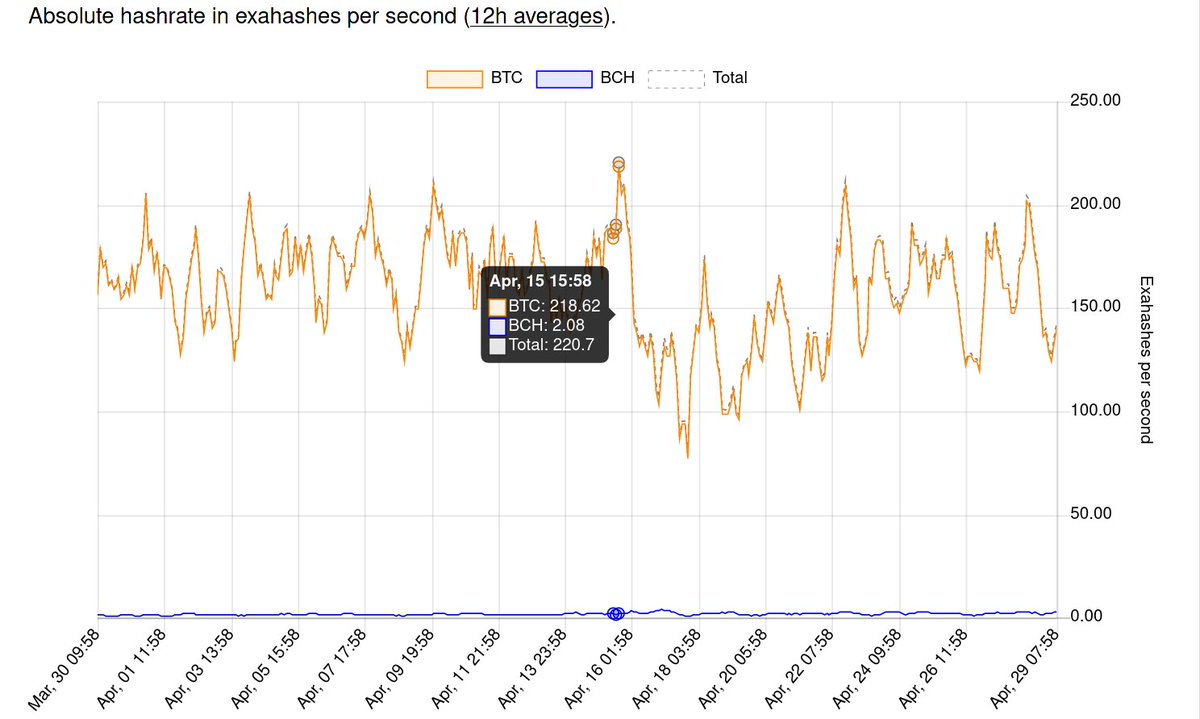

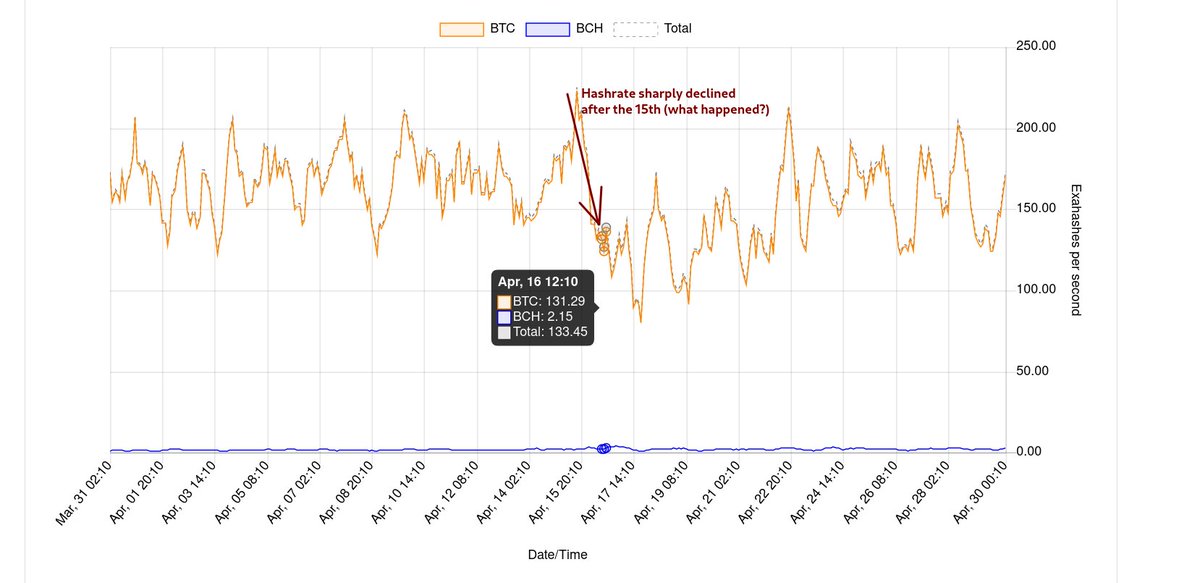

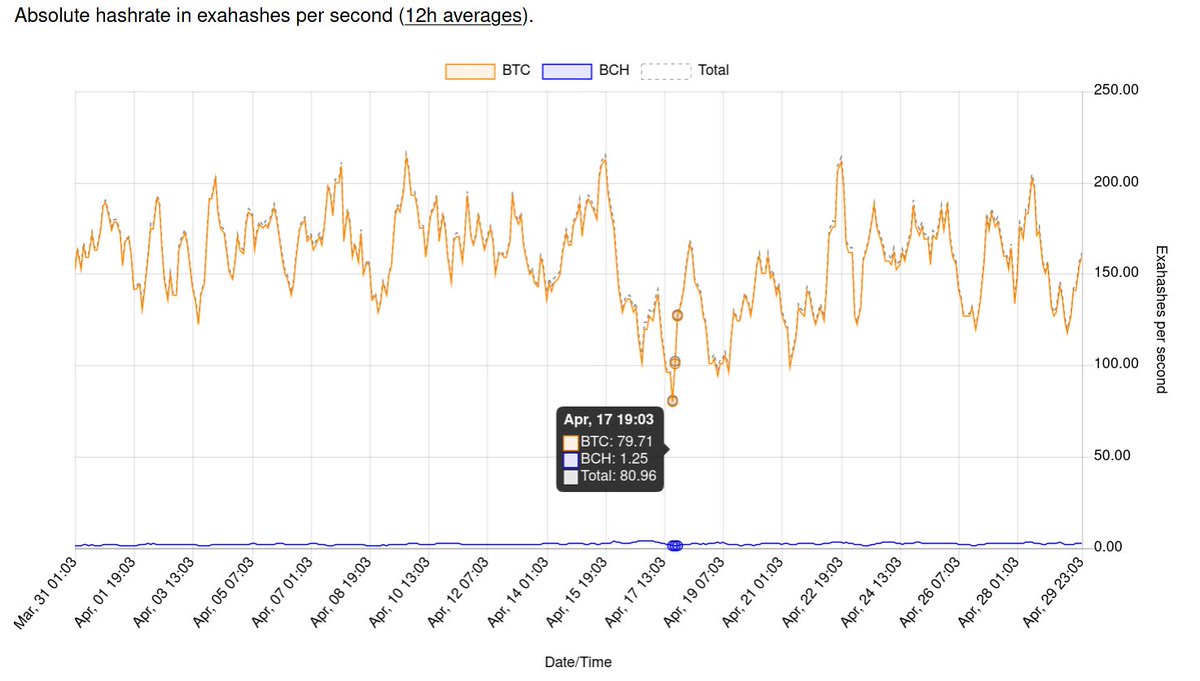

4a/ There are multiple sources we& #39;ll use for this, but we& #39;re going to start with & #39; http://bitcoinvisuals.com"> http://bitcoinvisuals.com & #39; ; attached to this tweet is a photo showing Bitcoin& #39;s approx. hashrate on April 10th (day of the explosion) and the day after (April 11th)

4b/ As we can see, there was *some* drop-off in the hashrate, but nothing substantial enough to exceed what we can expect via regular fluctuations (hashrate dropped by ~7%).

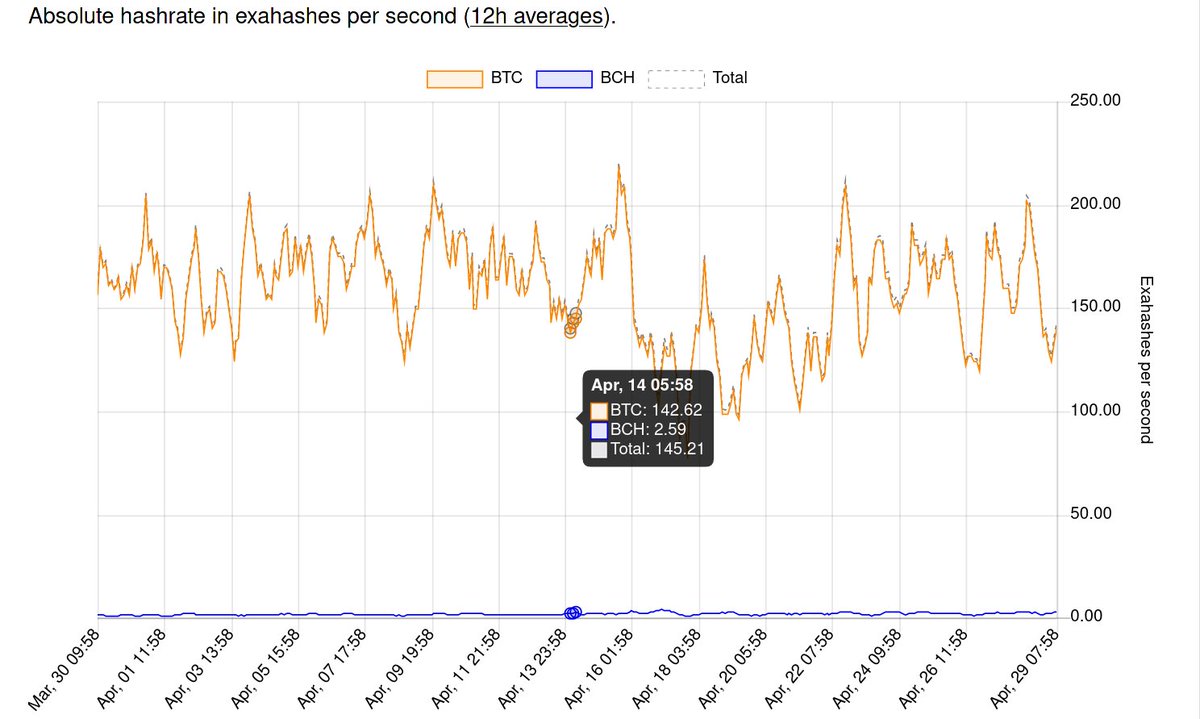

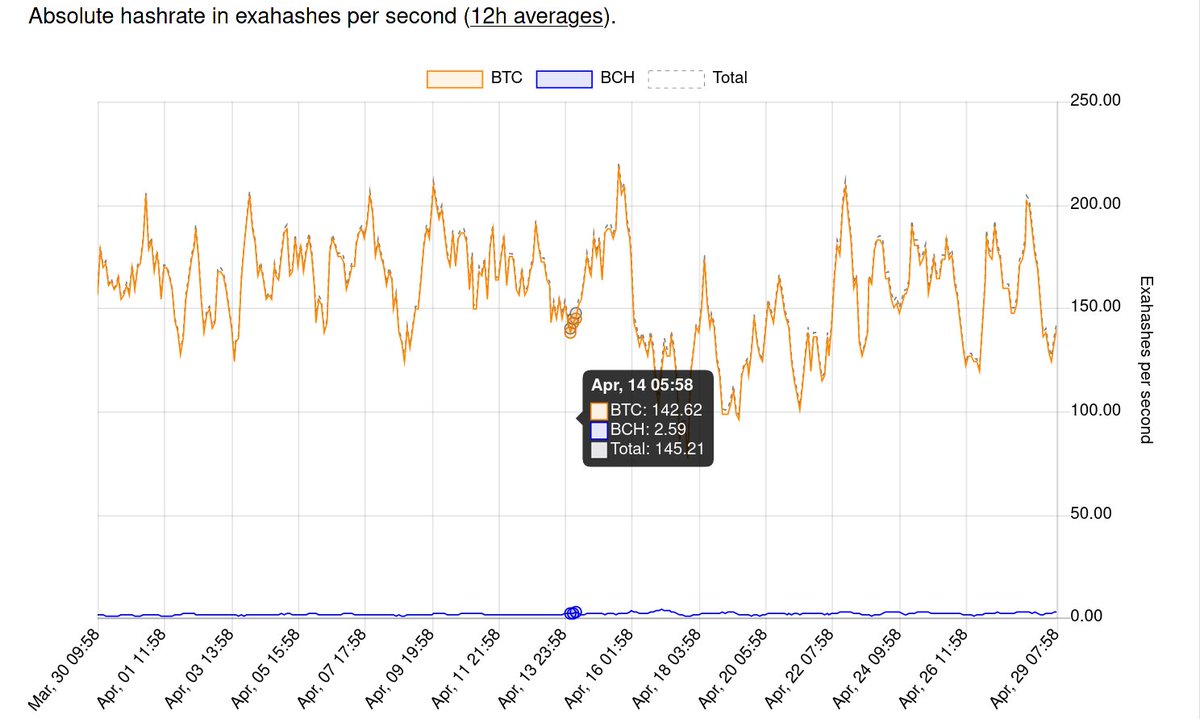

Attached we have the hashrate for April 14th (~145-155 Eh/s)

Attached we have the hashrate for April 14th (~145-155 Eh/s)

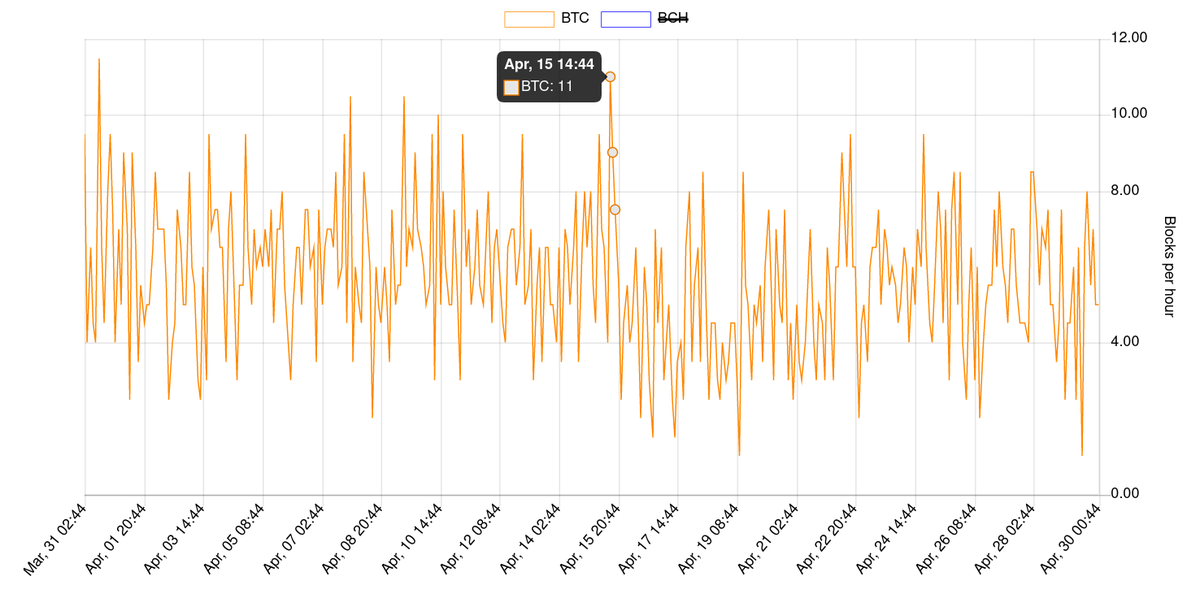

4c/ From April 14th - 15th, the hashrate *increased* by >50%.

In fact, on the 15th, Bitcoin experienced its *highest calculated hashrate of all time*

Keep in mind, this is *over 5 days since the coal mine explosion / flooding in Xinjiang*.

In fact, on the 15th, Bitcoin experienced its *highest calculated hashrate of all time*

Keep in mind, this is *over 5 days since the coal mine explosion / flooding in Xinjiang*.

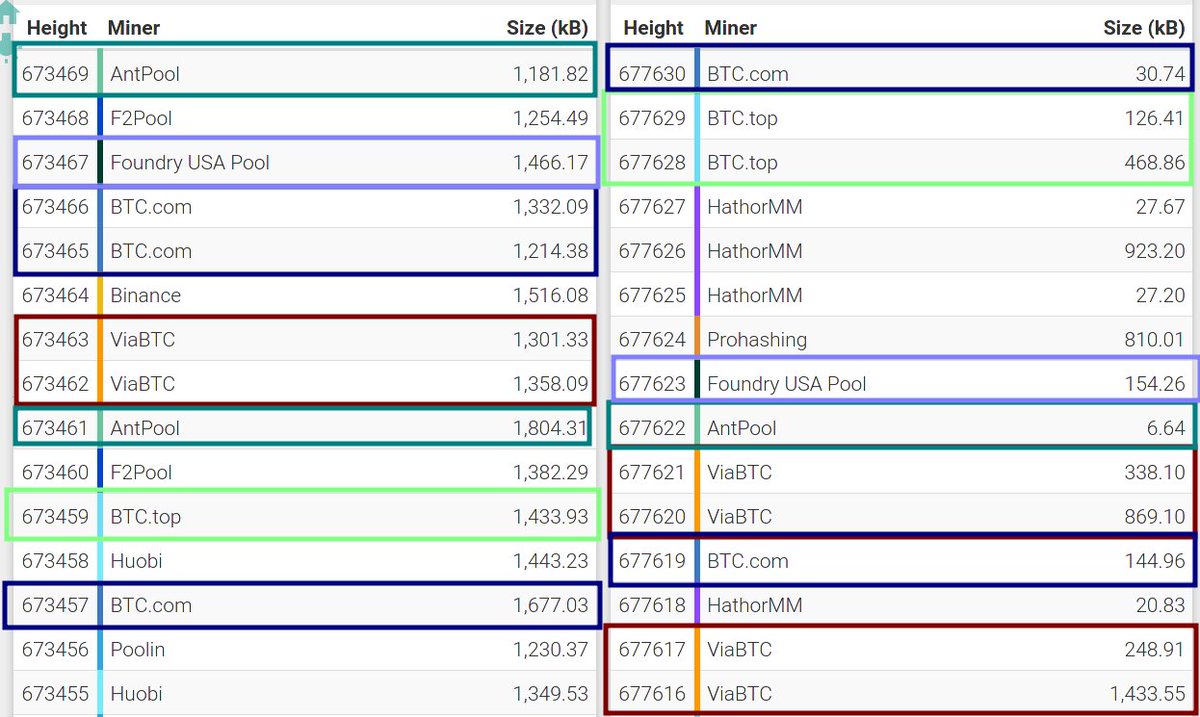

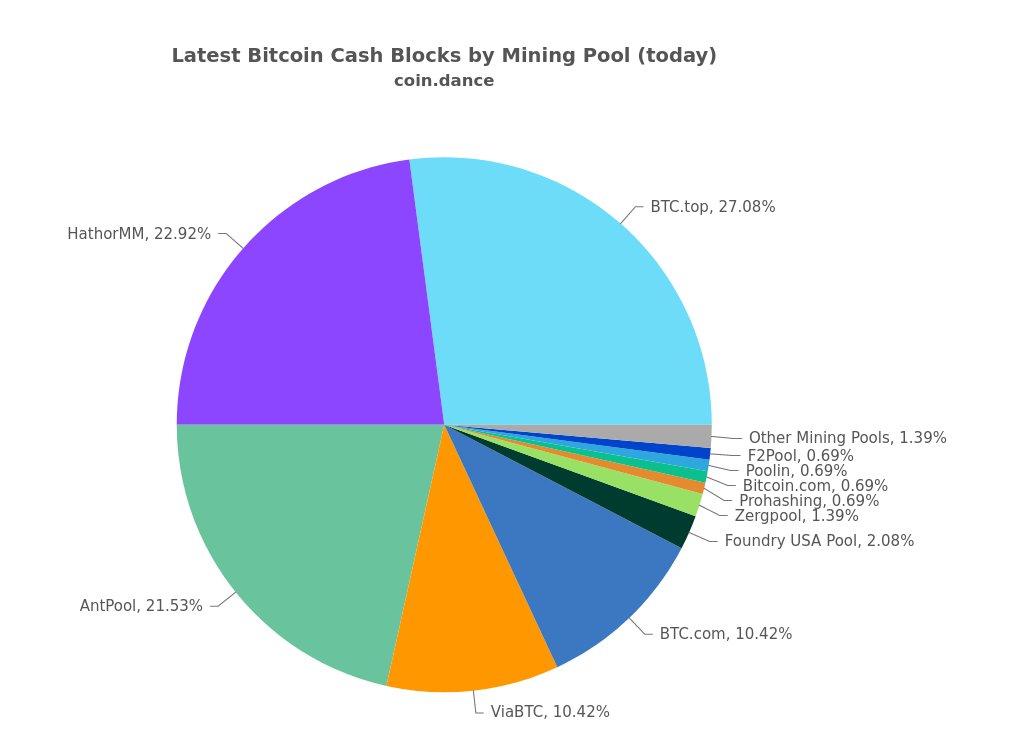

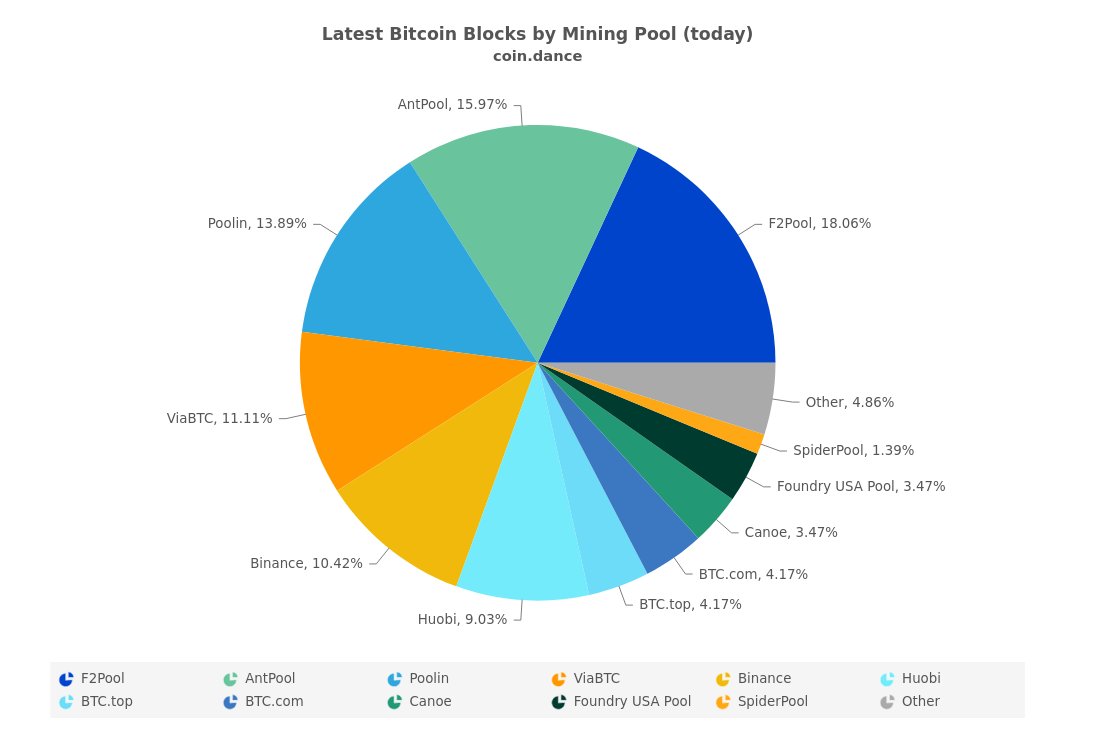

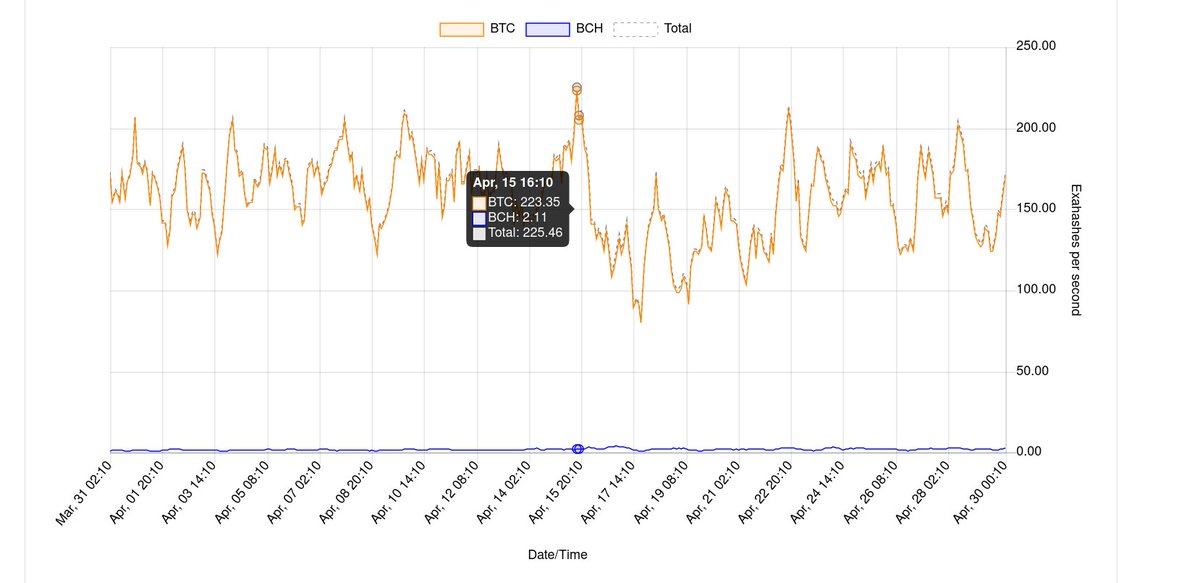

5/ Another necessary metric we need to look at is the hashrate of $BCH. As we all know, $BCH uses the same mining algo as $BTC (SHA-256).

The attached chart shows that virtually all the same miners that mine $BTC also mine $BCH.

The attached chart shows that virtually all the same miners that mine $BTC also mine $BCH.

5a/ The chart above depicts 15 blocks of $BTC (left) and $BCH (right).

- 6/7 of the mining pools shown above mined a block on both chains in that span

- only 4/15 blocks found on $BCH that were found by a pool that didn& #39;t find one on $BTC

- 6/7 of the mining pools shown above mined a block on both chains in that span

- only 4/15 blocks found on $BCH that were found by a pool that didn& #39;t find one on $BTC

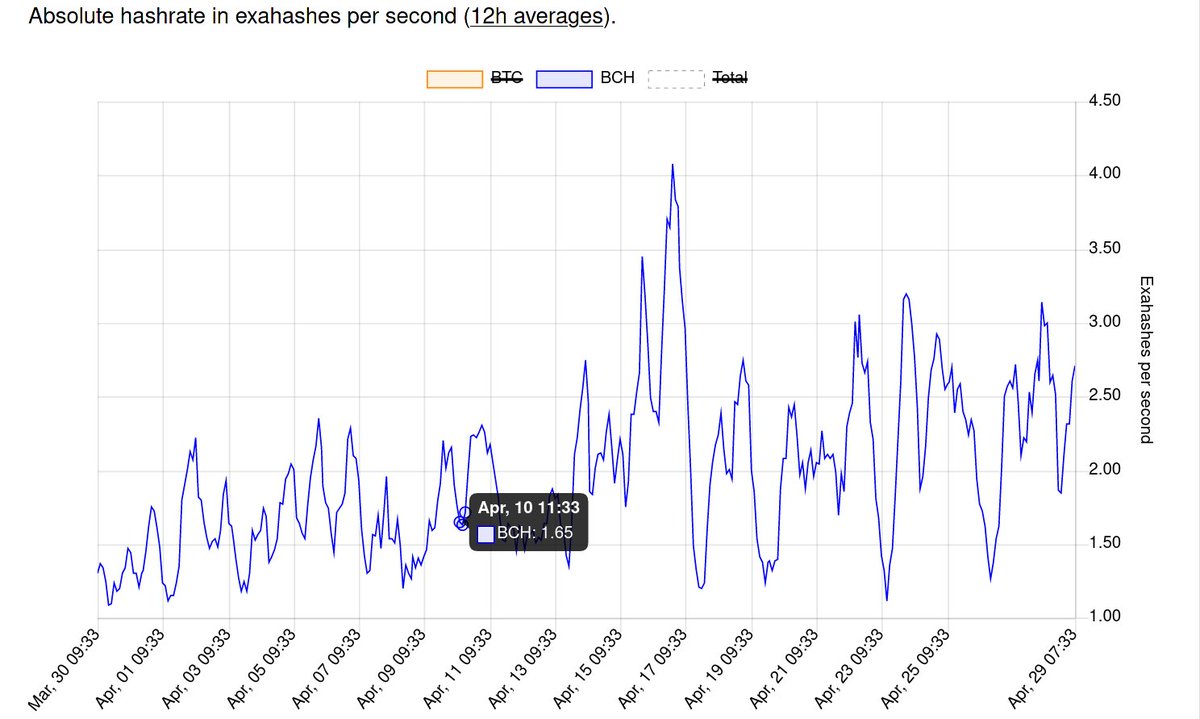

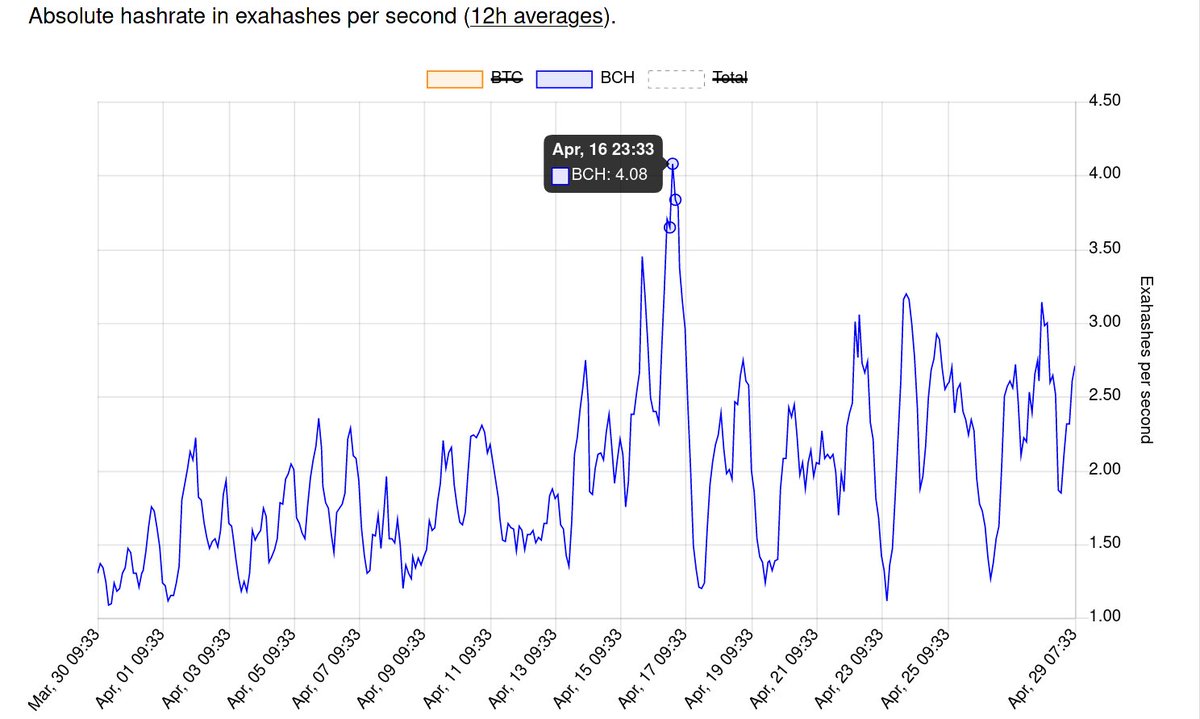

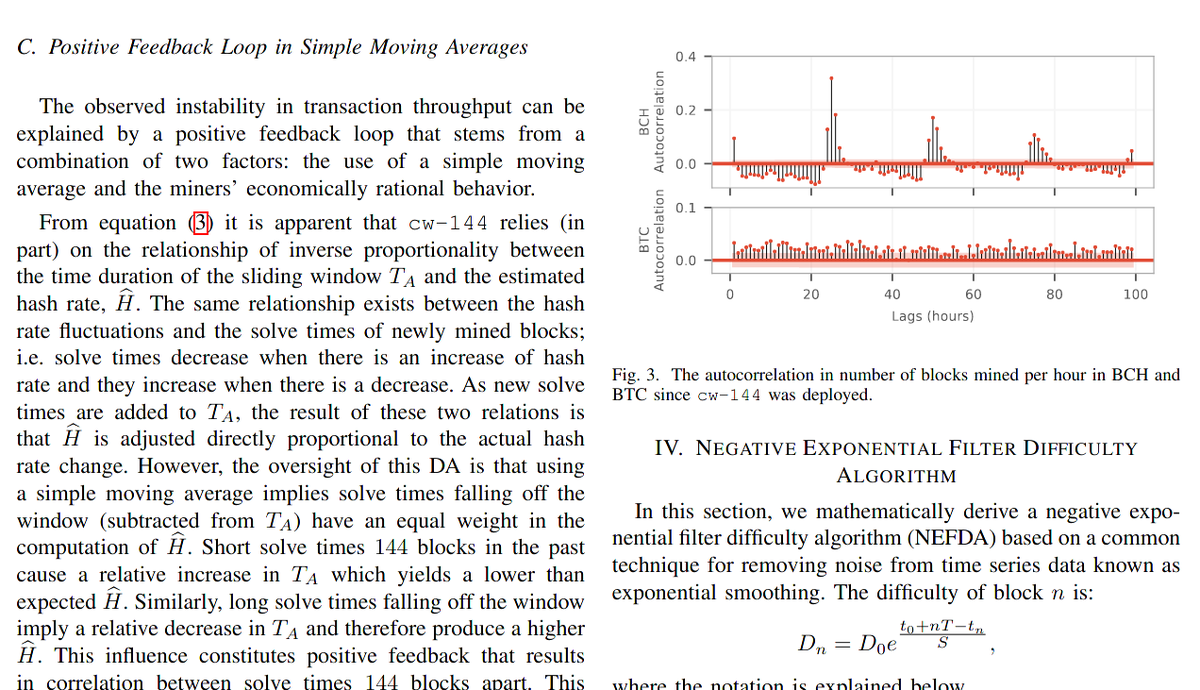

6/ Those facts about $BCH were established to help those following along understand the importance of $BCH& #39;s increasing hashrate during this entire span (following the coal mine explosion / flooding in Xinjiang)

These photos show $BCH hashrate increased by 245% from 4/10-4/16

These photos show $BCH hashrate increased by 245% from 4/10-4/16

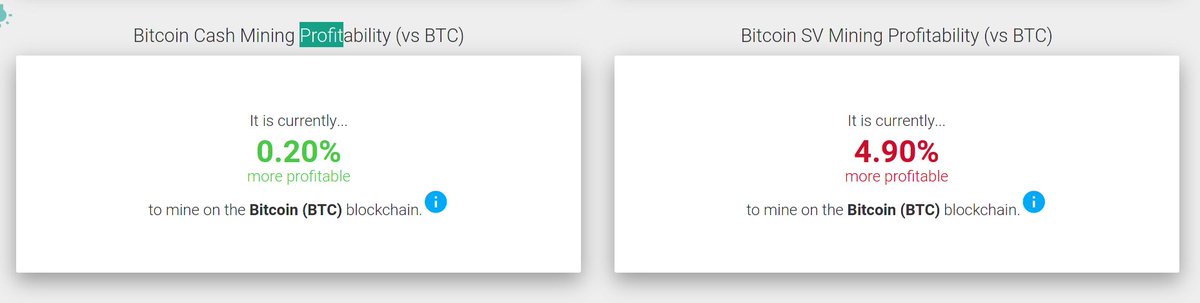

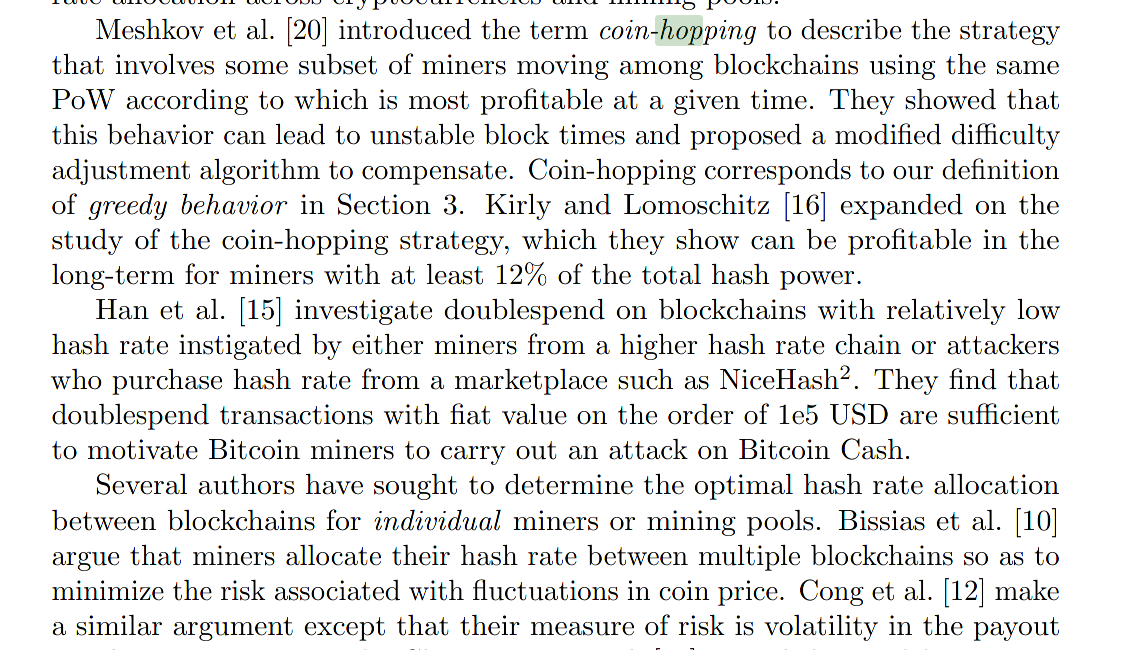

7/ For those that don& #39;t know, miners on the $BTC blockchain frequently "coin hop", which means that they& #39;ll move from mining $BTC to $BCH based on how profitable it is (relatively speaking) to mfine one or the other (this is why $BCH hasn& #39;t been reorg& #39;d yet)

7a/ Given everything we& #39;ve shown about $BCH in this thread thus far, $BCH& #39;s appreciation in hashrate indicates that some of the miner exodus from $BTC was re-apportioned to the $BCH blockchain (rather than being "knocked offline" as many publications falsely suggested).

8/ Now let& #39;s take a second and revisit some of those publications that started iterating this claim that a coal mine explosion in Xinjiang was the cause for a drop in hashrate. Remember we observed these stories started appearing on the 16th. Let& #39;s check the hashrate for that day

9/ Curiously, *all* of the publications that came out that day cited *one source* in particular for these claims about the coal mine explosion / flooding being correlated - and that was none other than @WuBlockchain

9a/ The specific tweet in question that everyone cited (thoughtlessly) is this one - https://twitter.com/WuBlockchain/status/1382886733444956160?s=20

The">https://twitter.com/WuBlockch... tweet (published around midnight April 15th/ very early hours April 16th), claimed hashrate from miners dropped due to a "complete blackout for safety inspections".

The">https://twitter.com/WuBlockch... tweet (published around midnight April 15th/ very early hours April 16th), claimed hashrate from miners dropped due to a "complete blackout for safety inspections".

9b/ There& #39;s no actual evidence to accompany this tweet. No news reports or anything else to corroborate these claims. The miners were found days earlier (April 11th-12th) and no China / American news source corroborates this claim (by any stretch)

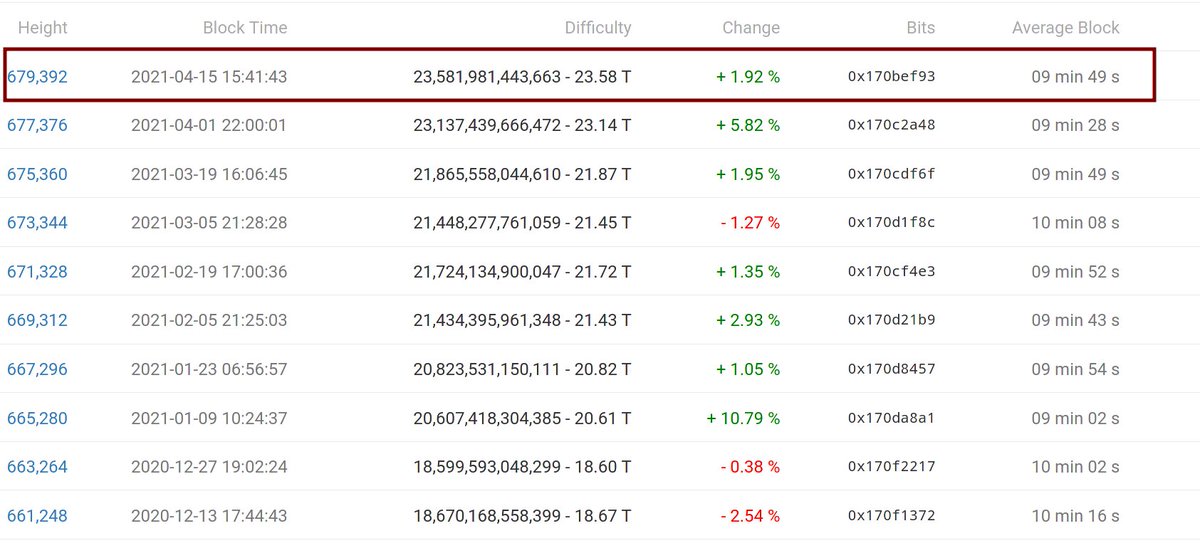

10/ However, one thing that *did* occur on the April 15th was an ADJUSTMENT IN THE DIFFICULTY TARGETING FOR BITCOIN.

What are the chances that may have had some sort of an impact on miners dropping out? (while Bitcoin& #39;s hashrate continued to spike through that day)

What are the chances that may have had some sort of an impact on miners dropping out? (while Bitcoin& #39;s hashrate continued to spike through that day)

10a/ For those that don& #39;t know, this act of & #39;coin hopping& #39; leaves the remaining miners mining the protocol "stranded" as they are forced to either scale up their operations accordingly or deal with an ecosystem that takes much longer to mine blocks

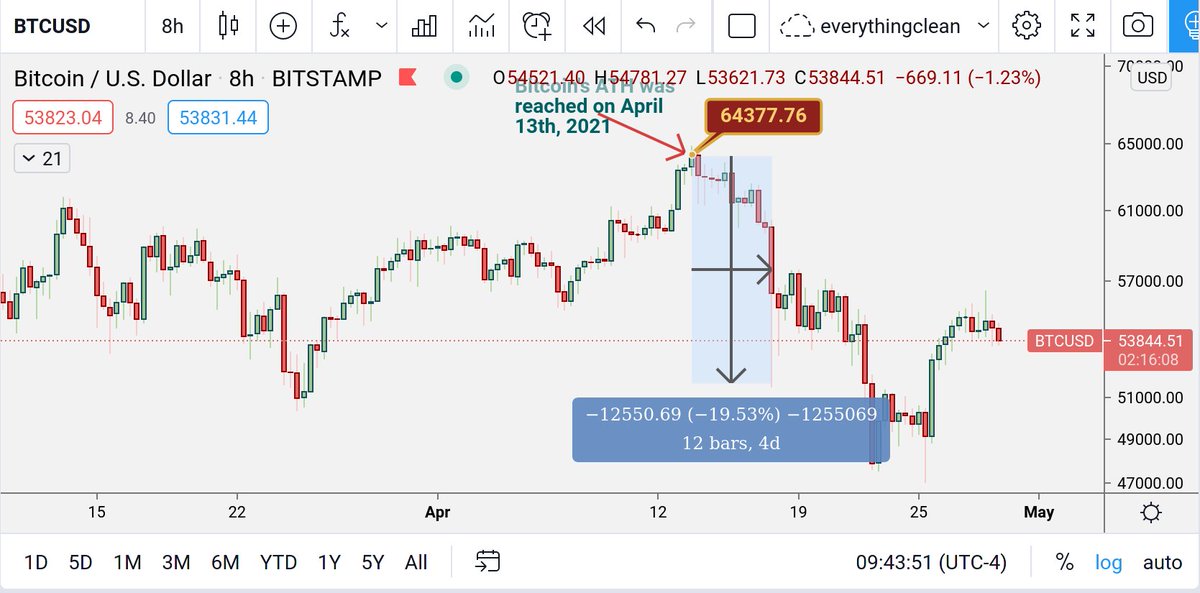

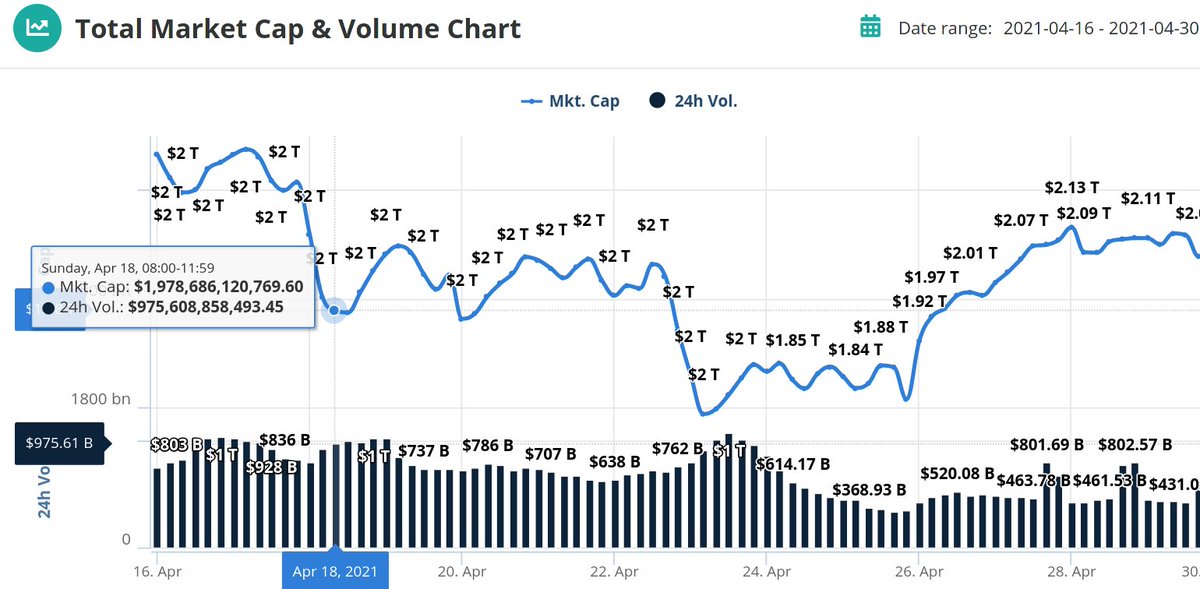

11/ Unfortunately for those miners that were left stranded mining $BTC, the price of the currency itself crashed through the floor shortly after the DAA (making it not only harder to mine Bitcoin, but >20-25% less profitable as well)

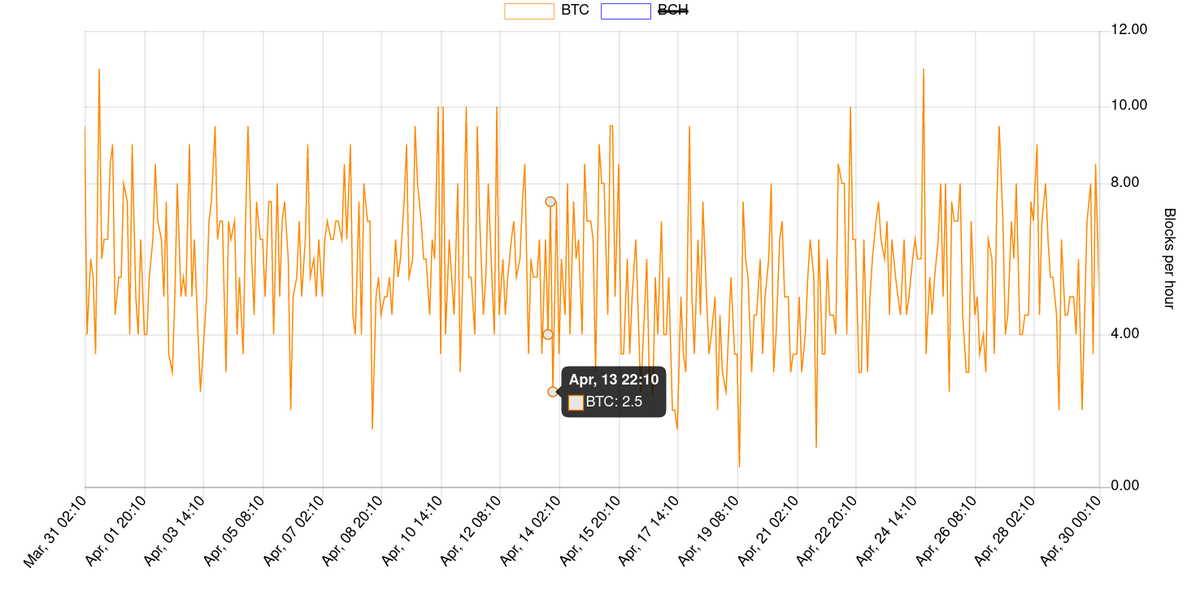

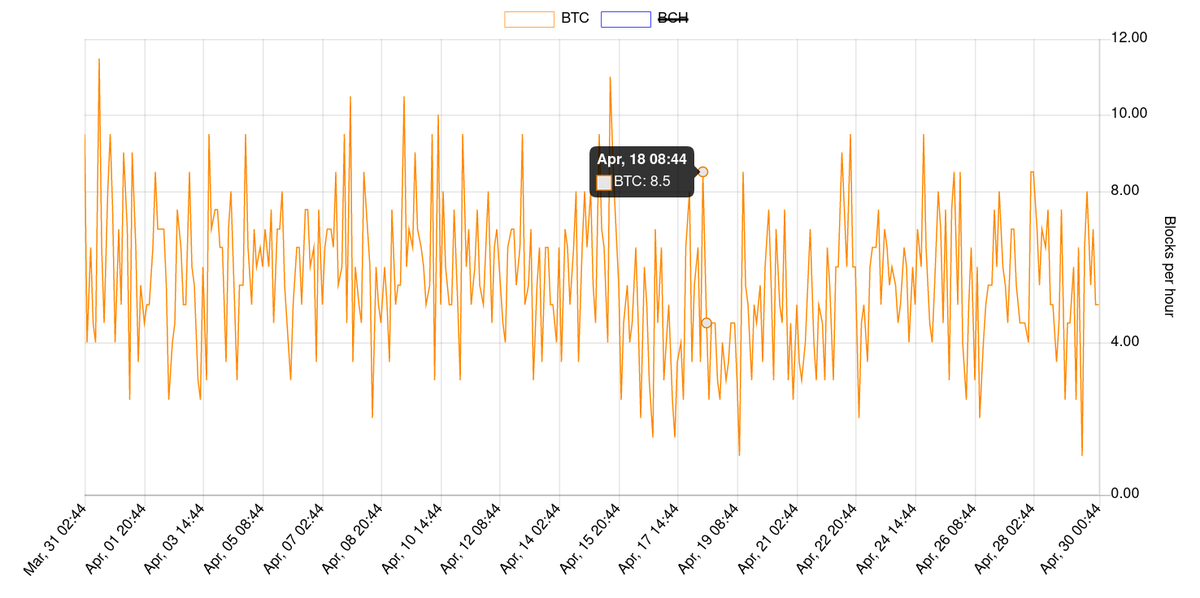

12/ Here we can see the avg blocks/hour produced jump from 3.5 on April 13th (before there were any claims of a coal mine explosion impacting miners) to 11+ on April 15th (target = 6); most likely in response to $BTC& #39;s hike in price

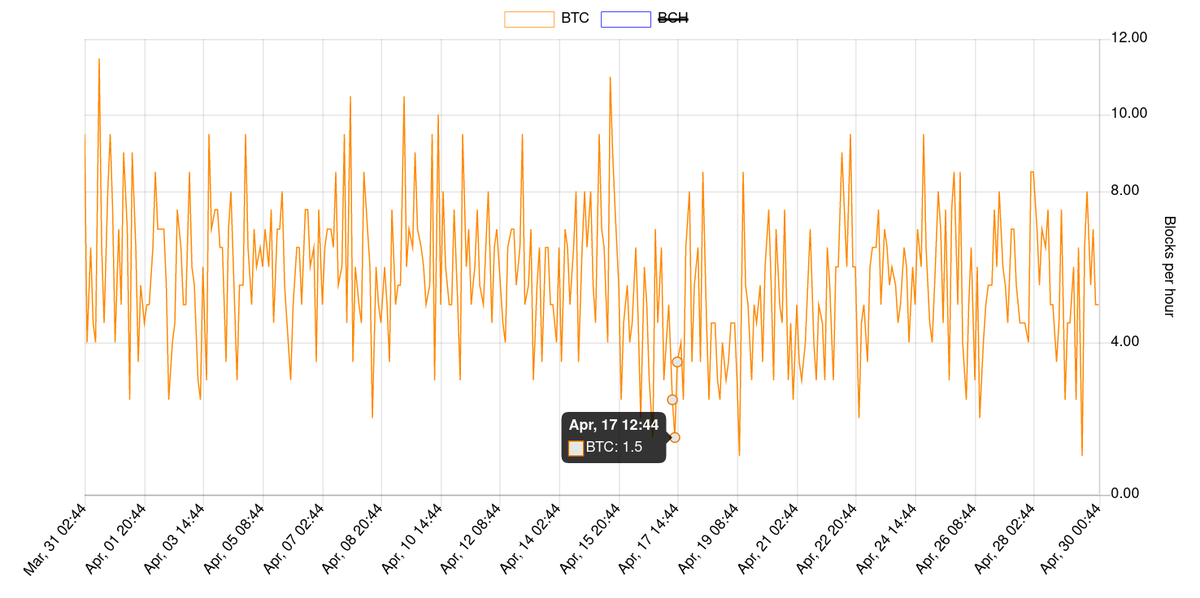

12a/ At its lowest on April 17th, there were only 1.5 blocks/hour being produced.

However, the rate *quickly recovered soon after* (as the price of crypto assets began rallying)

However, the rate *quickly recovered soon after* (as the price of crypto assets began rallying)

13/ The information contained in the tweets above defy the most recent claim made by @WuBlockchain here (April 28th, 2021) https://twitter.com/WuBlockchain/status/1387442516056678401?ref_src=twsrc%5Etfw">https://twitter.com/WuBlockch...

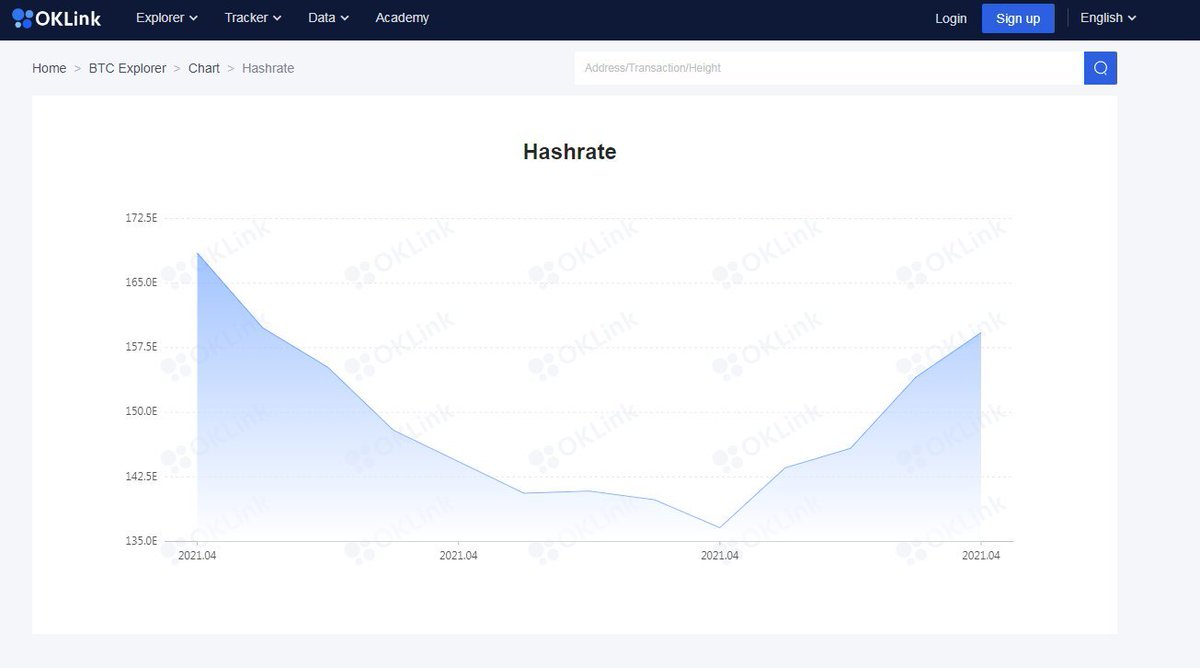

13a/ To debunk this narrative briefly, let& #39;s take a look at the attached picture they published in their tweet.

This picture gives the impression that the hashrate just began recovering recently (there are conveniently no dates attached)

This picture gives the impression that the hashrate just began recovering recently (there are conveniently no dates attached)

Read on Twitter

Read on Twitter