This is a thread about The Everything Bubble. And about #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> being for the people.

https://abs.twimg.com/hashflags... draggable="false" alt=""> being for the people.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

There’s a story from David Foster Wallace that goes like this - there are these two young fish swimming along, and they happen to meet an older fish swimming the other way, who nods at them and says, “Morning, boys. How’s the water?”

And the two young fish swim on for a bit, and then eventually one of them looks over at the other and goes, “What the hell is water?”

Ask a 24-yo, who was 12 the first time the US did QE, if we’re in an asset price bubble. Then ask a 74-yo the same question. You& #39;ll get 2 very diff answers. The former hasn’t experienced much at all, & that whole time has only been one way. While the latter has seen much more.

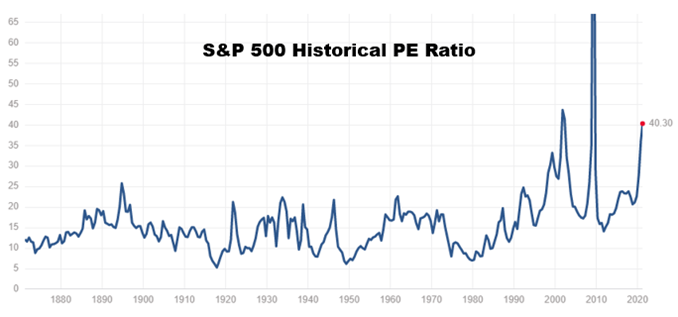

Now, certainly the 24-year-old analyst could pull up a chart like this, and see that stock prices appear to be quite elevated by historical standards-

But if you asked the young analyst if she wanted to sell stocks, she’d likely say no, because stocks only go up. And then she’d pitch you a couple weed stocks, a couple EV stocks and tell you to get an allocation to ByteDance when it IPOs.

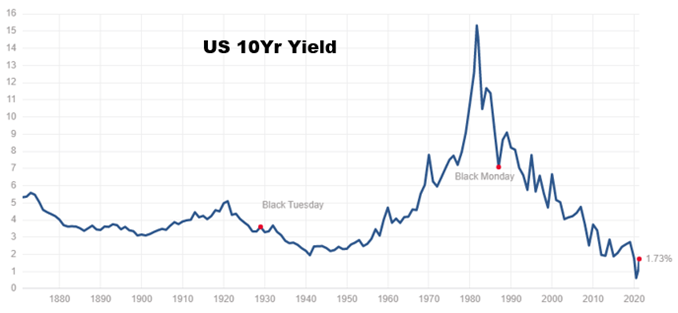

And see that debt prices are also very elevated by historical standards. But then if you asked the young analyst if she wanted to sell bonds, she’d likely….well this is where the story breaks down because young people think debt investing is boring...

But the point is, if you’ve only been paying attention for a decade or so, stocks only go up, yields only go down, and Every. Single. Dip. is a buying opportunity.

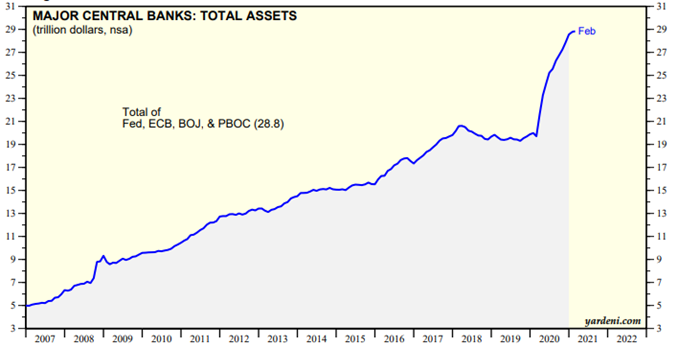

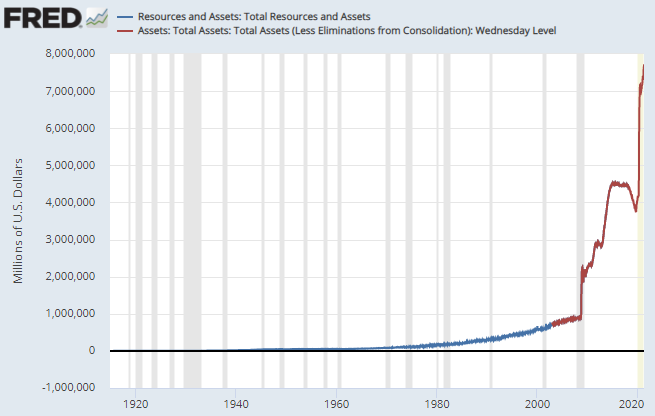

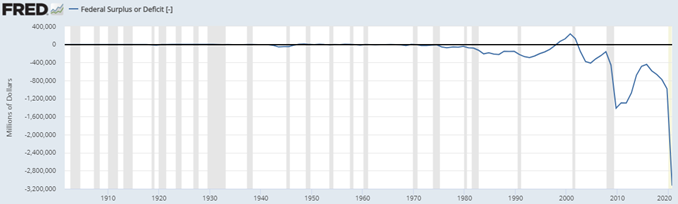

Why has that been the case? Because we’re in an everything bubble. And that everything bubble can be overwhelmingly attributed to one singular trend…

QE makes asset prices go up. It doesn& #39;t cause headline CPI price inflation, or at least not a lot of it. But it makes asset prices go up. And if QE is accompanied by loose fiscal policy (like we’re just now starting to see), there& #39;s a good chance we& #39;ll see CPI inflation too.

But for now, it’s mostly been asset prices. Specifically, the prices of assets that are only accessible and desirable to the wealthy have seen inflation. Stocks are for rich people. The wealthiest 1% of Americans own 52% of all equities, and the wealthiest 10% own 87%.

The higher up the Cantillon Effect ladder you are, the more you’ve seen prices rise for assets you want. You’re seeing that play out everywhere.

Yet, for as much as the SPX has increased in the last decade, the aggregate value of the Top 10 sports franchises has gone up even more.

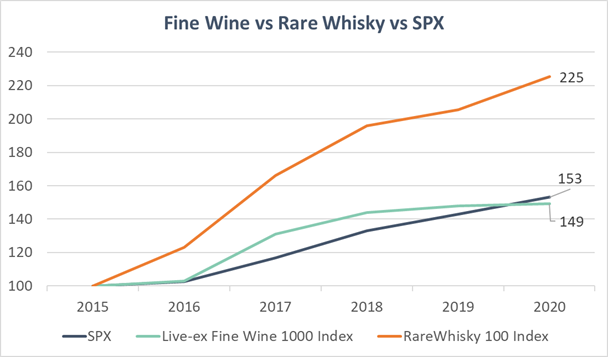

Fine wines have only been in-line with the S&P 500 over the last five years, but that’s probably just because rare whisky’s have absolutely crushed.

Classic Ferraris are well off their highs of a few years ago, likely as a function of EV’s and ESG, but the asset class has still kept up with the S&P 500.

It’s true you would’ve made more money buying tech company stocks than homes for tech company workers, but SF real estate has been quite a nice place to park cash, especially considering you borrowed the cash at 4% to pay for it.

It& #39;s everywhere. What’s going on? Artificially low interest rates and the “Fed put” have pushed capital further out on the risk curve in search of higher returns, while taking comfort that things can’t really get that bad because the Fed will be there with a tsunami of liquidity.

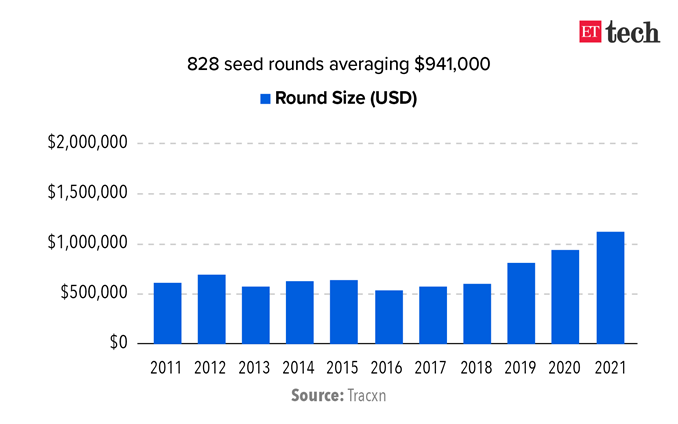

That setup has led the average size of seed stage venture capital deals to double in the last five years, even as the cost to start a business has declined.

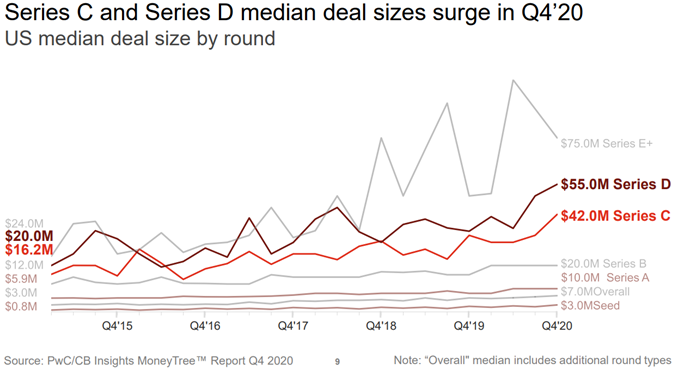

But that’s nothing compared to later stage VC deals, which have exploded in size over the last six years.

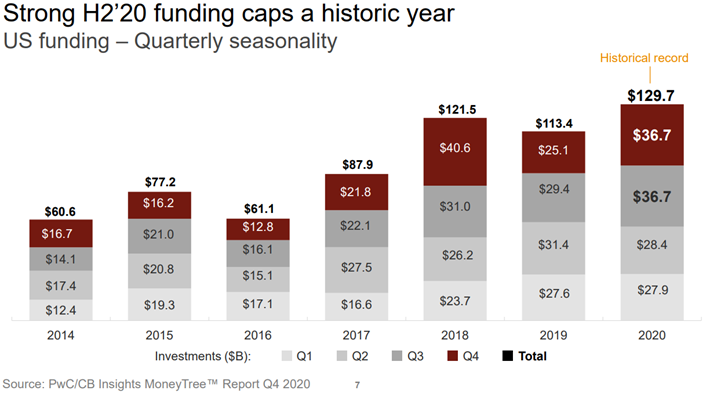

In fact, no matter how you want to slice it, venture capital has gone full gong show as the central bank printing presses have gone brrrr.

How about “companies that can’t pay the interest on their debt with cash flow generated by the business?”

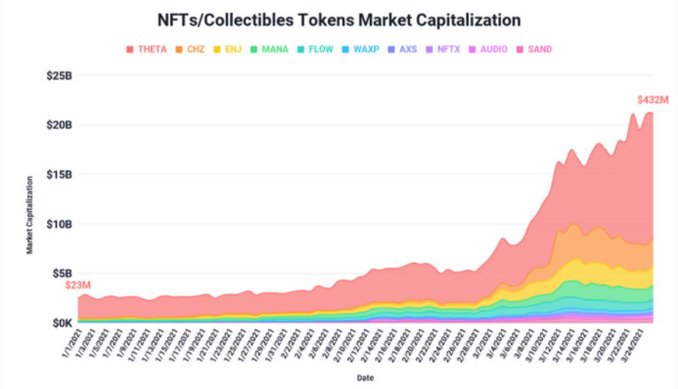

What about some more recent trends that hit a little closer to home for us crypto folk? Beeple sold a JPEG for an amount that makes it the third highest selling artwork EVER by a living artist. Is that a bubble?

Filecoin’s fully diluted market cap is 34x larger than Dropbox. Cardano’s market cap is larger than Twitter. Dogecoin is worth $4.7 billion bucks. Are those bubbles?

Which brings us to our final chart. The non-sovereign, hardcapped supply, global, immutable, decentralized, digital store of value.

Nine cents to $59,000 in under 11 years and heading higher. Is THAT a bubble? I think it depends on how you define a bubble. If the last 12 years of the chart below looked like the first 90 years of that same chart, the chart above wouldn’t look anything like it does.

If the chart above didn’t look like that, good chance BTC wouldnt have a chart at all bc it would be a science experiment that only a few cyberpunks & distributed systems enthusiasts cared about. You wouldnt be sitting here reading this and I wouldnt be sitting here writing this.

If the last 12 years of this chart looked like the first 100, Bitcoin’s chart wouldn’t look anything like it does.

But this is the world we’re living in right now and the outlook for monetary and fiscal policies is what it is. So stocks are running hot. Bonds are running hot.

Sports franchises hot.

Wine and whisky hot.

Ferraris.

Super Bowl tickets.

San Fran housing.

Video games.

Venture Capital.

Hermes purses.

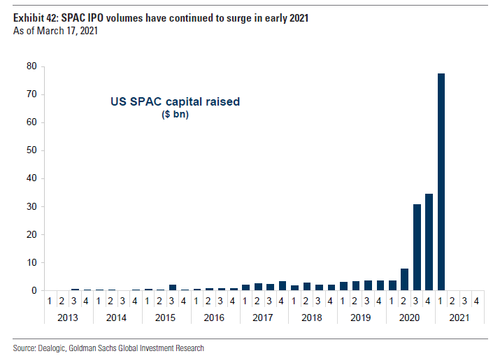

Blank check companies.

Zombie companies.

JPEGs on the blockchain.

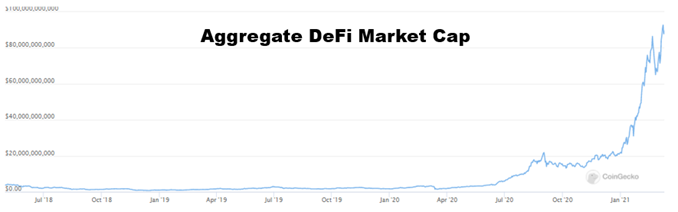

Finance on the blockchain.

Vaporware on the blockchain.

IT’S ALL RUNNING HOT.

Wine and whisky hot.

Ferraris.

Super Bowl tickets.

San Fran housing.

Video games.

Venture Capital.

Hermes purses.

Blank check companies.

Zombie companies.

JPEGs on the blockchain.

Finance on the blockchain.

Vaporware on the blockchain.

IT’S ALL RUNNING HOT.

And as for the hardest money in human history? Well it’s running the hottest of them all. The fastest horse, if you will.

As well it should be. Bitcoin appears to have been purpose-built for a time such as this. A perfect mirror reflection of monetary and fiscal policy irresponsibility. Money printer go brrr and number go up.

By now most of the world has taken notice, yet less than 1% of the population owns any. But they CAN. Anyone CAN. Bitcoin doesn’t sit out of reach for the vast majority of the human population like stocks, whisky, Ferraris, luxury real estate, venture capital & Hermes purses.

Anyone in the world with an internet connection can buy $1 worth of Bitcoin & begin protecting themselves against monetary debasement & the rapidly increasing risk that the largest monetary experiment in human history will end poorly.

Bitcoin is for the people and that is a beautiful thing.

/The end

/The end

Read on Twitter

Read on Twitter