1/ Thread on @LidoFinance and liquid staking derivatives

Lido is at the forefront of liquid staking derivatives on both Ethereum $ETH and Terra $LUNA.

Liquid staking derivatives will be key infrastructure for increasing the capital efficiency of PoS assets within DeFi.

Lido is at the forefront of liquid staking derivatives on both Ethereum $ETH and Terra $LUNA.

Liquid staking derivatives will be key infrastructure for increasing the capital efficiency of PoS assets within DeFi.

2/ Liquid staking derivative tokens currently have two different models.

1. stETH rebases everyday to reflect the underlying staked balance

2. bLuna is pegged 1:1 with Luna, it pays out UST equivalent of the staking rewards.

These derivatives can now be freely traded.

1. stETH rebases everyday to reflect the underlying staked balance

2. bLuna is pegged 1:1 with Luna, it pays out UST equivalent of the staking rewards.

These derivatives can now be freely traded.

3/ This greatly improves capital efficiency & liquidity for all stakable assets.

It allows previously locked up capital only earning a staking reward to be used in various DeFi protocols, increasing its yield and productivity.

Take bLuna and Anchor as an example.

It allows previously locked up capital only earning a staking reward to be used in various DeFi protocols, increasing its yield and productivity.

Take bLuna and Anchor as an example.

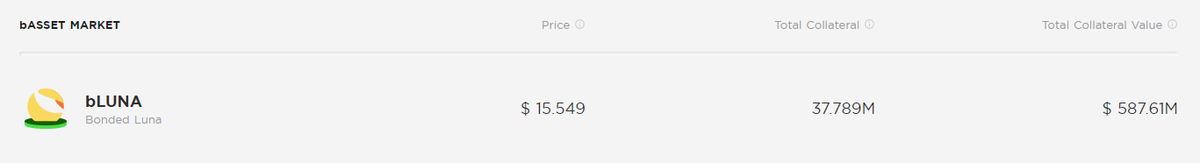

4/ bLuna has gained serious traction: in just over a month since its launch, 35m bLUNA has been minted with a market value of ~$550m, representing over 10% of all staked Luna.

bLuna can currently be used in Anchor to farm $ANC tokens and borrow $UST.

bLuna can currently be used in Anchor to farm $ANC tokens and borrow $UST.

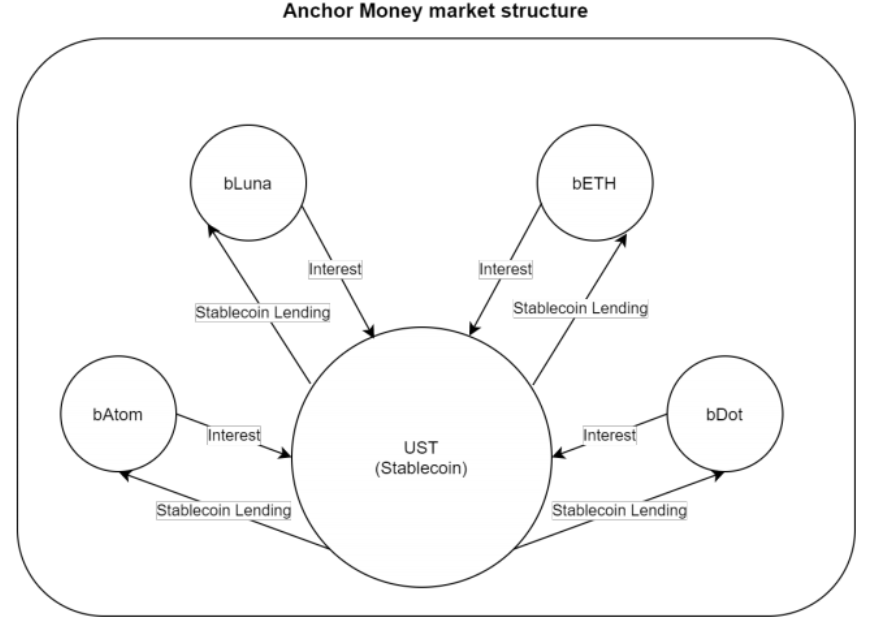

5/ The interest for a $UST loan is paid off via staking rewards.

stETH and other bAssets facilitated by Lido will be added as collateral options. In addition, it was hinted in the Anchor white paper that bDot and bAtom may be integrated. With rumors of bSol being circulated.

stETH and other bAssets facilitated by Lido will be added as collateral options. In addition, it was hinted in the Anchor white paper that bDot and bAtom may be integrated. With rumors of bSol being circulated.

6.5/ This is just the beginning of liquid staking derivatives: possibilities of self paying loans, where one can borrow against liquid staked assets up front, then use the staking reward to pay off the loan.

A deeper dive on Anchor is coming soon.

A deeper dive on Anchor is coming soon.

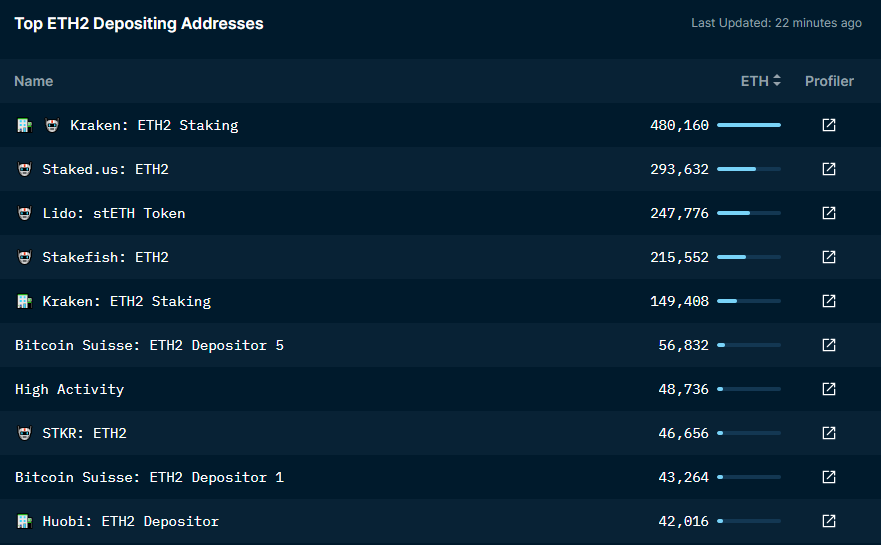

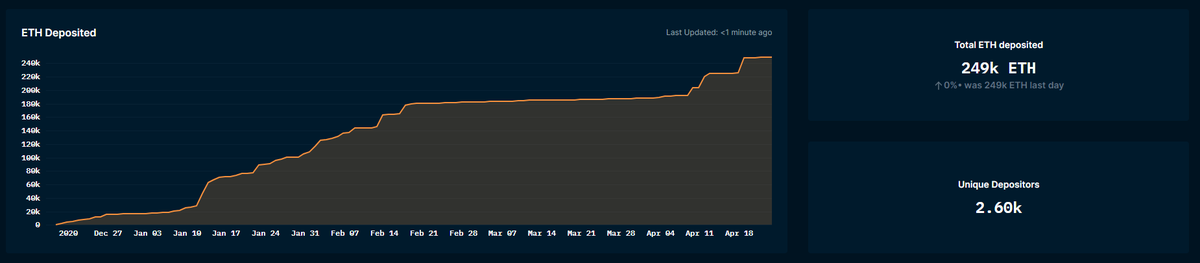

7/ Currently Lido Finance has over 245,000 $ETH on the Beacon Chain, making it the 4th largest ETH 2 entity.

Lido also has a significant advantage over some of the exchanges providing ETH 2.0 staking as the stETH token can interact with DeFi protocols to earn extra yield.

Lido also has a significant advantage over some of the exchanges providing ETH 2.0 staking as the stETH token can interact with DeFi protocols to earn extra yield.

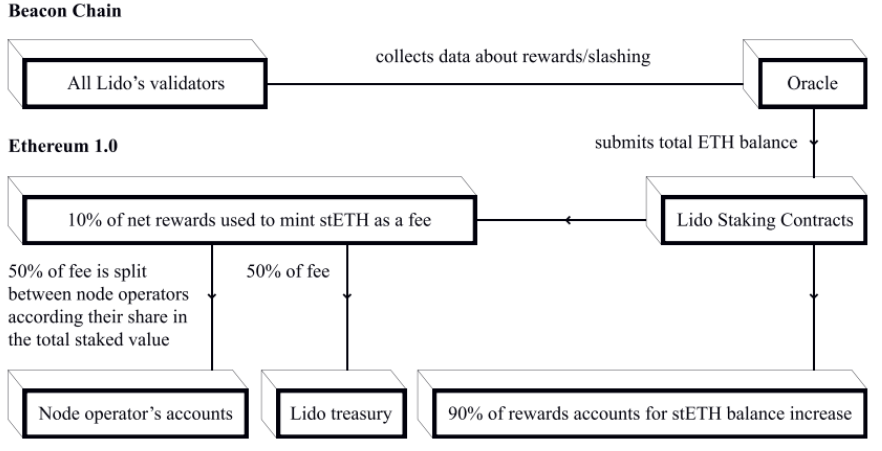

8/ Now let’s talk about how Lido makes money.

Currently Lido is monetizing stETH liquid staking derivatives by taking 10% of the staking rewards.

ETH 2 staking currently has an 8% APR and thus Lido receives 80 bps.

The revenue break down is as follows:

Currently Lido is monetizing stETH liquid staking derivatives by taking 10% of the staking rewards.

ETH 2 staking currently has an 8% APR and thus Lido receives 80 bps.

The revenue break down is as follows:

9/ The LDO token right now is only a governance token but it can vote on protocol cashflows.

Currently the treasury is using cashflows to grow the protocol and pay for slashing insurance.

This may change in the future, possibly distributing cashflows to $LDO token holders.

Currently the treasury is using cashflows to grow the protocol and pay for slashing insurance.

This may change in the future, possibly distributing cashflows to $LDO token holders.

10/ Currently 6.31% of staked ETH is controlled by Lido, further the 10-day and 30-day MA share of Lido for new staked ETH is 19% & 38%.

As ETH transitions to 2.0 these liquid staking derivatives will become more and more important, opening billion’s worth of collateral to Lido.

As ETH transitions to 2.0 these liquid staking derivatives will become more and more important, opening billion’s worth of collateral to Lido.

11/ Lido is one of the only projects focusing on other PoS chains like Terra, Polkadot, Atom and possibly Solana.

These are other ways Lido can diversify its revenue stream and be successful even with delays or slowdowns in ETH 2.0.

These are other ways Lido can diversify its revenue stream and be successful even with delays or slowdowns in ETH 2.0.

12/ TVL in Lido is growing rapidly with over 248,000 ETH deposited in 4 months.

As ETH 2.0 continues to near & protocols like Anchor get developed, the demand for $stETH is likely to accelerate.

As ETH 2.0 continues to near & protocols like Anchor get developed, the demand for $stETH is likely to accelerate.

13/ If Lido can continue to grow at its current trajectory, we will see around 750k ETH by the end of 2021.

At $2500 ETH that is ~$1.95bn in value. An 80 bps annualized fee on those assets is $15.6mm.

This seems like a base case as there are many catalysts on the horizon.

At $2500 ETH that is ~$1.95bn in value. An 80 bps annualized fee on those assets is $15.6mm.

This seems like a base case as there are many catalysts on the horizon.

14/ After EIP 1559 and the Merge, we are likely to see much higher staking APR’s (see following tweets @drakefijustin).

At 16-25% staking APR after the merge and a fee of 160 to 250 bps, annualized revenue could reach $31-48mm.

This is a short/medium term catalyst to consider.

At 16-25% staking APR after the merge and a fee of 160 to 250 bps, annualized revenue could reach $31-48mm.

This is a short/medium term catalyst to consider.

15/ These numbers start to look very interesting as ETH continues its merge over to PoS.

One would expect deposits to accelerate soon, as the opportunity cost of not staking increases.

Lido is not solely dependent on ETH as it can monetize other PoS layer 1 tokens.

One would expect deposits to accelerate soon, as the opportunity cost of not staking increases.

Lido is not solely dependent on ETH as it can monetize other PoS layer 1 tokens.

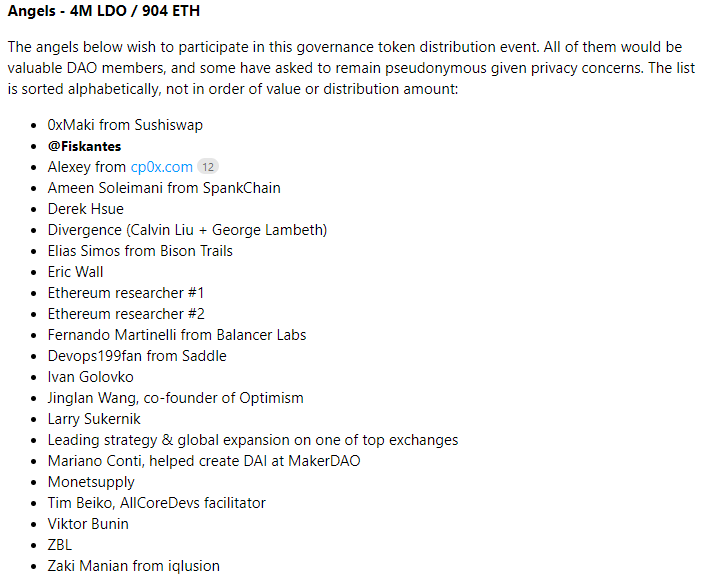

16/ Now for the giga brains who invested in Lido. @paraficapital, @terra_money, @stakefish, @StaniKulechov, @kaiynne, @RuneKek, @cryptocobain, @Tetranode.

The Lido DAO voted on @paradigm purchasing $30m worth of LDO tokens (7%) and it passed.

The Lido DAO voted on @paradigm purchasing $30m worth of LDO tokens (7%) and it passed.

17/ Recently another 3% of the tokens are being voted to be sold to more strategic investors, @zhusu @Arthur_0x @SBF_alameda @delphi_digital @coinbase @robotventures @0xMaki just to name a few.

Full List Below.

Full List Below.

18/ Read more about the Paradigm deal & treasury diversification here at the Lido Forum:

https://research.lido.fi/t/proposal-ldo-treasury-diversification/458">https://research.lido.fi/t/proposa... https://research.lido.fi/t/proposal-ldo-treasury-diversification-part-2/506">https://research.lido.fi/t/proposa...

https://research.lido.fi/t/proposal-ldo-treasury-diversification/458">https://research.lido.fi/t/proposa... https://research.lido.fi/t/proposal-ldo-treasury-diversification-part-2/506">https://research.lido.fi/t/proposa...

19/ Lido is a chain agnostic bet on the future of PoS blockchains and liquid staking derivatives. This project has some extremely smart investors behind it and a brilliant team @_vshapovalov

Bonus 1/ @gakonst & @hasufl recently published a paper on staking pools and staking derivatives on ETH, suggesting liquid staking derivatives will likely follow a power law (winner take all distribution).

Read here: https://research.paradigm.xyz/staking ">https://research.paradigm.xyz/staking&q...

Read here: https://research.paradigm.xyz/staking ">https://research.paradigm.xyz/staking&q...

Bonus 2/ If a power law scenario does play out due to this liquidity moat that stETH is building, let& #39;s say it reaches 20-30% of all ETH at a 4% staking APR that is annualized protocol revenue of $231-347mm.

See sensitivity table below for protocol revenue.

See sensitivity table below for protocol revenue.

Bonus 3/ For me Lido is an asymmetric bet that not only gives exposure to ETH but all other PoS layer ones that it is able to integrate with.

It currently has a strong liquidity/first mover advantage and as we all know that is essential in DeFi.

It currently has a strong liquidity/first mover advantage and as we all know that is essential in DeFi.

Read on Twitter

Read on Twitter