For at least a decade, US politicians have made symbolic, unfulfilled promises to do something about the " #CarriedInterest tax loophole," a thing that virtually no one understands. @yvessmith& #39;s explanation will remedy that.

https://www.nakedcapitalism.com/2021/04/private-equity-and-hedge-fund-barons-having-a-hissy-over-carried-interest-grift-because-biden-isnt-staying-bought.html

1/">https://www.nakedcapitalism.com/2021/04/p...

https://www.nakedcapitalism.com/2021/04/private-equity-and-hedge-fund-barons-having-a-hissy-over-carried-interest-grift-because-biden-isnt-staying-bought.html

1/">https://www.nakedcapitalism.com/2021/04/p...

To understand carried interest, you have to start with capital gains tax. In the US, wages - money you get for working - are taxed at a higher rate than capital gains (money you get because you sold something you own at a profit).

2/

2/

Supposedly, that& #39;s because capital gains are critical to pension savings. That& #39;s important given the annihilation of employer-backed pensions and the rise of "market-based" pensions dependent on working stiffs figuring out how to win at the stock-market casino.

3/

3/

But that& #39;s not a very compelling reason to protect capital gains. 401k-based pensions are a near-total failure.

#are-there-no-poorhouses">https://pluralistic.net/2020/07/25/derechos-humanos/ #are-there-no-poorhouses

4/">https://pluralistic.net/2020/07/2...

#are-there-no-poorhouses">https://pluralistic.net/2020/07/25/derechos-humanos/ #are-there-no-poorhouses

4/">https://pluralistic.net/2020/07/2...

Virtually the only people who have adequate 401ks are the very earliest workers who transitioned to them, at a time when employers offered generous matching funds as a sweetener while they got rid of real pensions with a guarantee of a dignified retirement.

5/

5/

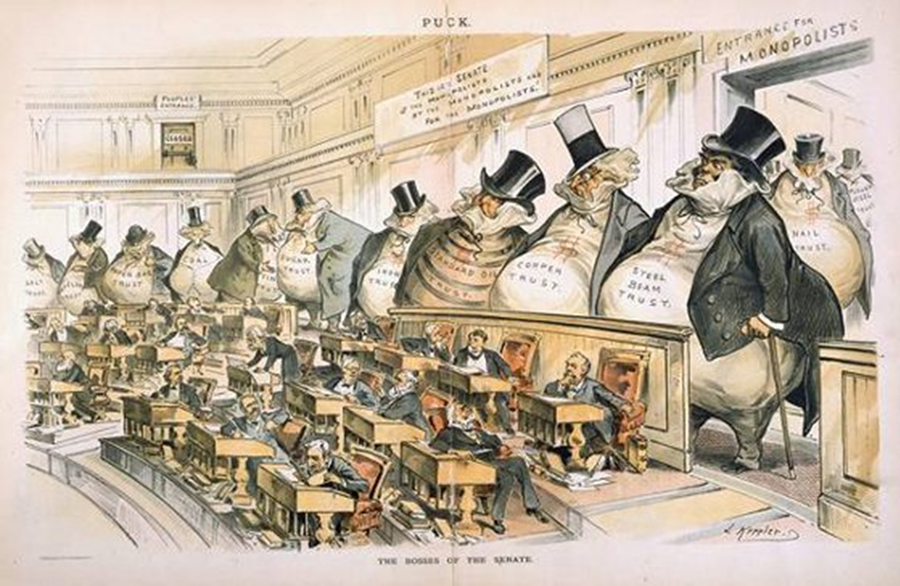

The real beneficiaries of tax-preferred status for capital gains are not retirement savers, they& #39;re wealthy people, especially super-wealthy people, because the richer you are, the more you make from OWNING stuff relative to what you make from DOING stuff.

6/

6/

As with other wealth-preferencing tax policies, the super-rich use the nearly nonexistent benefits to the middle class as an excuse for wildly regressive policies (think of the agitation for a SALT Cap repeal or the near-elimination of estate taxes):

#neotrumpism">https://pluralistic.net/2021/04/28/inequality-r-us/ #neotrumpism

7/">https://pluralistic.net/2021/04/2...

#neotrumpism">https://pluralistic.net/2021/04/28/inequality-r-us/ #neotrumpism

7/">https://pluralistic.net/2021/04/2...

The idea that people who make money from toil should be punished because they didn& #39;t make money by owning things is obviously fucked up - not least because if you tax workers& #39; wages it leaves them with less money to buy capital on which to realize gains.

8/

8/

And if you let the ownership class retain more of their income, it lets them buy more stuff on which they can realize those tax-preferenced gains. Preferential tax rates for capital gains are a way to make workers poorer and owners richer, period.

9/

9/

So that& #39;s capital gains. What about "carried interest?" It has nothing to do with "interest" on a loan - it& #39;s a way for a specific kind of very, very rich person to pretend that what wages they DO receive are actually capital gains and eligible for tax-preferenced treatment.

10/

10/

The name "carried interest" dates to 16th century mercantalist sea-captains, paid a 20% share ("interest") in the goods they shipped ("carried").

It& #39;s not the 16th century anymore, and the beneficiaries of carried interest aren& #39;t sea captains, they& #39;re money managers.

11/

It& #39;s not the 16th century anymore, and the beneficiaries of carried interest aren& #39;t sea captains, they& #39;re money managers.

11/

If you run a hedge fund or a private equity firm, you& #39;re typically compensated in a "2-and-20" scheme: every year, you pocket 2% of the money you& #39;ve been given to manage, and 20% of any profits that money has realized.

12/

12/

These are wages, not capital gains. The money in the fund isn& #39;t your money, it& #39;s someone else& #39;s (money managers investment in their own funds is a token sum, 1-3% of the total), and your share doesn& #39;t come from selling something you own, it comes from doing a job.

13/

13/

PE and hedge fund managers make millions - sometimes hundreds of millions - every year this way, and because of the carried interest loophole, they get to treat those wages as if they were capital gains.

14/

14/

That& #39;s how it is that if you work your guts our bending steel at a sheet-metal plant, your wages are taxed at a higher rate than the wages of the distant finance-ghoul who bought that plant, debt-loaded it, and drove it into bankruptcy.

15/

15/

So carried interest is bullshit and yeah, we should kill it. But as Smith points out, that would be a largely symbolic victory: there are many new tax-gimmicks that money-managers could use to shift those wages around and maintain the pretense that they are capital gains.

16/

16/

The only reason that these ripoff plutes are even fighting about the loophole is that they find it aesthetically untenable that the US government should poke holes in the risible fiction that their wages are, in fact, capital gains.

17/

17/

The thing is, PE and hedge-fund managers really do see themselves as saviors of civilization, somehow characterizing their ruinous, real-economy-destroying financial engineering as socially necessary.

18/

18/

In support of this, they cite hedge-fund and PE takeovers of health-care and renewable energy -two vital sectors driven they& #39;ve actually driven into crisis and, frequently, collapse.

https://www.nber.org/papers/w28474

19/">https://www.nber.org/papers/w2...

https://www.nber.org/papers/w28474

19/">https://www.nber.org/papers/w2...

As Smith points out, the fact that killing carried interest will merely trigger new accounting fictions to maintain the status quo tells us that this isn& #39;t the fight we should be having: instead, we should eliminate the tax-preferenced treatment of capital gains altogether.

20/

20/

If we taxed capital gains at the same rate (or higher) as wages, we& #39;d eliminate the entire purpose of carried interest shenanigans - and we& #39;d blunt the lobbying power of the casino-riggers who stole our pensions and forced us to rely on the market to support our old age.

eof/

eof/

ETA - If you& #39;d like an unrolled version of this thread to read or share, here& #39;s a link to it on http://pluralistic.net"> http://pluralistic.net , my surveillance-free, ad-free, tracker-free blog:

#carried-interest">https://pluralistic.net/2021/04/29/writers-must-be-paid/ #carried-interest">https://pluralistic.net/2021/04/2...

#carried-interest">https://pluralistic.net/2021/04/29/writers-must-be-paid/ #carried-interest">https://pluralistic.net/2021/04/2...

Read on Twitter

Read on Twitter