I wrote a long story about Robinhood, the app’s design and its business model, and about the tragic suicide of a young trader who thought he’d lost $730K on the app. I hope you’ll read it. /1 https://bit.ly/3tbw5GV ">https://bit.ly/3tbw5GV&q...

Robinhood’s revenue model depends on its traders making frequent, uninformed trades. That is a losing strategy for most customers—but a profit-making one for Robinhood and its Wall Street partners. /2 https://bit.ly/3tbw5GV ">https://bit.ly/3tbw5GV&q...

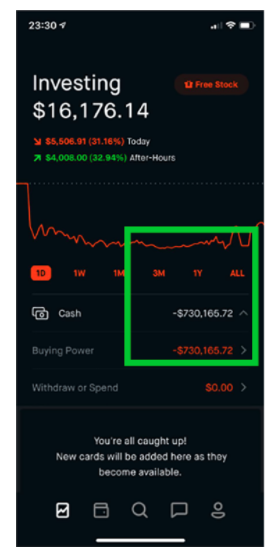

The young trader in this story, Alex Kearns, was able to get authorized to trade options, which are complex & risky. One night last June, his Robinhood display showed him a negative $730K balance, despite the fact that he had only about 16k in his account:

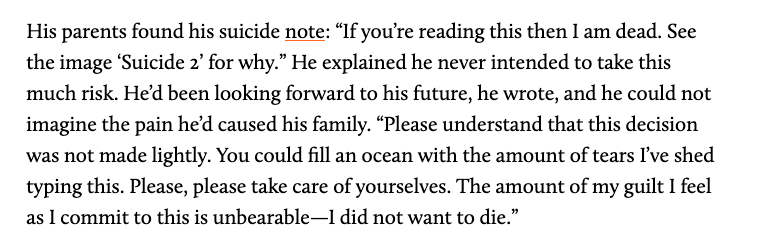

Alex spent a panicked night trying to get help from Robinhood. But they didn’t have telephone support for customers, and only sent back automated emails. Thinking he was saving his family from financial ruin, Alex took his own life. He left his family a note: /4

Alex’s family filed a wrongful death suit against Robinhood this winter. Around the same time, GameStop happened. Traders whom Robinhood blocked from buying shares of GME fumed, b/c they felt the actions of the app had prioritized the interests of hedge funds over their own. /5

Putting the interests of the wealthy first might be what you’d expect from other financial services firms. But Robinhood has built their company on a promise NOT to be like the other guys /6

And yet: the way that Robinhood makes money is necessarily dependent on its customers trading a lot—which in almost all cases=losing money. /7

The app’s single largest source of revenue is something called payment for order flow (PFOF)—where Wall Street firms called “market makers” pay brokers like Robinhood to execute their customer’s trades. So the math there is simple: More trades= more $ for Robinhood /8

But why do market-makers want to pay Robinhood for their customer’s trades? Because on Wall Street, there is BIG money to be made on information asymmetry. And who has the least information? The regular people trading on Robinhood /9

If those last few tweets sound like a bunch of finance-speak/gibberish, this quote sums it all up nicely /10

Which brings us back to Alex, a young guy who was misled by the way the app displayed his losses--which, tragically, were not even real /11

Read on Twitter

Read on Twitter