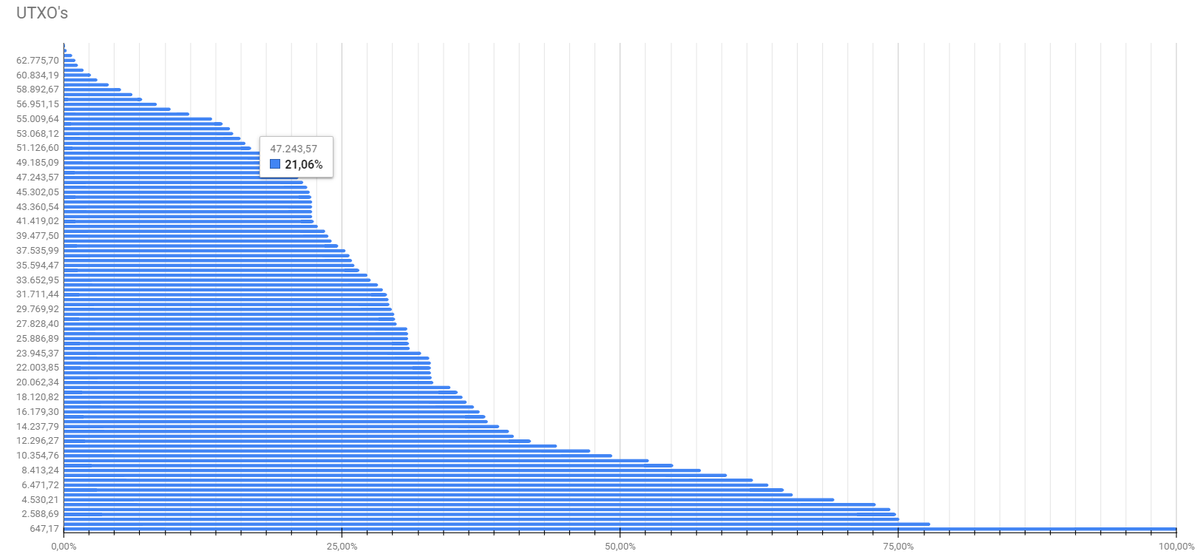

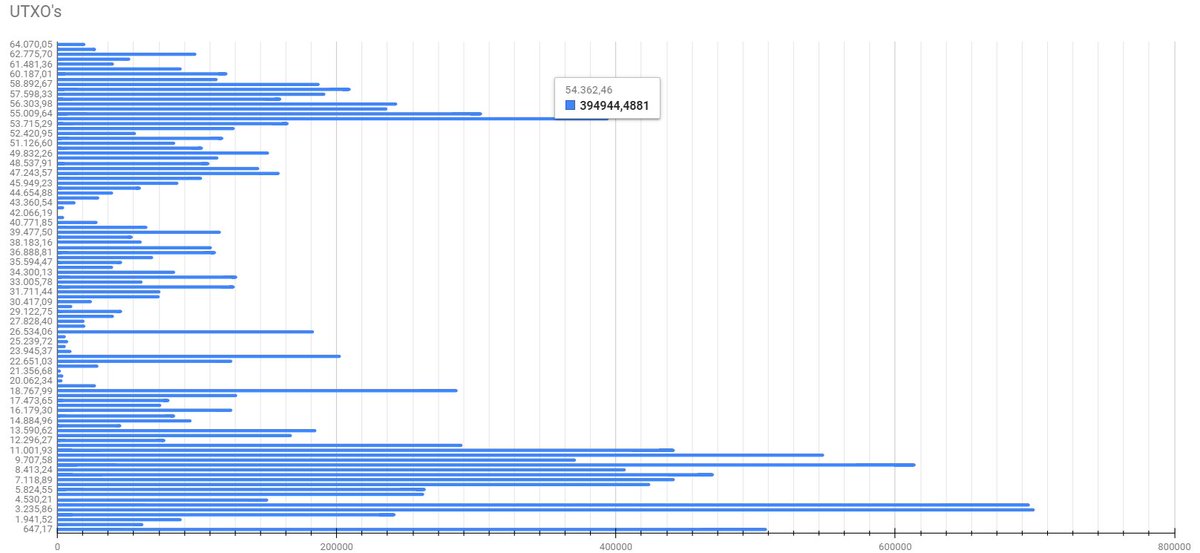

Charts: Bitcoin& #39;s UTXO volume profile

>20% of UTXO volume occured above $47000 with the moat of the volume at $54-55K

That makes it resistance - if price can travel through the cluster to the upside, we have a large accumulation base

If not, there is a lot of volume trapped 1/

>20% of UTXO volume occured above $47000 with the moat of the volume at $54-55K

That makes it resistance - if price can travel through the cluster to the upside, we have a large accumulation base

If not, there is a lot of volume trapped 1/

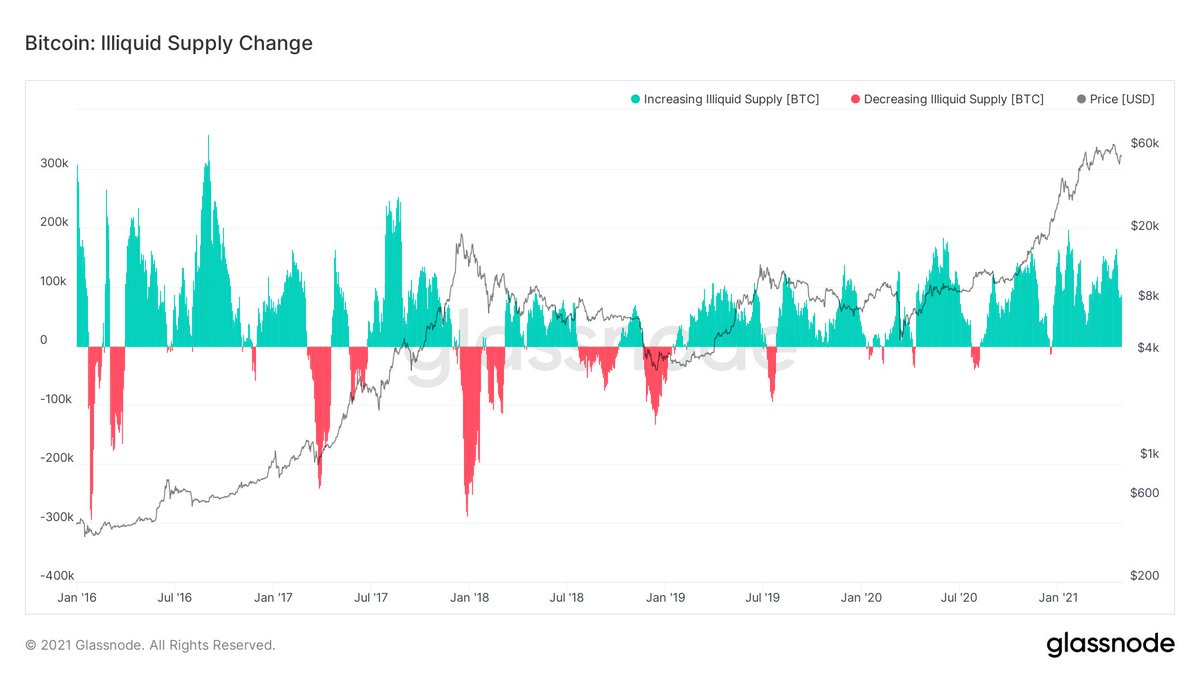

When volume is trapped in the wrong hands, markets tend to move against those positions as a result

In other words, if strong hands accumulated, weak hands end up chasing the market up

If strong hands distributed, weak hands end up capitulating in a panic dump 2/

In other words, if strong hands accumulated, weak hands end up chasing the market up

If strong hands distributed, weak hands end up capitulating in a panic dump 2/

Larger players are more price agnostic than smaller traders. They accumulate as supply is available and distribute as demand is present.

The charts in tweet 2 can be deceiving: price can travel corrective against accumulating strong hands and vice versa 3/

The charts in tweet 2 can be deceiving: price can travel corrective against accumulating strong hands and vice versa 3/

Eventually this results in an imbalance of supply & demand, setting up a new trend

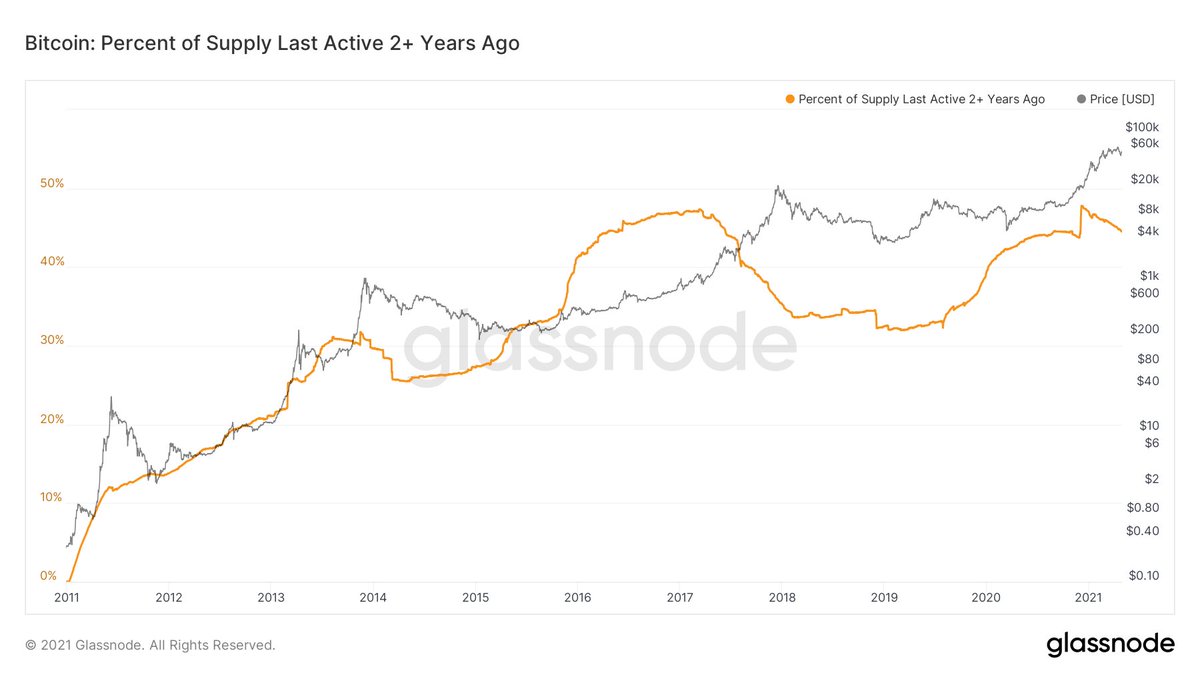

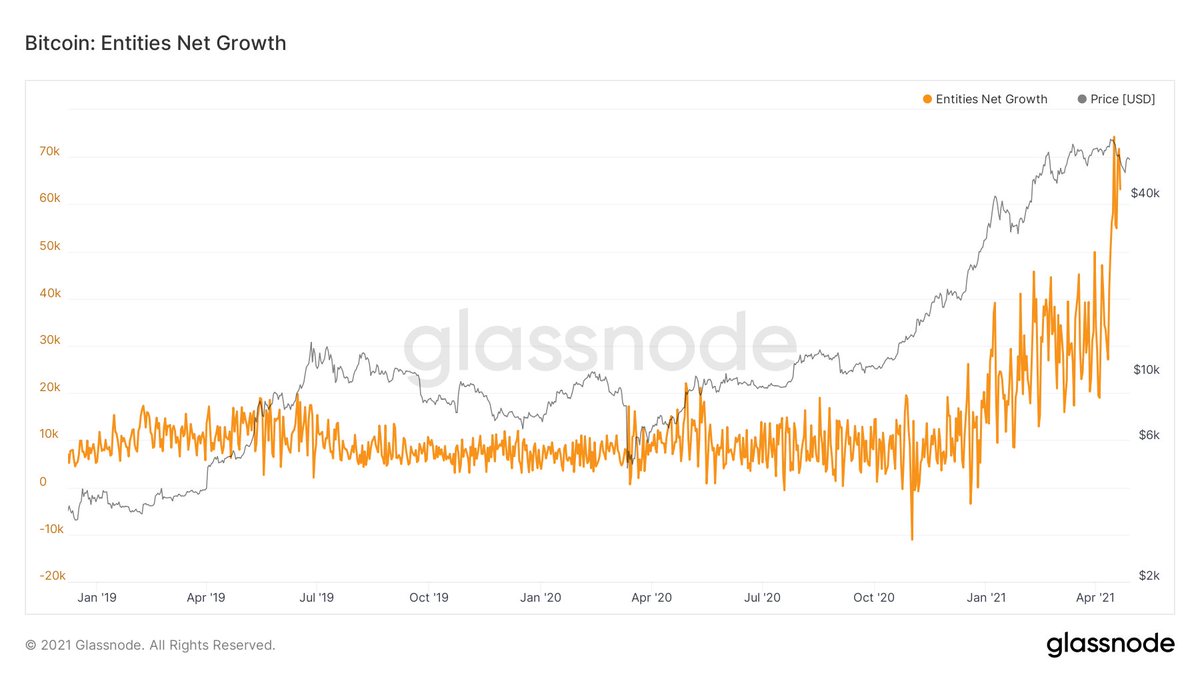

Longer term hodlers have started distributing, but are far from finished 4/

Longer term hodlers have started distributing, but are far from finished 4/

With the arrival of many new entities, if the supply & demand imbalance resolves bullish, the herd is arriving at rapid pace to match the need of long term hodlers taking profit 5/

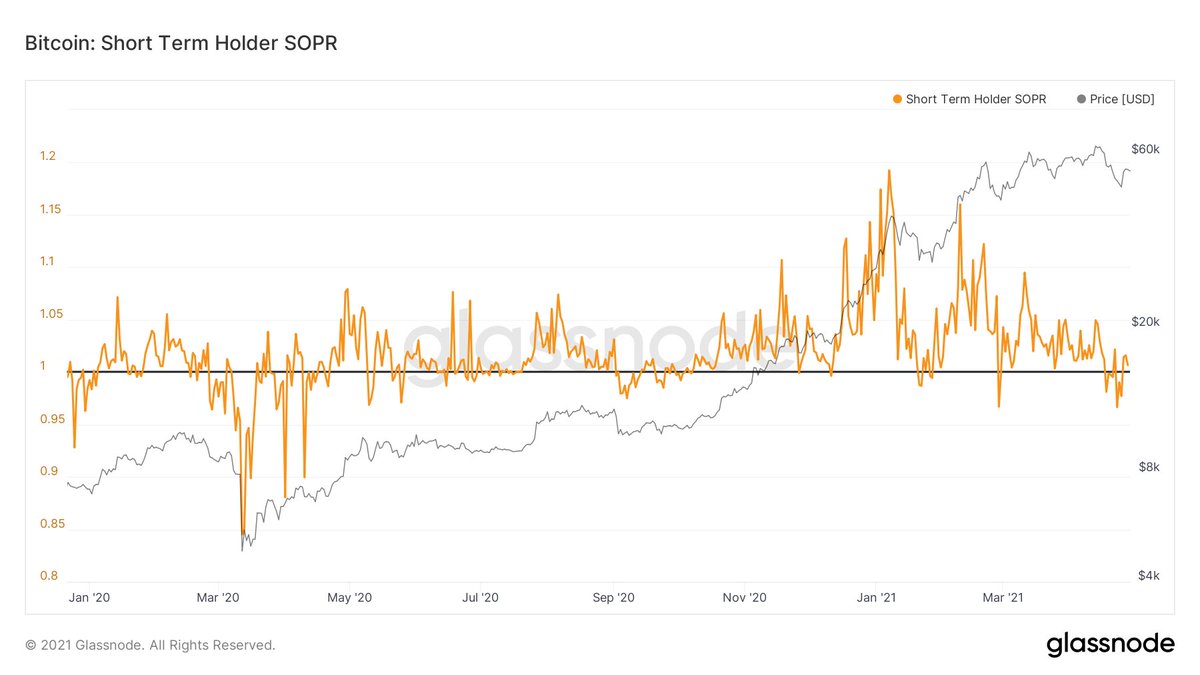

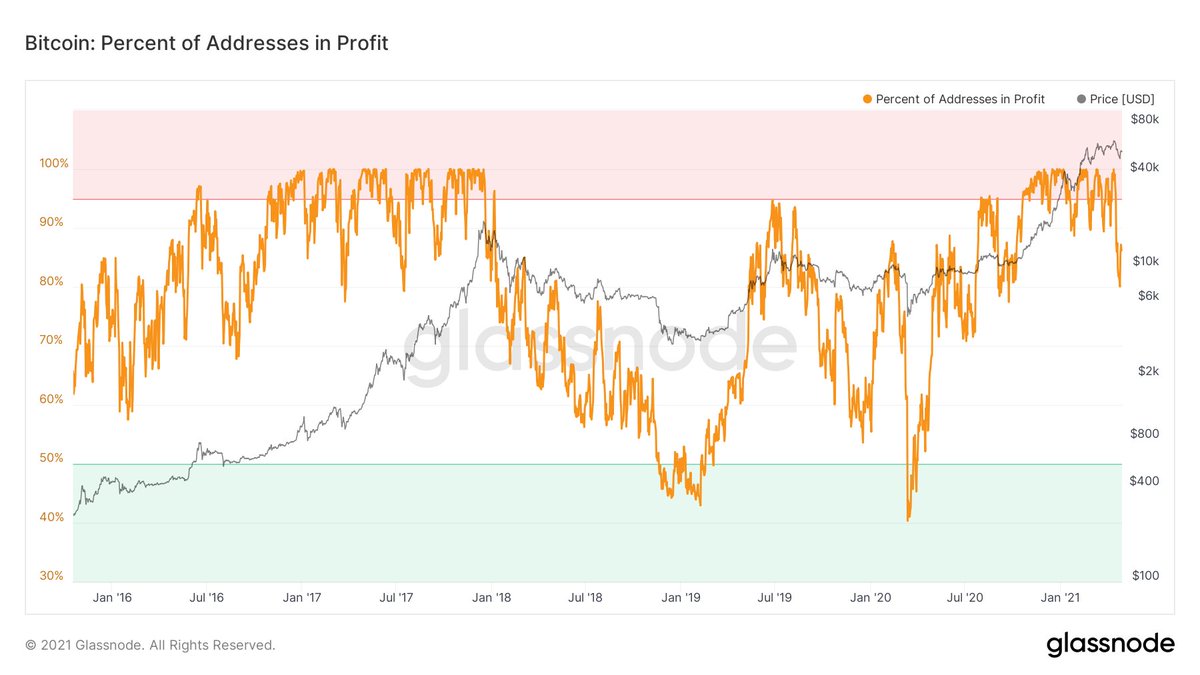

Short term holders have been selling at a loss, indicated by the negative readings on the first chart & a relatively large percentage of addresses were/are at a loss for bull market conditions 6/

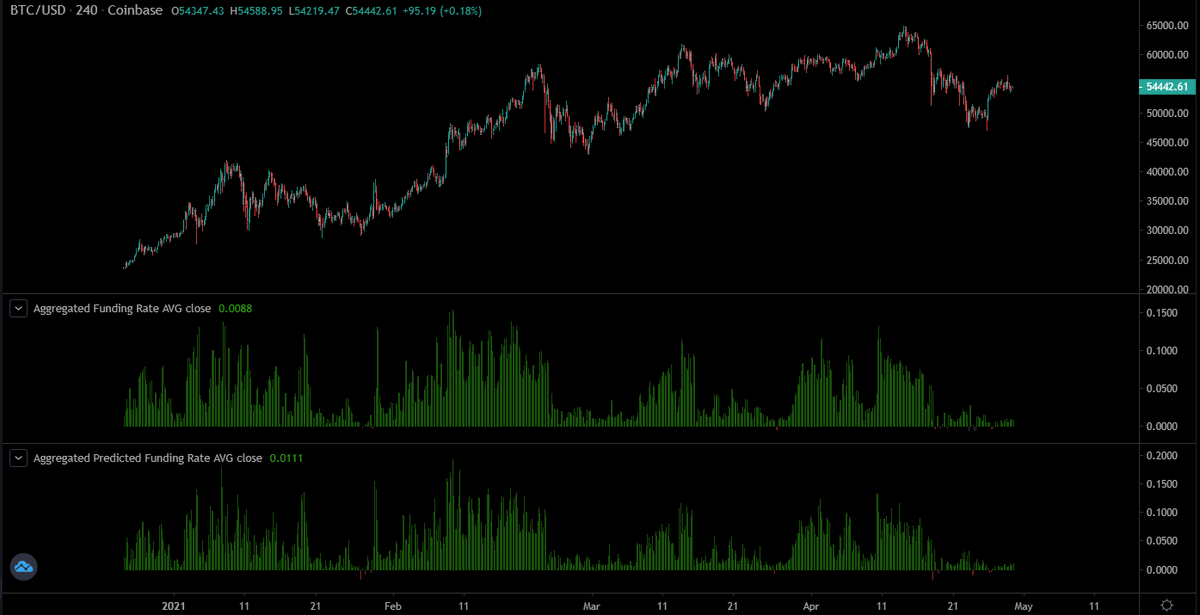

Sentiment readings have dropped to levels not seen in this bull run & funding on perpetual swaps confirms neutral/balanced market positioning

We have all the ingredients, but someone needs to start cooking 7/7

We have all the ingredients, but someone needs to start cooking 7/7

Read on Twitter

Read on Twitter