There& #39;s some interesting stuff going on in China& #39;s property market right now, with some of the tensions I& #39;ve written about over the last 2yrs getting worse.

First: government often talks a big game on RE deleveraging. It now looks like it means it. (1/5) https://www.wsj.com/articles/beijings-squeeze-on-fragile-real-estate-developers-is-getting-real-11619682390">https://www.wsj.com/articles/...

First: government often talks a big game on RE deleveraging. It now looks like it means it. (1/5) https://www.wsj.com/articles/beijings-squeeze-on-fragile-real-estate-developers-is-getting-real-11619682390">https://www.wsj.com/articles/...

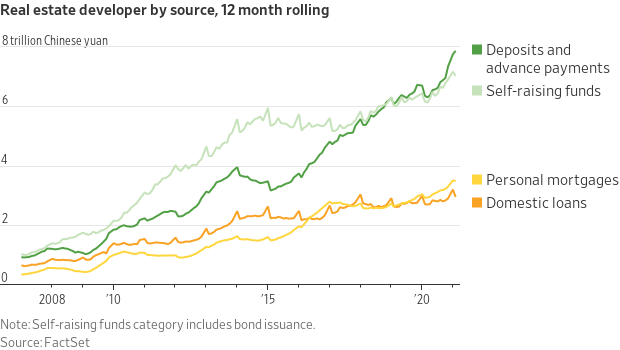

If RE developers are seriously constrained on both bank and bond mkt finance, *and* maybe mortgage lending, then there& #39;s only one significant source of financing available to them.

Deposits from buyers are +29% in the last 12 months, now the largest single portion. (2/5)

Deposits from buyers are +29% in the last 12 months, now the largest single portion. (2/5)

Households are unsophisticated creditors, many won& #39;t know that they& #39;re not paying for their own homes to be built - they& #39;re paying to finish years-old construction.

So when deliveries begin to lag, buyers worry. This is popping up more in media (3/5) http://www.xinhuanet.com/fortune/2021-04/13/c_1127325975.htm">https://www.xinhuanet.com/fortune/2...

So when deliveries begin to lag, buyers worry. This is popping up more in media (3/5) http://www.xinhuanet.com/fortune/2021-04/13/c_1127325975.htm">https://www.xinhuanet.com/fortune/2...

You can now see this not just in the national-level statistics, but in the financialreports of major developers. Growing gaps between properties which much eventually be completed and what& #39;s being built annually.

Vanke alone has *$100 billion* in unearned revenues! (4/5)

Vanke alone has *$100 billion* in unearned revenues! (4/5)

You can keep the show rolling longer if you really squeeze households, lengthening time between purchase and delivery. But buyers are a way bigger political sensitivity for govt than bondholders.

Worth keeping a v close eye out for construction delay protest stories (5/5)

Worth keeping a v close eye out for construction delay protest stories (5/5)

Read on Twitter

Read on Twitter