Today in DeFi Research: MakerDAO

MakerDAO is the oldest major DeFi protocol

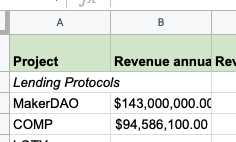

But did you know it also has the largest cash flows?

Thread:

MakerDAO is the oldest major DeFi protocol

But did you know it also has the largest cash flows?

Thread:

1/ MakerDAO is a collateralized stablecoin project

Collateralize ETH, mint DAI, a USD backed stablecoin

You can also think of it as a lending protocol.

Collateralize ETH, mint DAI, a USD backed stablecoin

You can also think of it as a lending protocol.

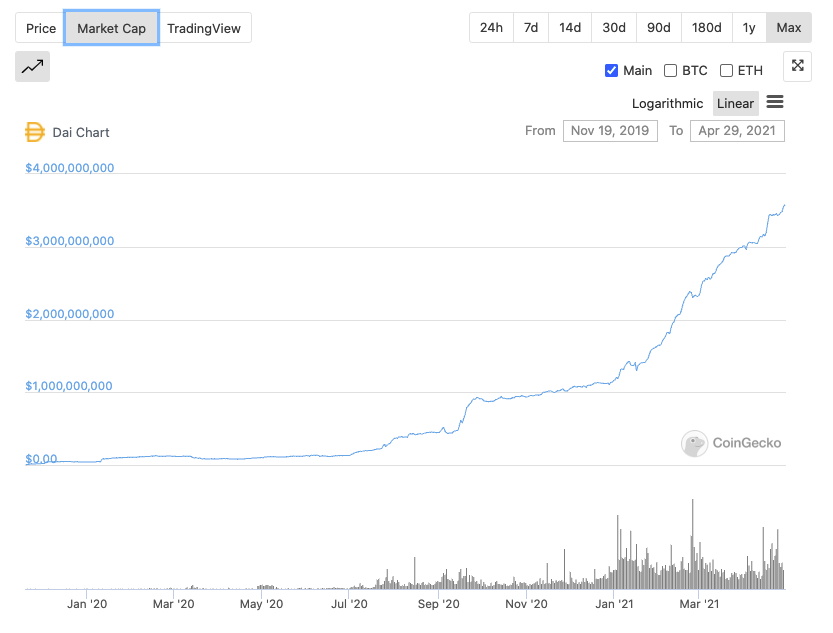

2/ DAI has been incredibly successful, with steady and fast growth which just keeps picking up pace.

But does DAI accrue value to MakerDAO?

But does DAI accrue value to MakerDAO?

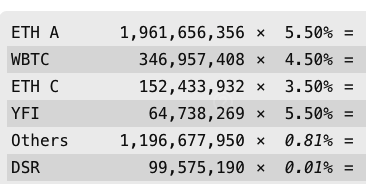

3/ The Stability Fee,

an interest rate charged on every DAI in circulation

is how MakerDAO earns cash.

an interest rate charged on every DAI in circulation

is how MakerDAO earns cash.

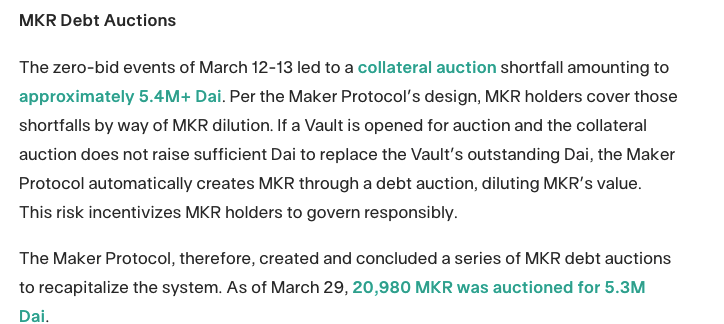

4/ Last year, due to a flash crash in March, the stability fee was set to around 0 for a while in order to restore the DAI peg. https://medium.com/coinmonks/understanding-the-impact-of-makerdaos-black-thursday-6e338e37c10c">https://medium.com/coinmonks...

6/ Worse, to make the system collateral healthy, MakerDAO minted additional MKR which it auctioned off.

This action more than eliminated all the revenue it had accrued to date.

This action more than eliminated all the revenue it had accrued to date.

6/ However, since that crash, DAI demand has grown exponentially.

This has allowed MakerDAO to increase the stability fee, and its revenues have grown with it.

This has allowed MakerDAO to increase the stability fee, and its revenues have grown with it.

7/ Stability fee revenue has now exceeded the DAI shortage.

MakerDAO is now making cash hand over fist

MakerDAO generates around $390k revenue per day from stability fees.

It has the highest earnings per token in DeFi.

And it does so without incentives/emissions.

MakerDAO is now making cash hand over fist

MakerDAO generates around $390k revenue per day from stability fees.

It has the highest earnings per token in DeFi.

And it does so without incentives/emissions.

8/ MKR holders accrue value through buy and burn.

Because MKR is bought off the market - it has a direct impact on MKR price, and this mechanism has tax advantages(no capital gains)

However there is also discussions around a possible staking mechanism. https://forum.makerdao.com/t/mip49-staking-rewards/6331/19">https://forum.makerdao.com/t/mip49-s...

Because MKR is bought off the market - it has a direct impact on MKR price, and this mechanism has tax advantages(no capital gains)

However there is also discussions around a possible staking mechanism. https://forum.makerdao.com/t/mip49-staking-rewards/6331/19">https://forum.makerdao.com/t/mip49-s...

9/ We do not have a directional view on the MKR token

We do think MakerDAO is an interesting project that many people may not be paying enough attention to.

Strong Cashflows, robust growth and smart governance make MakerDAO a core DeFi project to pay attention to.

We do think MakerDAO is an interesting project that many people may not be paying enough attention to.

Strong Cashflows, robust growth and smart governance make MakerDAO a core DeFi project to pay attention to.

Read on Twitter

Read on Twitter