1/ $FB 1Q& #39;21 Update

I have been told “nobody uses Facebook”.

Last quarter, 1.88 Bn “nobody” used Facebook daily.

Lots of interesting data points and snippets on this call. Here are my notes.

I have been told “nobody uses Facebook”.

Last quarter, 1.88 Bn “nobody” used Facebook daily.

Lots of interesting data points and snippets on this call. Here are my notes.

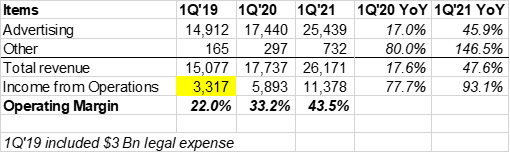

2/ Numbers in this quarter was a thing of beauty (perhaps applies to all big tech). They are making quite a mockery of “law of large numbers”.

FB’s 2016 *annual* topline was $27 Bn. Wow!

Acceleration in VR (other)+ overall revenue growth+ operating leverage make you drool.

FB’s 2016 *annual* topline was $27 Bn. Wow!

Acceleration in VR (other)+ overall revenue growth+ operating leverage make you drool.

3/ DAU +8% YoY; MAU +10%; Family DAP +15%

# of impressions +12%, avg price/ad +30%

Zuck highlighted three topics on the call:

I. AR/VR

II. Social Commerce

III. Creator Economy

# of impressions +12%, avg price/ad +30%

Zuck highlighted three topics on the call:

I. AR/VR

II. Social Commerce

III. Creator Economy

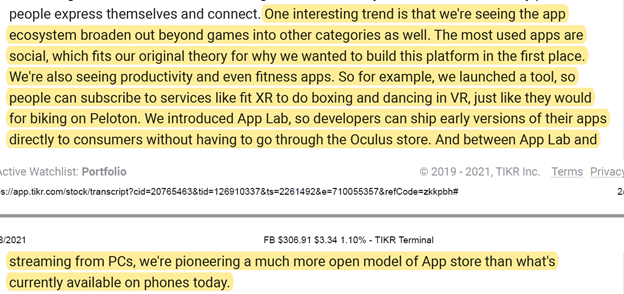

4/ AR/VR:

“AR/VR are going to enable a deeper sense of presence in social connection than any existing platform.”

“The most used apps are social, which fits our original theory for why we wanted to build this platform in the first place”

Still early days

“AR/VR are going to enable a deeper sense of presence in social connection than any existing platform.”

“The most used apps are social, which fits our original theory for why we wanted to build this platform in the first place”

Still early days

5/ “in virtual reality, I think you need to get to a high-quality wireless experience. In augmented reality, you& #39;re going to really need a pair of glasses that look like normal looking glasses”

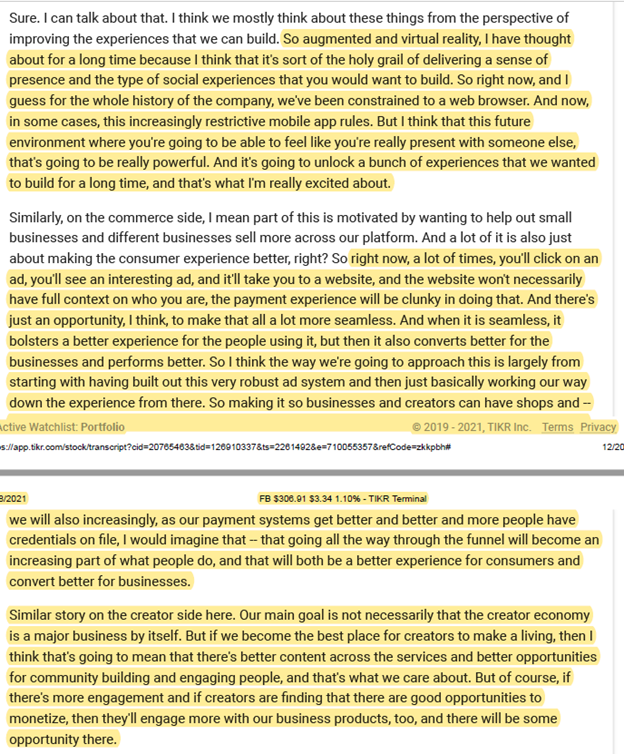

6/ Social Commerce:

“more than 1 billion people visit Marketplace each month.”

250 mn MAU Shops visitors.

Business messaging grew by 40% over the last year.

“more than 1 billion people visit Marketplace each month.”

250 mn MAU Shops visitors.

Business messaging grew by 40% over the last year.

7/ Creator economy:

Zuck seems to be all-in on creator economy.

I prefer the all-in approach. Make everything available. See which one works better and then double down on it. Harder to predict which one is the best approach without iteration.

Zuck seems to be all-in on creator economy.

I prefer the all-in approach. Make everything available. See which one works better and then double down on it. Harder to predict which one is the best approach without iteration.

8/ On personalized ads: “We& #39;re doing a huge amount of work to prepare”

Sheryl is making a case for personalized ads here. I find it ironic how much misinformation other people propagate on Facebook and then blame Facebook for misinformation.

Sheryl is making a case for personalized ads here. I find it ironic how much misinformation other people propagate on Facebook and then blame Facebook for misinformation.

9/ Advertising 101: it’s all relative game.

If post-IDFA, FB’s data points yield better result vs other platforms, that would be a gift FB didn’t ask for but will gleefully accept nonetheless.

If post-IDFA, FB’s data points yield better result vs other platforms, that would be a gift FB didn’t ask for but will gleefully accept nonetheless.

10/ “We& #39;ve also seen strong growth across ads in Facebook Watch, which now has more than 1.25 billion people visiting every month”.

People watch “Facebook Watch”? Huh, that’s news to me as well.

People watch “Facebook Watch”? Huh, that’s news to me as well.

11/ Outlook: expect Q2 to post similar growth as Q1, but expect material deceleration in 2H. Ad revenue will be primarily driven by price, not # of ad impressions.

12/ 2021 opex outlook increased from $68-73 Bn to $70-73 Bn. Capex outlook declined from $21-23 Bn to $19-21 Bn

I’m going to leave this hall of fame chart here. https://twitter.com/JerryCap/status/1118133251237924871">https://twitter.com/JerryCap/...

I’m going to leave this hall of fame chart here. https://twitter.com/JerryCap/status/1118133251237924871">https://twitter.com/JerryCap/...

13/ Highlights from Q&A

Is engagement going to be problem post-pandemic? It’s a headwind, but nothing dramatic expected in 2021.

On IDFA: “the impact on our own business, we think, will be manageable” (this is Wehner,so when he says “manageable”, it probably means much better)

Is engagement going to be problem post-pandemic? It’s a headwind, but nothing dramatic expected in 2021.

On IDFA: “the impact on our own business, we think, will be manageable” (this is Wehner,so when he says “manageable”, it probably means much better)

15/ Zuck is a 36-year old centi-billionaire who was deeply reminded recently that the future of his empire is still somewhat beholden to the whims of Apple. I expect Zuck to go really deep into AR/VR. If this stuff had even 10% prob. of outsized success, it& #39;s now 40-60%.

End/ Thanks to @theTIKR for the quick upload of transcripts (no affiliation)

I& #39;ll cover $AMZN tomorrow. You can access all my twitter threads here: https://mbi-deepdives.com/twitter-threads/">https://mbi-deepdives.com/twitter-t...

I& #39;ll cover $AMZN tomorrow. You can access all my twitter threads here: https://mbi-deepdives.com/twitter-threads/">https://mbi-deepdives.com/twitter-t...

Read on Twitter

Read on Twitter