George Soros Investment Strategies Explained

So many ppl talk about Soros ("he broke the Bank of England!", "Reflexivity FTW!") but it& #39;s so hard to find clear, easy-to-follow explanations of:

- i.) what reflexivity actually means

- ii.) the significance in 2021

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

So many ppl talk about Soros ("he broke the Bank of England!", "Reflexivity FTW!") but it& #39;s so hard to find clear, easy-to-follow explanations of:

- i.) what reflexivity actually means

- ii.) the significance in 2021

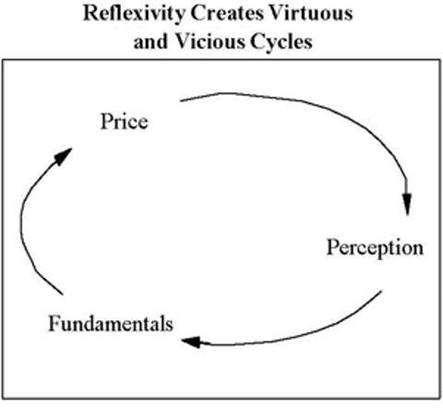

1) What is reflexivity?

- Reflexivity is the mutually reinforcing relationship btw expectation & reality. Ex: COVID hits and suddenly ppl think "not enough TP to wipe my butt tm!"; they hoard like bloody magpies; TP supply falls off a cliff

- Reflexivity is the mutually reinforcing relationship btw expectation & reality. Ex: COVID hits and suddenly ppl think "not enough TP to wipe my butt tm!"; they hoard like bloody magpies; TP supply falls off a cliff

2nd example: ppl think SNOW& #39;s the hottest data chick in town; stonk accelerates faster than its peers; inflated multiples inject SNOW with more capital for S&M; would-be clients start banging on sales reps& #39; doors; revenue goes up; positive earnings surprise; stonk goes up; repeat

3rd example: Asimovians dream of electric sheep--er, cars-- TSLA goes up; enters S&P 500, gets added into index funds and robo advisors; robot buyers hike the stonk; millions of US-fawning Chinese parvenus adopt it as their new status symbol; stonk go up

2) Corporeal knowledge aka “Listen to your gut”

When so-called "rationalists" shirk their emotions as silly, they& #39;re usually being... silly. Emotions are not data-free. In fact they contain A TON of data. Ppl need to understand the diff btw endogenous & exogenous variables.

When so-called "rationalists" shirk their emotions as silly, they& #39;re usually being... silly. Emotions are not data-free. In fact they contain A TON of data. Ppl need to understand the diff btw endogenous & exogenous variables.

Read on Twitter

Read on Twitter