. @Nexon_America is a Japanese gaming co that disclosed today they purchased $100 million in bitcoin.

Journos failed to articulate the magnitude of this news similar to when Norwegian billionaire Kjell Rokke purchased bitcoin for his company, @Seetee_io

A thread...

Journos failed to articulate the magnitude of this news similar to when Norwegian billionaire Kjell Rokke purchased bitcoin for his company, @Seetee_io

A thread...

Nexon has a $30 billion market cap and is a top 30 holding in the Nikkei 225 Index.

To compare, @MicroStrategy is only a $6 billion market cap and look at the impact @michael_saylor has had on the digital asset space.

To compare, @MicroStrategy is only a $6 billion market cap and look at the impact @michael_saylor has had on the digital asset space.

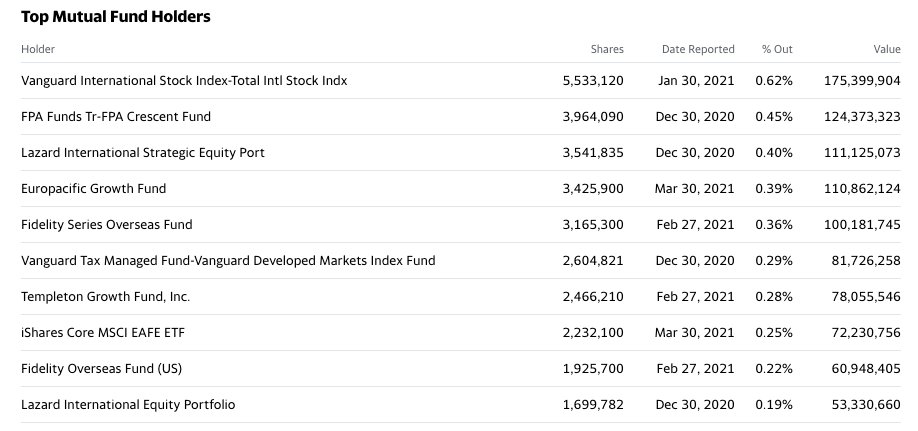

Nexon is a huge global corporation owned by other mega corporations like @Vanguard_Group and @Fidelity

Those mega asset managers now indirectly own bitcoin through Nexon.

Transactions like these will keep happening as global growth slows with demographics.

Those mega asset managers now indirectly own bitcoin through Nexon.

Transactions like these will keep happening as global growth slows with demographics.

Capital and corporate balance sheets will continue to seek stores of value.

The worlds of legacy finance and digital assets are inexorably merging.

Mega asset managers should front-run this phenomenon if they are going to own it indirectly through their corporations anyways.

The worlds of legacy finance and digital assets are inexorably merging.

Mega asset managers should front-run this phenomenon if they are going to own it indirectly through their corporations anyways.

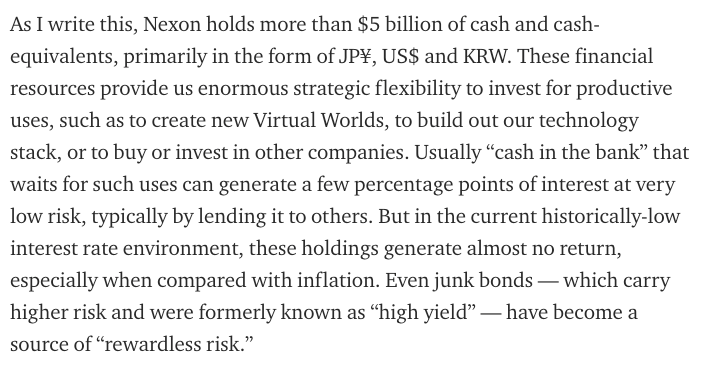

This $100 million purchase was only 2% of Nexon’s cash reserves but symbolizes a bigger conundrum.

Global corps are realizing their purchasing power is being eroded by governments and are being forced to protect themselves.

Isn’t this how you would picture it unraveling?

Global corps are realizing their purchasing power is being eroded by governments and are being forced to protect themselves.

Isn’t this how you would picture it unraveling?

What makes things so healthy for the bitcoin ecosystem is a geographically and geopolitically diverse holder base.

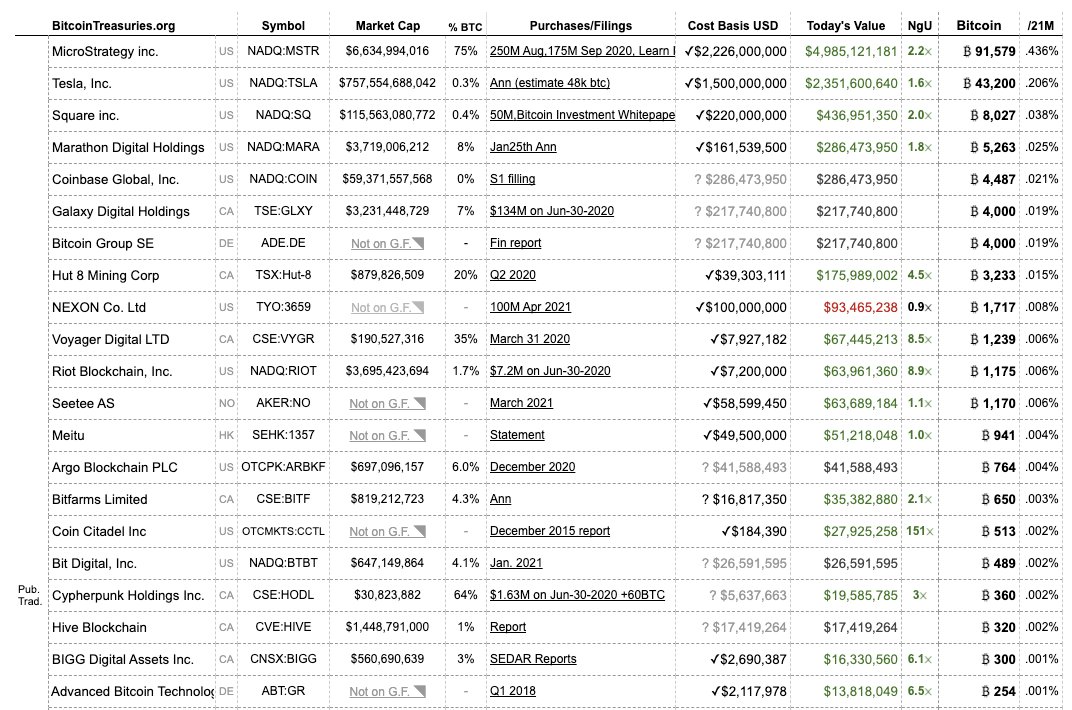

Take a look at http://bitcointreasuries.org"> http://bitcointreasuries.org

Take a look at http://bitcointreasuries.org"> http://bitcointreasuries.org

These are corporations from Japan, the US, China, the UK, Canada, Germany, Norway, Hong Kong, Australia, Ukraine gov and probably more private companies that haven’t disclosed their holdings.

It may be the most geographically diverse holder base next to the FANGMAN stocks.

It may be the most geographically diverse holder base next to the FANGMAN stocks.

In a globalized world of secular stagnation and fiat currency wars, is it really surprising we are seeing this happen?

Money printing and fiat devaluation allows countries to adjust their trade balances, and corporations are finally buying insurance on these monetary policies.

Money printing and fiat devaluation allows countries to adjust their trade balances, and corporations are finally buying insurance on these monetary policies.

Yes! Mahoney just said it!

Bonds are REWARDLESS RISK and he is betting on the convexity of bitcoin to be a safe haven.

Bonds are REWARDLESS RISK and he is betting on the convexity of bitcoin to be a safe haven.

Canadian high-yield trader, @FossGregfoss , was correct when he posited, “Bitcoin is equivalent to a default insurance on a basket of fiat credit.”

I can’t overstate the ramifications of this.

If corporations see inflation on the horizon and refuse to hold bonds with their excess cash, then we could be at a global turning point in understanding what value really is.

If corporations see inflation on the horizon and refuse to hold bonds with their excess cash, then we could be at a global turning point in understanding what value really is.

Let’s watch bond yields closely and see how bitcoin reacts if we see the beginnings of a credit crisis.

The US dollar and treasury yields will tell us if this will end with hyperinflation or deflation.

The US dollar and treasury yields will tell us if this will end with hyperinflation or deflation.

It appears Jay Powell is out to lunch after today’s FOMC release, so I’m leaning towards hyperinflation for now.

One thing is for sure…

We are at a seminal turning point in history.

One thing is for sure…

We are at a seminal turning point in history.

If you liked this thread, please check out my daily newsletter here https://blockworks.co/newsletter/ ">https://blockworks.co/newslette...

. @owenmahoney Love the move!

Read on Twitter

Read on Twitter