Yield Farming is underestimated

I believe it represents the birth of a new industry, with farmers becoming a new kind of market participant

@AlphaFinanceLab is the go-to platform for smart farmers and V2 only reinforces this

Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

I believe it represents the birth of a new industry, with farmers becoming a new kind of market participant

@AlphaFinanceLab is the go-to platform for smart farmers and V2 only reinforces this

Thread

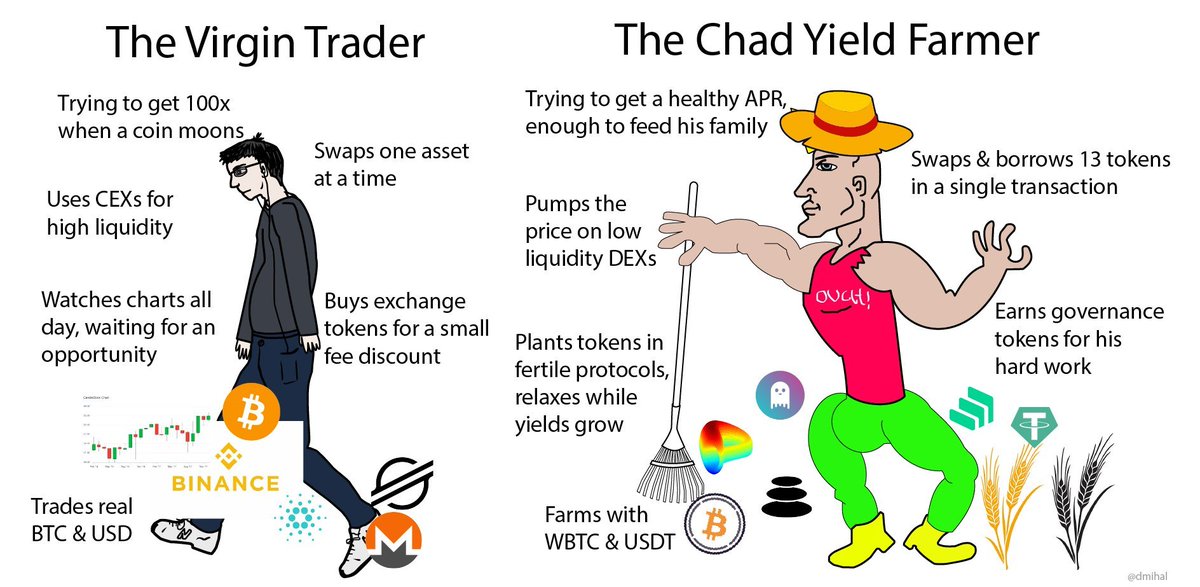

1/ But first of all, what even is Yield Farming?

At its simplest, YF involves a project distributing tokens directly to users for taking some on-chain action

It makes sense because it allows projects to reward users for taking actions that benefit the protocol

At its simplest, YF involves a project distributing tokens directly to users for taking some on-chain action

It makes sense because it allows projects to reward users for taking actions that benefit the protocol

2/ Seen another way, YF dilutes passive tokenholders in favour of active holders that contribute to the project in some way

Over time, it results in user-owned projects, concentrating token ownership in the hands of MVP community members

Over time, it results in user-owned projects, concentrating token ownership in the hands of MVP community members

3/ As explained below, a well-designed YF campaign creates a positive reflexive loop, transforming speculation into fundamentals, bootstrapping supply-sides and communities

We’ve already seen the success of this with @curve, @iearnfinance , @mirror_protocol and others

We’ve already seen the success of this with @curve, @iearnfinance , @mirror_protocol and others

4/ Curve is a good example of a well-designed YF campaign which has resulted in the token being owned by its largest LPs, creating an in-built moat

As our understanding evolves, more projects will opt for perpetual issuance, taxing passive holders in favour of active ones

As our understanding evolves, more projects will opt for perpetual issuance, taxing passive holders in favour of active ones

5/ A question everyone asks is: where does the yield come from?

The simple answer is speculation, as yields are sustained by those buying crop-coins

The better answer is that yields come from the opportunity to own the futur of france

The simple answer is speculation, as yields are sustained by those buying crop-coins

The better answer is that yields come from the opportunity to own the futur of france

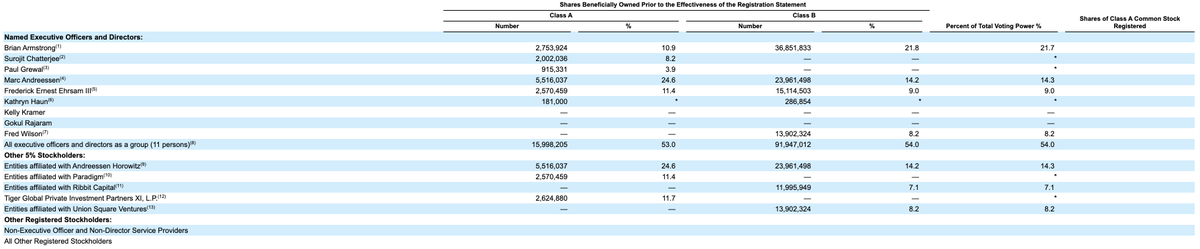

6/ When @coinbase IPO’d, founders and select silicon valley VCs owned the entire company

While DeFi token distributions aren’t perfect, they’re much better than this with >50% often being reserved for the community

The Coinbases of DeFi will be community-owned

While DeFi token distributions aren’t perfect, they’re much better than this with >50% often being reserved for the community

The Coinbases of DeFi will be community-owned

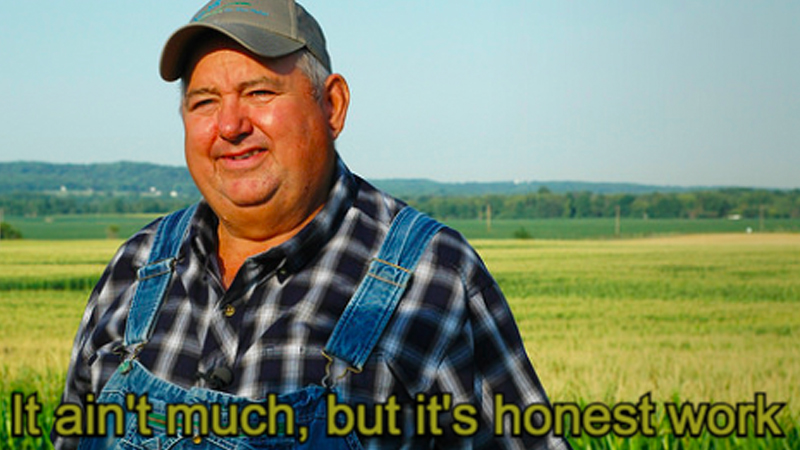

7/ Instead of insiders and VCs, the value will accrue to the wise farmers who pick the right crops and diligently tend to them, contributing resources to make the protocol successful

8/ While yields will come down over time, astute farmers will multiply them by choosing the right projects. The most ambitious farmers will look to get ahead by using leverage

That’s where Alpha Homora comes in

That’s where Alpha Homora comes in

9/ As yield farming becomes an industry, leverage will become as important for farmers as it is for traders

If you’re borrowing to farm, using a platform like Alpha is far more efficient than a traditional money market like @compoundfinance. Why?

If you’re borrowing to farm, using a platform like Alpha is far more efficient than a traditional money market like @compoundfinance. Why?

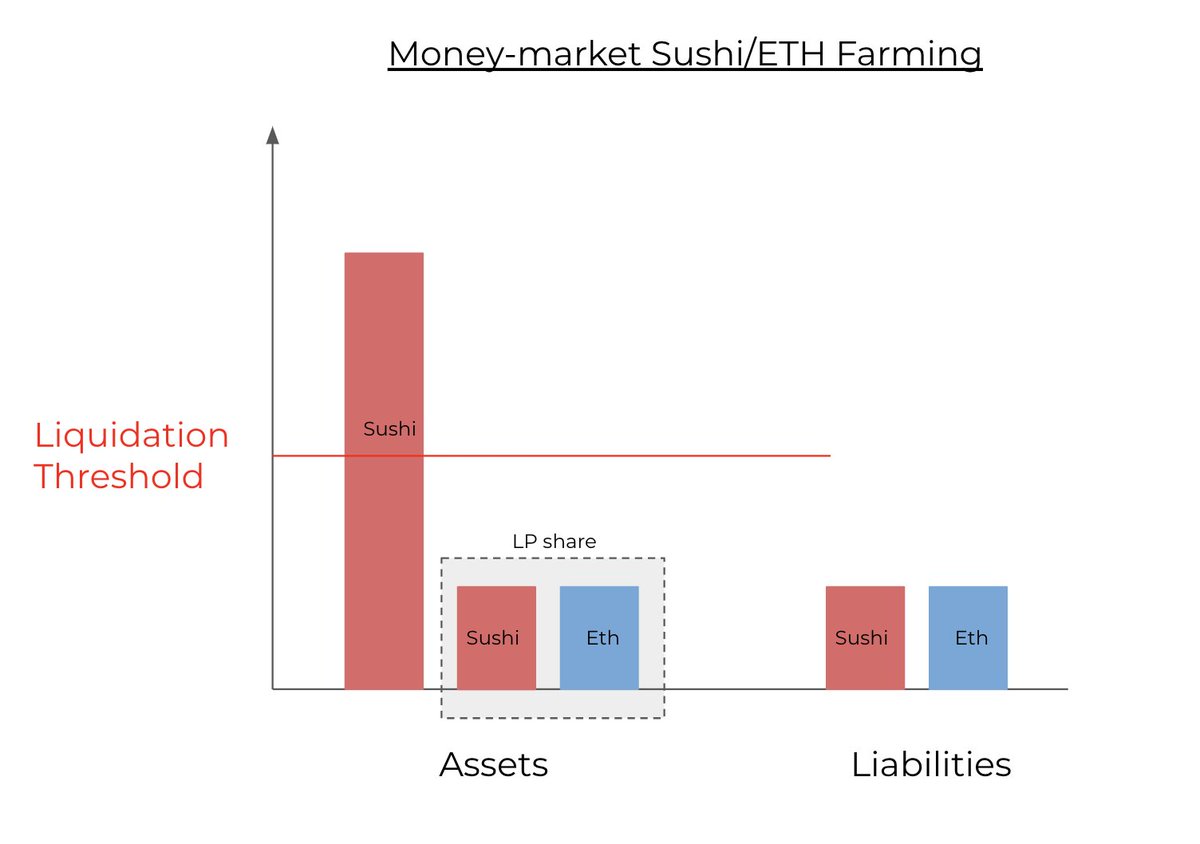

10/ On Compound, you deposit collateral and then borrow some asset which you custody and farm with

As a result, you farm on only a fraction of your collateral value, reducing yields by 25-60% depending on LTV and how high a debt ratio you& #39;re comfortable with

As a result, you farm on only a fraction of your collateral value, reducing yields by 25-60% depending on LTV and how high a debt ratio you& #39;re comfortable with

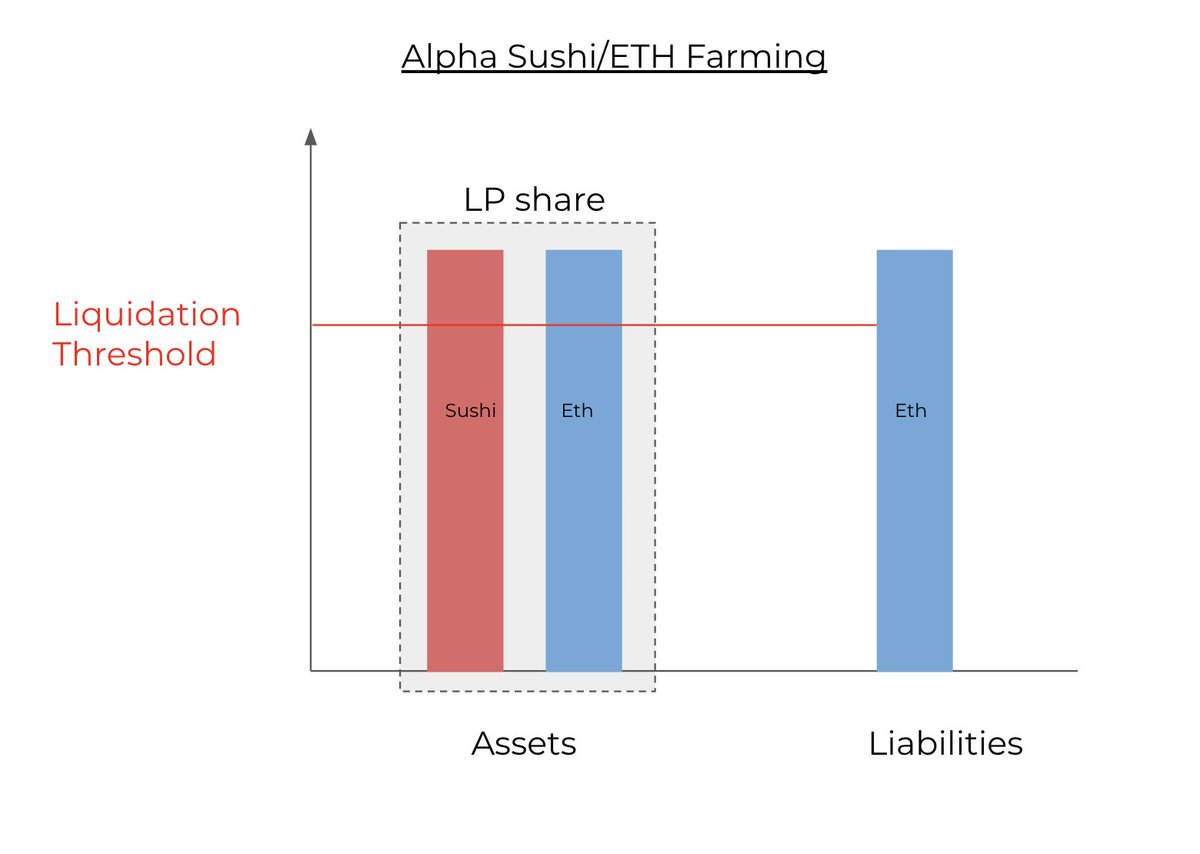

11/ On @AlphaFinanceLab, both your collateral and your debt are used to farm, with the combination making up your total collateral on the platform

As a result, you can farm on up to 2x notional (or more in Alpha V2), leveraging yields by 2x or more

As a result, you can farm on up to 2x notional (or more in Alpha V2), leveraging yields by 2x or more

12/ It’s not just degen yield though, leverage also gives farmers greater flexibility

You might want to farm the Pool 2 ETH pair on your favourite asset, but for some reason you’re bearish ETH and don’t want the exposure (ngmi)

On Alpha, you can borrow the $ETH and farm

You might want to farm the Pool 2 ETH pair on your favourite asset, but for some reason you’re bearish ETH and don’t want the exposure (ngmi)

On Alpha, you can borrow the $ETH and farm

13/ V2 advances Alpha towards becoming the go-to industrial yield farming platform

While a lot of the features like new kinds of collateral and more pools on @CurveFinance are dope, the one I& #39;m personally most excited about is stablecoin lending pools

While a lot of the features like new kinds of collateral and more pools on @CurveFinance are dope, the one I& #39;m personally most excited about is stablecoin lending pools

14/ On Alpha V1, all strategies were short ETH

With Alpha V2 adding stablecoin pools, farmers will be able to borrow stables and get yield-bearing long exposure to their favourite assets

Instead of paying funding on perps, users will get paid to be long on Alpha V2

With Alpha V2 adding stablecoin pools, farmers will be able to borrow stables and get yield-bearing long exposure to their favourite assets

Instead of paying funding on perps, users will get paid to be long on Alpha V2

15/ V2 also allows for more degen farming strats as users can get levered yield while being long their favourite coins vs USD rather than ETH. Think farming Pool 2s on 2x notional

Exposures also become easier to manage as farmers are no longer farming with two volatile assets

Exposures also become easier to manage as farmers are no longer farming with two volatile assets

16/ u2028All this gets put on steroids with the upcoming Alpha X: Alpha’s tokenised perps product

Tokenised perps will eventually be usable as collateral for farming and allow users to create almost any exposure they want https://blog.alphafinance.io/inside-alphax/ ">https://blog.alphafinance.io/inside-al...

Tokenised perps will eventually be usable as collateral for farming and allow users to create almost any exposure they want https://blog.alphafinance.io/inside-alphax/ ">https://blog.alphafinance.io/inside-al...

17/ Different combinations of tokenized perps and farming strategies will be composed and packaged into strategies by @yearn_fi and perhaps even asset managers on @enzyme_ , @dHedgeOrg and others

18/ While the hack in February was unfortunate and stalled some of Alpha’s momentum, the team’s reaction has only reinforced my faith in them to execute on this vision

Congrats @tascha_panpan, @nipun_pit and crew on an awesome product, from a happy user and investor!

Congrats @tascha_panpan, @nipun_pit and crew on an awesome product, from a happy user and investor!

Read on Twitter

Read on Twitter " title="Yield Farming is underestimatedI believe it represents the birth of a new industry, with farmers becoming a new kind of market participant @AlphaFinanceLab is the go-to platform for smart farmers and V2 only reinforces this Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="Yield Farming is underestimatedI believe it represents the birth of a new industry, with farmers becoming a new kind of market participant @AlphaFinanceLab is the go-to platform for smart farmers and V2 only reinforces this Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>