1/17

The first small cap research project of the week is Pandaswap ($PNDA) by $Bao which is creating a new concept of & #39;franchises& #39; by bringing related products to other chains, in this case the BSC.

It passed $70M TLV in 24 hours, despite an mcap of $20M circulating.

The first small cap research project of the week is Pandaswap ($PNDA) by $Bao which is creating a new concept of & #39;franchises& #39; by bringing related products to other chains, in this case the BSC.

It passed $70M TLV in 24 hours, despite an mcap of $20M circulating.

2/17

While I might have been one of the first people to tweet about bao, I dropped the ball on Panda at first, not really realizing the approach.

https://farms.pandaswap.xyz"> https://farms.pandaswap.xyz brings the classic Bao Finance model to BSC, but not just as another meme farm.

While I might have been one of the first people to tweet about bao, I dropped the ball on Panda at first, not really realizing the approach.

https://farms.pandaswap.xyz"> https://farms.pandaswap.xyz brings the classic Bao Finance model to BSC, but not just as another meme farm.

3/17

According to their dev teams posts ( https://thebaoman.medium.com/panda-and-other-surprises-9c990bc54288)">https://thebaoman.medium.com/panda-and... the goal with Panda is to leverage the BSC ecosystem as a testing ground for their new product features without a negative impact for Bao.

You can think of it as the same relationship between $DOT and $KSM

According to their dev teams posts ( https://thebaoman.medium.com/panda-and-other-surprises-9c990bc54288)">https://thebaoman.medium.com/panda-and... the goal with Panda is to leverage the BSC ecosystem as a testing ground for their new product features without a negative impact for Bao.

You can think of it as the same relationship between $DOT and $KSM

4/17

Their $PNDA token (which isn& #39;t even on CoinGecko yet) introduces new test products like their "Bamboo staking" rewards and "Rhino staking" rewards which test out two different liquidity staking models designed to lock in long term incentives.

Their $PNDA token (which isn& #39;t even on CoinGecko yet) introduces new test products like their "Bamboo staking" rewards and "Rhino staking" rewards which test out two different liquidity staking models designed to lock in long term incentives.

5/17

You& #39;ll remember that Bao has designed a lock mechanism which has 95% of farming rewards locked long term, and penalties for short-term farming. Something that seems to have worked out well for them so far.

These staking models are designed with the same long term view.

You& #39;ll remember that Bao has designed a lock mechanism which has 95% of farming rewards locked long term, and penalties for short-term farming. Something that seems to have worked out well for them so far.

These staking models are designed with the same long term view.

6/17

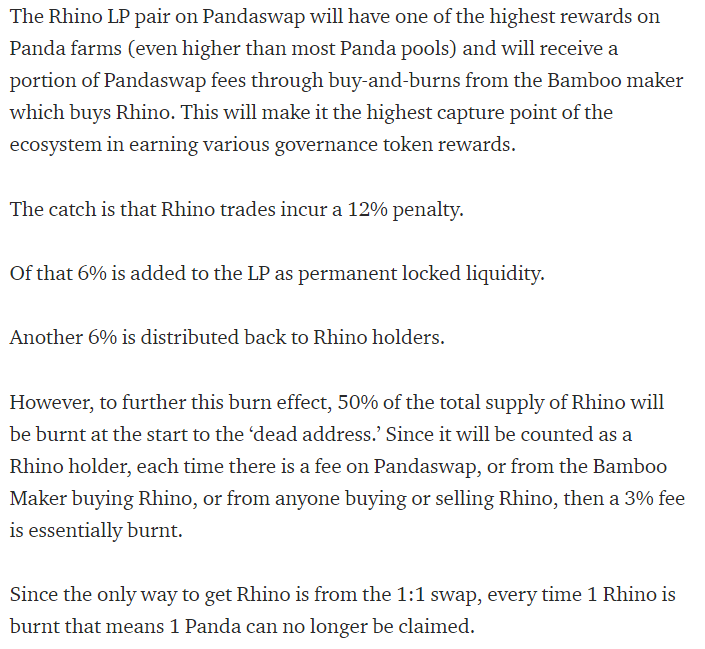

While their Bamboo staking is similar to xSushi and distributes straight rewards. Their Rhino staking actually took the liquidity locking fee penalty from schemes like SafeMoon and gave it a real purpose.

While their Bamboo staking is similar to xSushi and distributes straight rewards. Their Rhino staking actually took the liquidity locking fee penalty from schemes like SafeMoon and gave it a real purpose.

7/17

They are also getting ready to roll out tests of their synthetic assets (similar to SNX) and an auto-farming tool called Robo.

They are also getting ready to roll out tests of their synthetic assets (similar to SNX) and an auto-farming tool called Robo.

8/17

So while I& #39;m not a huge advocate for the BSC system, I think the product likely has its own standalone value in the ecosystem and seems like it will continue to soak up massive volume given the large yields it sees in that ecosystem.

So while I& #39;m not a huge advocate for the BSC system, I think the product likely has its own standalone value in the ecosystem and seems like it will continue to soak up massive volume given the large yields it sees in that ecosystem.

9/17

What I find more interesting is the franchise model, in which $BAO token holders own 15% of the new governance tokens locked in a community vault, allowing them to vote on issues on the new chain.

What I find more interesting is the franchise model, in which $BAO token holders own 15% of the new governance tokens locked in a community vault, allowing them to vote on issues on the new chain.

10/17

It also allows them the ability to vote to sell those resources back to $BAO when the holdings are >15% and that vault is growing fast, inclusive of the launch tokens it earned 20% per $BAO yesterday: https://twitter.com/thebaoman/status/1387102494443065344">https://twitter.com/thebaoman...

It also allows them the ability to vote to sell those resources back to $BAO when the holdings are >15% and that vault is growing fast, inclusive of the launch tokens it earned 20% per $BAO yesterday: https://twitter.com/thebaoman/status/1387102494443065344">https://twitter.com/thebaoman...

11/17

I think that& #39;s something a lot of their users overlooked as we saw a lot of $BAO users sell their holdings to chase after the new shiny farms, meanwhile the underlying asset was actually seeing an increase in its value and governance holdings.

I think that& #39;s something a lot of their users overlooked as we saw a lot of $BAO users sell their holdings to chase after the new shiny farms, meanwhile the underlying asset was actually seeing an increase in its value and governance holdings.

12/17

Not to mention, that the products that the team is experimenting with on their Pandaswap infrastructure can quickly be rolled out to mainnet/xDAI

Not to mention, that the products that the team is experimenting with on their Pandaswap infrastructure can quickly be rolled out to mainnet/xDAI

13/17

The franchise model is interesting as it allows this team to quickly grab liquidity opportunities on new chains and capture the value back to bao.

It also means launching in a way that minimizes risk for the main product.

The franchise model is interesting as it allows this team to quickly grab liquidity opportunities on new chains and capture the value back to bao.

It also means launching in a way that minimizes risk for the main product.

14/17

It also means one of the first times we can see new farms launch with a higher confidence because the team has already developed and maintained launches before without a rug pull, and while investing heavily in grants and bounties (something scams tend not to do!)

It also means one of the first times we can see new farms launch with a higher confidence because the team has already developed and maintained launches before without a rug pull, and while investing heavily in grants and bounties (something scams tend not to do!)

15/17

Now the core goals and value prop of Bao (and in turn Panda) are still lofty, and its yet to be seen if the small team can pull it off.

But, they& #39;ve certainly made some great progress at a pace that is faster than many large well funded teams.

Now the core goals and value prop of Bao (and in turn Panda) are still lofty, and its yet to be seen if the small team can pull it off.

But, they& #39;ve certainly made some great progress at a pace that is faster than many large well funded teams.

16/17

So while we can& #39;t know how it will play out, the risk to opportunity ratio seems strong. The farms give a potential to earn at high rates even if the governance tokens depreciate making it a pretty strong hedge.

So while we can& #39;t know how it will play out, the risk to opportunity ratio seems strong. The farms give a potential to earn at high rates even if the governance tokens depreciate making it a pretty strong hedge.

17/17

If bao can capture a fraction of that lucrative market on BSC it can mean some pretty promising growth for their primary ecosystem as well to continue pursuing their lofty vision.

That said either could 10x in marketcap from here even with small wins in this market.

If bao can capture a fraction of that lucrative market on BSC it can mean some pretty promising growth for their primary ecosystem as well to continue pursuing their lofty vision.

That said either could 10x in marketcap from here even with small wins in this market.

Standard disclaimer: This is not investment advice, these threads are product and ecosystem research. I am also bias, as I only spend time researching and writing about things where I actively own some.

Read on Twitter

Read on Twitter