This is a running documentation of me figuring out how to bill, collect, remit tax as an online course creator

#ODCC1

In EU  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇪🇺" title="Flagge der Europäischen Union" aria-label="Emoji: Flagge der Europäischen Union"> tax there& #39;s a concept called & #39;Place of Supply& #39;

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇪🇺" title="Flagge der Europäischen Union" aria-label="Emoji: Flagge der Europäischen Union"> tax there& #39;s a concept called & #39;Place of Supply& #39;

You pay tax in the country where your business is based == where sell the product

This does not apply for digital products

In that case you have to pay tax where the customer is based

You pay tax in the country where your business is based == where sell the product

This does not apply for digital products

In that case you have to pay tax where the customer is based

Example:

* I sell online courses

* I have customers in Germany and Ireland

This means:

Add 19% VAT rate to the invoice for German customer

Add 23% VAT rate to the invoice for Irish customer

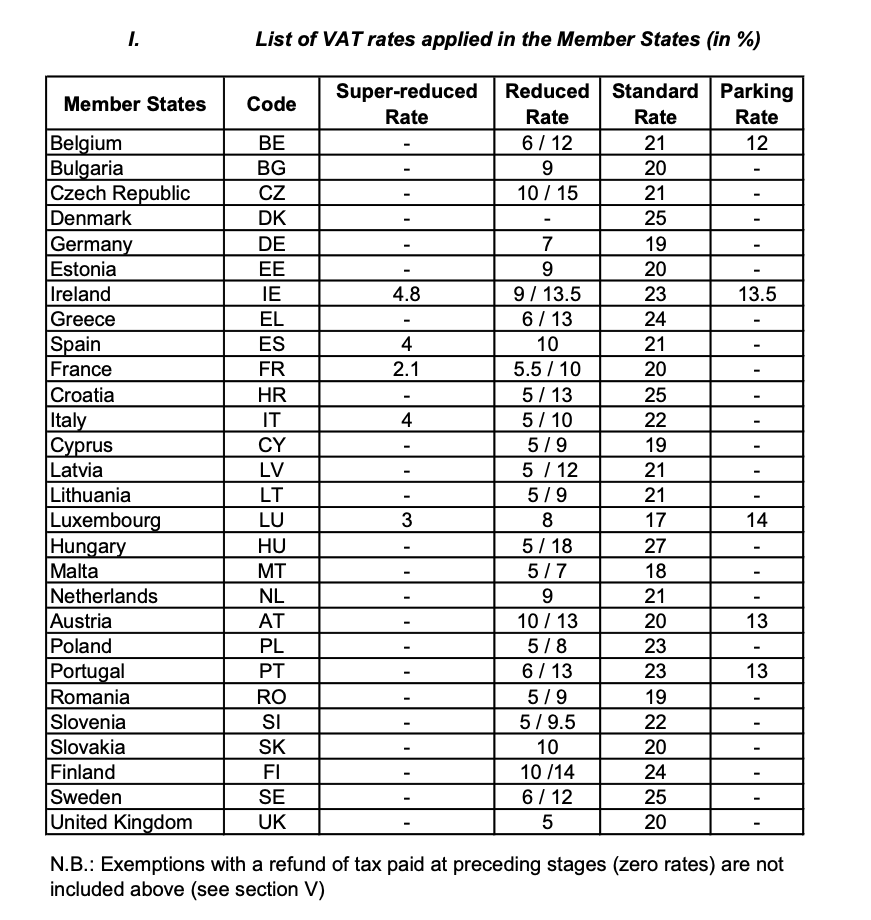

The VAT table looks as follows https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

* I sell online courses

* I have customers in Germany and Ireland

This means:

Add 19% VAT rate to the invoice for German customer

Add 23% VAT rate to the invoice for Irish customer

The VAT table looks as follows

I can solve it as follows:

A) Manually: Create each invoice by hand and have my accountant calculate + remit the tax obligation for each country separately

B) Automatically: Implement a tech solution to take care of it

Wouldn& #39;t it be nice if Option B were easy?

A) Manually: Create each invoice by hand and have my accountant calculate + remit the tax obligation for each country separately

B) Automatically: Implement a tech solution to take care of it

Wouldn& #39;t it be nice if Option B were easy?

Gumroad + Paypal: Does the trick

Pro: Easy to spin up

Con: Paypal& #39;s fees are intransparent and way too high https://twitter.com/artlapinsch/status/1377627087708753921?s=20">https://twitter.com/artlapins...

Pro: Easy to spin up

Con: Paypal& #39;s fees are intransparent and way too high https://twitter.com/artlapinsch/status/1377627087708753921?s=20">https://twitter.com/artlapins...

Paddle: The solution w/ a caveat

Pro: Start-to-finish revenue delivery platform + takes care of tax calc + remittance

Con: Doesn& #39;t seem to integrate with all online course platforms (i.e. Podia++)

Pro: Start-to-finish revenue delivery platform + takes care of tax calc + remittance

Con: Doesn& #39;t seem to integrate with all online course platforms (i.e. Podia++)

Stripe: The big fish but with a recent acquisition

Pro: Integrates with all platforms

Con: Doesn& #39;t support EU VAT calc/remittance yet

My buddy @ChrisSamiullah shared that Stripe acquired TaxJar - Definitely a move in the right direction https://www.indiehackers.com/post/yes-stripe-acquires-taxjar-53db5c21d1">https://www.indiehackers.com/post/yes-...

Pro: Integrates with all platforms

Con: Doesn& #39;t support EU VAT calc/remittance yet

My buddy @ChrisSamiullah shared that Stripe acquired TaxJar - Definitely a move in the right direction https://www.indiehackers.com/post/yes-stripe-acquires-taxjar-53db5c21d1">https://www.indiehackers.com/post/yes-...

My friend @nikwen_de shared this interesting discussion on IndieHackers

It is a comparison between Strip & Paddle https://www.indiehackers.com/post/stripe-vs-paddle-89161b0d5c">https://www.indiehackers.com/post/stri...

It is a comparison between Strip & Paddle https://www.indiehackers.com/post/stripe-vs-paddle-89161b0d5c">https://www.indiehackers.com/post/stri...

Fantastic writeup by @iwootten - he compares

@Stripe

@PaddleHQ

@quaderno

@gumroad https://www.ianwootten.co.uk/2021/02/23/comparing-vat-solutions-for-bootstrapped-uk-businesses/">https://www.ianwootten.co.uk/2021/02/2...

@Stripe

@PaddleHQ

@quaderno

@gumroad https://www.ianwootten.co.uk/2021/02/23/comparing-vat-solutions-for-bootstrapped-uk-businesses/">https://www.ianwootten.co.uk/2021/02/2...

Steven from @goodandprosper as well as @DominicZijlstra pointed me to VAT tax exemption schemes IF sales are below a certain threshold

As a DE sole proprietor it seems that educational product sales below <17.5k are exempt from VAT. https://europa.eu/youreurope/business/taxation/vat/vat-exemptions/index_en.htm">https://europa.eu/youreurop...

As a DE sole proprietor it seems that educational product sales below <17.5k are exempt from VAT. https://europa.eu/youreurope/business/taxation/vat/vat-exemptions/index_en.htm">https://europa.eu/youreurop...

@_karimelk would love to hear from you if you came across this problem + how you/your clients are usually going about it.

Read on Twitter

Read on Twitter " title="Example:* I sell online courses* I have customers in Germany and IrelandThis means:Add 19% VAT rate to the invoice for German customer Add 23% VAT rate to the invoice for Irish customerThe VAT table looks as follows https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="Example:* I sell online courses* I have customers in Germany and IrelandThis means:Add 19% VAT rate to the invoice for German customer Add 23% VAT rate to the invoice for Irish customerThe VAT table looks as follows https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>