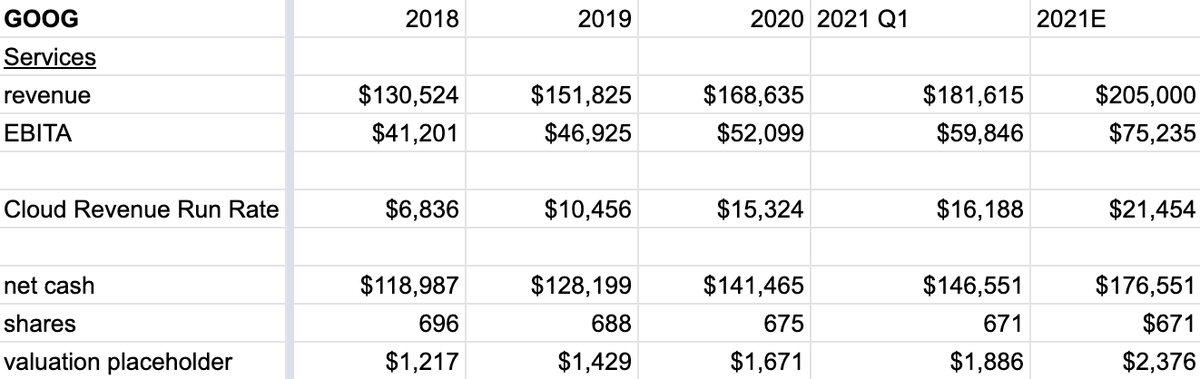

(1/n) Here& #39;s my rough outline of $GOOG& #39;s intrinsic value over the past few years. Based on these numbers, intrinsic value is likely to roughly double from EOY 2018-2021.

Caveats and methodology in the tweets to follow. Please do your own work, not advice, etc.

Caveats and methodology in the tweets to follow. Please do your own work, not advice, etc.

Methodology:

Services - uses reported numbers, deducts corporate level costs and adds back amortization expense

Cloud - annualizes current quarter& #39;s revenue (4x)

Net Cash - cash + marketable securities + non-marketable investments - debt

Shares - outstanding at end of quarter

Services - uses reported numbers, deducts corporate level costs and adds back amortization expense

Cloud - annualizes current quarter& #39;s revenue (4x)

Net Cash - cash + marketable securities + non-marketable investments - debt

Shares - outstanding at end of quarter

2021 Revenue Numbers:

I tried to use some relatively conservative numbers. Services +21% revenue growth YoY, cloud +40% revenue growth, $30bb of FCF generation.

Also note that I haven& #39;t included "Other Bets" losses. That makes sense if you think NPV > 0 but they& #39;re real losses.

I tried to use some relatively conservative numbers. Services +21% revenue growth YoY, cloud +40% revenue growth, $30bb of FCF generation.

Also note that I haven& #39;t included "Other Bets" losses. That makes sense if you think NPV > 0 but they& #39;re real losses.

Valuation Placeholder:

IMPORTANT - this is not what I think it& #39;s worth, it& #39;s just a placeholder on numbers to watch how intrinsic value moves. I& #39;ve valued services at 20x earnings assuming a 20% tax rate, cloud at 10x revenue, and cash at its face value.

IMPORTANT - this is not what I think it& #39;s worth, it& #39;s just a placeholder on numbers to watch how intrinsic value moves. I& #39;ve valued services at 20x earnings assuming a 20% tax rate, cloud at 10x revenue, and cash at its face value.

The one big and not conservative assumption that I made was to carry forward Q1& #39;s EBITA margin as I& #39;ve defined it of 36.7%. I think it& #39;s likely that $GOOG keeps investing short to medium-term and margins could come down.

But importantly, for long-term investors, this quarter has shown us that $GOOG *can* operate at these margin levels if it wants to do so. It may try to depress them for optics but I& #39;m looking at earnings power over time and we know that margins can be *at least* this high.

Back to the big picture. Looking back, we can see that intrinsic value growth has been driven by the core segment (+45% EBITA growth over the last 9 quarters), cloud (137% revenue growth), and cash generation combined with some reduction in shares outstanding.

Importantly (to me at least), $GOOG has also been addressing its excess cash problem and has stepped up share repurchases significantly over the past three years. I& #39;m okay with a conservative balance sheet, but at some point it just becomes inefficient. https://twitter.com/willis_cap/status/1387167964802256902">https://twitter.com/willis_ca...

Looking forward, with revenue numbers that are hopefully conservative for 2021 and current margin targets that, as discussed, might be slightly aggressive in the short-term, it trades at ~20x core earnings + 10x cloud revenue + net cash with Other Bets effectively valued at $0.

Of course there are risks in every line item - regulatory pressure, in app search (esp by $AMZN) taking some relevance from the core business, the need to actually drive profitability along with growth in cloud, Other Bets losses, and a cash balance that keeps rising.

I said a couple of months ago that even after a big run $GOOG might be the cheapest thing I own. Given a relatively undemanding valuation along with a potentially still long growth runway, I still feel that way (maybe my other longs are just too expensive?).

Happy / eager to hear from people who disagree with any of this. DMs open if that& #39;s easier.

This thread mostly looked at the numbers but here& #39;s a good take looking at some more qualitative aspects as well: https://twitter.com/borrowed_ideas/status/1387228149541376007">https://twitter.com/borrowed_...

Read on Twitter

Read on Twitter