Thread on Equitas Small Finance Bank https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

Market cap: 6061 crores

Revenues: 2645 crores

P/E: 24.9

P/B: 2.21

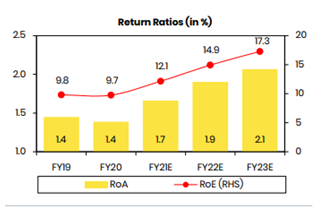

ROE: 9.75%

Here we go https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

1/25

Market cap: 6061 crores

Revenues: 2645 crores

P/E: 24.9

P/B: 2.21

ROE: 9.75%

Here we go

1/25

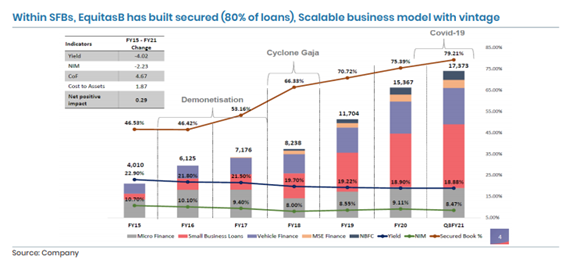

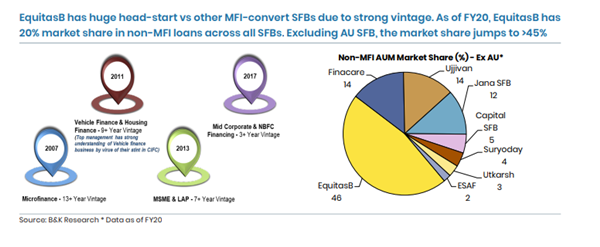

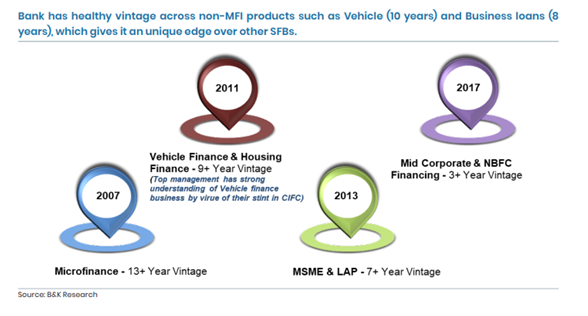

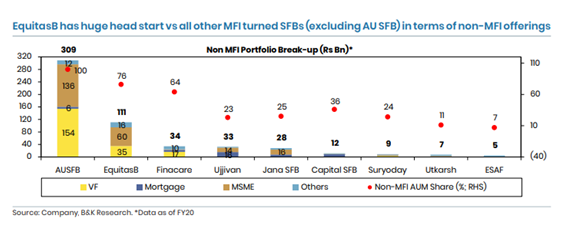

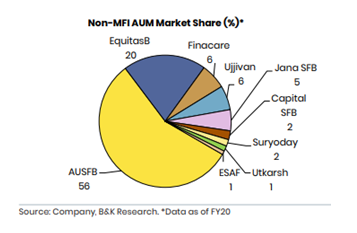

EquitasB is five years old bank though has over 13 years of lending experience. Amongst all MFI-convert SFBs, the share of MFI at EquitasB is amongst the lowest and settled at around 20%;

2/25

2/25

Non-MFI businesses (~80% share) such as Small Business, Vehicle, etc. have a reasonably good vintage, already been fine-tuned, and have established their niche;

CV business (started in 2011) and Small Business loans (started in 2013) are likely to be key growth drivers.

3/25

CV business (started in 2011) and Small Business loans (started in 2013) are likely to be key growth drivers.

3/25

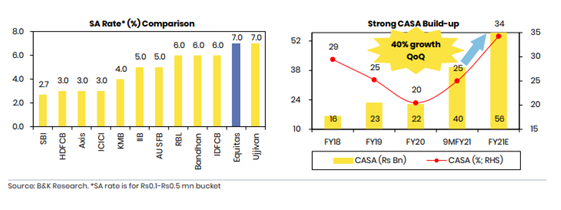

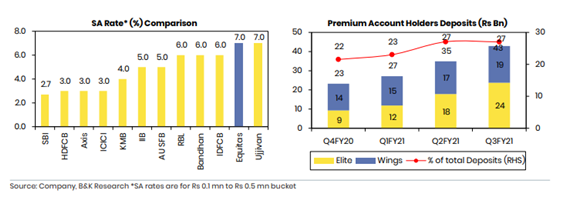

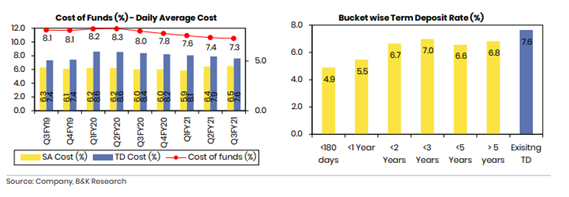

Bank has strong liability strategy, with focus on Mass affluent customers with Industry leading Savings rate (at 7.0%)

With a bouquet of services/offering (cross-sell) along with digital capabilities which ensure a smooth onboarding & rising customer loyalty & retention,

4/25

With a bouquet of services/offering (cross-sell) along with digital capabilities which ensure a smooth onboarding & rising customer loyalty & retention,

4/25

Strong 40% QoQ rise and 150% YoY rise in CASA very encouraging. Within SFBs, the bank has amongst highest share of secured loans.

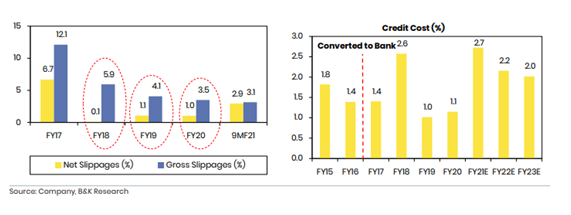

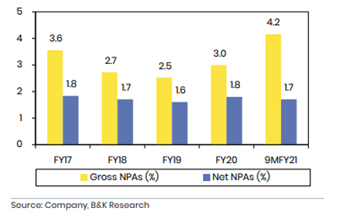

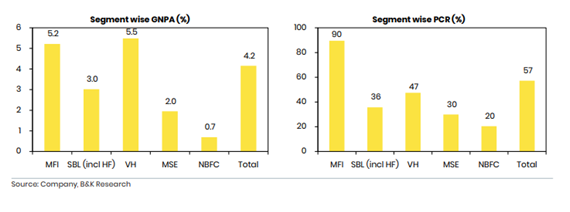

Considering bank mainly serves the low-income group customer segment, it has seen elevated gross delinquency levels (at 4-6% in the last few years);

Considering bank mainly serves the low-income group customer segment, it has seen elevated gross delinquency levels (at 4-6% in the last few years);

Positively, strong focus on Secured products and Moving up the customer segment, the bank has contained net slippages (at 0.1-1.1%);

Equitas Holding Limited (EHL) is the promoter (owns 82%) of the bank and is a Non-operating financial holding company (NOFHC).

6/25

Equitas Holding Limited (EHL) is the promoter (owns 82%) of the bank and is a Non-operating financial holding company (NOFHC).

6/25

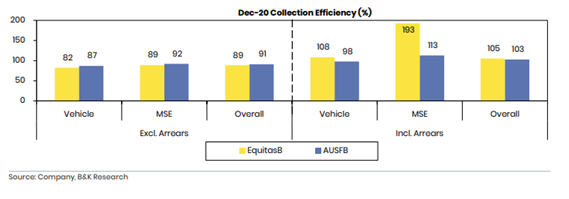

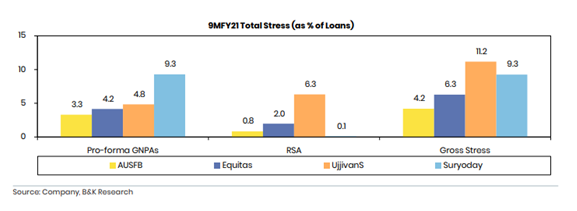

The transition from ~100% loans under moratorium to 6% reported stress (GNPAs + RSA) and ~4% in early delinquencies speak volumes about the bank’s customer selection and monitoring.

7/25

7/25

Amongst all MFI-convert SFBs, the share of MFI at EquitasB Is amongst lowest and settled at around 20%;

CV business (started in 2011) and Small Business Loans (started in 2013) are likely to be key growth drivers and considering the under penetration in both segments;

8/25

CV business (started in 2011) and Small Business Loans (started in 2013) are likely to be key growth drivers and considering the under penetration in both segments;

8/25

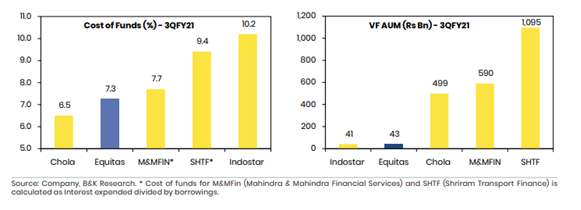

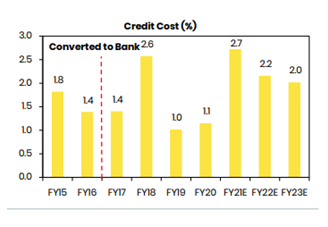

The bank has already scaled up retail deposits and the cost of funds has declined by 400-500 bps vs when it was NBFC;

The bank has focused on secured business loans (LAP) and Vehicle Financing (Used/New CV) as the growth drivers;

9/25

The bank has focused on secured business loans (LAP) and Vehicle Financing (Used/New CV) as the growth drivers;

9/25

EquitasB could be a potent competitor to LAP financiers or CV financiers NBFCs

Over the last 5 years (FY15-20), the MFI growth has been 11% CAGR as compared to 30% CAGR overall

The MFI share in the loan book has come down from 45% in FY17 & has stabilized at ~20% as of 3QFY21.

Over the last 5 years (FY15-20), the MFI growth has been 11% CAGR as compared to 30% CAGR overall

The MFI share in the loan book has come down from 45% in FY17 & has stabilized at ~20% as of 3QFY21.

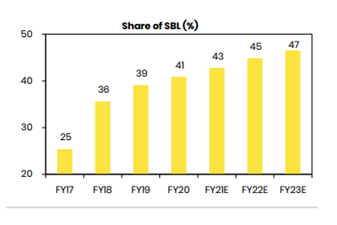

Small Business Loans- Secured nature and low NPA; Key growth driver:

Small Business loans were started as secured loan products backed by property, As a cross-sell to existing MFI customers who have demonstrated a strong track record for 2-3 cycles;

11/25

Small Business loans were started as secured loan products backed by property, As a cross-sell to existing MFI customers who have demonstrated a strong track record for 2-3 cycles;

11/25

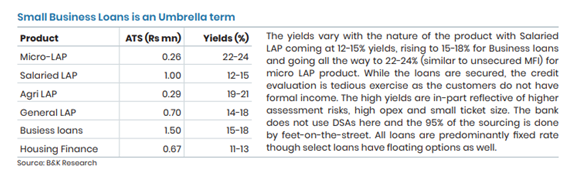

The Small Business loan is an umbrella term And houses several products, with a loan against the property being the underlying theme, the bank has also put affordable housing here;

Predominantly, the collateral is self-occupied residential property;

12/25

Predominantly, the collateral is self-occupied residential property;

12/25

Over the last few years, the bank has steadily moved up the ticket size and has penetrated more with an extended bouquet of products. The bank started with micro-LAP (ATS Rs 0.26 mn) and has also launched Business loans (ATS Rs 1.5 mn; highest limit Rs 10 mn);

13/25

13/25

SBL is likely to be the key growth driver for the bank.

Vehicle Finance- Fairly seasoned with deep expertise; Key growth driver:

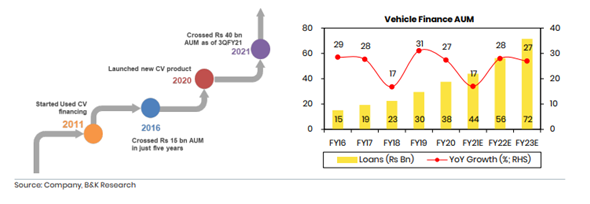

The Vehicle finance business, started in 2011, has a reasonable vintage and has healthy customer loyalty and financials;

14/25

Vehicle Finance- Fairly seasoned with deep expertise; Key growth driver:

The Vehicle finance business, started in 2011, has a reasonable vintage and has healthy customer loyalty and financials;

14/25

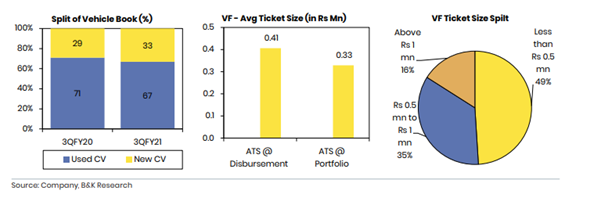

Initially, it was restricted to Used Vehicle Financing & leveraged strong relationship & understanding of the driver cum owners segment;

With conversion to bank & ease in funding cost, the bank has also ventured into new CV financing which is 1/3rd of the vehicle finance book.

With conversion to bank & ease in funding cost, the bank has also ventured into new CV financing which is 1/3rd of the vehicle finance book.

The book is fairly granular with 2/3rd in Used and 1/3rd in new. The average ticket size at origination is Rs 0.4 mn while the average o/s is Rs 0.33mn.

Banks are not a large player in the Used CV space, which is dominated by NBFCs;

16/25

Banks are not a large player in the Used CV space, which is dominated by NBFCs;

16/25

Other segments: MSE / Corporate:

MSE- The bank stated MSE finance in 2013 as part of the small business loans segment

Target customer segment: self-employed entrepreneurs, primarily engaged in manufacturing & trading activities & has formal records of credit evaluation.

17/25

MSE- The bank stated MSE finance in 2013 as part of the small business loans segment

Target customer segment: self-employed entrepreneurs, primarily engaged in manufacturing & trading activities & has formal records of credit evaluation.

17/25

The bank offers both Working capital and term loans here, as of 3QFY21, the O/s book was Rs 9.9 bn (6% of loans);

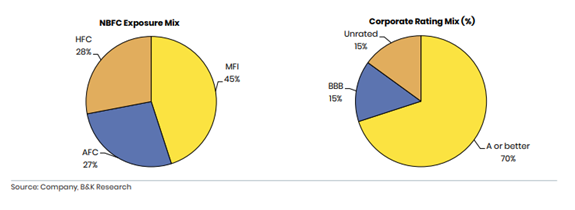

Corporate: The corporate loans, launched in 2017, are mainly restricted to smaller NBFCs, a segment which the bank knows well;

18/25

Corporate: The corporate loans, launched in 2017, are mainly restricted to smaller NBFCs, a segment which the bank knows well;

18/25

Nearly 1/3rd of the exposure is towards MFI followed by AFC (~25%) and HFCs (23%) and the rest 17% to others;

70% of entities have a rating A or better while 15% are BBB and rest are Unrated;

The O/s portfolio was Rs 8.9 bn (5% of loans) as of 3QFY21.

19/25

70% of entities have a rating A or better while 15% are BBB and rest are Unrated;

The O/s portfolio was Rs 8.9 bn (5% of loans) as of 3QFY21.

19/25

These loans are repayable by monthly installments or interest modes scheme and have an average tenure of around 2 years;

Corporate loans share is ~5% and is likely to remain limited.

20/25

Corporate loans share is ~5% and is likely to remain limited.

20/25

Banks have very attractively SA products with amongst highest rate at 7% for balances above Rs 0.1 mn. The higher rates act as a hook & have other attractive offerings to retain and deepen the client engagement.

21/25

21/25

The gross slippages for the last 3 years ending FY20 were 3.5-6.0% range while net slippages (net of recovery and upgrade) were in the 0.1-1.1% range.

The blended PCR stands at 57%. However, it masks the strong PCR at Unsecured MFI loans. The PCR at MFI loans is 90%

22/25

The blended PCR stands at 57%. However, it masks the strong PCR at Unsecured MFI loans. The PCR at MFI loans is 90%

22/25

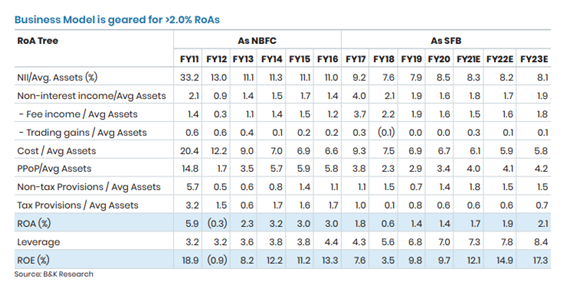

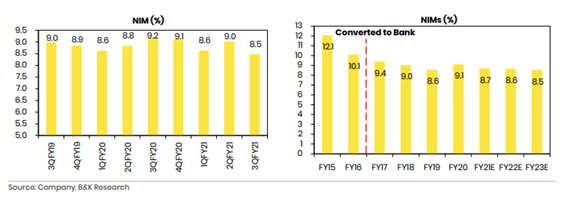

NIMs to moderate a bit but to remain amongst the highest:

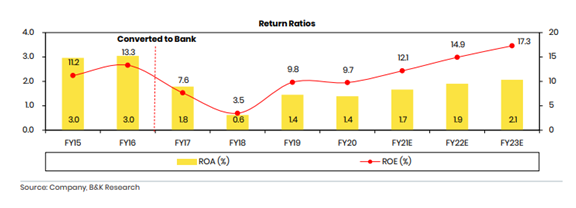

As the bank transitioned from NBFC to SFB & shifted its focus from high-yielding microfinance to relatively low-yielding secured products, NIMs witnessed compression;

23/25

As the bank transitioned from NBFC to SFB & shifted its focus from high-yielding microfinance to relatively low-yielding secured products, NIMs witnessed compression;

23/25

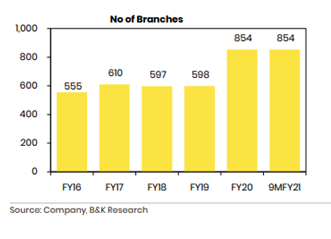

Within 5 years, the bank has built a strong branch network of 850, within which 370 are pure liability branches. Incremental branch expansion is likely to remain calibrated at 15-20 branches for the next 2 years.

24/25

24/25

Capital levels have been strong with Tier 1 at 20.8% and overall CRAR at 21.6% (as of Q3FY21);

The capital position was supported by recent capital raise of Rs 2.8 bn (fresh issue) in the IPO in October 2020.

End of thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

25/25

The capital position was supported by recent capital raise of Rs 2.8 bn (fresh issue) in the IPO in October 2020.

End of thread

25/25

Read on Twitter

Read on Twitter

25/25" title="Capital levels have been strong with Tier 1 at 20.8% and overall CRAR at 21.6% (as of Q3FY21);The capital position was supported by recent capital raise of Rs 2.8 bn (fresh issue) in the IPO in October 2020.End of thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">25/25">

25/25" title="Capital levels have been strong with Tier 1 at 20.8% and overall CRAR at 21.6% (as of Q3FY21);The capital position was supported by recent capital raise of Rs 2.8 bn (fresh issue) in the IPO in October 2020.End of thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">25/25">

25/25" title="Capital levels have been strong with Tier 1 at 20.8% and overall CRAR at 21.6% (as of Q3FY21);The capital position was supported by recent capital raise of Rs 2.8 bn (fresh issue) in the IPO in October 2020.End of thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">25/25">

25/25" title="Capital levels have been strong with Tier 1 at 20.8% and overall CRAR at 21.6% (as of Q3FY21);The capital position was supported by recent capital raise of Rs 2.8 bn (fresh issue) in the IPO in October 2020.End of thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">25/25">

25/25" title="Capital levels have been strong with Tier 1 at 20.8% and overall CRAR at 21.6% (as of Q3FY21);The capital position was supported by recent capital raise of Rs 2.8 bn (fresh issue) in the IPO in October 2020.End of thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">25/25">

25/25" title="Capital levels have been strong with Tier 1 at 20.8% and overall CRAR at 21.6% (as of Q3FY21);The capital position was supported by recent capital raise of Rs 2.8 bn (fresh issue) in the IPO in October 2020.End of thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">25/25">