Let& #39;s get (f)risky!

A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

0/ Risk is one of the most misunderstood aspects in the markets and arguably the most important. Some traders will bet less than 1% per trade while George Soros bet more than his entire fund while shorting the British Pound in 1992.

A thread

0/ Risk is one of the most misunderstood aspects in the markets and arguably the most important. Some traders will bet less than 1% per trade while George Soros bet more than his entire fund while shorting the British Pound in 1992.

1/ Controlling risk is the difference between winning, winning well AND staying in the game.

But how can we quantify risk in trading/investing? Well, think of each decision as a bet and you might start thinking more clearly.

But how can we quantify risk in trading/investing? Well, think of each decision as a bet and you might start thinking more clearly.

2/ Annie Duke’s book “Thinking in bets” is a must read and can really put this theme into action.

h/t @mrjasonchoi for the recommendation.

h/t @mrjasonchoi for the recommendation.

3/ OK, so if you’re taking a bet you need to weigh up the odds, calculate the risk/return then size appropriately.

4/ The odds of success and r/r are subjective and one can think of them based on some fundamental research, on-chain analysis and some technical analysis. If all three line up we may have an edge or “alpha” that gives a high r/r.

5/ We also need to factor in what the market as a whole is doing and where our play sits within the macro picture. @elite_investor did a great job at pointing this out, quoting Scott Bessent in his epic Soros thread. https://twitter.com/elite_investor/status/1365749945446334465?s=20">https://twitter.com/elite_inv...

6/ You may have found a great piece of alpha within the NFT sector for example, but if NFTs are in a down trend it might not be the best r/r at the time.

7/ So you think you have a winning play, you’ve spotted a good entry point and are ready to ape. But are you sizing correctly? OG& #39;s like @rewkang say it best. https://twitter.com/Rewkang/status/1383984847362740248?s=20">https://twitter.com/Rewkang/s...

8/ But don& #39;t go all in! We truly live in a random world, that’s impossible to predict with 100% certainty. Black swans do exist and we want to be in the game to see them pass. So let’s take a more tactical approach to our sizing by introducing the Kelly Criterion.

9/ Without getting super detailed, the Kelly formula is used to calculate the bet size based on the probabilities and the odds of success.

@NickYoder86 wrote a tremendous piece on his website. https://nickyoder.com/kelly-criterion/">https://nickyoder.com/kelly-cri...

@NickYoder86 wrote a tremendous piece on his website. https://nickyoder.com/kelly-criterion/">https://nickyoder.com/kelly-cri...

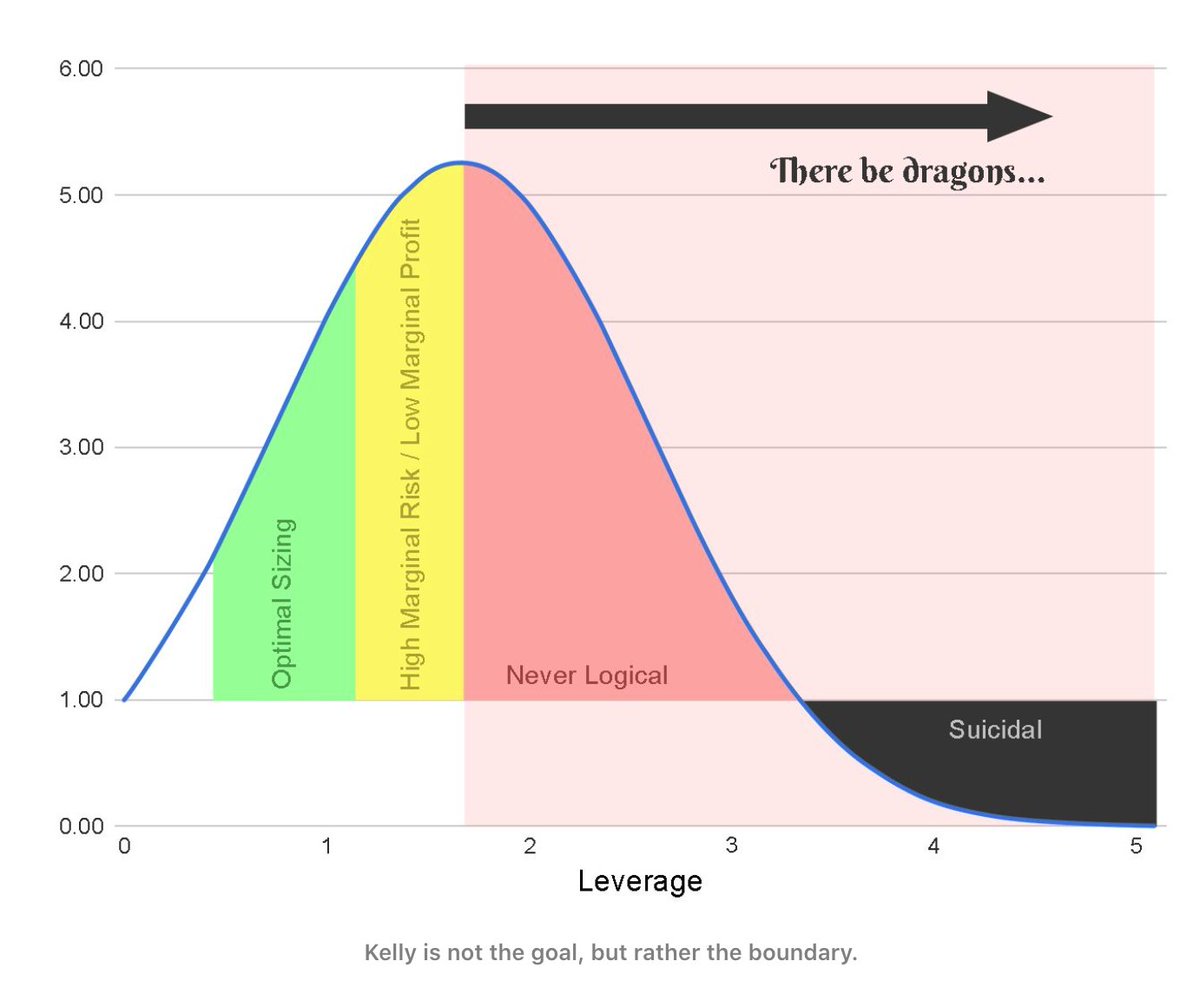

10/ This image from the piece shows the relationship between the growth rate and the size of your bet relative to your portfolio (leverage), suggesting that there is an optimal point for returns.

11/ Nick goes on to say: “Using this level of leverage would maximize the Geometric Growth Rate of your wealth over the course of many bets, investments or trades.

12/ As the bet size approaches the Kelly-optimal point, the ratio of additional risk to additional profit goes to infinity. Eventually you would have to risk an additional one billion dollars to earn one more cent of expected profit”.

13/ Sooo... consistently betting more than the Kelly value will lead to diminishing returns.

14/ Nick points out that Kelly represents the *limit* for the range of rational bets. And as we live in an imperfect world and the odds and probabilities we are inputting are far from optimal, it would be prudent to use conservative assumptions to gain a “Margin of Safety”.

15/ So we want to bet heavy when we think we are right but not too heavy (looking at you over-leveraged apes)…

16/ Next up we need to factor in time/opportunity cost. A month in crypto is like a year in the real world and if a trade takes a long time to play out, the market could have multiplied in that period.

17/ So bearing all these in mind here are a few important rules that I’ve been implementing:

Aim for investments that have potential for huge upside or short term investments with high certainty.

Size appropriately, focus on the Kelly number with some safety baked in.

Aim for investments that have potential for huge upside or short term investments with high certainty.

Size appropriately, focus on the Kelly number with some safety baked in.

18/ If you can quantify risk and adjust your bets accordingly, not only can you maximise your returns but you can build in a safety net to allow you to stay in the game when things don’t pay off.

19/ As the great George Soros said:

“Risk taking is painful. Risk taking is, to me, an essential ingredient in thinking clearly”.

“Risk taking is painful. Risk taking is, to me, an essential ingredient in thinking clearly”.

Thanks for reading my thread!

The goal of this was always to improve my own understanding of the topic and I hope that reading this has brought some clarity to the reader as much as it has for myself.

The goal of this was always to improve my own understanding of the topic and I hope that reading this has brought some clarity to the reader as much as it has for myself.

Read on Twitter

Read on Twitter