2/n

$PINS

Guidance

... ongoing COVID-19 pandemic and other factors. Our current expectation is that Q2 revenue will grow around 105% year over year.

In Q2, we expect global MAUs to grow in the mid-teens and US MAUs to be around flat on a year-over-year percentage basis.

$PINS

Guidance

... ongoing COVID-19 pandemic and other factors. Our current expectation is that Q2 revenue will grow around 105% year over year.

In Q2, we expect global MAUs to grow in the mid-teens and US MAUs to be around flat on a year-over-year percentage basis.

4/n

$PINS

* Q1: 78% yoy revenue growth

($485M vs $471M est)

* Q2: 105% yoy revenue growth guidance

($559M vs $530M est)

$PINS

* Q1: 78% yoy revenue growth

($485M vs $471M est)

* Q2: 105% yoy revenue growth guidance

($559M vs $530M est)

6/n

$PINS

I& #39;m very happy with these initial numbers, will dive in now to see if there is a wart.

The company is growing faster than even I anticipated.

Q1 +78%, Q2 +105%

Now time to read...

$PINS

I& #39;m very happy with these initial numbers, will dive in now to see if there is a wart.

The company is growing faster than even I anticipated.

Q1 +78%, Q2 +105%

Now time to read...

7/n

$PINS

OK, digested the report, and here are some more thoughts.

First, since MAUs are the thing, let& #39;s go there.

$PINS

OK, digested the report, and here are some more thoughts.

First, since MAUs are the thing, let& #39;s go there.

8/n

$PINS

"MAUs continued to grow in both the US and international markets during Q1, with particular strength coming from users under the age of 25, a persistent trend that we’ve seen for many quarters.

"Gen Z Pinners tend to also be more engaged than older users."

$PINS

"MAUs continued to grow in both the US and international markets during Q1, with particular strength coming from users under the age of 25, a persistent trend that we’ve seen for many quarters.

"Gen Z Pinners tend to also be more engaged than older users."

9/n

$PINS

We noted two weeks ago the prior bearish thesis:

Pinterest will miss out on the younger generation which is the money honey pot

...

$PINS

We noted two weeks ago the prior bearish thesis:

Pinterest will miss out on the younger generation which is the money honey pot

...

10/n

$PINS

And wrote: "The number of Gen Z users grew by 40% between 2019 and 2020. In terms of generational demographics, Pinterest saw the most growth last year with Gen Z."

Then we got the news for Q1 2021:

$PINS

And wrote: "The number of Gen Z users grew by 40% between 2019 and 2020. In terms of generational demographics, Pinterest saw the most growth last year with Gen Z."

Then we got the news for Q1 2021:

11/n

$PINS

Next up w MAUs we got:

Total MAU: 478 million, a 30% year over year growth versus analyst estimates of 480.5 million.

(A miss)

And then...

$PINS

Next up w MAUs we got:

Total MAU: 478 million, a 30% year over year growth versus analyst estimates of 480.5 million.

(A miss)

And then...

12/n

$PINS

"Since Q2 2020, we have noted the strong correlation between lockdowns and engagement on Pinterest.

"We believe that lockdowns probably pulled forward some user growth during 2020, particularly in the US where our service has been available longer."

$PINS

"Since Q2 2020, we have noted the strong correlation between lockdowns and engagement on Pinterest.

"We believe that lockdowns probably pulled forward some user growth during 2020, particularly in the US where our service has been available longer."

13/n

$PINS

"Starting in mid-March, the easing of pandemic restrictions slowed US MAU growth ... as people spent less time online.

"In Q1, we saw good retention of the MAUs we gained during 2020, but we still don’t know if or how long this retention will last."

$PINS

"Starting in mid-March, the easing of pandemic restrictions slowed US MAU growth ... as people spent less time online.

"In Q1, we saw good retention of the MAUs we gained during 2020, but we still don’t know if or how long this retention will last."

14/n

$PINS

This feels like a temporary slowdown due to comps from COVID.

At this point, not concerned and I still feel that Pinterest is on its way to 1B MAU within 5 years.

$PINS

This feels like a temporary slowdown due to comps from COVID.

At this point, not concerned and I still feel that Pinterest is on its way to 1B MAU within 5 years.

15/n

$PINS

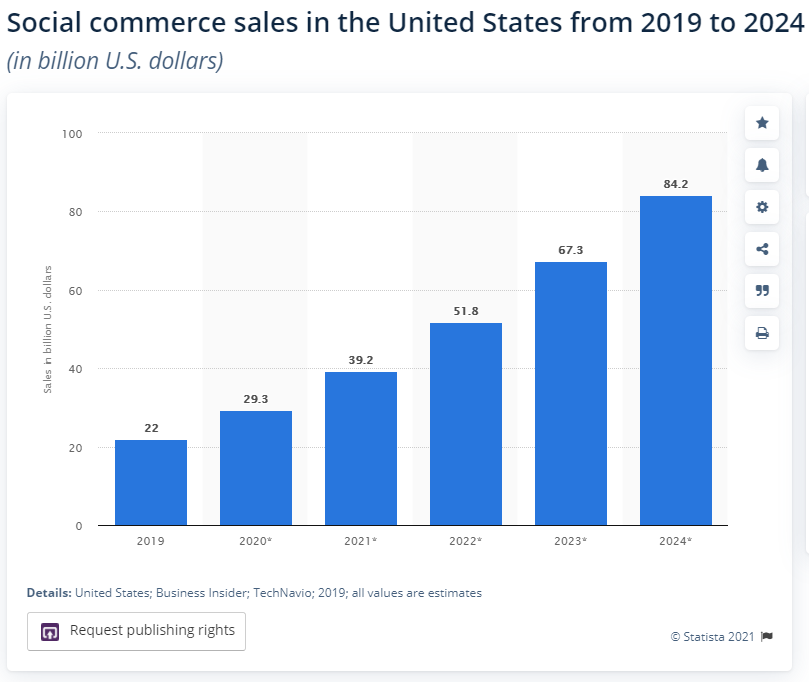

But then there was exceptionally good news as well.

"Based on what we’ve observed in the U.S. recently, we believe that post-COVID shopping engagement could be more resilient than overall engagement."

"Social commerce" is a big deal.

$PINS

But then there was exceptionally good news as well.

"Based on what we’ve observed in the U.S. recently, we believe that post-COVID shopping engagement could be more resilient than overall engagement."

"Social commerce" is a big deal.

16/n

$PINS

ARPU has shown remarkable strength.

Global ARPU: $1.04 versus analyst estimates of $0.99

(a beat)

U.S. ARPU: $3.99 (+50% yoy) versus estimates of $3.86

(a beat)

International ARPU: $0.26 (+91% yoy) versus estimates of $0.23.

(a beat)

But there& #39;s more...

$PINS

ARPU has shown remarkable strength.

Global ARPU: $1.04 versus analyst estimates of $0.99

(a beat)

U.S. ARPU: $3.99 (+50% yoy) versus estimates of $3.86

(a beat)

International ARPU: $0.26 (+91% yoy) versus estimates of $0.23.

(a beat)

But there& #39;s more...

17/n

$PINS

Q4 2020

* Revenue +76%

* MAU +37%

Q1 2021

* Revenue +78%

* MAU +30%

Q2 2021 (guide)

* Revenue +105% (weak COVID comp)

* MAU + "mid teens"

See the leverage?...

$PINS

Q4 2020

* Revenue +76%

* MAU +37%

Q1 2021

* Revenue +78%

* MAU +30%

Q2 2021 (guide)

* Revenue +105% (weak COVID comp)

* MAU + "mid teens"

See the leverage?...

18/n

$PINS

We also see it in EBITDA

* Adj EBITDA %: 17% of revenue vs 11.9% est

* Adj EBITDA: $83.8M vs $61M est

User leverage and operating leverage lead to 76%, 78% and 105% yoy growth for Q4/Q1/Q2e

$PINS

We also see it in EBITDA

* Adj EBITDA %: 17% of revenue vs 11.9% est

* Adj EBITDA: $83.8M vs $61M est

User leverage and operating leverage lead to 76%, 78% and 105% yoy growth for Q4/Q1/Q2e

Read on Twitter

Read on Twitter