#txlege is considering a bill (HB570) that would incentivize investments in small business recovery in Texas. It provides tax credits for small business funds. What could go wrong? A thread.(1/8)

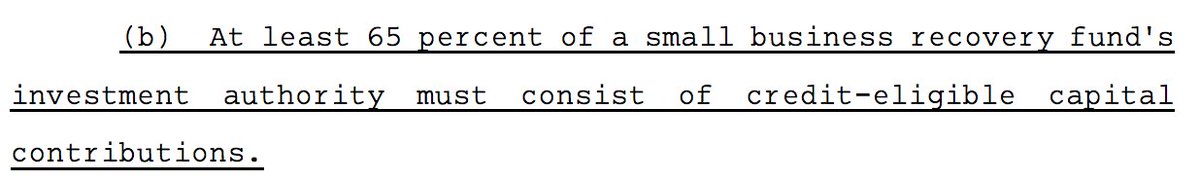

First, if you read the fine print, these funds only have to invest 65% of the investment into eligible small business. This might be why some big businesses support it. (I& #39;ll get to that in a bit). (2/8)

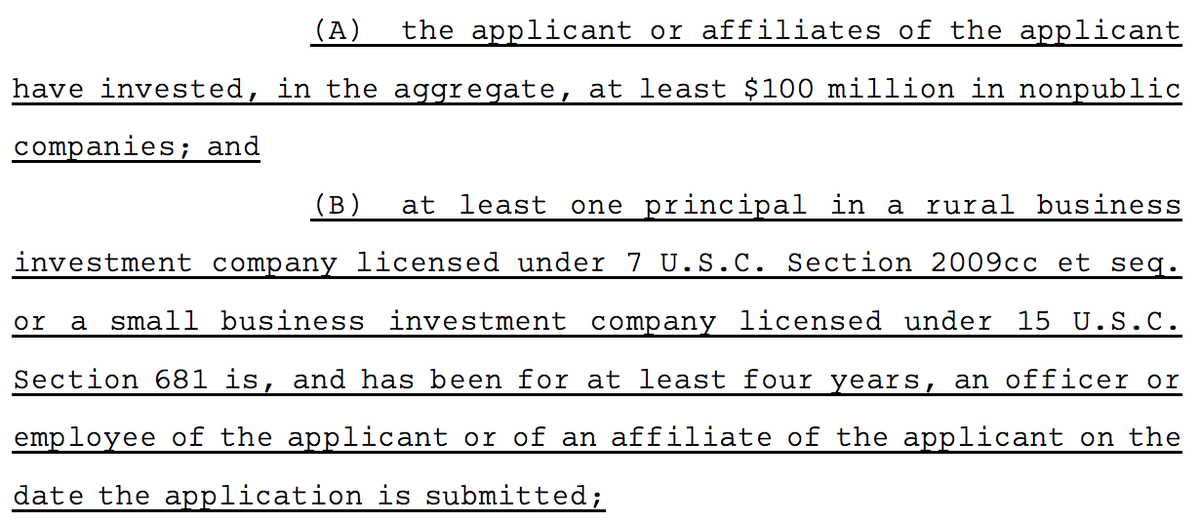

But who manages the funds? It turns out the the lobbyists figured this out. They made sure that only very large funds that have already been in the state for years are eligible. Create a new incentive but limit the competition. Evil genius. (3/8)

There is a proposed small business fund program that only 65% goes to small business, and it can only be managed by very big businesses. Sound odd. Who would support this plan? (4/8)

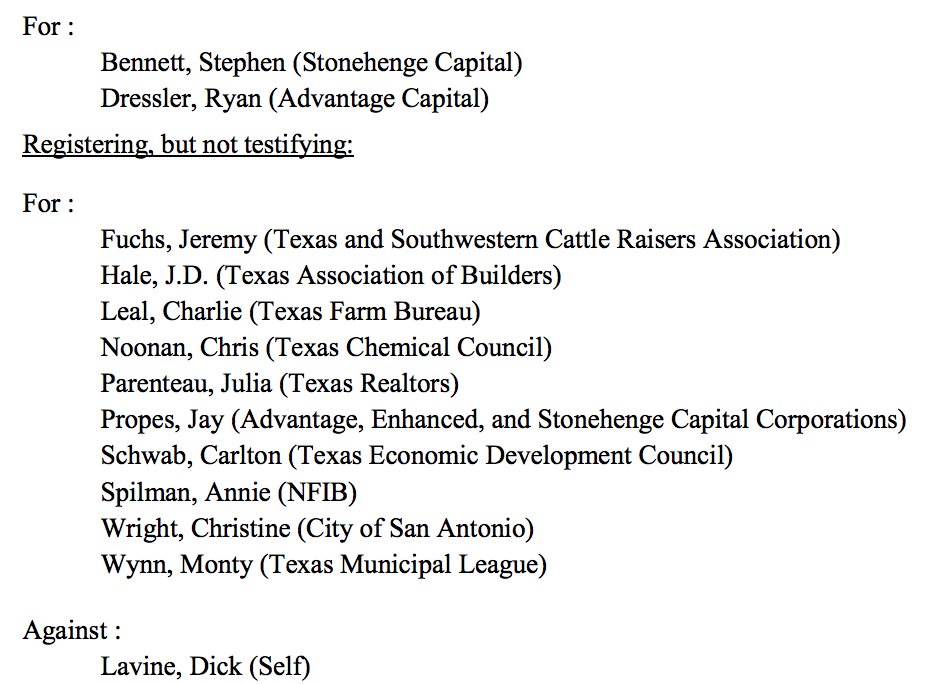

This older piece documents how three financial institutions (Advantage, Enhanced, and Stonehege Capital) have lobbied in the past. They have gone state to state pushing for more business. (They are into film incentives too). (5/8) https://www.pewtrusts.org/en/research-and-analysis/blogs/stateline/2017/04/03/how-savvy-financiers-pitch-complex-investment-programs">https://www.pewtrusts.org/en/resear...

What does this have to do with Texas? Who was testifying in support of this bill. You guessed it, these three same institutions testified for this bill. Only @dlavine opposed it. Also some odd supporters like the Texas Chemical Council. I guess they stand to gain too. (6/8)

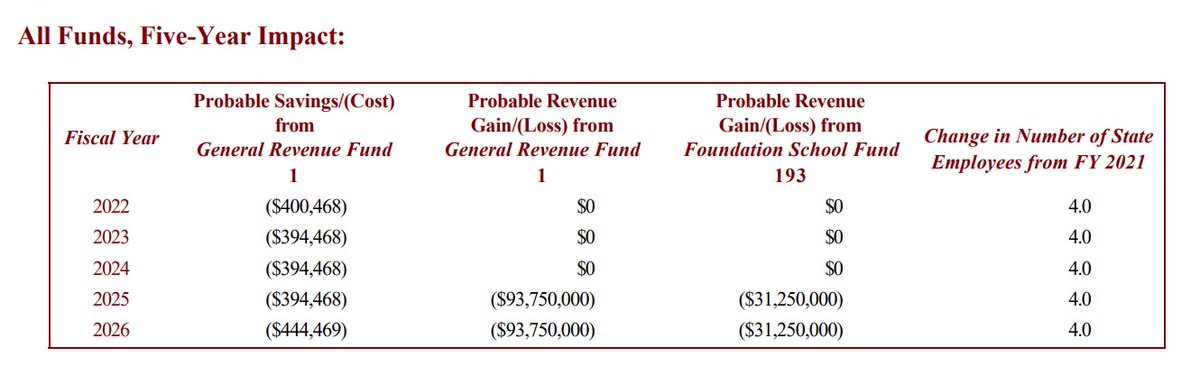

What is the cost of this bill? $125 million a year. But that& #39;s not it. Take a look at the breakdown. $31 million is going to come out of our schools. (7/8)

#navpanes=0">https://capitol.texas.gov/tlodocs/87R/fiscalnotes/pdf/HB00570H.pdf #navpanes=0">https://capitol.texas.gov/tlodocs/8...

#navpanes=0">https://capitol.texas.gov/tlodocs/87R/fiscalnotes/pdf/HB00570H.pdf #navpanes=0">https://capitol.texas.gov/tlodocs/8...

So we have a small business program that will cost taxpayers and our schools, is allowed to invest 35% in not small business, and that the lobbyists have made sure that only a handful of really big and well connected businesses can administer this program. Shameless. (8/8)

Read on Twitter

Read on Twitter