@bumperfinance is a project I am working heavily with (+invested)

What is it?

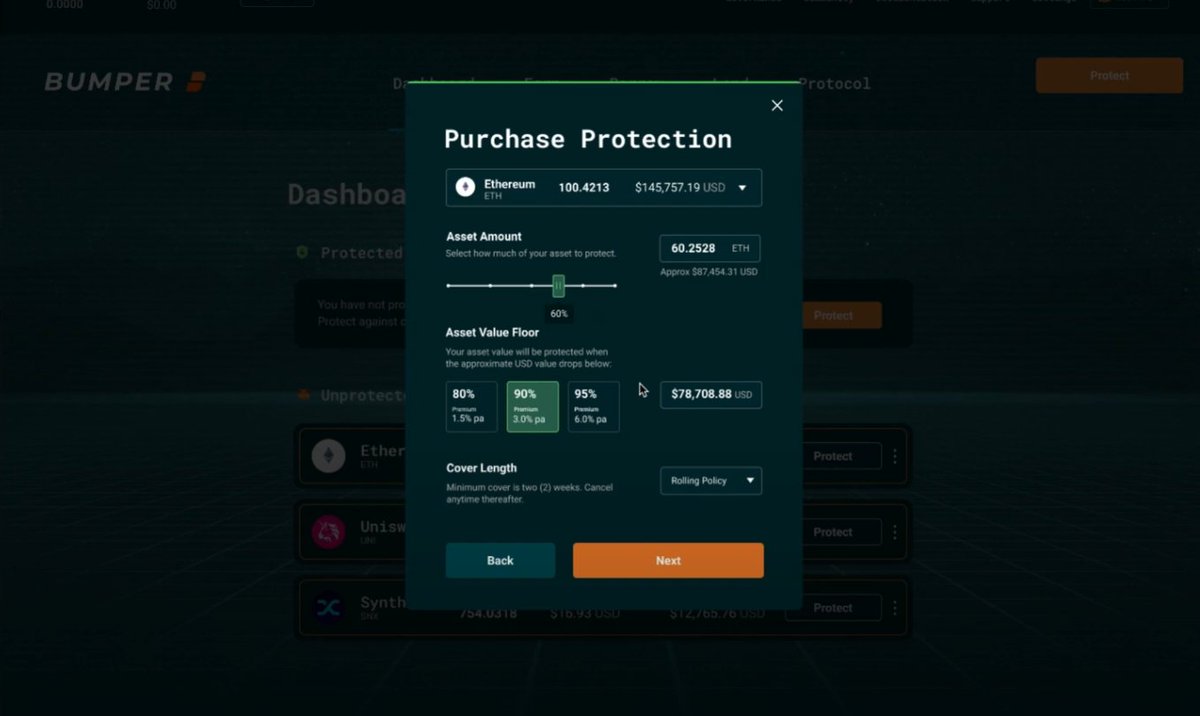

Bumper is a DeFi protocol that allows you to set a floor price for your $ETH. It& #39;s better than a simple stop loss because you aren’t simply cashed out to USDC when the ETH prices drops below your...

What is it?

Bumper is a DeFi protocol that allows you to set a floor price for your $ETH. It& #39;s better than a simple stop loss because you aren’t simply cashed out to USDC when the ETH prices drops below your...

set floor price. You never lose your exposure to the $ETH upside. You pay a small APR in premiums which is essentially buying an option to always sell your ETH for at least $xxxx, a price of your choosing.

2. How does Bumper work?

You simply open the dapp, set your floor price and amount of $ETH you wish to protect, deposit your ETH and receive bETH (bumper ETH) in return.

See this video for a demo of the dapp: https://www.youtube.com/watch?v=yphv-hgJdao">https://www.youtube.com/watch...

You simply open the dapp, set your floor price and amount of $ETH you wish to protect, deposit your ETH and receive bETH (bumper ETH) in return.

See this video for a demo of the dapp: https://www.youtube.com/watch?v=yphv-hgJdao">https://www.youtube.com/watch...

3. What is the future for Bumper and how can it work w. other DeFi protocols?

Once you have bETH, you now hold a token arguably more valuable than ETH itself, in that it will always be worth at least your floor price. This opens up many use cases for bETH.

Once you have bETH, you now hold a token arguably more valuable than ETH itself, in that it will always be worth at least your floor price. This opens up many use cases for bETH.

Borrowing against bETH with a much lower collateral ratio is possible with less liquidation risk. Protocols that require 150% eth collateral but only need 105% worth of bETH in order to maintain their protocol risk levels.

More info about Bumper protocol can be found in the following places:

Twitter: https://twitter.com/bumperfinance

Discord:">https://twitter.com/bumperfin... https://discord.com/invite/YyzRws4Ujd

Telegram:">https://discord.com/invite/Yy... https://t.me/bumperfinance

Medium:">https://t.me/bumperfin... https://medium.com/bumper-finance

Website:">https://medium.com/bumper-fi... http://bumper.finance"> http://bumper.finance

Twitter: https://twitter.com/bumperfinance

Discord:">https://twitter.com/bumperfin... https://discord.com/invite/YyzRws4Ujd

Telegram:">https://discord.com/invite/Yy... https://t.me/bumperfinance

Medium:">https://t.me/bumperfin... https://medium.com/bumper-finance

Website:">https://medium.com/bumper-fi... http://bumper.finance"> http://bumper.finance

Read on Twitter

Read on Twitter