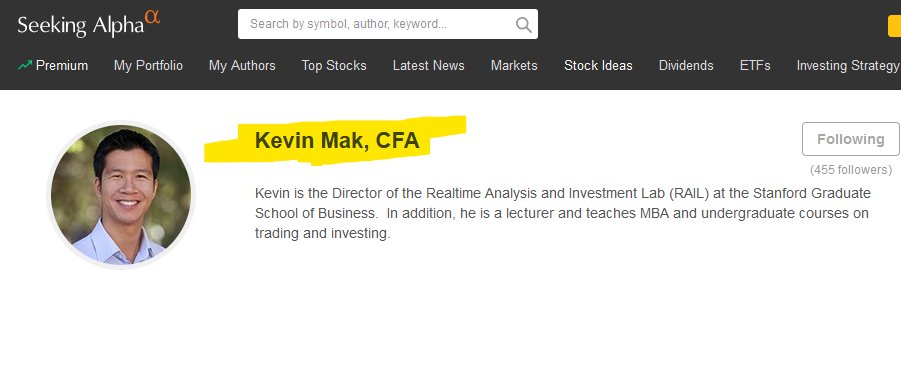

$Muds by Kevin Mak of SeekingAlpha - The first & only analyst to publicly cover the Topps/Muds merger.

I will post some highlights from his article from 4/26. He is legit. He teaches trading & investment at Stanford MBA Business.

He covers the NFT impact. Link in comments.

I will post some highlights from his article from 4/26. He is legit. He teaches trading & investment at Stanford MBA Business.

He covers the NFT impact. Link in comments.

Here are 4 key quotes:

1. & #39;The unit economics on this business are insane..."

2. [NFTs] will "generate substantially higher margins..."

3. "NFTs allow Topps to print money..."

4. "The potential upside of the NFT business is transformative and massive."

More? he also had this...

1. & #39;The unit economics on this business are insane..."

2. [NFTs] will "generate substantially higher margins..."

3. "NFTs allow Topps to print money..."

4. "The potential upside of the NFT business is transformative and massive."

More? he also had this...

"I strongly believe these economics are why Mudrick Capital has more than doubled their exposure, and Eisner....have not sold a single share."

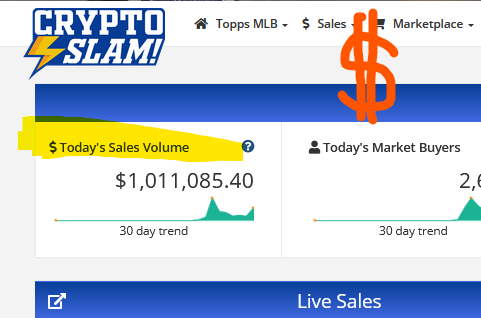

NFTs were not part of the investor presentation with Topps & MUDS. Since that time Topps launched the Baseball NFTs. Lets just say they& #39;ve been a hit!

About not having the NFT revenue in the investor presentation, Kevin Mak wrote:

"If I had to pay for this growth potential, I would struggle to determine the fair price for this - but with this investment, you& #39;re getting it nearly for free."

"If I had to pay for this growth potential, I would struggle to determine the fair price for this - but with this investment, you& #39;re getting it nearly for free."

About the NFTs he wrote...

"These NFTs have since hit the market and have generated extremely strong interest from collectors and, should these trends persist, will easily multiply Topps& #39; valuation by many fold."

"These NFTs have since hit the market and have generated extremely strong interest from collectors and, should these trends persist, will easily multiply Topps& #39; valuation by many fold."

About NFTs and how they improve the margins...

When the company sells NFTs, this 20% cost (card production) becomes zero. This nearly doubles the contribution margin..."

When the company sells NFTs, this 20% cost (card production) becomes zero. This nearly doubles the contribution margin..."

And finally there are royalties on the resale of the NFTs...

"the financial implications of NFTs to Topps leads to...(with the lower costs & royalty)....a tripling their profitability"

"the financial implications of NFTs to Topps leads to...(with the lower costs & royalty)....a tripling their profitability"

Read the article here: https://seekingalpha.com/article/4421338-topps-well-priced-company-substantial-upside

At">https://seekingalpha.com/article/4... the bottom he has his target price. The conservative target? Lets just say its MUCH higher than the current share price.

At">https://seekingalpha.com/article/4... the bottom he has his target price. The conservative target? Lets just say its MUCH higher than the current share price.

Read on Twitter

Read on Twitter