While the Portal in RMI& #39;s Utility Transition Hub does a lot of things, it doesn& #39;t tell you what to think.

This is what RMI has learned from the Portal& #39;s data https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

Thread #2... https://twitter.com/rachit_kansal/status/1387029811919478784">https://twitter.com/rachit_ka...

This is what RMI has learned from the Portal& #39;s data

Thread #2... https://twitter.com/rachit_kansal/status/1387029811919478784">https://twitter.com/rachit_ka...

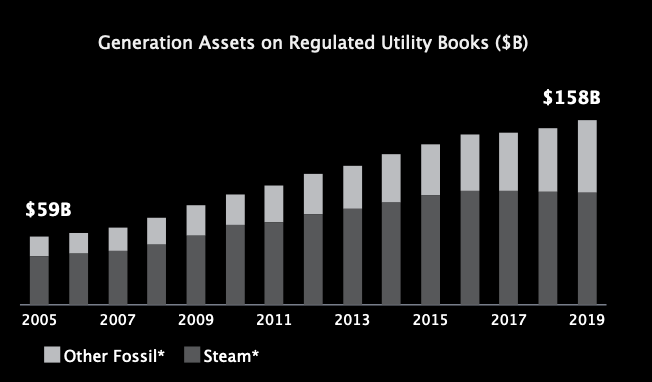

Despite a wave of US coal plant retirements, fossil assets on regulated utility books have never been higher.

They rose from ~$59B to ~$158B, 2005-2019

They rose from ~$59B to ~$158B, 2005-2019

With approval from regulators, utilities & #39;doubled down& #39; on coal - & #39;locking in& #39; customers and communities.

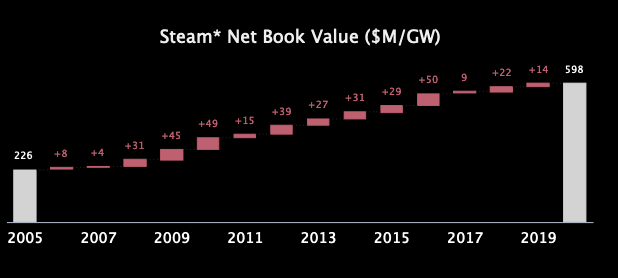

The average 1 GW coal plant more than DOUBLED in value, from ~$220MM/GW to ~$600MM/GW, 2005-2019

The average 1 GW coal plant more than DOUBLED in value, from ~$220MM/GW to ~$600MM/GW, 2005-2019

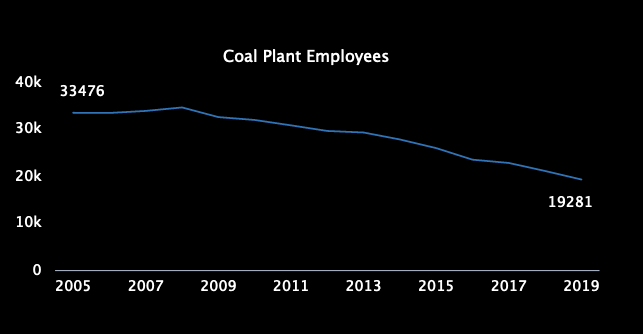

As a result, customers are stuck paying more for less energy from coal plants that employ fewer people.

Over 14,000 coal plant jobs were lost from 2005-2019, a ~42% reduction

Over 14,000 coal plant jobs were lost from 2005-2019, a ~42% reduction

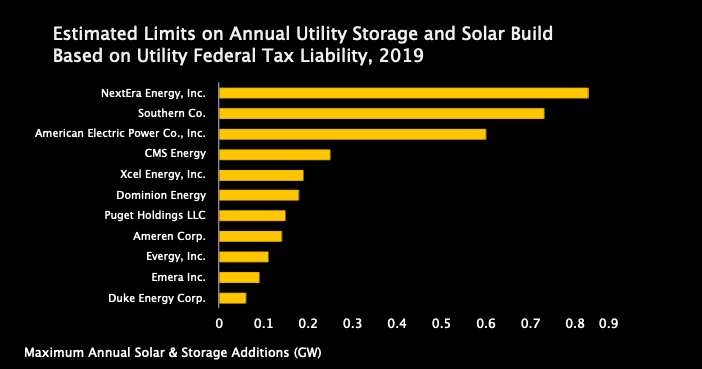

Recently extended fed tax credits should help IN THEORY, but most utilities can& #39;t make use of them effectively.

W/ current tax policies, utilities across the country can affordably transition a TOTAL of one or two fossil plants a year.

W/ current tax policies, utilities across the country can affordably transition a TOTAL of one or two fossil plants a year.

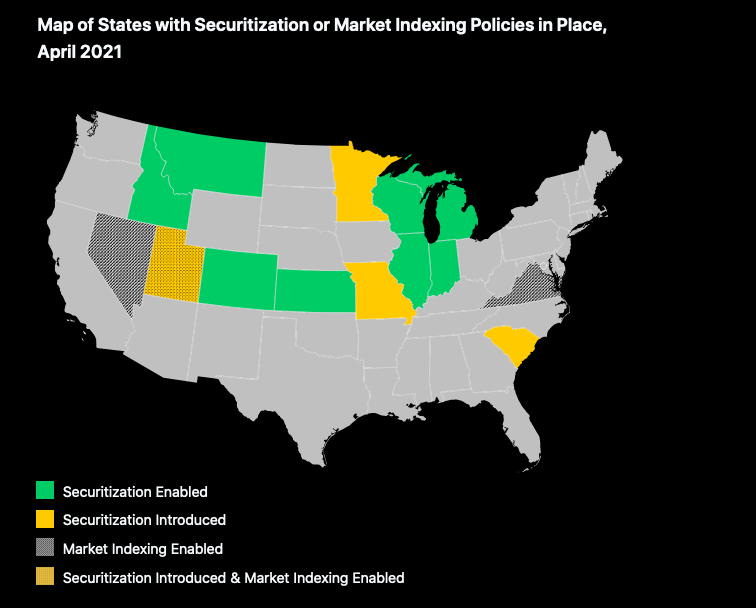

State policies like securitization, market indexing, and performance-based regulation can help, but are not yet widely deployed

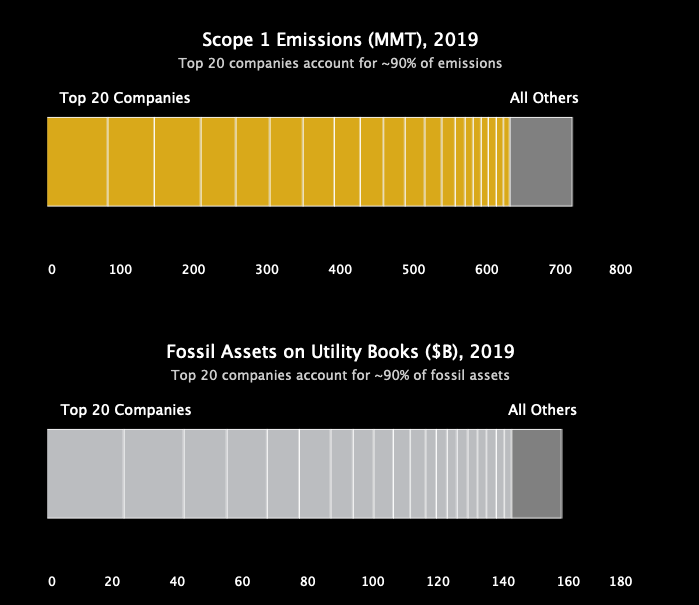

All is not lost! The path forward in the regulated utility sector relies on TWENTY holding companies.

These are responsible for ~90% of the sector& #39;s sales, emissions and fossil assets.

I.e. this is doable

These are responsible for ~90% of the sector& #39;s sales, emissions and fossil assets.

I.e. this is doable

There are many more stories lurking in the Hub, come find them with us! (or by yourself too)

Check out the Hub here - https://utilitytransitionhub.rmi.org/ ">https://utilitytransitionhub.rmi.org/">...

Check out the Hub here - https://utilitytransitionhub.rmi.org/ ">https://utilitytransitionhub.rmi.org/">...

The Hub has been the result of tireless work from a stellar team, all over the past year!

Too many names to recognize but special shout-out to @JonRea5 as the Hub& #39;s data lead, and to @samardell, @nachykanfer, @al_hurley538, @Coreina_Chan, @leiaguccione and Sarah LaMonaca

Too many names to recognize but special shout-out to @JonRea5 as the Hub& #39;s data lead, and to @samardell, @nachykanfer, @al_hurley538, @Coreina_Chan, @leiaguccione and Sarah LaMonaca

Read on Twitter

Read on Twitter