1/ Algorithmic stablecoins have exploded over the past year: Dai, FEI, ESD, Basis Cash.

But fewer and fewer people actually understand how these stablecoins work.

So I made a simple visual explanation of the major algorithmic stablecoins. Check https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://medium.com/dragonfly-research/a-visual-explanation-of-algorithmic-stablecoins-9a0c1f0f51a0">https://medium.com/dragonfly...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://medium.com/dragonfly-research/a-visual-explanation-of-algorithmic-stablecoins-9a0c1f0f51a0">https://medium.com/dragonfly...

But fewer and fewer people actually understand how these stablecoins work.

So I made a simple visual explanation of the major algorithmic stablecoins. Check

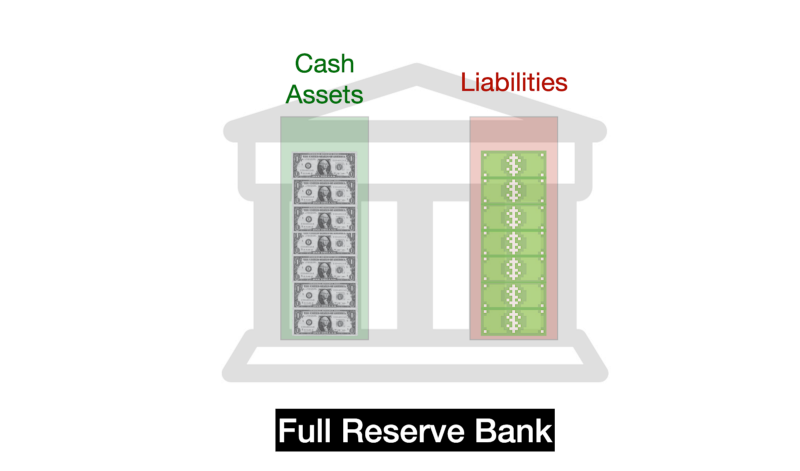

2/ There are four basic types of stablecoins. First, full-reserve banks, a la Tether. These are centralized, hold all their assets in fiat, and their liabilities should always match their assets.

Think USDT, USDC, BUSD, and all the others.

Think USDT, USDC, BUSD, and all the others.

3/ Then there are full-reserve crypto stablecoins. To create the crypto equivalent, you have to overcollateralize the "bank."

These designs include MakerDAO and Synthetix. (Animation depicts MakerDAO.)

These designs include MakerDAO and Synthetix. (Animation depicts MakerDAO.)

Read on Twitter

Read on Twitter