Biden is expected to add billions in IRS funding to significantly ramp up enforcement of America& #39;s wealthiest tax avoiders. We& #39;ve been reporting for years on the games the ultra-rich pay to skirt their tax liability & the IRS& #39; inability to do anything about it. (THREAD)

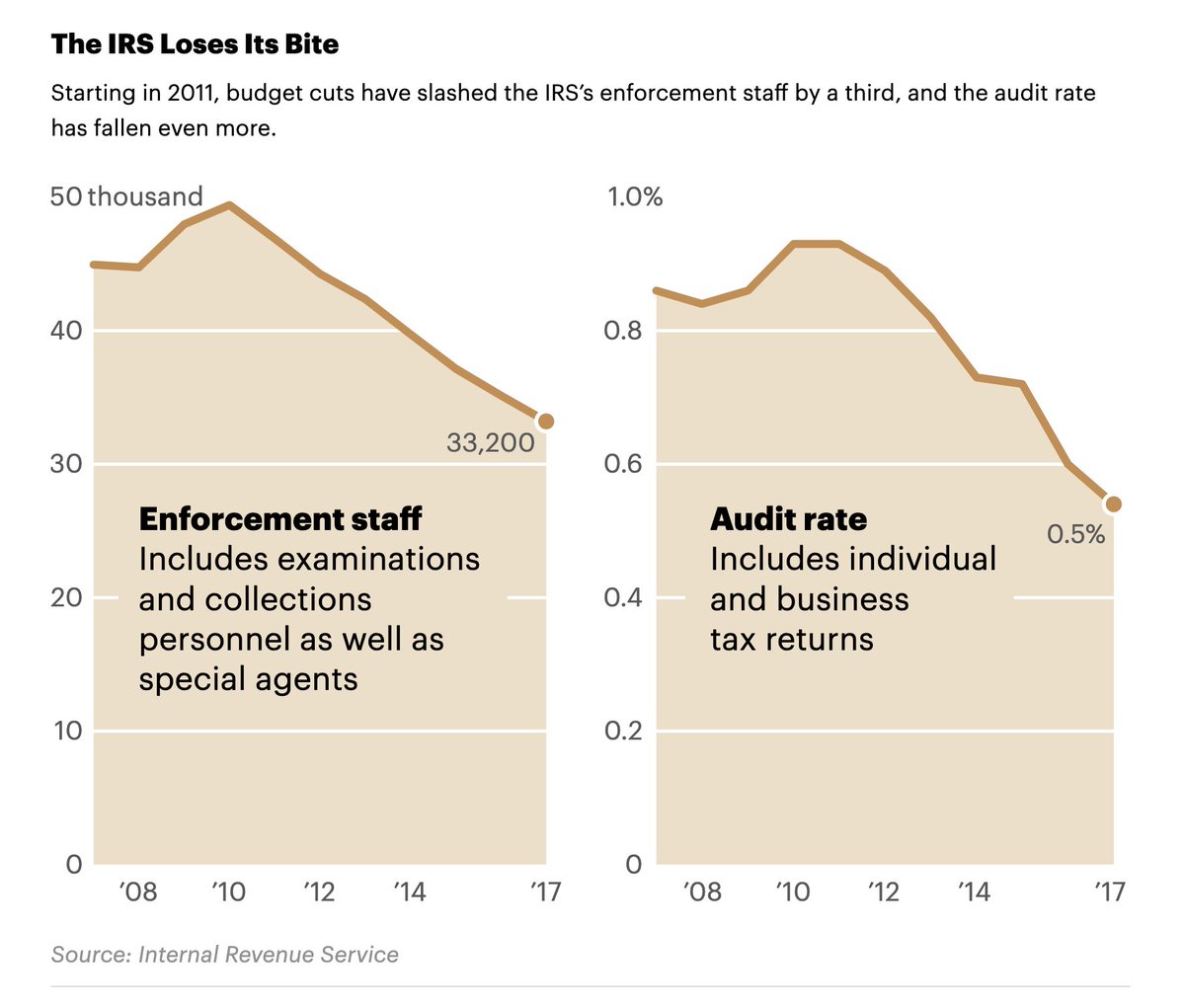

2/ Congressional Republicans began slashing the IRS budget in 2011, hobbling the agency& #39;s ability to pursue fraud allegations.

3/ By 2017, the IRS enforcement staff had been cut by a third, its criminal division brought about 25% fewer cases in which tax fraud was the primary crime, and audits had been nearly halved.

4/ Additionally, current and former IRS agents told us there was a push to close audits more quickly, leading to fewer records requests and interviews, and generally less-intensive audits. https://www.propublica.org/article/after-budget-cuts-the-irs-work-against-tax-cheats-is-facing-collapse">https://www.propublica.org/article/a...

5/ By 2018, millionaires were about 80% less likely to be audited than they were in 2011, meaning America& #39;s poorest were being audited at about the same rate as the top 1%. https://www.propublica.org/article/irs-now-audits-poor-americans-at-about-the-same-rate-as-the-top-1-percent">https://www.propublica.org/article/i...

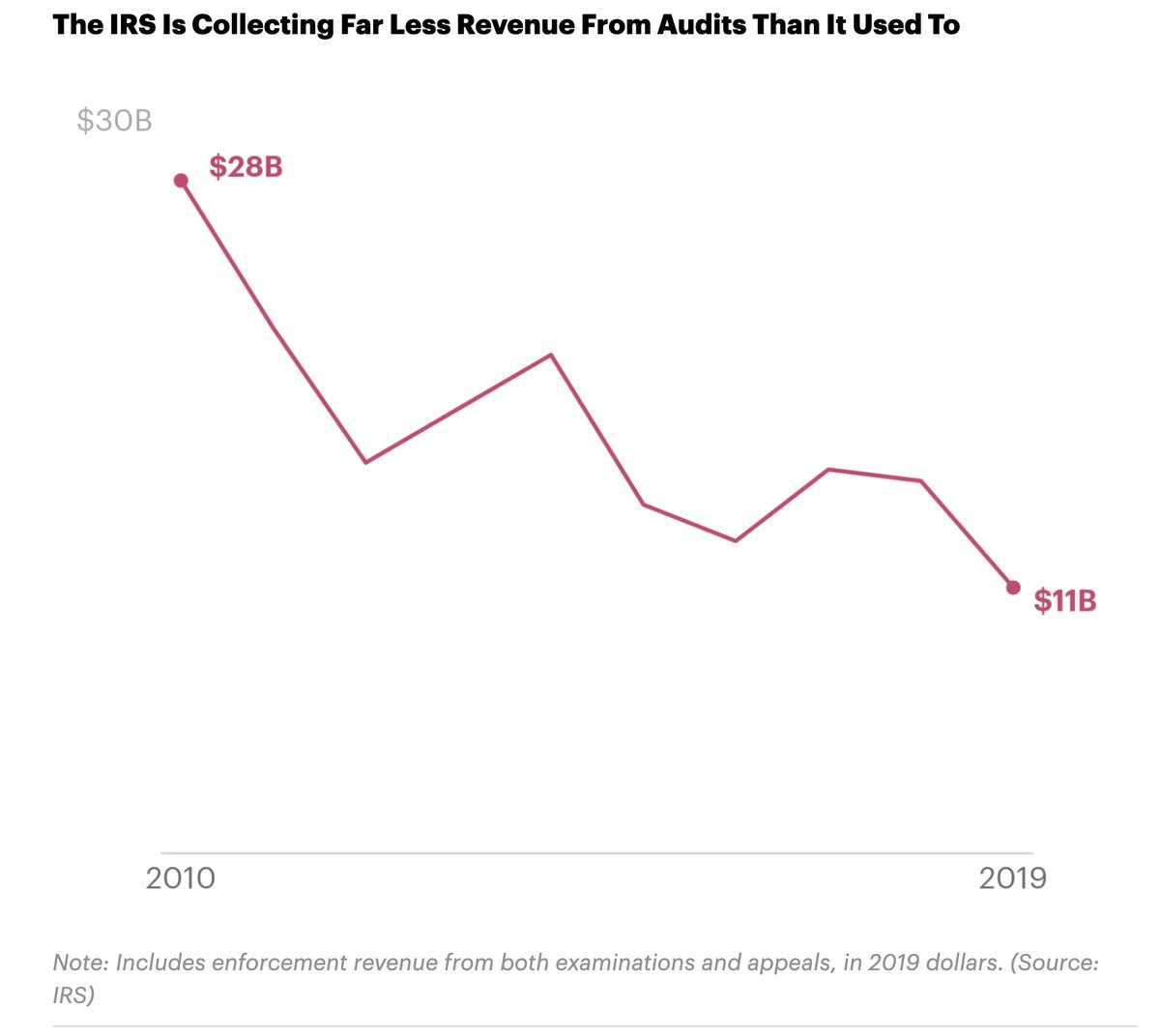

6/ Between 2010-19, the IRS went from collecting around $28 billion/year from audits (adjusting for inflation) to only $11 billion, a drop of 61%.

https://www.propublica.org/article/has-the-irs-hit-bottom">https://www.propublica.org/article/h...

https://www.propublica.org/article/has-the-irs-hit-bottom">https://www.propublica.org/article/h...

7/ In 2009, the IRS formed a special team to unravel the complex tax-lowering strategies of America’s ultra-wealthy. But in the face of nearly limitless wealth, and opposition from Congress, it never stood a chance.

8/ Take, for example, the story of billionaire Georg Schaeffler, whom the IRS accused of hiding $5 billion in income. It said he owed $1.2 billion in taxes & penalties.

9/ Schaeffler& #39;s attorneys denied he owed any money, arguing the IRS misunderstood the tax issues involved. They complained to top IRS officials & challenged document requests. “Mr. Schaeffler always strives to comply with the complex U.S. tax code,” a rep said in a statement.

10/ After years of delays and challenges, the IRS all but abandoned pursuit of the $1.2 billion and said it would accept "tens of millions," according to sources.

The IRS declined to comment on this story. https://www.propublica.org/article/ultrawealthy-taxes-irs-internal-revenue-service-global-high-wealth-audits">https://www.propublica.org/article/u...

The IRS declined to comment on this story. https://www.propublica.org/article/ultrawealthy-taxes-irs-internal-revenue-service-global-high-wealth-audits">https://www.propublica.org/article/u...

11/ The IRS has faced similar issues when it takes on big corporations, where the size of the audits is often larger & the resources rallied against the agency are often more daunting.

12/ After Microsoft shifted $39+ billion in profits to Puerto Rico, where the territorial govt. gave it a tax rate of about 0%, the IRS tried to get tough, resulting in the agency& #39;s largest audit ever.

13/ The tech giant& #39;s attorneys argued Microsoft& #39;s Puerto Rican company “was a real business with real risks and was not a tax shelter," & that the IRS violated rules by bringing in expert outside attorneys to interview witnesses. Microsoft& #39;s tax consultants declined to comment.

14/ Microsoft fought back with every tool it could muster. The Chamber of Commerce, the nation& #39;s biggest lobbyist, and tech trade groups hired attorneys to make its case to IRS leaders and lawmakers.

15/ Soon, members of Congress, both Republicans and Democrats, were decrying the IRS’ tactics and introducing legislation to stop the IRS from ever taking similar steps again.

16/ By 2019, Microsoft and its allies had succeeded in changing the law, removing or limiting tools the IRS team had used against the company. The agency declined to comment. https://www.propublica.org/article/the-irs-decided-to-get-tough-against-microsoft-microsoft-got-tougher">https://www.propublica.org/article/t...

17/ Last year, we reported on the IRS& #39; efforts to collect as much as $9 billion in taxes from Facebook, a dispute that is still unresolved. https://www.propublica.org/article/whos-afraid-of-the-irs-not-facebook">https://www.propublica.org/article/w...

18/ These are only a handful of stories from our "Gutting the IRS" series, which is all available here: https://www.propublica.org/series/gutting-the-irs">https://www.propublica.org/series/gu...

Read on Twitter

Read on Twitter