Binance Smart Chain vs. Ethereum.

Let& #39;s look at some simple metrics.

tl;dr: at least in the foreseeable future, BSC remains a strong alternative to Ethereum, particularly in Asia.

My guess is Ethereum would see more activity again when Optimism and other layer twos launch.

Let& #39;s look at some simple metrics.

tl;dr: at least in the foreseeable future, BSC remains a strong alternative to Ethereum, particularly in Asia.

My guess is Ethereum would see more activity again when Optimism and other layer twos launch.

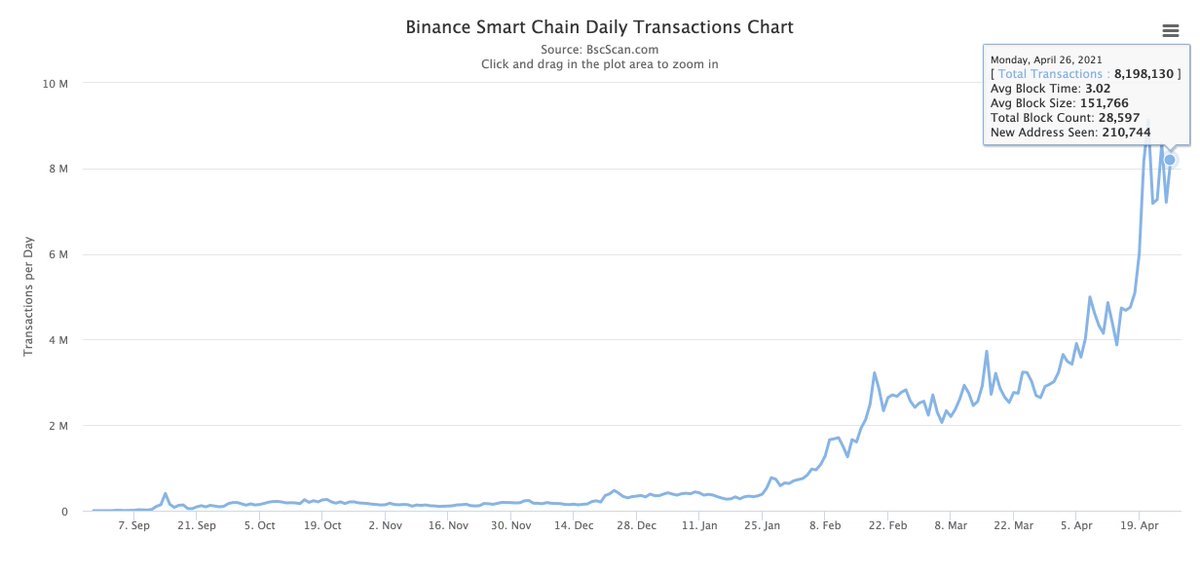

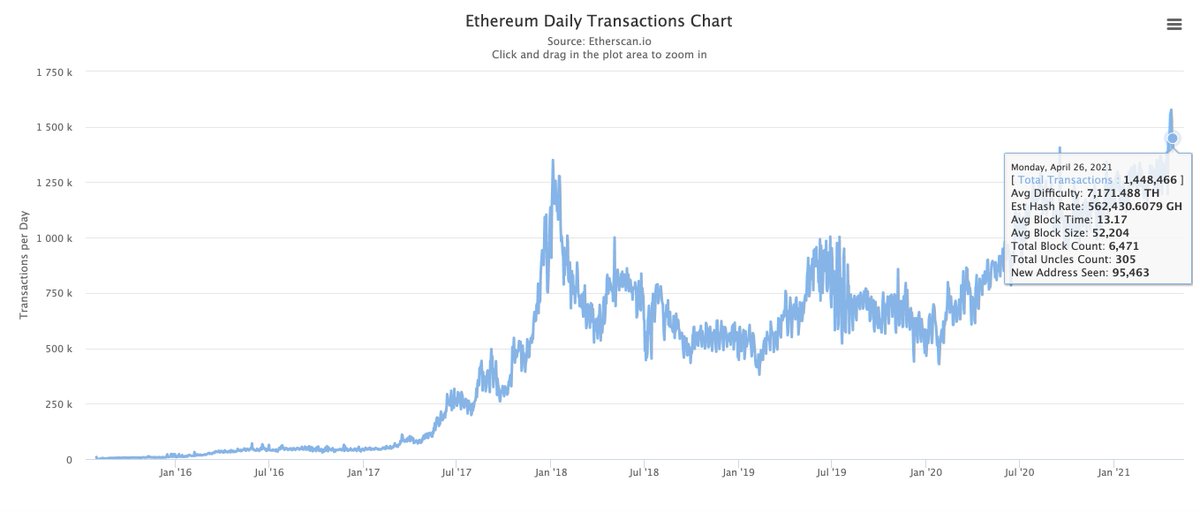

1. Daily TX volume

Binance Smart Chain: 8 million txs/ per day

Ethereum: 1.5 million per day

But, this does not take into account xDAI and other practical layer 2 solutions on Ethereum that are currently in use.

Binance Smart Chain: 8 million txs/ per day

Ethereum: 1.5 million per day

But, this does not take into account xDAI and other practical layer 2 solutions on Ethereum that are currently in use.

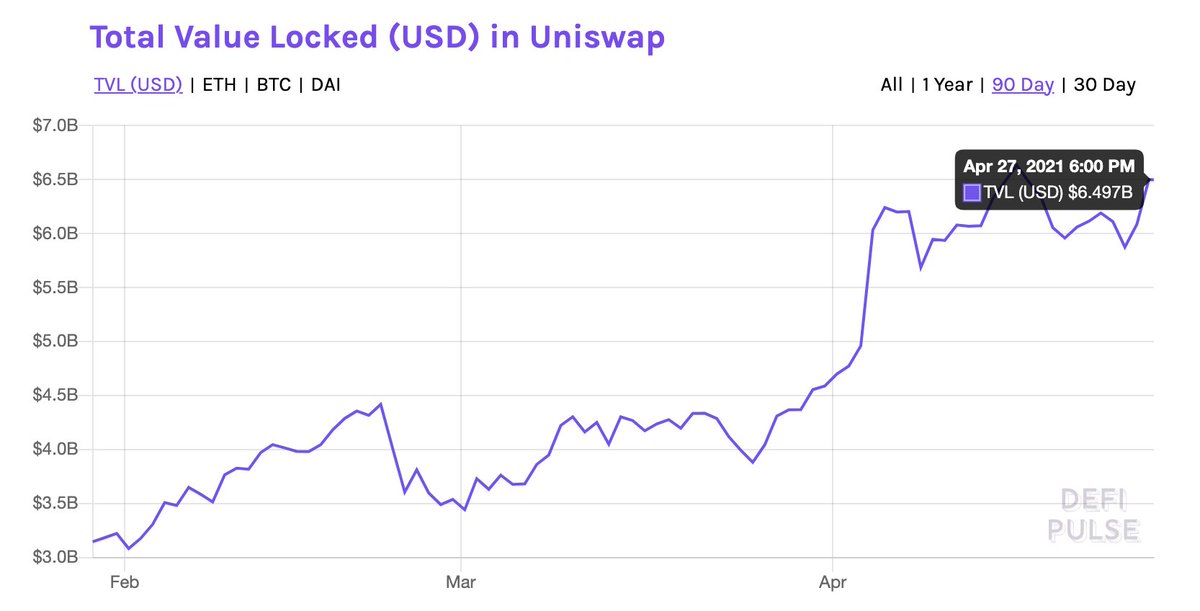

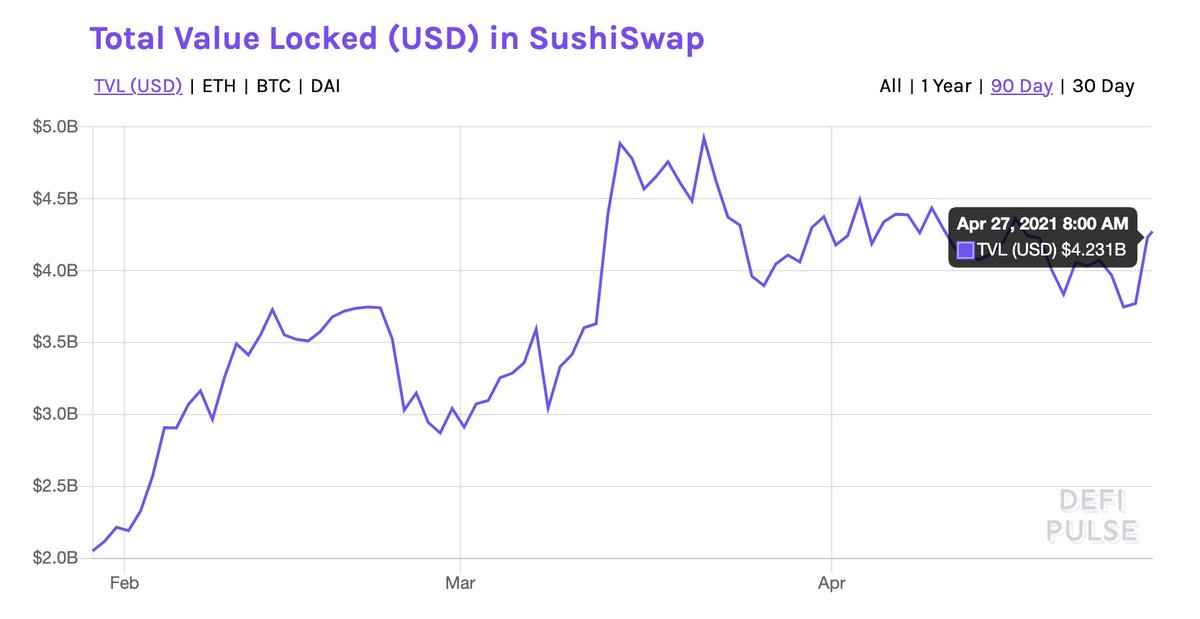

2. PancakeSwap vs Uniswap + SushiSwap TVL

- PancakeSwap: $8.7 billion

- Uniswap: $6.5 billion

- SushiSwap: $4.2 billion

Many people stake on PancakeSwap to participate in their farms and pools. So it would be more fair to compare PancakeSwap versus. Uniswap + SushiSwap.

- PancakeSwap: $8.7 billion

- Uniswap: $6.5 billion

- SushiSwap: $4.2 billion

Many people stake on PancakeSwap to participate in their farms and pools. So it would be more fair to compare PancakeSwap versus. Uniswap + SushiSwap.

3. NFT marketplaces

Ethereum: Opensea, Rarible

Binance Smart Chain: Refinable

NFT sector so far is dominated by platforms on Ethereum. There are new platforms invested by Binance that are beginning to launch.

Ethereum: Opensea, Rarible

Binance Smart Chain: Refinable

NFT sector so far is dominated by platforms on Ethereum. There are new platforms invested by Binance that are beginning to launch.

Refinable interests me because it is the first major NFT marketplace on Binance Smart Chain that Binance is directly investing in.

Will $FINE be a competitor to Rarible? time will tell.

Will $FINE be a competitor to Rarible? time will tell.

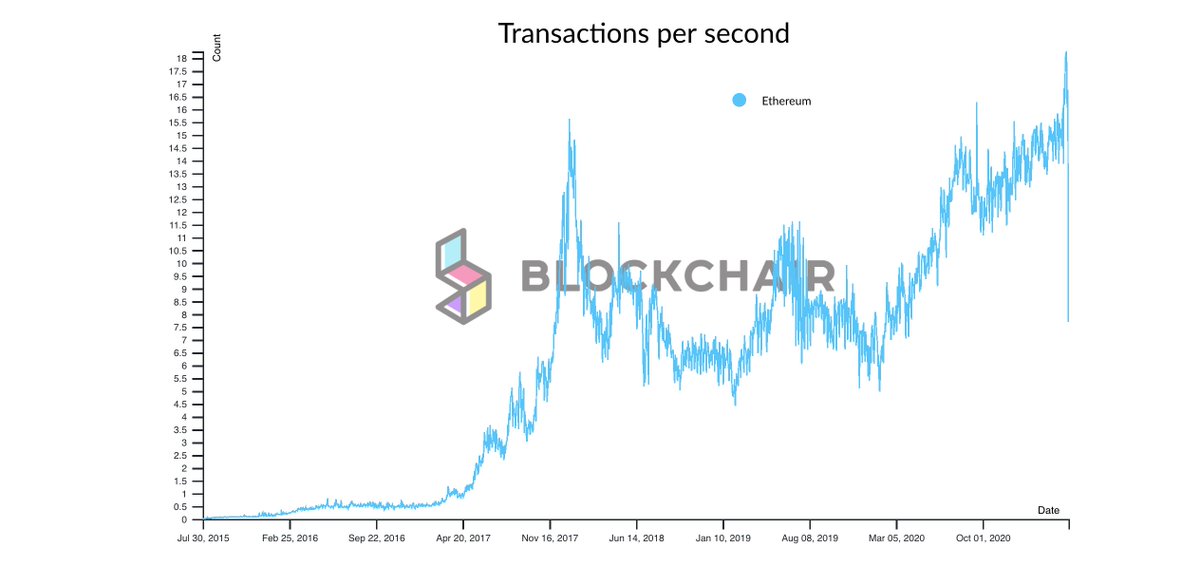

4. TX capacity

BSC currently processes a block every 3 seconds

Ethereum processes ~18 txs per second.

But, layer twos, like Optimism, would bring it to about 2k transactions per second for Ethereum.

BSC currently processes a block every 3 seconds

Ethereum processes ~18 txs per second.

But, layer twos, like Optimism, would bring it to about 2k transactions per second for Ethereum.

Conclusion:

Binance Smart Chain& #39;s metrics are not to scoff at.

There clearly is high user demand for it, and metrics point toward growing adoption in Asia.

I personally believe Ethereum would see a 2nd phase of growth after major layer twos start coming out. We will see.

Binance Smart Chain& #39;s metrics are not to scoff at.

There clearly is high user demand for it, and metrics point toward growing adoption in Asia.

I personally believe Ethereum would see a 2nd phase of growth after major layer twos start coming out. We will see.

Read on Twitter

Read on Twitter