What do the pledges from last week’s #LeadersClimateSummit mean for the future of natural gas?

An open-ended thread on what we know so far:

1/

An open-ended thread on what we know so far:

1/

Some starting points.

Natural gas is currently responsible for 22% of global CO2 emissions from energy, but is the world’s fastest growing fossil fuel.

https://www.globalcarbonproject.org/

2/">https://www.globalcarbonproject.org/">...

Natural gas is currently responsible for 22% of global CO2 emissions from energy, but is the world’s fastest growing fossil fuel.

https://www.globalcarbonproject.org/

2/">https://www.globalcarbonproject.org/">...

Natural gas demand is expected to grow strongly in BAU scenarios.

But in IPCC 1.5C scenarios with low-to-moderate BECCS and low overshoot, gas demand falls 20-25% by 2030 on current levels - and up to 74% by 2050.

3/

But in IPCC 1.5C scenarios with low-to-moderate BECCS and low overshoot, gas demand falls 20-25% by 2030 on current levels - and up to 74% by 2050.

3/

Despite this, only 2 leaders mentioned natural gas directly at the #LeadersClimateSummit.

Emissions pledges will shape gas demand, but this is not always explicit.

4/ https://twitter.com/ntsafos/status/1386702116132212736?s=20">https://twitter.com/ntsafos/s...

Emissions pledges will shape gas demand, but this is not always explicit.

4/ https://twitter.com/ntsafos/status/1386702116132212736?s=20">https://twitter.com/ntsafos/s...

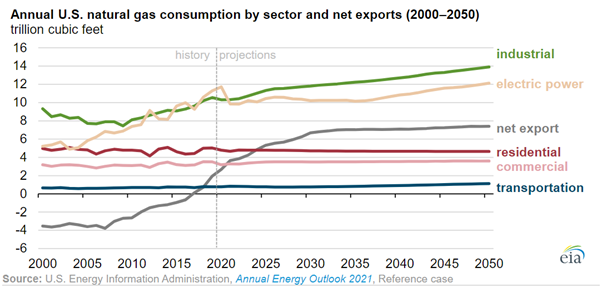

The return of the USA to climate action is big news for gas markets.

The US is the world’s largest producer *and* consumer of natural gas, and continued growth was projected.

5/

The US is the world’s largest producer *and* consumer of natural gas, and continued growth was projected.

5/

The US pledged a 50-52% GHG cut on 2005 levels by 2030.

This will put the squeeze on gas: it can’t be done through coal phaseout alone.

But I haven’t seen a good analysis yet of what the new target means for overall gas demand (hit me up in the replies if you have!)

6/

This will put the squeeze on gas: it can’t be done through coal phaseout alone.

But I haven’t seen a good analysis yet of what the new target means for overall gas demand (hit me up in the replies if you have!)

6/

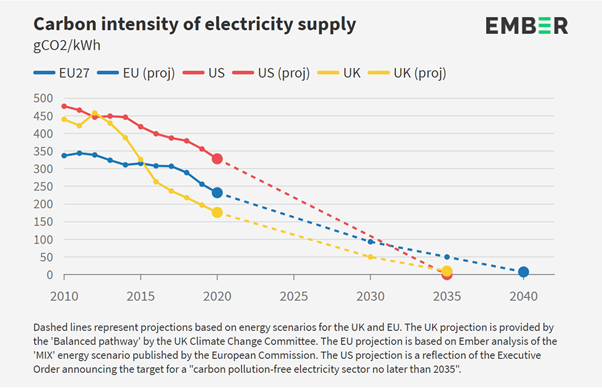

The power sector accounts for 39% of US gas demand.

The new US pledge for a zero carbon power system by 2035 means the bulk of that demand will disappear within 15 years. (Some residual gas demand for CCUS, tbc).

https://ember-climate.org/project/zero-carbon-power/

7/">https://ember-climate.org/project/z...

The new US pledge for a zero carbon power system by 2035 means the bulk of that demand will disappear within 15 years. (Some residual gas demand for CCUS, tbc).

https://ember-climate.org/project/zero-carbon-power/

7/">https://ember-climate.org/project/z...

The EU is the world& #39;s largest importer of natural gas.

The new 2030 55% GHG target enshrined in the EU climate law will imply a reduction in gas demand of around 36%, according to European Commission modelling.

8/

The new 2030 55% GHG target enshrined in the EU climate law will imply a reduction in gas demand of around 36%, according to European Commission modelling.

8/

The UK, previously a poster child for the & #39;dash for gas& #39;, announced a new target of a 78% GHG reduction by 2035.

According to @theCCCuk models, this means reducing overall UK gas demand by 49% on current levels by 2035 - even with CCS.

9/

According to @theCCCuk models, this means reducing overall UK gas demand by 49% on current levels by 2035 - even with CCS.

9/

Japan is the world& #39;s largest LNG importer. It announced a new target of a 43% reduction in GHGs over fiscal 2013.

Shifting away from coal will do the heaviest lifting, but the acceleration of renewables will limit space for new gas.

10/ https://asia.nikkei.com/Spotlight/Environment/Climate-Change/Japan-s-lofty-climate-pledge-demands-radical-energy-innovation">https://asia.nikkei.com/Spotlight...

Shifting away from coal will do the heaviest lifting, but the acceleration of renewables will limit space for new gas.

10/ https://asia.nikkei.com/Spotlight/Environment/Climate-Change/Japan-s-lofty-climate-pledge-demands-radical-energy-innovation">https://asia.nikkei.com/Spotlight...

Russia, the world& #39;s largest gas exporter, didn& #39;t promise much more, as expected.

Yet Putin was one of the few leaders to mention methane emissions. Is Russia starting to feel pressure on the environmental impact of its oil and gas production?

11/ http://en.kremlin.ru/events/president/news/65425">https://en.kremlin.ru/events/pr...

Yet Putin was one of the few leaders to mention methane emissions. Is Russia starting to feel pressure on the environmental impact of its oil and gas production?

11/ http://en.kremlin.ru/events/president/news/65425">https://en.kremlin.ru/events/pr...

China& #39;s new commitment to a “gradual decrease of coal consumption” from 2026-2030 could imply more gas in the near term.

But meeting China& #39;s net zero 2060 target means full power decarbonisation by 2050- within the lifetime of new gas infrastructure.

12/ https://www.newscientist.com/article/2275172-china-must-act-fast-to-avoid-breaching-the-worlds-1-5c-climate-goal/">https://www.newscientist.com/article/2...

But meeting China& #39;s net zero 2060 target means full power decarbonisation by 2050- within the lifetime of new gas infrastructure.

12/ https://www.newscientist.com/article/2275172-china-must-act-fast-to-avoid-breaching-the-worlds-1-5c-climate-goal/">https://www.newscientist.com/article/2...

Canada& #39;s commitment was "meh"

Australia& #39;s number-wangling was embarrassing

South Korea and South Africa are still working on their targets

India remained enigmatic

... so I haven& #39;t done the numbers on those countries yet.

13/

Australia& #39;s number-wangling was embarrassing

South Korea and South Africa are still working on their targets

India remained enigmatic

... so I haven& #39;t done the numbers on those countries yet.

13/

Big news on gas finance too.

The US was previously a funder of gas expansion across the world, recently including $5bn for the ill-fated Mozambique LNG project.

It is now "ending official international finance for carbon-intensive fossil fuel"

14/ https://twitter.com/adoukas/status/1385261967540109320?s=20">https://twitter.com/adoukas/s...

The US was previously a funder of gas expansion across the world, recently including $5bn for the ill-fated Mozambique LNG project.

It is now "ending official international finance for carbon-intensive fossil fuel"

14/ https://twitter.com/adoukas/status/1385261967540109320?s=20">https://twitter.com/adoukas/s...

This NRDC explainer of the new US finance announcements is worth a read:

https://www.nrdc.org/experts/han-chen/us-climate-finance-plan-restricts-fossil-fuel-finance

15/">https://www.nrdc.org/experts/h...

https://www.nrdc.org/experts/han-chen/us-climate-finance-plan-restricts-fossil-fuel-finance

15/">https://www.nrdc.org/experts/h...

The US announcement on ending international fossil finance follows similar decisions from the UK and EIB.

7 European countries also committed to aligning export credit with finance commitments, although their timelines still need work

16/ https://www.tresor.economie.gouv.fr/Articles/2021/04/14/seven-countries-launch-international-coalition-export-finance-for-future-e3f-to-align-export-finance-with-climate-objectives">https://www.tresor.economie.gouv.fr/Articles/...

7 European countries also committed to aligning export credit with finance commitments, although their timelines still need work

16/ https://www.tresor.economie.gouv.fr/Articles/2021/04/14/seven-countries-launch-international-coalition-export-finance-for-future-e3f-to-align-export-finance-with-climate-objectives">https://www.tresor.economie.gouv.fr/Articles/...

South Korea committed to (finally!) ending international finance for coal.

Expect them to come under pressure for their oil and gas financing next.

17/ https://twitter.com/LaurievdBurg/status/1385222259271471107?s=20">https://twitter.com/LaurievdB...

Expect them to come under pressure for their oil and gas financing next.

17/ https://twitter.com/LaurievdBurg/status/1385222259271471107?s=20">https://twitter.com/LaurievdB...

On the production side, US, Saudi, Qatar, Norway and Canada joined a new Net-Zero Producers Forum.

Together they represent 38% of global gas output - but it& #39;s still not clear what the initiative will entail.

18/ https://twitter.com/jonathangaventa/status/1385614094137495557?s=20">https://twitter.com/jonathang...

Together they represent 38% of global gas output - but it& #39;s still not clear what the initiative will entail.

18/ https://twitter.com/jonathangaventa/status/1385614094137495557?s=20">https://twitter.com/jonathang...

So in summary: despite the lack of explicit reference to natural gas, the outcome of the #LeadersClimateSummit implies a changing outlook for gas demand, finance and production.

Let me know in the replies if you know of other useful analysis.

19/

Let me know in the replies if you know of other useful analysis.

19/

Final thought: there was little coverage of the Leaders Climate Summit in the gas industry trade press. Much of the industry discounts these sorts of commitments anyway.

But if the pledges are in fact met or exceeded, many gas industry players could face a hard landing.

20/

But if the pledges are in fact met or exceeded, many gas industry players could face a hard landing.

20/

Read on Twitter

Read on Twitter