Video games are a billion-dollar business and have been for many years.

Play-to-earn games will be disruptive for the entire gaming industry.

I think @Illuvium and it& #39;s token $ILV will be one of them. /1

Play-to-earn games will be disruptive for the entire gaming industry.

I think @Illuvium and it& #39;s token $ILV will be one of them. /1

Illuvium is an RPG game where players travel to various regions of the world and

encounter creatures called Illuvials which they battle. By defeating them in combat the player has

the option of capturing them in Shards. /2

encounter creatures called Illuvials which they battle. By defeating them in combat the player has

the option of capturing them in Shards. /2

Players gradually build up a collection that grows in power

over time, which they can use to venture into more dangerous regions, or battle other players.

A portion of the $ILV will be distributed in-game for tournament battles, quests,

and daily challenges. /3

over time, which they can use to venture into more dangerous regions, or battle other players.

A portion of the $ILV will be distributed in-game for tournament battles, quests,

and daily challenges. /3

One of the primary issues NFT projects and users are currently facing is the cost of performing

transactions on the Ethereum network.

@Immutable X changes this, allowing users to trade their NFTs without paying gas fees using what

is known as a Zero-Knowledge (ZK) Rollup. /4

transactions on the Ethereum network.

@Immutable X changes this, allowing users to trade their NFTs without paying gas fees using what

is known as a Zero-Knowledge (ZK) Rollup. /4

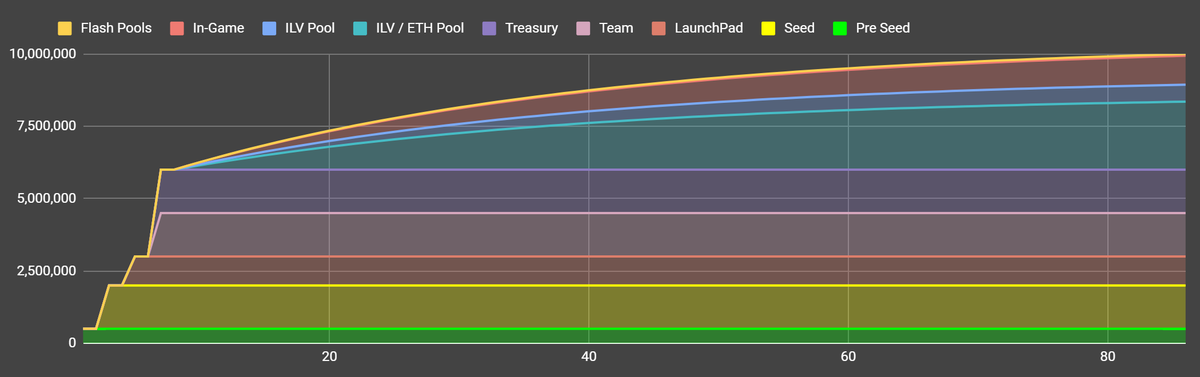

Tokenomy is a very important factor on the basis of which we invest in a given project or not

All tokens except those bought in the BLBP and In-Game Yield are subject to a 12 month lockup period.

It means that inflation does not exist for another year. /5

All tokens except those bought in the BLBP and In-Game Yield are subject to a 12 month lockup period.

It means that inflation does not exist for another year. /5

$ILV The holders will receive 100% of the profits generated by the game in the form of ILV.

These tokens will be bought from the market which means an endless demand for ILV.

Let& #39;s assume that in 5 years Illuvium will generate 1 billion profit. /6

These tokens will be bought from the market which means an endless demand for ILV.

Let& #39;s assume that in 5 years Illuvium will generate 1 billion profit. /6

For 5,000,000 million staked tokens, $ 1 ILV will generate an annual profit of

approximately 200$.

Now let& #39;s take a look at the profits made by other games. /7

approximately 200$.

Now let& #39;s take a look at the profits made by other games. /7

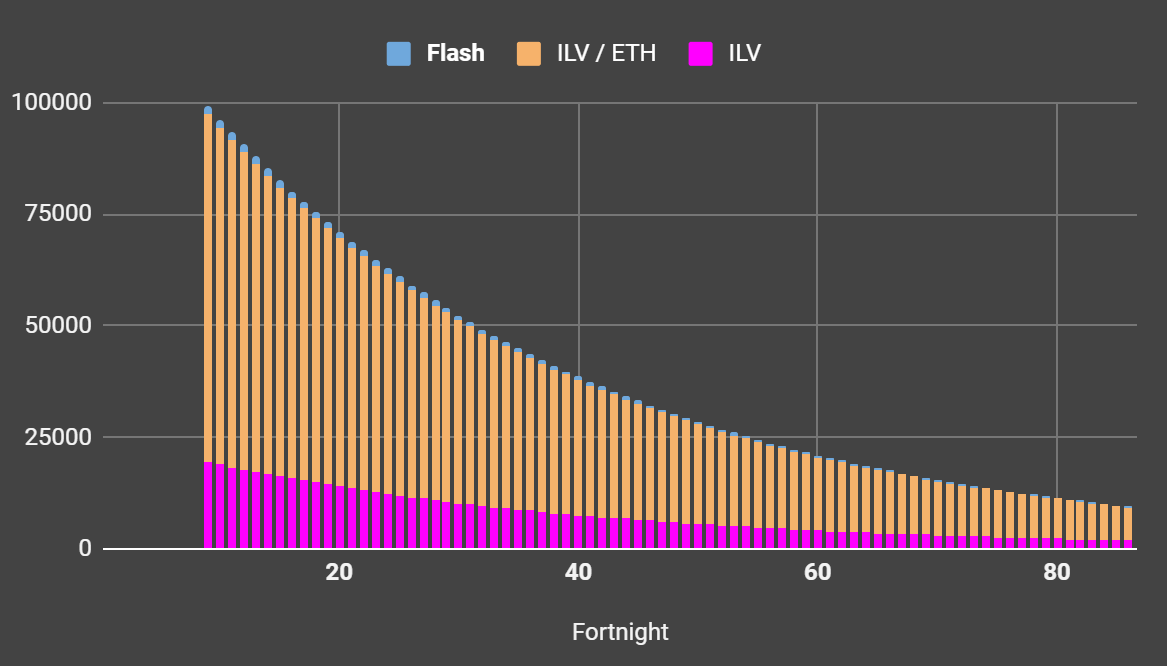

In addition, we will be able to stake $ILV and provide ETH / ILV liquidity.

Stakers have the option of locking their staked tokens on a sliding scale for

anything up to 12 months. /8

Stakers have the option of locking their staked tokens on a sliding scale for

anything up to 12 months. /8

If you choose to lock $ILV, you will earn more = less circulating supply for 1-12 months =

potential price increase.

Staking rewards will be locked for 12 months but we will be able to use them earlier

in the form of $sILV for in-game purchases. /9

potential price increase.

Staking rewards will be locked for 12 months but we will be able to use them earlier

in the form of $sILV for in-game purchases. /9

@Illuvium will be integrating @Chainlink’s Verifiable Randomness Function (VRF) to fairly distribute

rare promo NFTs to random users who participate in Illuvium’s upcoming $ILV yield farming program. /10

rare promo NFTs to random users who participate in Illuvium’s upcoming $ILV yield farming program. /10

Yield farmers will be able to earn $ILV token rewards for their liquidity contribution, as well as earn the chance to win rare promo NFTs. /11

The genesis of the Illuvium project was a desire to make a collectible NFT game that was open,

transparent, and governed by the community.

$ILV holders will govern and maintain the protocol, via the Illuvinati Council. /12

transparent, and governed by the community.

$ILV holders will govern and maintain the protocol, via the Illuvinati Council. /12

@KieranWarwick and @aaron_warwickare founders of @Illuvium. @kaiynne(founder of @Synthetix) is

their brother.

About 70 people are currently working on the @Illuvium, e.g @PrettyLarceny (Bioshock, the Last of Us) /13

their brother.

About 70 people are currently working on the @Illuvium, e.g @PrettyLarceny (Bioshock, the Last of Us) /13

@Illuvium partners consist of influential VC and crypto founder personalities @kaiynne of

@Synthetix, @StaniKulechov of @Aave, @k06a of 1inch, and @santiagoroel of ParaFi. /13

@Synthetix, @StaniKulechov of @Aave, @k06a of 1inch, and @santiagoroel of ParaFi. /13

“Our investors see the very real potential to make a quality product that will revolutionize

what we previously thought possible for a crypto game,” @Kieran says. /14

what we previously thought possible for a crypto game,” @Kieran says. /14

When it comes to price predictions, suppose that @Illuvium reaches the average market cap of

these 4 games.

@My Neighbor Alice ($ALICE) : $160,956,195

@The Sandbox ($SAND) : $350,465,571

@Axie Infinity ($AXIE) : $455,816,233

@Decentraland ($MANA) : $1,726,584,394 /15

these 4 games.

@My Neighbor Alice ($ALICE) : $160,956,195

@The Sandbox ($SAND) : $350,465,571

@Axie Infinity ($AXIE) : $455,816,233

@Decentraland ($MANA) : $1,726,584,394 /15

This means that the potential @ILLUVIUM market cap would be approx $673,455,250 with 1026$ per token.

All the tokens listed above are on the @Binance.

Now read what @Kieran wrote on the discord. /16

All the tokens listed above are on the @Binance.

Now read what @Kieran wrote on the discord. /16

I& #39;m bullish but DYOR.

I almost forgot, the community is very involved.

You should join us!

https://illuvium.io/ ">https://illuvium.io/">... - website.

https://bit.ly/3gHTIE4 ">https://bit.ly/3gHTIE4&q... - cinematic trailer.

https://discord.com/invite/T5pMyU8QtH">https://discord.com/invite/T5... - discord.

I almost forgot, the community is very involved.

You should join us!

https://illuvium.io/ ">https://illuvium.io/">... - website.

https://bit.ly/3gHTIE4 ">https://bit.ly/3gHTIE4&q... - cinematic trailer.

https://discord.com/invite/T5pMyU8QtH">https://discord.com/invite/T5... - discord.

Read on Twitter

Read on Twitter