In 2020, after failed winter rains, #Haryana #farmer Ramandeep, 34 renewed his contract with #Modi’s #PMFBY, hoping one of the world& #39;s largest crop-insurance schemes would protect him from hard times.

In the year of #Covid19, Ramandeep’s premium rose 2.5 times. As that happened, whiteflies destroyed much of the cotton harvest on his 1.5-acre farm. Drought claimed the rest. Like him, every farmer in his village of Kirtan suffered deep harvest losses.

Ramandeep said around 80% of his crop was lost. He was expecting Rs 26,000 per acre as compensation, by his understanding of #Modi’s insurance policy. However, @RelianceGenIn Insurance paid him 5 times less, Rs 4,600 per acre in February 2021.

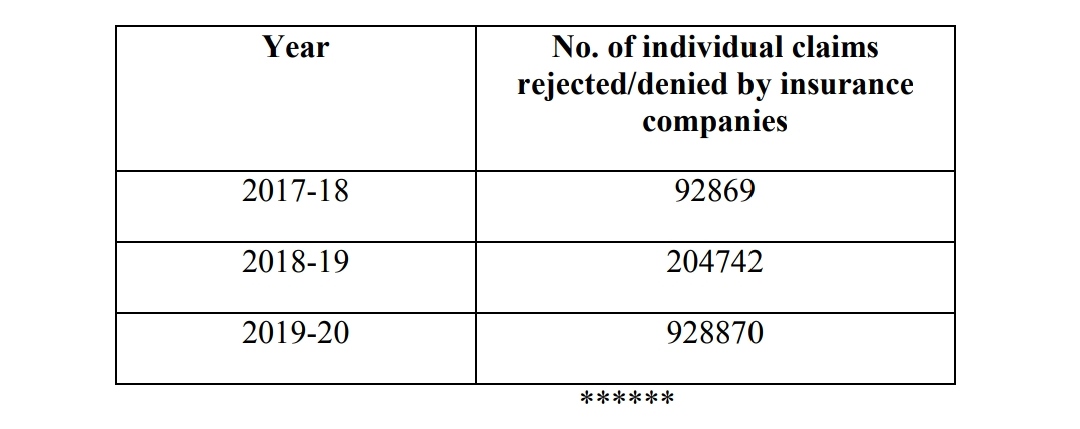

Ramandeep was not the only farmer to have got a fraction of the insurance amount. The claims of 928,870 farmers nationwide in 2019-2020 were rejected by insurance companies working with #PMFBY.

@RelianceGenIn did not give any official comments but approached me atleast nine times to know identification details of farmers quoted in the story including the address, bank accounts and Kisan Credit Card details.

A local reliance officer requesting anonymity told me that they calculated compensation based on data provided by the Haryana Agri dept which claims that farmers had just 200 kg of loss per acre. Whereas Ramandeep claims that he lost atleast 1000 Kgs. A discrepancy of 800 kgs.

Over 3 yrs to 2020, as the Indian farm crisis deepened, 18 insurance companies running Prime Minister Modi’s grand crop insurance scheme, PMFBY, rejected nearly a million claims and 8.4 million farmers dropped out in 2 years.

In this three-month-long investigation for @Article14live supported by the National Foundation for India ( @NFI_India ) I find out where 16,000 crores funded through taxpayers& #39; money go if farmers were not compensated for their loss under PMFBY. https://www.article-14.com/post/modi-s-grand-insurance-scheme-prioritises-profit-over-farm-losses">https://www.article-14.com/post/modi...

A big thank you to my mentor Mr Ram Mohan, @samar11 for being such an excellent editor, @nit_set, @birajpat and @NFI_India for unconditional support while reporting and @sayantanbera for helping me to understand this very very complex scheme.

Read on Twitter

Read on Twitter