𝐅𝐨𝐫𝐰𝐚𝐫𝐝  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚆" title="Zug" aria-label="Emoji: Zug">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚆" title="Zug" aria-label="Emoji: Zug">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥩" title="Stück Fleisch" aria-label="Emoji: Stück Fleisch"> In the advent of DeFI investors have found a new way to maximize their ROI by staking their assets for a high percentage return. This new trend has not come without risks though, and can cause maximum financial damage through an event called a "rug-pull".

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥩" title="Stück Fleisch" aria-label="Emoji: Stück Fleisch"> In the advent of DeFI investors have found a new way to maximize their ROI by staking their assets for a high percentage return. This new trend has not come without risks though, and can cause maximum financial damage through an event called a "rug-pull".

𝐅𝐨𝐫𝐰𝐚𝐫𝐝  https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪦" title="Headstone" aria-label="Emoji: Headstone"> A rug-pull means to take away the buying support or have the (DEX) liquidity pool suddenly taken away from a market. This sudden loss of liquidity results in a sell death spiral as other liquidity providers, holders & traders sell to salvage their holdings

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪦" title="Headstone" aria-label="Emoji: Headstone"> A rug-pull means to take away the buying support or have the (DEX) liquidity pool suddenly taken away from a market. This sudden loss of liquidity results in a sell death spiral as other liquidity providers, holders & traders sell to salvage their holdings

𝗠𝗶𝘀𝘀𝗶𝗼𝗻  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛩️" title="Kleines Flugzeug" aria-label="Emoji: Kleines Flugzeug">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛩️" title="Kleines Flugzeug" aria-label="Emoji: Kleines Flugzeug">

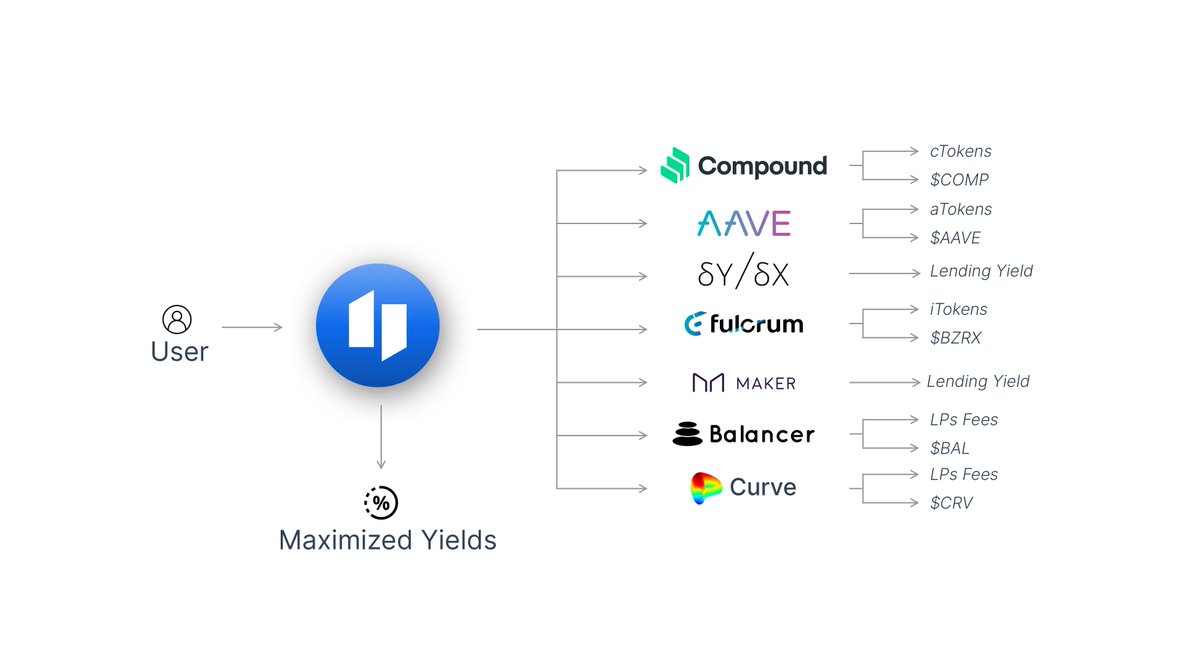

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔐" title="Geschlossenes Schloss mit Schlüssel" aria-label="Emoji: Geschlossenes Schloss mit Schlüssel">Idle wishes to unlock the power of decentralized finance for everyone with a single instrument, that automatically rebalances between underlying providers to always maintain the highest rates or the optimal risk/return allocation.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔐" title="Geschlossenes Schloss mit Schlüssel" aria-label="Emoji: Geschlossenes Schloss mit Schlüssel">Idle wishes to unlock the power of decentralized finance for everyone with a single instrument, that automatically rebalances between underlying providers to always maintain the highest rates or the optimal risk/return allocation.

𝗢𝘃𝗲𝗿𝘃𝗶𝗲𝘄  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎑" title="Tsukimi" aria-label="Emoji: Tsukimi">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎑" title="Tsukimi" aria-label="Emoji: Tsukimi">

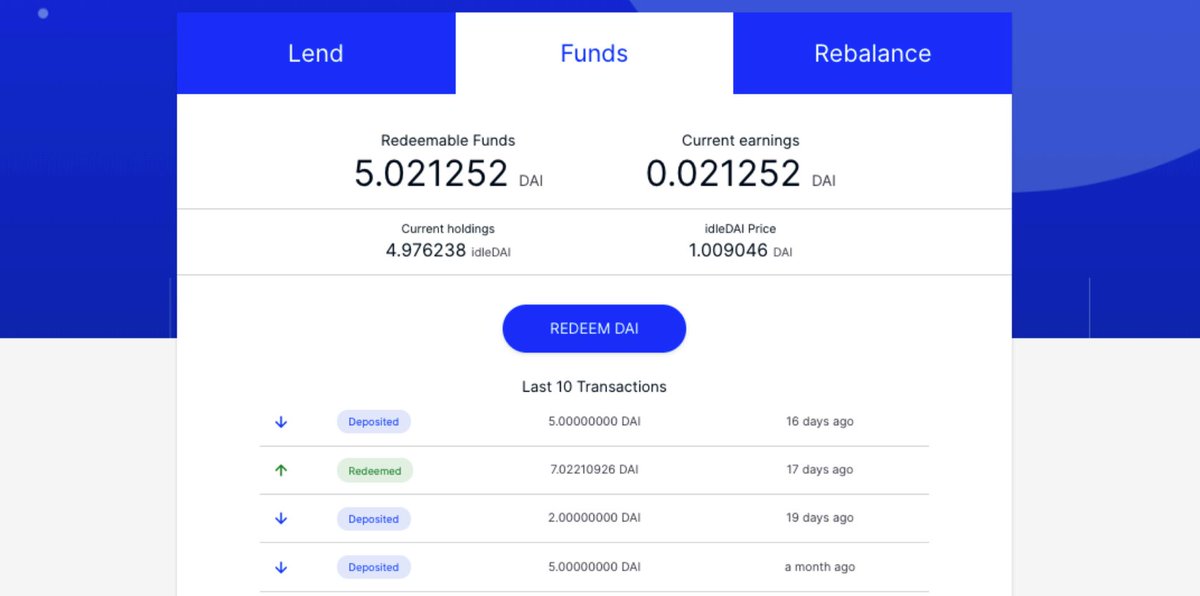

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏱️" title="Stoppuhr" aria-label="Emoji: Stoppuhr"> Idle Finance brings automatic asset allocation & aggregation to the interest-bearing tokens economy. It bundles stable crypto-assets (stablecoins) into tokenized baskets that are programmed to automatically rebalance based on different management logics

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏱️" title="Stoppuhr" aria-label="Emoji: Stoppuhr"> Idle Finance brings automatic asset allocation & aggregation to the interest-bearing tokens economy. It bundles stable crypto-assets (stablecoins) into tokenized baskets that are programmed to automatically rebalance based on different management logics

𝐈𝐝𝐥𝐞 𝐀𝐫𝐜𝐡𝐢𝐭𝐞𝐜𝐭𝐮𝐫𝐞  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏨" title="Hotel" aria-label="Emoji: Hotel">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏨" title="Hotel" aria-label="Emoji: Hotel">

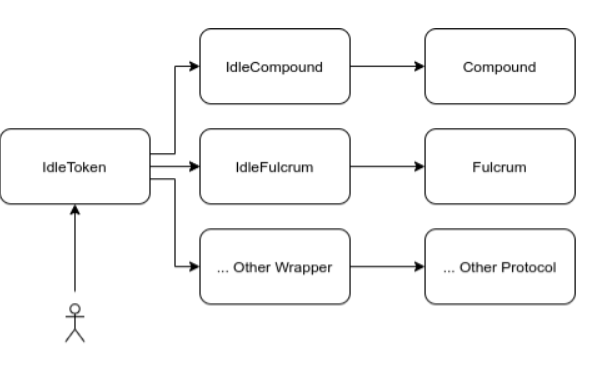

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💲" title="Fettes Dollarzeichen" aria-label="Emoji: Fettes Dollarzeichen">APR is constantly monitored along with the risk scores of every lending protocol. When new allocations can improve the main performance metric of the strategy chosen, Idle submits new allocations to the contract with our rebalance manager

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💲" title="Fettes Dollarzeichen" aria-label="Emoji: Fettes Dollarzeichen">APR is constantly monitored along with the risk scores of every lending protocol. When new allocations can improve the main performance metric of the strategy chosen, Idle submits new allocations to the contract with our rebalance manager

𝗔𝗹𝗹𝗼𝗰𝗮𝘁𝗶𝗼𝗻 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🖨️" title="Drucker" aria-label="Emoji: Drucker">It has its own set of tokens that represent a pool of yield-generating assets spread across many DeFi protocols. The tokens show investor’s proportional ownership of the pool & interest accrued. It allows Idle to be non-custodial

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🖨️" title="Drucker" aria-label="Emoji: Drucker">It has its own set of tokens that represent a pool of yield-generating assets spread across many DeFi protocols. The tokens show investor’s proportional ownership of the pool & interest accrued. It allows Idle to be non-custodial

𝗔𝗹𝗹𝗼𝗰𝗮𝘁𝗶𝗼𝗻 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔎" title="Nach rechts zeigende Lupe" aria-label="Emoji: Nach rechts zeigende Lupe">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔎" title="Nach rechts zeigende Lupe" aria-label="Emoji: Nach rechts zeigende Lupe">

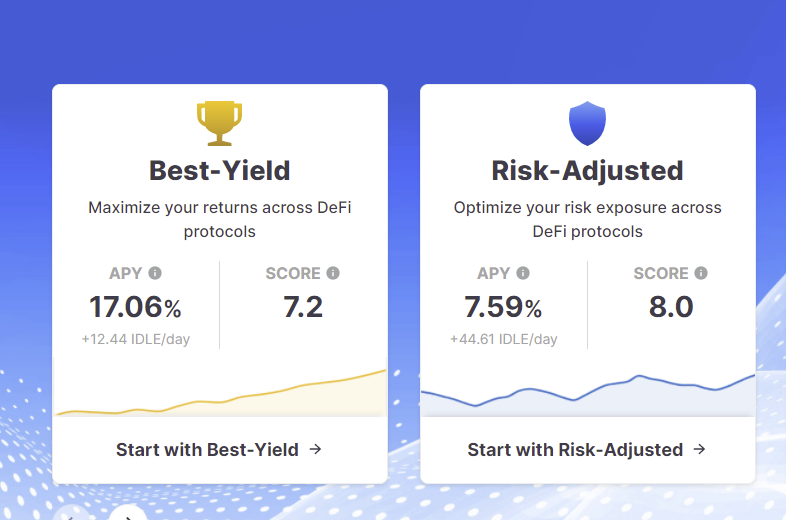

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💹" title="Tabelle mit Abwärtstrend und Yen-Zeichen" aria-label="Emoji: Tabelle mit Abwärtstrend und Yen-Zeichen">Best-Yield: this strategy combines multiple money markets to automatically provide the highest interest rates, smashing the best traditional offerings across interest-bearing tokens in DeFi.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💹" title="Tabelle mit Abwärtstrend und Yen-Zeichen" aria-label="Emoji: Tabelle mit Abwärtstrend und Yen-Zeichen">Best-Yield: this strategy combines multiple money markets to automatically provide the highest interest rates, smashing the best traditional offerings across interest-bearing tokens in DeFi.

𝗔𝗹𝗹𝗼𝗰𝗮𝘁𝗶𝗼𝗻 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆  https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💯" title="Hundert Punkte Symbol" aria-label="Emoji: Hundert Punkte Symbol">Risk-Adjusted: this strategy automatically changes the asset allocation in order to find the best mix between risk scores and yield.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💯" title="Hundert Punkte Symbol" aria-label="Emoji: Hundert Punkte Symbol">Risk-Adjusted: this strategy automatically changes the asset allocation in order to find the best mix between risk scores and yield.

𝗟𝗲𝗻𝗱𝗶𝗻𝗴 𝗣𝗿𝗼𝘃𝗶𝗱𝗲𝗿𝘀  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="☑️" title="Kästchen mit Häkchen" aria-label="Emoji: Kästchen mit Häkchen">If you are unfamiliar with the DeFi protocols below. they are some of the premier Bluechips in Crypto.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="☑️" title="Kästchen mit Häkchen" aria-label="Emoji: Kästchen mit Häkchen">If you are unfamiliar with the DeFi protocols below. they are some of the premier Bluechips in Crypto.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Compound

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Compound

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Fulcrum

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Fulcrum

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Aave

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Aave

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">DyDx

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">DyDx

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Maker DSR

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Maker DSR

𝐈𝐝𝐥𝐞& #39;𝐬 𝐍𝐞𝐰 𝐕𝟐 𝐁𝐚𝐥𝐚𝐧𝐜𝐞𝐫 𝐩𝐫𝐨𝐭𝐨𝐜𝐨𝐥  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Waage" aria-label="Emoji: Waage">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Waage" aria-label="Emoji: Waage">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏦" title="Bank" aria-label="Emoji: Bank">V2 introduces a new feature which allows asset Managers to release a portion of the funds from a liquidity pool to be lent out to lending providers to boost the yield for a LP pool. https://gov.idle.finance/t/balancer-v2-lending-provider-for-asset-managers/433">https://gov.idle.finance/t/balance...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏦" title="Bank" aria-label="Emoji: Bank">V2 introduces a new feature which allows asset Managers to release a portion of the funds from a liquidity pool to be lent out to lending providers to boost the yield for a LP pool. https://gov.idle.finance/t/balancer-v2-lending-provider-for-asset-managers/433">https://gov.idle.finance/t/balance...

𝐋𝐏 𝐒𝐭𝐚𝐤𝐢𝐧𝐠 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥩" title="Stück Fleisch" aria-label="Emoji: Stück Fleisch">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥩" title="Stück Fleisch" aria-label="Emoji: Stück Fleisch">

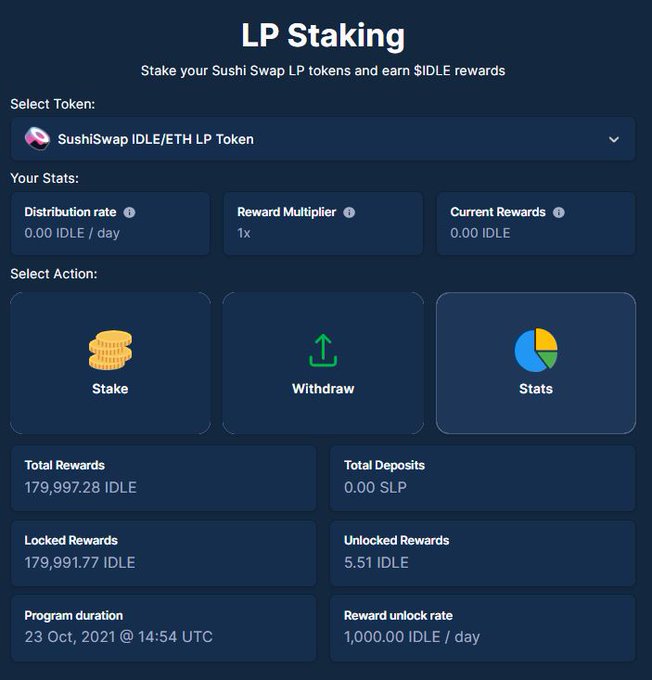

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥃" title="Tumblerglas" aria-label="Emoji: Tumblerglas">Is the process depositing and then the locking of assets on a DEX pool & earning rewards in return. They mint special tokens known as liquidity tokens and send them to the buyers address.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥃" title="Tumblerglas" aria-label="Emoji: Tumblerglas">Is the process depositing and then the locking of assets on a DEX pool & earning rewards in return. They mint special tokens known as liquidity tokens and send them to the buyers address.

𝐋𝐏 𝐒𝐭𝐚𝐤𝐢𝐧𝐠  https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📆" title="Abreißkalender" aria-label="Emoji: Abreißkalender">When a trade occurs, a percentage of a fee is distributed to all LPs in the pool at the moment of the trade. The current staking length is 6 months & most likely will be extended by the governance members. The current reward unlock rate 1,000 IDLE /day

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📆" title="Abreißkalender" aria-label="Emoji: Abreißkalender">When a trade occurs, a percentage of a fee is distributed to all LPs in the pool at the moment of the trade. The current staking length is 6 months & most likely will be extended by the governance members. The current reward unlock rate 1,000 IDLE /day

𝐋𝐏 𝐒𝐭𝐚𝐤𝐢𝐧𝐠  https://abs.twimg.com/emoji/v2/... draggable="false" alt="3⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="3⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⌚️" title="Armbanduhr" aria-label="Emoji: Armbanduhr">The rewards will be split between LP staking and Idle staking with a 50/50 ratio and a time lock as a reward. In the beginning we will incentivize LP staking over idle staking to get higher TVL on exchanges, but over time pivot to idle staking

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⌚️" title="Armbanduhr" aria-label="Emoji: Armbanduhr">The rewards will be split between LP staking and Idle staking with a 50/50 ratio and a time lock as a reward. In the beginning we will incentivize LP staking over idle staking to get higher TVL on exchanges, but over time pivot to idle staking

𝐒𝐦𝐚𝐫𝐭 𝐓𝐫𝐞𝐚𝐬𝐮𝐫𝐲  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

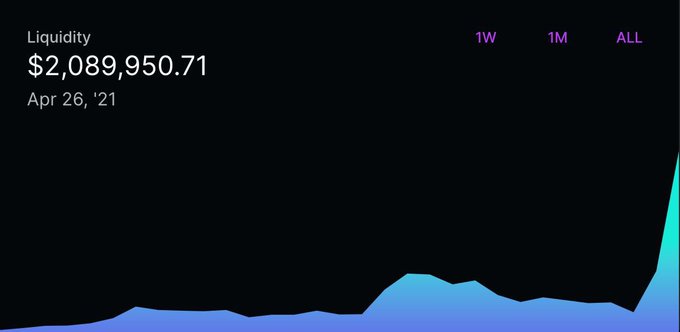

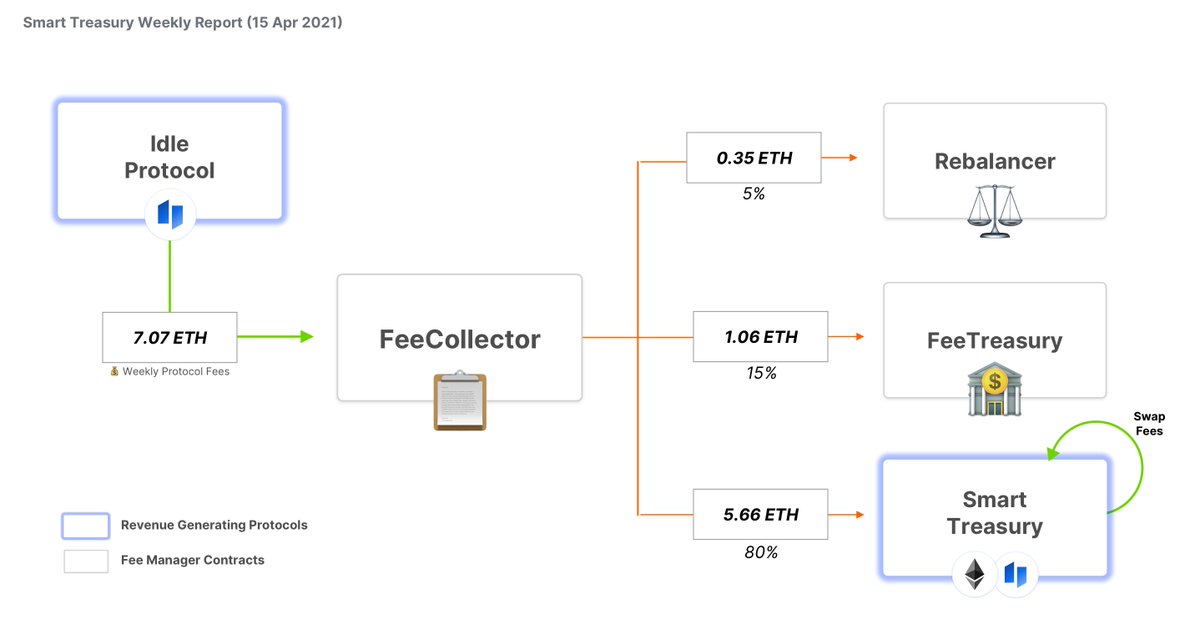

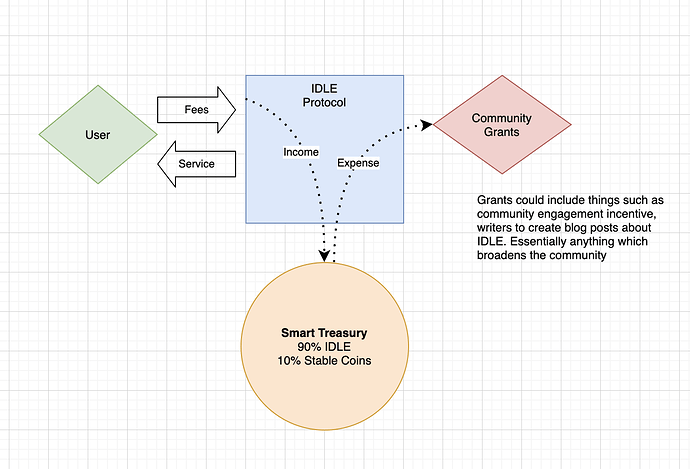

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛓️" title="Ketten" aria-label="Emoji: Ketten">In order to increase the on chain liquidity of the token, and to give the tokens economic value in the long term to its holders Idle has developed a Smart Treasury. Fees are generated from the protocol can be redirected into the balancer pool.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛓️" title="Ketten" aria-label="Emoji: Ketten">In order to increase the on chain liquidity of the token, and to give the tokens economic value in the long term to its holders Idle has developed a Smart Treasury. Fees are generated from the protocol can be redirected into the balancer pool.

𝐒𝐦𝐚𝐫𝐭 𝐓𝐫𝐞𝐚𝐬𝐮𝐫𝐲  https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔁" title="Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn" aria-label="Emoji: Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn"> The treasury acts as a buy back machine. The pool is available for investors to swap against, which increases on chain liquidity. The fees generated from swaps will be added to the pool, and becomes additional income for Idle.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔁" title="Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn" aria-label="Emoji: Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn"> The treasury acts as a buy back machine. The pool is available for investors to swap against, which increases on chain liquidity. The fees generated from swaps will be added to the pool, and becomes additional income for Idle.

𝐒𝐦𝐚𝐫𝐭 𝐓𝐫𝐞𝐚𝐬𝐮𝐫𝐲  https://abs.twimg.com/emoji/v2/... draggable="false" alt="3⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="3⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin"> This also makes Idle eligible for $BAL tokens which are held, or re-invested back into the treasury

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin"> This also makes Idle eligible for $BAL tokens which are held, or re-invested back into the treasury

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Parameters

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Parameters

Weights: 90/10

Tokens: Idle/WETH

Swapping fee 0.5%

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Fees

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Fees

80% to smart treasury

15%-to fee treasury

5%-to the idle rebalancer

Weights: 90/10

Tokens: Idle/WETH

Swapping fee 0.5%

80% to smart treasury

15%-to fee treasury

5%-to the idle rebalancer

𝗦𝗲𝗰𝘂𝗿𝗶𝘁𝘆 𝐀𝐮𝐝𝐢𝐭  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📋" title="Klemmbrett" aria-label="Emoji: Klemmbrett">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📋" title="Klemmbrett" aria-label="Emoji: Klemmbrett">

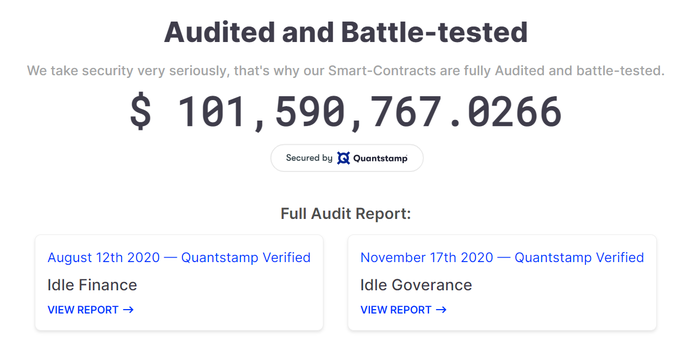

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔒" title="Schloss" aria-label="Emoji: Schloss"> Completed multiple & incremental security audits with Quantstamp in Dec. 2019 and April/May 2020. Due to their stringent security and partnering with protocols that have the same security, it makes it far less likely that they are rug-pulled

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔒" title="Schloss" aria-label="Emoji: Schloss"> Completed multiple & incremental security audits with Quantstamp in Dec. 2019 and April/May 2020. Due to their stringent security and partnering with protocols that have the same security, it makes it far less likely that they are rug-pulled

𝐂𝐮𝐬𝐝𝐨𝐭𝐲 𝐨𝐟 𝐀𝐬𝐬𝐞𝐬𝐭  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛃" title="Zoll" aria-label="Emoji: Zoll">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛃" title="Zoll" aria-label="Emoji: Zoll">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧾" title="Receipt" aria-label="Emoji: Receipt">Idle does not custody digital assets. Your digital assets are sent to a smart contract that Idle does not control. Only you have access to the contract. These accounts have balances for each asset that are lent out to underlying protocols.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧾" title="Receipt" aria-label="Emoji: Receipt">Idle does not custody digital assets. Your digital assets are sent to a smart contract that Idle does not control. Only you have access to the contract. These accounts have balances for each asset that are lent out to underlying protocols.

𝐆𝐨𝐯𝐞𝐫𝐧𝐚𝐧𝐜𝐞  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👨⚖️" title="Richter" aria-label="Emoji: Richter">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👨⚖️" title="Richter" aria-label="Emoji: Richter">

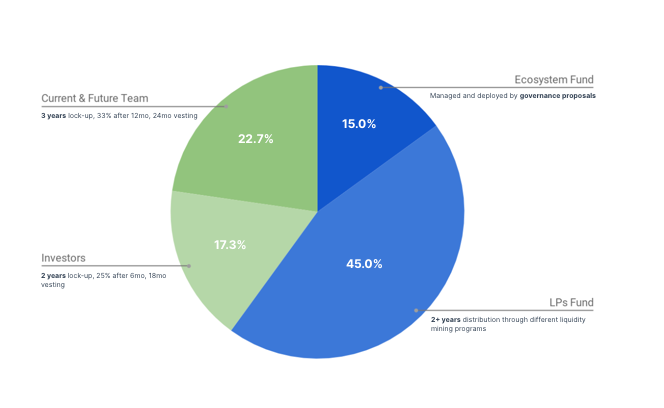

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">Idle has created an ideal structure for its holders to vote and decide as a community how the project progresses. It covers many areas such as:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">Idle has created an ideal structure for its holders to vote and decide as a community how the project progresses. It covers many areas such as:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗝️" title="Alter Schlüssel" aria-label="Emoji: Alter Schlüssel">Ecosystem Fund

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗝️" title="Alter Schlüssel" aria-label="Emoji: Alter Schlüssel">Ecosystem Fund

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Treasury Governance

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Treasury Governance

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗝️" title="Alter Schlüssel" aria-label="Emoji: Alter Schlüssel">LP& #39;s fund

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗝️" title="Alter Schlüssel" aria-label="Emoji: Alter Schlüssel">LP& #39;s fund

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Idle Allocation

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Idle Allocation

𝐑𝐨𝐚𝐝𝐦𝐚𝐩  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛣️" title="Autobahn" aria-label="Emoji: Autobahn">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛣️" title="Autobahn" aria-label="Emoji: Autobahn"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗺️" title="Weltkarte" aria-label="Emoji: Weltkarte">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗺️" title="Weltkarte" aria-label="Emoji: Weltkarte">

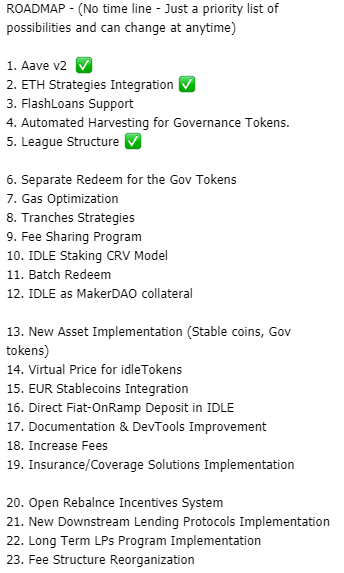

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">In no particular order or timeline. These are the ambitious things they are setting out to achieve.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">In no particular order or timeline. These are the ambitious things they are setting out to achieve.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">There are also discussions possible of flash loans.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">There are also discussions possible of flash loans.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Integrations with Yearn Finance has already begun.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Integrations with Yearn Finance has already begun.

𝐏𝐚𝐫𝐭𝐧𝐞𝐫𝐬𝐡𝐢𝐩𝐬  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤝" title="Handschlag" aria-label="Emoji: Handschlag">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤝" title="Handschlag" aria-label="Emoji: Handschlag">

𝐋𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👓" title="Brille" aria-label="Emoji: Brille">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👓" title="Brille" aria-label="Emoji: Brille">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">Samuele Cester, Co-Founder

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">Samuele Cester, Co-Founder

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎓" title="Doktorhut" aria-label="Emoji: Doktorhut">Max Planck, Computer engineering https://www.linkedin.com/in/samuele-cester-00755635/">https://www.linkedin.com/in/samuel...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎓" title="Doktorhut" aria-label="Emoji: Doktorhut">Max Planck, Computer engineering https://www.linkedin.com/in/samuele-cester-00755635/">https://www.linkedin.com/in/samuel...

𝐋𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩  https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">William Bergamo, Co-founder & CTO

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">William Bergamo, Co-founder & CTO

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎓" title="Doktorhut" aria-label="Emoji: Doktorhut">Università Ca& #39; Foscari Venezia, Bachelor& #39;s degree. Computer Science https://www.linkedin.com/in/william-bergamo-14822860/">https://www.linkedin.com/in/willia...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎓" title="Doktorhut" aria-label="Emoji: Doktorhut">Università Ca& #39; Foscari Venezia, Bachelor& #39;s degree. Computer Science https://www.linkedin.com/in/william-bergamo-14822860/">https://www.linkedin.com/in/willia...

𝐋𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩  https://abs.twimg.com/emoji/v2/... draggable="false" alt="3⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="3⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">Matteo Pandolfi, Financial Data Analyst and Blockchain Entrepreneur.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">Matteo Pandolfi, Financial Data Analyst and Blockchain Entrepreneur.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎓" title="Doktorhut" aria-label="Emoji: Doktorhut">Università Ca& #39; Foscari Venezia, Global Development and Entrepreneurship and FinanceGrade110L/110 https://www.linkedin.com/in/pandolfimatteo/">https://www.linkedin.com/in/pandol...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎓" title="Doktorhut" aria-label="Emoji: Doktorhut">Università Ca& #39; Foscari Venezia, Global Development and Entrepreneurship and FinanceGrade110L/110 https://www.linkedin.com/in/pandolfimatteo/">https://www.linkedin.com/in/pandol...

𝐋𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩  https://abs.twimg.com/emoji/v2/... draggable="false" alt="4⃣" title="Tastenkappe Ziffer 4" aria-label="Emoji: Tastenkappe Ziffer 4">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="4⃣" title="Tastenkappe Ziffer 4" aria-label="Emoji: Tastenkappe Ziffer 4">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">Davide Menegaldo, Forbes Under30 | Crypto Entrepreneur

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">Davide Menegaldo, Forbes Under30 | Crypto Entrepreneur

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎓" title="Doktorhut" aria-label="Emoji: Doktorhut">Politecnico di Torino, Laurea Specialistica, Ingegneria energetica e nucleare https://www.linkedin.com/in/davidemenegaldo/">https://www.linkedin.com/in/davide...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎓" title="Doktorhut" aria-label="Emoji: Doktorhut">Politecnico di Torino, Laurea Specialistica, Ingegneria energetica e nucleare https://www.linkedin.com/in/davidemenegaldo/">https://www.linkedin.com/in/davide...

𝐋𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩  https://abs.twimg.com/emoji/v2/... draggable="false" alt="5⃣" title="Tastenkappe Ziffer 5" aria-label="Emoji: Tastenkappe Ziffer 5">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="5⃣" title="Tastenkappe Ziffer 5" aria-label="Emoji: Tastenkappe Ziffer 5">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">Emiliano Palermo, Project Manager, Treasury Committee

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">Emiliano Palermo, Project Manager, Treasury Committee

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎓" title="Doktorhut" aria-label="Emoji: Doktorhut"> Questrom School of Business, Boston University,

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎓" title="Doktorhut" aria-label="Emoji: Doktorhut"> Questrom School of Business, Boston University,

MicroMasters, Digital Product Management https://www.linkedin.com/in/emiliano-palermo/">https://www.linkedin.com/in/emilia...

MicroMasters, Digital Product Management https://www.linkedin.com/in/emiliano-palermo/">https://www.linkedin.com/in/emilia...

𝐋𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩  https://abs.twimg.com/emoji/v2/... draggable="false" alt="6⃣" title="Tastenkappe Ziffer 6" aria-label="Emoji: Tastenkappe Ziffer 6">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="6⃣" title="Tastenkappe Ziffer 6" aria-label="Emoji: Tastenkappe Ziffer 6">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">Salomé Bernhart, Project Manager, Pilot League

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">Salomé Bernhart, Project Manager, Pilot League

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎓" title="Doktorhut" aria-label="Emoji: Doktorhut">University of Applied Sciences and Arts Northwestern Switzerland FHNW, Bachelor of Applied Science, Banking and Finance https://www.linkedin.com/in/salom%C3%A9-bernhart-77bbb614basel/">https://www.linkedin.com/in/salom%...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎓" title="Doktorhut" aria-label="Emoji: Doktorhut">University of Applied Sciences and Arts Northwestern Switzerland FHNW, Bachelor of Applied Science, Banking and Finance https://www.linkedin.com/in/salom%C3%A9-bernhart-77bbb614basel/">https://www.linkedin.com/in/salom%...

𝐂𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📖" title="Offenes Buch" aria-label="Emoji: Offenes Buch">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📖" title="Offenes Buch" aria-label="Emoji: Offenes Buch">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Schreibende Hand" aria-label="Emoji: Schreibende Hand"> This project is led by a team of what appears to be masterminds, from every sector one would need to launch a project into the stratosphere. It is no wonder there GitHub is flourishing and buzzing with excitement.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Schreibende Hand" aria-label="Emoji: Schreibende Hand"> This project is led by a team of what appears to be masterminds, from every sector one would need to launch a project into the stratosphere. It is no wonder there GitHub is flourishing and buzzing with excitement.

𝐂𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📖" title="Offenes Buch" aria-label="Emoji: Offenes Buch">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📖" title="Offenes Buch" aria-label="Emoji: Offenes Buch">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Schreibende Hand" aria-label="Emoji: Schreibende Hand">Idle is much further ahead of most of its competition, and have what appears to be one of the highest yield generating platforms, while also being the most secure in blockchain finance.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Schreibende Hand" aria-label="Emoji: Schreibende Hand">Idle is much further ahead of most of its competition, and have what appears to be one of the highest yield generating platforms, while also being the most secure in blockchain finance.

Tier https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥇" title="Goldmedaille" aria-label="Emoji: Goldmedaille">Gem

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥇" title="Goldmedaille" aria-label="Emoji: Goldmedaille">Gem

Tier

𝐑𝐞𝐟𝐞𝐫𝐞𝐧𝐜𝐞𝐬  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📜" title="Schriftrolle" aria-label="Emoji: Schriftrolle">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📜" title="Schriftrolle" aria-label="Emoji: Schriftrolle">

https://www.notion.so/ffe8115b7b53489ab0a7f84e656e4bb0?v=916250f54ff24daabad72cf095fd6d88

https://www.notion.so/ffe8115b7... href=" https://gov.idle.finance/t/balancer-v2-lending-provider-for-asset-managers/433

https://gov.idle.finance/t/balance... href=" https://idlefinance.medium.com/introducing-the-new-idle-governance-model-3409371c3fa0

https://idlefinance.medium.com/introduci... href=" https://gov.idle.finance/t/iip-2-add-a-smart-treasury-to-idle/211/22

https://gov.idle.finance/t/iip-2-a... href=" https://idle.finance/#/

https://idle.finance/... href=" https://certificate.quantstamp.com/full/idle-finance

https://certificate.quantstamp.com/full/idle... href=" https://duneanalytics.com/aaaaaaaaaa/idle-v4">https://duneanalytics.com/aaaaaaaaa...

https://www.notion.so/ffe8115b7b53489ab0a7f84e656e4bb0?v=916250f54ff24daabad72cf095fd6d88

@threader_app compile

Read on Twitter

Read on Twitter 𝐈𝐝𝐥𝐞 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏦" title="Bank" aria-label="Emoji: Bank"> $IDLEhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚍" title="Entgegenkommender Bus" aria-label="Emoji: Entgegenkommender Bus"> A rebalancing protocol that allows users to manage their digital assetshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚘" title="Entgegenkommendes Auto" aria-label="Emoji: Entgegenkommendes Auto"> Assets connect with Compound, Aave, dYdX, & Fulcrum https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚖" title="Entgegenkommendes Taxi" aria-label="Emoji: Entgegenkommendes Taxi"> Likely the most secure DeFi protocol that exists https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚔" title="Entgegenkommender Polizeiwagen" aria-label="Emoji: Entgegenkommender Polizeiwagen"> Has a Superior smart treasury with very high yields" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏦" title="Bank" aria-label="Emoji: Bank"> 𝐈𝐝𝐥𝐞 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏦" title="Bank" aria-label="Emoji: Bank"> $IDLEhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚍" title="Entgegenkommender Bus" aria-label="Emoji: Entgegenkommender Bus"> A rebalancing protocol that allows users to manage their digital assetshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚘" title="Entgegenkommendes Auto" aria-label="Emoji: Entgegenkommendes Auto"> Assets connect with Compound, Aave, dYdX, & Fulcrum https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚖" title="Entgegenkommendes Taxi" aria-label="Emoji: Entgegenkommendes Taxi"> Likely the most secure DeFi protocol that exists https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚔" title="Entgegenkommender Polizeiwagen" aria-label="Emoji: Entgegenkommender Polizeiwagen"> Has a Superior smart treasury with very high yields" class="img-responsive" style="max-width:100%;"/>

𝐈𝐝𝐥𝐞 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏦" title="Bank" aria-label="Emoji: Bank"> $IDLEhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚍" title="Entgegenkommender Bus" aria-label="Emoji: Entgegenkommender Bus"> A rebalancing protocol that allows users to manage their digital assetshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚘" title="Entgegenkommendes Auto" aria-label="Emoji: Entgegenkommendes Auto"> Assets connect with Compound, Aave, dYdX, & Fulcrum https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚖" title="Entgegenkommendes Taxi" aria-label="Emoji: Entgegenkommendes Taxi"> Likely the most secure DeFi protocol that exists https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚔" title="Entgegenkommender Polizeiwagen" aria-label="Emoji: Entgegenkommender Polizeiwagen"> Has a Superior smart treasury with very high yields" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏦" title="Bank" aria-label="Emoji: Bank"> 𝐈𝐝𝐥𝐞 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏦" title="Bank" aria-label="Emoji: Bank"> $IDLEhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚍" title="Entgegenkommender Bus" aria-label="Emoji: Entgegenkommender Bus"> A rebalancing protocol that allows users to manage their digital assetshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚘" title="Entgegenkommendes Auto" aria-label="Emoji: Entgegenkommendes Auto"> Assets connect with Compound, Aave, dYdX, & Fulcrum https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚖" title="Entgegenkommendes Taxi" aria-label="Emoji: Entgegenkommendes Taxi"> Likely the most secure DeFi protocol that exists https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚔" title="Entgegenkommender Polizeiwagen" aria-label="Emoji: Entgegenkommender Polizeiwagen"> Has a Superior smart treasury with very high yields" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥩" title="Stück Fleisch" aria-label="Emoji: Stück Fleisch"> In the advent of DeFI investors have found a new way to maximize their ROI by staking their assets for a high percentage return. This new trend has not come without risks though, and can cause maximum financial damage through an event called a "rug-pull"." title="𝐅𝐨𝐫𝐰𝐚𝐫𝐝 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚆" title="Zug" aria-label="Emoji: Zug">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥩" title="Stück Fleisch" aria-label="Emoji: Stück Fleisch"> In the advent of DeFI investors have found a new way to maximize their ROI by staking their assets for a high percentage return. This new trend has not come without risks though, and can cause maximum financial damage through an event called a "rug-pull"." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥩" title="Stück Fleisch" aria-label="Emoji: Stück Fleisch"> In the advent of DeFI investors have found a new way to maximize their ROI by staking their assets for a high percentage return. This new trend has not come without risks though, and can cause maximum financial damage through an event called a "rug-pull"." title="𝐅𝐨𝐫𝐰𝐚𝐫𝐝 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚆" title="Zug" aria-label="Emoji: Zug">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥩" title="Stück Fleisch" aria-label="Emoji: Stück Fleisch"> In the advent of DeFI investors have found a new way to maximize their ROI by staking their assets for a high percentage return. This new trend has not come without risks though, and can cause maximum financial damage through an event called a "rug-pull"." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪦" title="Headstone" aria-label="Emoji: Headstone"> A rug-pull means to take away the buying support or have the (DEX) liquidity pool suddenly taken away from a market. This sudden loss of liquidity results in a sell death spiral as other liquidity providers, holders & traders sell to salvage their holdings" title="𝐅𝐨𝐫𝐰𝐚𝐫𝐝 https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪦" title="Headstone" aria-label="Emoji: Headstone"> A rug-pull means to take away the buying support or have the (DEX) liquidity pool suddenly taken away from a market. This sudden loss of liquidity results in a sell death spiral as other liquidity providers, holders & traders sell to salvage their holdings" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪦" title="Headstone" aria-label="Emoji: Headstone"> A rug-pull means to take away the buying support or have the (DEX) liquidity pool suddenly taken away from a market. This sudden loss of liquidity results in a sell death spiral as other liquidity providers, holders & traders sell to salvage their holdings" title="𝐅𝐨𝐫𝐰𝐚𝐫𝐝 https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪦" title="Headstone" aria-label="Emoji: Headstone"> A rug-pull means to take away the buying support or have the (DEX) liquidity pool suddenly taken away from a market. This sudden loss of liquidity results in a sell death spiral as other liquidity providers, holders & traders sell to salvage their holdings" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔐" title="Geschlossenes Schloss mit Schlüssel" aria-label="Emoji: Geschlossenes Schloss mit Schlüssel">Idle wishes to unlock the power of decentralized finance for everyone with a single instrument, that automatically rebalances between underlying providers to always maintain the highest rates or the optimal risk/return allocation." title="𝗠𝗶𝘀𝘀𝗶𝗼𝗻 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛩️" title="Kleines Flugzeug" aria-label="Emoji: Kleines Flugzeug">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔐" title="Geschlossenes Schloss mit Schlüssel" aria-label="Emoji: Geschlossenes Schloss mit Schlüssel">Idle wishes to unlock the power of decentralized finance for everyone with a single instrument, that automatically rebalances between underlying providers to always maintain the highest rates or the optimal risk/return allocation." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔐" title="Geschlossenes Schloss mit Schlüssel" aria-label="Emoji: Geschlossenes Schloss mit Schlüssel">Idle wishes to unlock the power of decentralized finance for everyone with a single instrument, that automatically rebalances between underlying providers to always maintain the highest rates or the optimal risk/return allocation." title="𝗠𝗶𝘀𝘀𝗶𝗼𝗻 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛩️" title="Kleines Flugzeug" aria-label="Emoji: Kleines Flugzeug">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔐" title="Geschlossenes Schloss mit Schlüssel" aria-label="Emoji: Geschlossenes Schloss mit Schlüssel">Idle wishes to unlock the power of decentralized finance for everyone with a single instrument, that automatically rebalances between underlying providers to always maintain the highest rates or the optimal risk/return allocation." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏱️" title="Stoppuhr" aria-label="Emoji: Stoppuhr"> Idle Finance brings automatic asset allocation & aggregation to the interest-bearing tokens economy. It bundles stable crypto-assets (stablecoins) into tokenized baskets that are programmed to automatically rebalance based on different management logics" title="𝗢𝘃𝗲𝗿𝘃𝗶𝗲𝘄 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎑" title="Tsukimi" aria-label="Emoji: Tsukimi">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏱️" title="Stoppuhr" aria-label="Emoji: Stoppuhr"> Idle Finance brings automatic asset allocation & aggregation to the interest-bearing tokens economy. It bundles stable crypto-assets (stablecoins) into tokenized baskets that are programmed to automatically rebalance based on different management logics" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏱️" title="Stoppuhr" aria-label="Emoji: Stoppuhr"> Idle Finance brings automatic asset allocation & aggregation to the interest-bearing tokens economy. It bundles stable crypto-assets (stablecoins) into tokenized baskets that are programmed to automatically rebalance based on different management logics" title="𝗢𝘃𝗲𝗿𝘃𝗶𝗲𝘄 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎑" title="Tsukimi" aria-label="Emoji: Tsukimi">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏱️" title="Stoppuhr" aria-label="Emoji: Stoppuhr"> Idle Finance brings automatic asset allocation & aggregation to the interest-bearing tokens economy. It bundles stable crypto-assets (stablecoins) into tokenized baskets that are programmed to automatically rebalance based on different management logics" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💲" title="Fettes Dollarzeichen" aria-label="Emoji: Fettes Dollarzeichen">APR is constantly monitored along with the risk scores of every lending protocol. When new allocations can improve the main performance metric of the strategy chosen, Idle submits new allocations to the contract with our rebalance manager" title="𝐈𝐝𝐥𝐞 𝐀𝐫𝐜𝐡𝐢𝐭𝐞𝐜𝐭𝐮𝐫𝐞 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏨" title="Hotel" aria-label="Emoji: Hotel">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💲" title="Fettes Dollarzeichen" aria-label="Emoji: Fettes Dollarzeichen">APR is constantly monitored along with the risk scores of every lending protocol. When new allocations can improve the main performance metric of the strategy chosen, Idle submits new allocations to the contract with our rebalance manager" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💲" title="Fettes Dollarzeichen" aria-label="Emoji: Fettes Dollarzeichen">APR is constantly monitored along with the risk scores of every lending protocol. When new allocations can improve the main performance metric of the strategy chosen, Idle submits new allocations to the contract with our rebalance manager" title="𝐈𝐝𝐥𝐞 𝐀𝐫𝐜𝐡𝐢𝐭𝐞𝐜𝐭𝐮𝐫𝐞 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏨" title="Hotel" aria-label="Emoji: Hotel">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💲" title="Fettes Dollarzeichen" aria-label="Emoji: Fettes Dollarzeichen">APR is constantly monitored along with the risk scores of every lending protocol. When new allocations can improve the main performance metric of the strategy chosen, Idle submits new allocations to the contract with our rebalance manager" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🖨️" title="Drucker" aria-label="Emoji: Drucker">It has its own set of tokens that represent a pool of yield-generating assets spread across many DeFi protocols. The tokens show investor’s proportional ownership of the pool & interest accrued. It allows Idle to be non-custodial" title="𝗔𝗹𝗹𝗼𝗰𝗮𝘁𝗶𝗼𝗻 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🖨️" title="Drucker" aria-label="Emoji: Drucker">It has its own set of tokens that represent a pool of yield-generating assets spread across many DeFi protocols. The tokens show investor’s proportional ownership of the pool & interest accrued. It allows Idle to be non-custodial" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🖨️" title="Drucker" aria-label="Emoji: Drucker">It has its own set of tokens that represent a pool of yield-generating assets spread across many DeFi protocols. The tokens show investor’s proportional ownership of the pool & interest accrued. It allows Idle to be non-custodial" title="𝗔𝗹𝗹𝗼𝗰𝗮𝘁𝗶𝗼𝗻 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🖨️" title="Drucker" aria-label="Emoji: Drucker">It has its own set of tokens that represent a pool of yield-generating assets spread across many DeFi protocols. The tokens show investor’s proportional ownership of the pool & interest accrued. It allows Idle to be non-custodial" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💹" title="Tabelle mit Abwärtstrend und Yen-Zeichen" aria-label="Emoji: Tabelle mit Abwärtstrend und Yen-Zeichen">Best-Yield: this strategy combines multiple money markets to automatically provide the highest interest rates, smashing the best traditional offerings across interest-bearing tokens in DeFi." title="𝗔𝗹𝗹𝗼𝗰𝗮𝘁𝗶𝗼𝗻 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔎" title="Nach rechts zeigende Lupe" aria-label="Emoji: Nach rechts zeigende Lupe">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💹" title="Tabelle mit Abwärtstrend und Yen-Zeichen" aria-label="Emoji: Tabelle mit Abwärtstrend und Yen-Zeichen">Best-Yield: this strategy combines multiple money markets to automatically provide the highest interest rates, smashing the best traditional offerings across interest-bearing tokens in DeFi." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💹" title="Tabelle mit Abwärtstrend und Yen-Zeichen" aria-label="Emoji: Tabelle mit Abwärtstrend und Yen-Zeichen">Best-Yield: this strategy combines multiple money markets to automatically provide the highest interest rates, smashing the best traditional offerings across interest-bearing tokens in DeFi." title="𝗔𝗹𝗹𝗼𝗰𝗮𝘁𝗶𝗼𝗻 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔎" title="Nach rechts zeigende Lupe" aria-label="Emoji: Nach rechts zeigende Lupe">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💹" title="Tabelle mit Abwärtstrend und Yen-Zeichen" aria-label="Emoji: Tabelle mit Abwärtstrend und Yen-Zeichen">Best-Yield: this strategy combines multiple money markets to automatically provide the highest interest rates, smashing the best traditional offerings across interest-bearing tokens in DeFi." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💯" title="Hundert Punkte Symbol" aria-label="Emoji: Hundert Punkte Symbol">Risk-Adjusted: this strategy automatically changes the asset allocation in order to find the best mix between risk scores and yield." title="𝗔𝗹𝗹𝗼𝗰𝗮𝘁𝗶𝗼𝗻 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆 https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💯" title="Hundert Punkte Symbol" aria-label="Emoji: Hundert Punkte Symbol">Risk-Adjusted: this strategy automatically changes the asset allocation in order to find the best mix between risk scores and yield." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💯" title="Hundert Punkte Symbol" aria-label="Emoji: Hundert Punkte Symbol">Risk-Adjusted: this strategy automatically changes the asset allocation in order to find the best mix between risk scores and yield." title="𝗔𝗹𝗹𝗼𝗰𝗮𝘁𝗶𝗼𝗻 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆 https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💯" title="Hundert Punkte Symbol" aria-label="Emoji: Hundert Punkte Symbol">Risk-Adjusted: this strategy automatically changes the asset allocation in order to find the best mix between risk scores and yield." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥃" title="Tumblerglas" aria-label="Emoji: Tumblerglas">Is the process depositing and then the locking of assets on a DEX pool & earning rewards in return. They mint special tokens known as liquidity tokens and send them to the buyers address." title="𝐋𝐏 𝐒𝐭𝐚𝐤𝐢𝐧𝐠https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥩" title="Stück Fleisch" aria-label="Emoji: Stück Fleisch">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥃" title="Tumblerglas" aria-label="Emoji: Tumblerglas">Is the process depositing and then the locking of assets on a DEX pool & earning rewards in return. They mint special tokens known as liquidity tokens and send them to the buyers address." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥃" title="Tumblerglas" aria-label="Emoji: Tumblerglas">Is the process depositing and then the locking of assets on a DEX pool & earning rewards in return. They mint special tokens known as liquidity tokens and send them to the buyers address." title="𝐋𝐏 𝐒𝐭𝐚𝐤𝐢𝐧𝐠https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥩" title="Stück Fleisch" aria-label="Emoji: Stück Fleisch">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥃" title="Tumblerglas" aria-label="Emoji: Tumblerglas">Is the process depositing and then the locking of assets on a DEX pool & earning rewards in return. They mint special tokens known as liquidity tokens and send them to the buyers address." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📆" title="Abreißkalender" aria-label="Emoji: Abreißkalender">When a trade occurs, a percentage of a fee is distributed to all LPs in the pool at the moment of the trade. The current staking length is 6 months & most likely will be extended by the governance members. The current reward unlock rate 1,000 IDLE /day" title="𝐋𝐏 𝐒𝐭𝐚𝐤𝐢𝐧𝐠 https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📆" title="Abreißkalender" aria-label="Emoji: Abreißkalender">When a trade occurs, a percentage of a fee is distributed to all LPs in the pool at the moment of the trade. The current staking length is 6 months & most likely will be extended by the governance members. The current reward unlock rate 1,000 IDLE /day" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📆" title="Abreißkalender" aria-label="Emoji: Abreißkalender">When a trade occurs, a percentage of a fee is distributed to all LPs in the pool at the moment of the trade. The current staking length is 6 months & most likely will be extended by the governance members. The current reward unlock rate 1,000 IDLE /day" title="𝐋𝐏 𝐒𝐭𝐚𝐤𝐢𝐧𝐠 https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📆" title="Abreißkalender" aria-label="Emoji: Abreißkalender">When a trade occurs, a percentage of a fee is distributed to all LPs in the pool at the moment of the trade. The current staking length is 6 months & most likely will be extended by the governance members. The current reward unlock rate 1,000 IDLE /day" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⌚️" title="Armbanduhr" aria-label="Emoji: Armbanduhr">The rewards will be split between LP staking and Idle staking with a 50/50 ratio and a time lock as a reward. In the beginning we will incentivize LP staking over idle staking to get higher TVL on exchanges, but over time pivot to idle staking" title="𝐋𝐏 𝐒𝐭𝐚𝐤𝐢𝐧𝐠 https://abs.twimg.com/emoji/v2/... draggable="false" alt="3⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⌚️" title="Armbanduhr" aria-label="Emoji: Armbanduhr">The rewards will be split between LP staking and Idle staking with a 50/50 ratio and a time lock as a reward. In the beginning we will incentivize LP staking over idle staking to get higher TVL on exchanges, but over time pivot to idle staking" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⌚️" title="Armbanduhr" aria-label="Emoji: Armbanduhr">The rewards will be split between LP staking and Idle staking with a 50/50 ratio and a time lock as a reward. In the beginning we will incentivize LP staking over idle staking to get higher TVL on exchanges, but over time pivot to idle staking" title="𝐋𝐏 𝐒𝐭𝐚𝐤𝐢𝐧𝐠 https://abs.twimg.com/emoji/v2/... draggable="false" alt="3⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⌚️" title="Armbanduhr" aria-label="Emoji: Armbanduhr">The rewards will be split between LP staking and Idle staking with a 50/50 ratio and a time lock as a reward. In the beginning we will incentivize LP staking over idle staking to get higher TVL on exchanges, but over time pivot to idle staking" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛓️" title="Ketten" aria-label="Emoji: Ketten">In order to increase the on chain liquidity of the token, and to give the tokens economic value in the long term to its holders Idle has developed a Smart Treasury. Fees are generated from the protocol can be redirected into the balancer pool." title="𝐒𝐦𝐚𝐫𝐭 𝐓𝐫𝐞𝐚𝐬𝐮𝐫𝐲 https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛓️" title="Ketten" aria-label="Emoji: Ketten">In order to increase the on chain liquidity of the token, and to give the tokens economic value in the long term to its holders Idle has developed a Smart Treasury. Fees are generated from the protocol can be redirected into the balancer pool." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛓️" title="Ketten" aria-label="Emoji: Ketten">In order to increase the on chain liquidity of the token, and to give the tokens economic value in the long term to its holders Idle has developed a Smart Treasury. Fees are generated from the protocol can be redirected into the balancer pool." title="𝐒𝐦𝐚𝐫𝐭 𝐓𝐫𝐞𝐚𝐬𝐮𝐫𝐲 https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛓️" title="Ketten" aria-label="Emoji: Ketten">In order to increase the on chain liquidity of the token, and to give the tokens economic value in the long term to its holders Idle has developed a Smart Treasury. Fees are generated from the protocol can be redirected into the balancer pool." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔁" title="Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn" aria-label="Emoji: Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn"> The treasury acts as a buy back machine. The pool is available for investors to swap against, which increases on chain liquidity. The fees generated from swaps will be added to the pool, and becomes additional income for Idle." title="𝐒𝐦𝐚𝐫𝐭 𝐓𝐫𝐞𝐚𝐬𝐮𝐫𝐲 https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔁" title="Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn" aria-label="Emoji: Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn"> The treasury acts as a buy back machine. The pool is available for investors to swap against, which increases on chain liquidity. The fees generated from swaps will be added to the pool, and becomes additional income for Idle." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔁" title="Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn" aria-label="Emoji: Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn"> The treasury acts as a buy back machine. The pool is available for investors to swap against, which increases on chain liquidity. The fees generated from swaps will be added to the pool, and becomes additional income for Idle." title="𝐒𝐦𝐚𝐫𝐭 𝐓𝐫𝐞𝐚𝐬𝐮𝐫𝐲 https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔁" title="Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn" aria-label="Emoji: Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn"> The treasury acts as a buy back machine. The pool is available for investors to swap against, which increases on chain liquidity. The fees generated from swaps will be added to the pool, and becomes additional income for Idle." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin"> This also makes Idle eligible for $BAL tokens which are held, or re-invested back into the treasury https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">ParametersWeights: 90/10Tokens: Idle/WETHSwapping fee 0.5%https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Fees80% to smart treasury15%-to fee treasury5%-to the idle rebalancer" title="𝐒𝐦𝐚𝐫𝐭 𝐓𝐫𝐞𝐚𝐬𝐮𝐫𝐲 https://abs.twimg.com/emoji/v2/... draggable="false" alt="3⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin"> This also makes Idle eligible for $BAL tokens which are held, or re-invested back into the treasury https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">ParametersWeights: 90/10Tokens: Idle/WETHSwapping fee 0.5%https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Fees80% to smart treasury15%-to fee treasury5%-to the idle rebalancer" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin"> This also makes Idle eligible for $BAL tokens which are held, or re-invested back into the treasury https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">ParametersWeights: 90/10Tokens: Idle/WETHSwapping fee 0.5%https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Fees80% to smart treasury15%-to fee treasury5%-to the idle rebalancer" title="𝐒𝐦𝐚𝐫𝐭 𝐓𝐫𝐞𝐚𝐬𝐮𝐫𝐲 https://abs.twimg.com/emoji/v2/... draggable="false" alt="3⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin"> This also makes Idle eligible for $BAL tokens which are held, or re-invested back into the treasury https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">ParametersWeights: 90/10Tokens: Idle/WETHSwapping fee 0.5%https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Fees80% to smart treasury15%-to fee treasury5%-to the idle rebalancer" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔒" title="Schloss" aria-label="Emoji: Schloss"> Completed multiple & incremental security audits with Quantstamp in Dec. 2019 and April/May 2020. Due to their stringent security and partnering with protocols that have the same security, it makes it far less likely that they are rug-pulled" title="𝗦𝗲𝗰𝘂𝗿𝗶𝘁𝘆 𝐀𝐮𝐝𝐢𝐭 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📋" title="Klemmbrett" aria-label="Emoji: Klemmbrett">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔒" title="Schloss" aria-label="Emoji: Schloss"> Completed multiple & incremental security audits with Quantstamp in Dec. 2019 and April/May 2020. Due to their stringent security and partnering with protocols that have the same security, it makes it far less likely that they are rug-pulled" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔒" title="Schloss" aria-label="Emoji: Schloss"> Completed multiple & incremental security audits with Quantstamp in Dec. 2019 and April/May 2020. Due to their stringent security and partnering with protocols that have the same security, it makes it far less likely that they are rug-pulled" title="𝗦𝗲𝗰𝘂𝗿𝗶𝘁𝘆 𝐀𝐮𝐝𝐢𝐭 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📋" title="Klemmbrett" aria-label="Emoji: Klemmbrett">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔒" title="Schloss" aria-label="Emoji: Schloss"> Completed multiple & incremental security audits with Quantstamp in Dec. 2019 and April/May 2020. Due to their stringent security and partnering with protocols that have the same security, it makes it far less likely that they are rug-pulled" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧾" title="Receipt" aria-label="Emoji: Receipt">Idle does not custody digital assets. Your digital assets are sent to a smart contract that Idle does not control. Only you have access to the contract. These accounts have balances for each asset that are lent out to underlying protocols." title="𝐂𝐮𝐬𝐝𝐨𝐭𝐲 𝐨𝐟 𝐀𝐬𝐬𝐞𝐬𝐭 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛃" title="Zoll" aria-label="Emoji: Zoll">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧾" title="Receipt" aria-label="Emoji: Receipt">Idle does not custody digital assets. Your digital assets are sent to a smart contract that Idle does not control. Only you have access to the contract. These accounts have balances for each asset that are lent out to underlying protocols." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧾" title="Receipt" aria-label="Emoji: Receipt">Idle does not custody digital assets. Your digital assets are sent to a smart contract that Idle does not control. Only you have access to the contract. These accounts have balances for each asset that are lent out to underlying protocols." title="𝐂𝐮𝐬𝐝𝐨𝐭𝐲 𝐨𝐟 𝐀𝐬𝐬𝐞𝐬𝐭 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛃" title="Zoll" aria-label="Emoji: Zoll">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧾" title="Receipt" aria-label="Emoji: Receipt">Idle does not custody digital assets. Your digital assets are sent to a smart contract that Idle does not control. Only you have access to the contract. These accounts have balances for each asset that are lent out to underlying protocols." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">Idle has created an ideal structure for its holders to vote and decide as a community how the project progresses. It covers many areas such as:https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗝️" title="Alter Schlüssel" aria-label="Emoji: Alter Schlüssel">Ecosystem Fundhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Treasury Governance https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗝️" title="Alter Schlüssel" aria-label="Emoji: Alter Schlüssel">LP& #39;s fundhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Idle Allocation" title="𝐆𝐨𝐯𝐞𝐫𝐧𝐚𝐧𝐜𝐞 https://abs.twimg.com/emoji/v2/... draggable="false" alt="👨⚖️" title="Richter" aria-label="Emoji: Richter">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">Idle has created an ideal structure for its holders to vote and decide as a community how the project progresses. It covers many areas such as:https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗝️" title="Alter Schlüssel" aria-label="Emoji: Alter Schlüssel">Ecosystem Fundhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Treasury Governance https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗝️" title="Alter Schlüssel" aria-label="Emoji: Alter Schlüssel">LP& #39;s fundhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Idle Allocation" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">Idle has created an ideal structure for its holders to vote and decide as a community how the project progresses. It covers many areas such as:https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗝️" title="Alter Schlüssel" aria-label="Emoji: Alter Schlüssel">Ecosystem Fundhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Treasury Governance https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗝️" title="Alter Schlüssel" aria-label="Emoji: Alter Schlüssel">LP& #39;s fundhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Idle Allocation" title="𝐆𝐨𝐯𝐞𝐫𝐧𝐚𝐧𝐜𝐞 https://abs.twimg.com/emoji/v2/... draggable="false" alt="👨⚖️" title="Richter" aria-label="Emoji: Richter">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">Idle has created an ideal structure for its holders to vote and decide as a community how the project progresses. It covers many areas such as:https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗝️" title="Alter Schlüssel" aria-label="Emoji: Alter Schlüssel">Ecosystem Fundhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Treasury Governance https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗝️" title="Alter Schlüssel" aria-label="Emoji: Alter Schlüssel">LP& #39;s fundhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Idle Allocation" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗺️" title="Weltkarte" aria-label="Emoji: Weltkarte">https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">In no particular order or timeline. These are the ambitious things they are setting out to achieve. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">There are also discussions possible of flash loans.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Integrations with Yearn Finance has already begun." title="𝐑𝐨𝐚𝐝𝐦𝐚𝐩 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛣️" title="Autobahn" aria-label="Emoji: Autobahn">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗺️" title="Weltkarte" aria-label="Emoji: Weltkarte">https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">In no particular order or timeline. These are the ambitious things they are setting out to achieve. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">There are also discussions possible of flash loans.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Integrations with Yearn Finance has already begun." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗺️" title="Weltkarte" aria-label="Emoji: Weltkarte">https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">In no particular order or timeline. These are the ambitious things they are setting out to achieve. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">There are also discussions possible of flash loans.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Integrations with Yearn Finance has already begun." title="𝐑𝐨𝐚𝐝𝐦𝐚𝐩 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛣️" title="Autobahn" aria-label="Emoji: Autobahn">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗺️" title="Weltkarte" aria-label="Emoji: Weltkarte">https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">In no particular order or timeline. These are the ambitious things they are setting out to achieve. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">There are also discussions possible of flash loans.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Integrations with Yearn Finance has already begun." class="img-responsive" style="max-width:100%;"/>

" title="𝐏𝐚𝐫𝐭𝐧𝐞𝐫𝐬𝐡𝐢𝐩𝐬 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤝" title="Handschlag" aria-label="Emoji: Handschlag">" class="img-responsive" style="max-width:100%;"/>

" title="𝐏𝐚𝐫𝐭𝐧𝐞𝐫𝐬𝐡𝐢𝐩𝐬 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤝" title="Handschlag" aria-label="Emoji: Handschlag">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Schreibende Hand" aria-label="Emoji: Schreibende Hand"> This project is led by a team of what appears to be masterminds, from every sector one would need to launch a project into the stratosphere. It is no wonder there GitHub is flourishing and buzzing with excitement." title="𝐂𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📖" title="Offenes Buch" aria-label="Emoji: Offenes Buch">https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Schreibende Hand" aria-label="Emoji: Schreibende Hand"> This project is led by a team of what appears to be masterminds, from every sector one would need to launch a project into the stratosphere. It is no wonder there GitHub is flourishing and buzzing with excitement." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Schreibende Hand" aria-label="Emoji: Schreibende Hand"> This project is led by a team of what appears to be masterminds, from every sector one would need to launch a project into the stratosphere. It is no wonder there GitHub is flourishing and buzzing with excitement." title="𝐂𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📖" title="Offenes Buch" aria-label="Emoji: Offenes Buch">https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Schreibende Hand" aria-label="Emoji: Schreibende Hand"> This project is led by a team of what appears to be masterminds, from every sector one would need to launch a project into the stratosphere. It is no wonder there GitHub is flourishing and buzzing with excitement." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Schreibende Hand" aria-label="Emoji: Schreibende Hand">Idle is much further ahead of most of its competition, and have what appears to be one of the highest yield generating platforms, while also being the most secure in blockchain finance. Tier https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥇" title="Goldmedaille" aria-label="Emoji: Goldmedaille">Gem" title="𝐂𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📖" title="Offenes Buch" aria-label="Emoji: Offenes Buch">https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Schreibende Hand" aria-label="Emoji: Schreibende Hand">Idle is much further ahead of most of its competition, and have what appears to be one of the highest yield generating platforms, while also being the most secure in blockchain finance. Tier https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥇" title="Goldmedaille" aria-label="Emoji: Goldmedaille">Gem" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Schreibende Hand" aria-label="Emoji: Schreibende Hand">Idle is much further ahead of most of its competition, and have what appears to be one of the highest yield generating platforms, while also being the most secure in blockchain finance. Tier https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥇" title="Goldmedaille" aria-label="Emoji: Goldmedaille">Gem" title="𝐂𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📖" title="Offenes Buch" aria-label="Emoji: Offenes Buch">https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Schreibende Hand" aria-label="Emoji: Schreibende Hand">Idle is much further ahead of most of its competition, and have what appears to be one of the highest yield generating platforms, while also being the most secure in blockchain finance. Tier https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥇" title="Goldmedaille" aria-label="Emoji: Goldmedaille">Gem" class="img-responsive" style="max-width:100%;"/>

https://www.notion.so/ffe8115b7... href=" https://gov.idle.finance/t/balancer-v2-lending-provider-for-asset-managers/433" title="𝐑𝐞𝐟𝐞𝐫𝐞𝐧𝐜𝐞𝐬 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📜" title="Schriftrolle" aria-label="Emoji: Schriftrolle"> https://www.notion.so/ffe8115b7... href=" https://gov.idle.finance/t/balancer-v2-lending-provider-for-asset-managers/433" class="img-responsive" style="max-width:100%;"/>

https://www.notion.so/ffe8115b7... href=" https://gov.idle.finance/t/balancer-v2-lending-provider-for-asset-managers/433" title="𝐑𝐞𝐟𝐞𝐫𝐞𝐧𝐜𝐞𝐬 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📜" title="Schriftrolle" aria-label="Emoji: Schriftrolle"> https://www.notion.so/ffe8115b7... href=" https://gov.idle.finance/t/balancer-v2-lending-provider-for-asset-managers/433" class="img-responsive" style="max-width:100%;"/>