It’s time to break down one of the most popular stocks in the market. Here is the break down of $TSLA, otherwise known as Tesla.

Current Price: $719.86

52/Wk High: $900.40

52/Wk Low: $136.61

Market Cap: $700.1 Billion

Read below for the breakdown! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

Current Price: $719.86

52/Wk High: $900.40

52/Wk Low: $136.61

Market Cap: $700.1 Billion

Read below for the breakdown!

Tesla ($TSLA) is the largest electric vehicle company in the game, boasting an expansive lineup of electric cars and a growing manufacturing footprint.

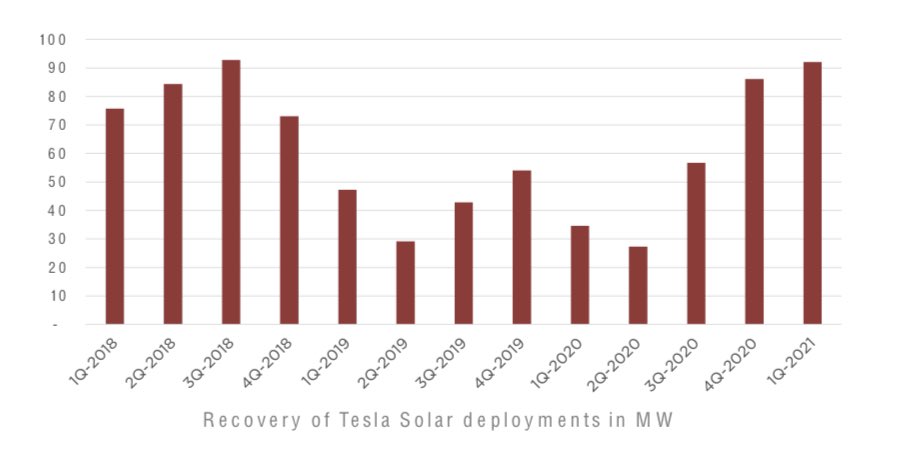

Tesla is also a major innovator in the energy storage and solar industry, with energy storage deployments jumping a strong 71% year-over-year in Q1 2021.

On the technology front, Tesla continues to innovate and is currently working on a Full Self Driving (FSD) system that is AI based and created by Tesla’s in house artificial intelligence AI team.

Recently, many have feared the semiconductor shortage would have a major impact on Tesla, but due to leadership& #39;s ability to pivot, Tesla shifted to new microcontrollers and developed new firmware to avert major setbacks as other major auto manufacturers have suffered.

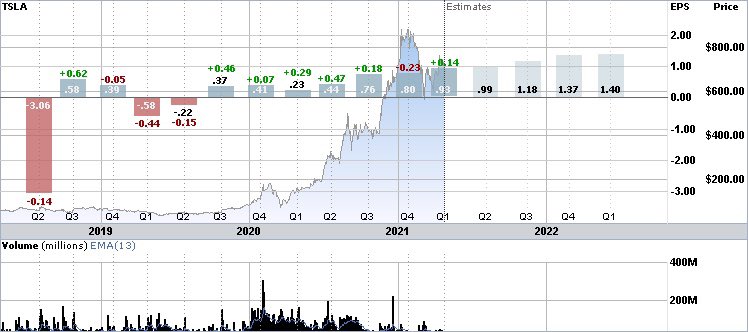

Throughout the past year, Tesla has rallied just over 405% but could be presenting opportunity as it has sold off just over 16% throughout the past three months.

Digging into the numbers Tesla beat Q1 2021 expectations with an EPS of $0.93, better than the analysts EPS consensus estimate of $0.79. On a year-over-year basis, EPS expanded by 304.34%.

Revenues impressed as well, increasing by 74% year-over-year to $10.389 billion. Breaking down revenues automotive revenues totaled $9.002 billion, representing a 75% year-over-year increase.

It is important to note that $518 million in regulatory credits is included in the automotive revenues total. For comparison, the Q1 2020 automotive revenues totaled $5.132 billion.

Tesla’s energy generation and storage segment delivered $494 million in revenues, down on a quarterly basis from the $752 million in Q4 2020 but up on a yearly basis from the $293 million in Q1 2020.

Rounding out revenues, the services and other segment turned out $893 million in revenues, representing a jump over the Q1 2020 revenues level of $560 million.

Shifting into profits, automotive gross profit totaled $2.385 million, representing a strong 82% jump on a year-over-year basis. As for overall gross profit, total gross profit increased by 79% to $2.215 billion

On the margins front, automotive gross margin landed at 26.5%, representing a 95 basis point jump from the Q1 2020 level of 25.5%. Furthermore, total GAAP gross margin increased by 70 basis points year-over-year to 21.3%, significantly better than the Q1 2020 level of 20.6%.

Taking a look at income, income from operations totaled $594 million for the quarter, representing a 110% increase on a year-over-year basis. Lastly, net income totaled $464 million, a big jump over the Q1 2020 net income level of just $68 million.

Rounding out the quarter, adjusted EBITDA totaled $1.841 billion, representing a 84% increase on a year-over-year basis.

Tesla sold $272 million worth of their $1.5 billion Bitcoin position. In turn, Tesla experience a $101 million positive impact on profitability throughout Q1.

Tesla sold $272 million worth of their $1.5 billion Bitcoin position. In turn, Tesla experience a $101 million positive impact on profitability throughout Q1.

Shifting into deliveries, total deliveries increased by 109% to 184,877. Furthermore, model S/X deliveries fell by 83% to 2,030 while model 3/Y deliveries increased by 140% to 182,847.

Taking a look at the balance sheet, the numbers aren’t bad. (Q4 Levels)

Total Debt: $11.739 Billion

Total Liabilities: $29.923 Billion

Total Assets: $52.148 Billion

Cash & Short Term Inv: $19.384 Billion

Total Debt: $11.739 Billion

Total Liabilities: $29.923 Billion

Total Assets: $52.148 Billion

Cash & Short Term Inv: $19.384 Billion

On a valuation basis, Tesla trades at a premium.

Price to Earnings: 1186.82x

Forward Price to Earnings: 124.76x

Price to Sales: 22.47x

Price to Book: 31.59x

Price to Cash Flow: 190.97x

Price to Earnings: 1186.82x

Forward Price to Earnings: 124.76x

Price to Sales: 22.47x

Price to Book: 31.59x

Price to Cash Flow: 190.97x

Management has been effective.

Return on Equity: 4.78%

Return on Assets: 1.99%

Return on Invested Capital: 2.94%

Return on Equity: 4.78%

Return on Assets: 1.99%

Return on Invested Capital: 2.94%

Given the numbers the analysts are neutral with a mean price target of $682.13/share, representing a -7.60% downside.

The high price target is $1,200/share, representing a 62.56% gain, while the low price target is $150.00/share, representing a -79.68% loss.

The high price target is $1,200/share, representing a 62.56% gain, while the low price target is $150.00/share, representing a -79.68% loss.

The big money is less involved with just 44.23% of Tesla being owned by institutions. Top holders include The Vanguard Group, Capital World Investors, and BlackRock Institutional Trust.

According to the six-month charts the MACD is moving to the upside with weakening momentum within a tight range around 9.5.

The six-month charts are also indicating an RSI of 52.88 and CCI of 60.02, both of which are trending slowly downward.

The six-month charts are also indicating an RSI of 52.88 and CCI of 60.02, both of which are trending slowly downward.

In short, Tesla ($TSLA) is the strongest electric vehicle bet in the market, offering expanding revenues, increasing deliveries, a strong management team, and customer following that is far and above.

EAT - SLEEP - PROFIT  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

Disclaimer: This is not direct financial advice, simply an opinion based on independent research.

Disclaimer: This is not direct financial advice, simply an opinion based on independent research.

Read on Twitter

Read on Twitter " title="It’s time to break down one of the most popular stocks in the market. Here is the break down of $TSLA, otherwise known as Tesla.Current Price: $719.8652/Wk High: $900.4052/Wk Low: $136.61Market Cap: $700.1 BillionRead below for the breakdown!https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">" class="img-responsive" style="max-width:100%;"/>

" title="It’s time to break down one of the most popular stocks in the market. Here is the break down of $TSLA, otherwise known as Tesla.Current Price: $719.8652/Wk High: $900.4052/Wk Low: $136.61Market Cap: $700.1 BillionRead below for the breakdown!https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">" class="img-responsive" style="max-width:100%;"/>