There are (or will be) 3 key objections to Tesla’s record-breaking Q1 earnings.

I’ll debunk them in this thread.

I’ll debunk them in this thread.

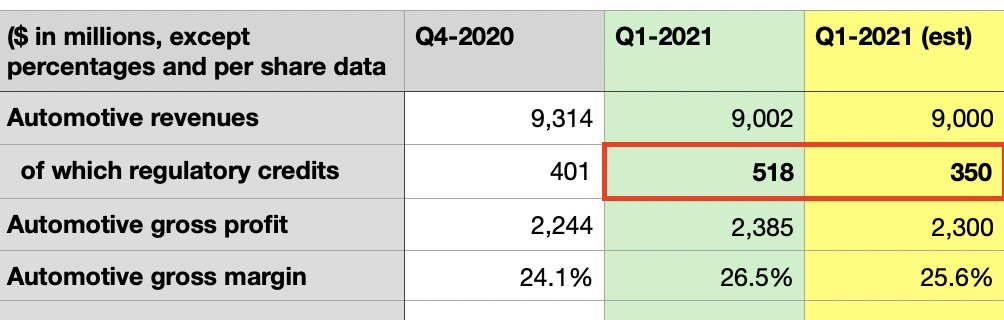

First, regulatory credit sales were higher than normal at $518m. Argument is going forward that number could shrink and impact profit.

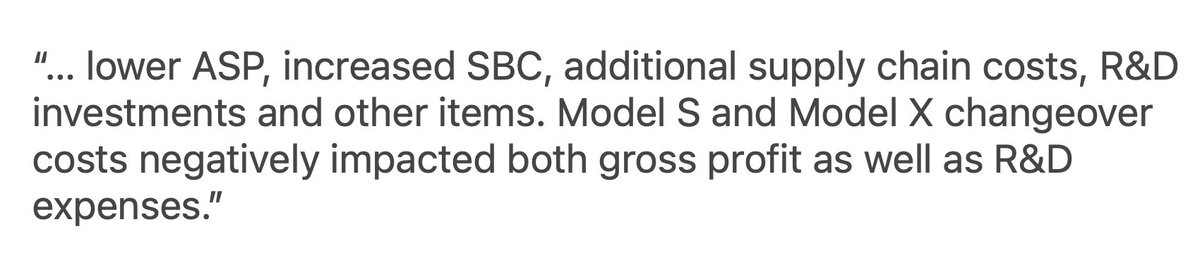

However, during earnings call Zach Kirkhorn shared that the S/X changeover incurred a $200m one-time expense in COGS (or gross profit).

However, during earnings call Zach Kirkhorn shared that the S/X changeover incurred a $200m one-time expense in COGS (or gross profit).

So, once S/X is fully changed over to the refreshed version and Tesla doesn& #39;t need to book those additional one-time expenses, then that will outweigh the extra ~$100m or so in regulatory credits this quarter.

Second, operating expenses jumped from $1.49B to $1.62B this quarter. Argument could be made that expenses will increase rapidly in future quarters hurting profit.

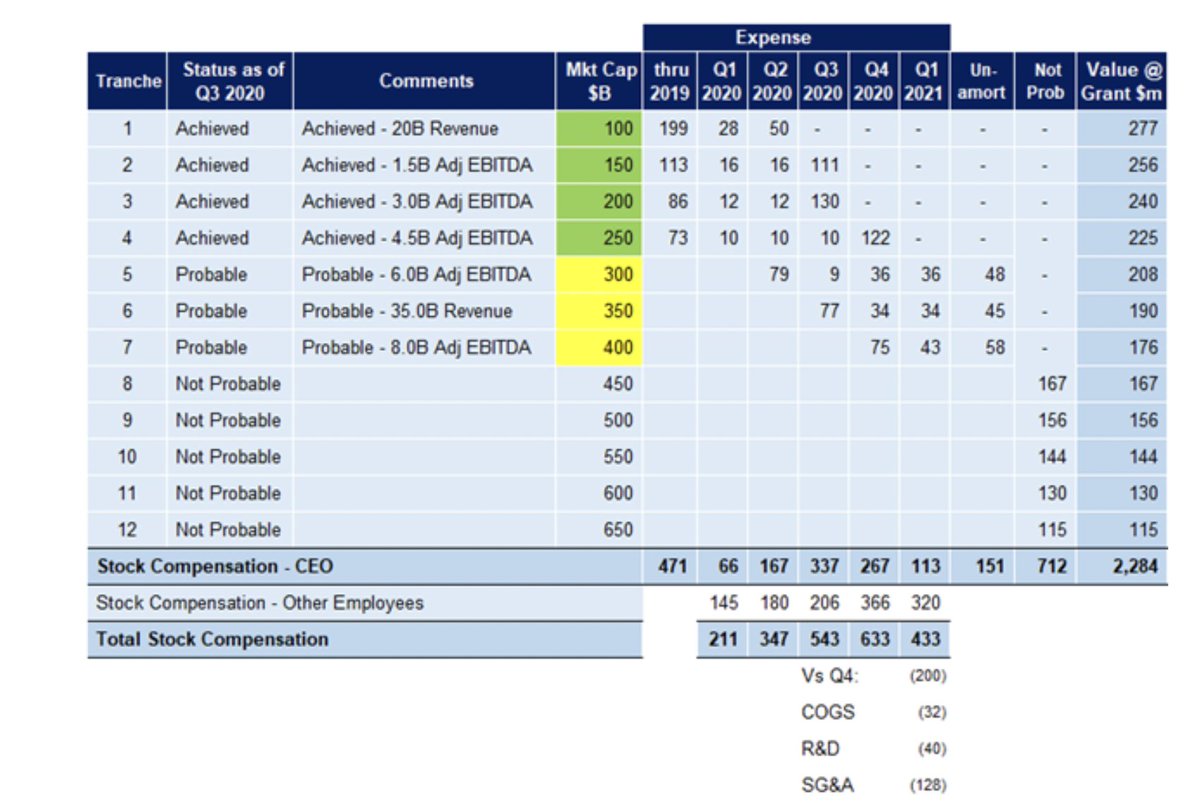

But this quarter had extremely high one-time expenses related to Elon Musk& #39;s CEO compensation plan, $299M in Q1.

But this quarter had extremely high one-time expenses related to Elon Musk& #39;s CEO compensation plan, $299M in Q1.

This SBC (stock-based compensation) expense goes directly into GAAP operating expenses, but will be much lower in future quarters.

Here& #39;s a chart from The Accountant at TMC that shows this expense trends lower in future quarters.

Here& #39;s a chart from The Accountant at TMC that shows this expense trends lower in future quarters.

Third, some will say Tesla padded profits by selling Bitcoin for a ~$100m profit. And that they can& #39;t do that sustainably.

However, the S/X changeover also had an impact on R&D expenses so it& #39;s likely if we remove that (and other one-time expenses) then that could offset BTC $.

However, the S/X changeover also had an impact on R&D expenses so it& #39;s likely if we remove that (and other one-time expenses) then that could offset BTC $.

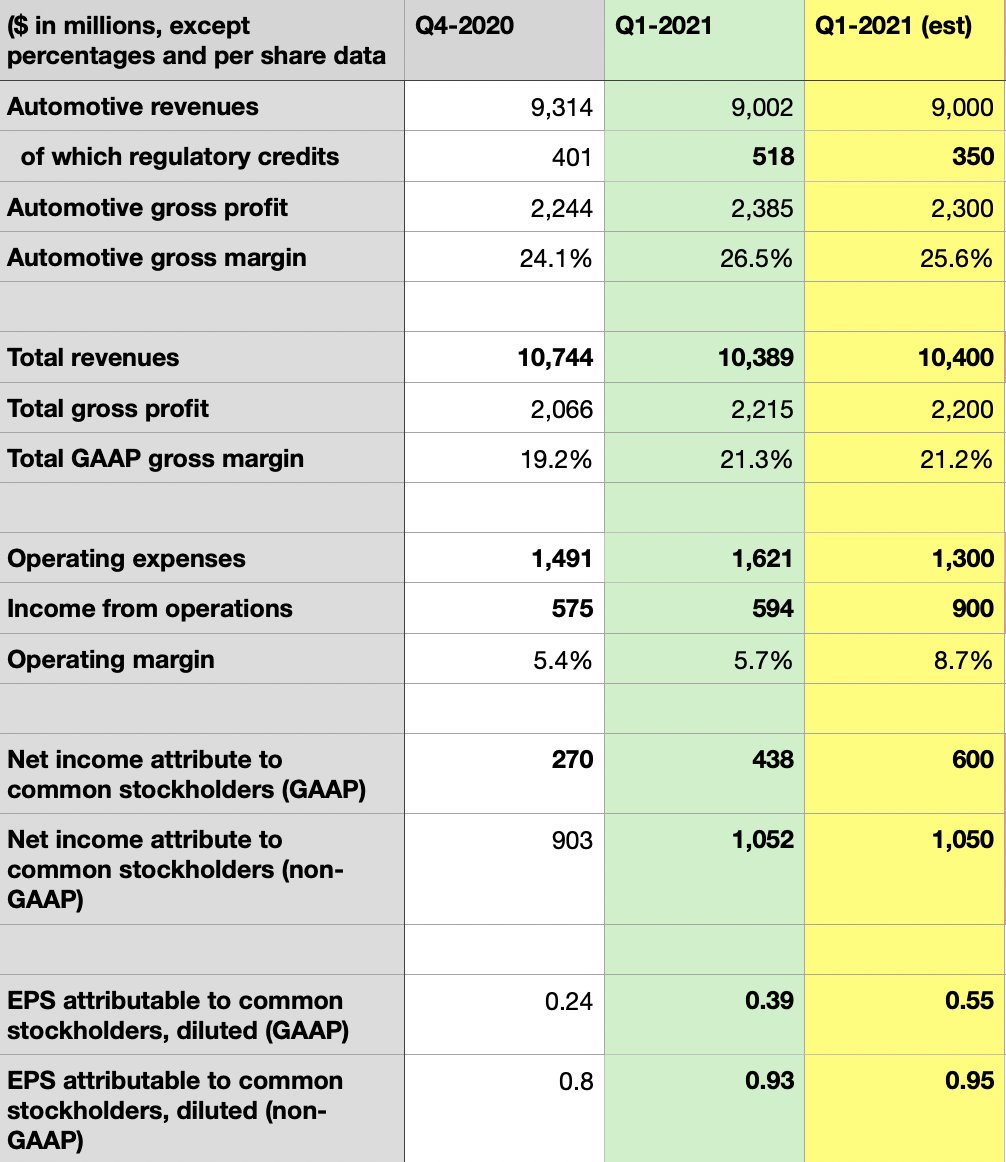

Overall, I& #39;m very happy with Tesla& #39;s Q1 earnings.

They largely came in within expectations, and I can& #39;t wait to see Tesla keep executing for future quarters.

Below are my estimates vs actual Q1 earnings.

They largely came in within expectations, and I can& #39;t wait to see Tesla keep executing for future quarters.

Below are my estimates vs actual Q1 earnings.

Also, I do a deep dive into these 3 objections in this video. https://youtu.be/JWLvR5mumyM ">https://youtu.be/JWLvR5mum...

Read on Twitter

Read on Twitter