In September 2007 Mint took on Microsoft.

2 years later Mint sold to Intuit for $170M and Microsoft shut down their Mint competitor.

Here& #39;s Mint& #39;s pitch deck and how you could tell they would be a smashing success

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

2 years later Mint sold to Intuit for $170M and Microsoft shut down their Mint competitor.

Here& #39;s Mint& #39;s pitch deck and how you could tell they would be a smashing success

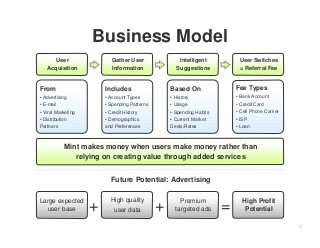

1/ Be Wallet Adjacent

"Mint makes money when users make money."

Businesses that are tied to financial gain win.

@mint was born to help people understand and improve their financial situation.

This created a flywheel effect where the better their users do the more they make

"Mint makes money when users make money."

Businesses that are tied to financial gain win.

@mint was born to help people understand and improve their financial situation.

This created a flywheel effect where the better their users do the more they make

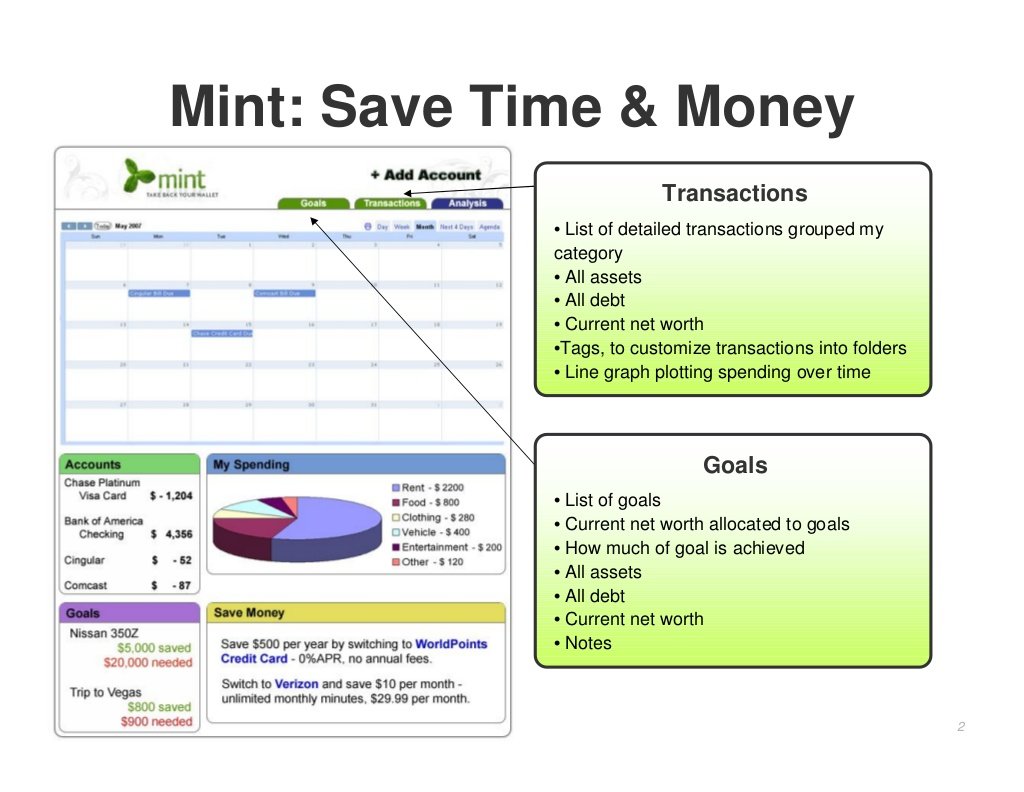

2/ Creating Financial Clarity

"WTF I spent $200 at Chipotle this month?"

In 5 minutes Mint gave users a financial snapshot all their money.

Microsoft money was complicated

Mint onboarded people in two screens.

Focus on core functionality and getting users to the "Aha" moment

"WTF I spent $200 at Chipotle this month?"

In 5 minutes Mint gave users a financial snapshot all their money.

Microsoft money was complicated

Mint onboarded people in two screens.

Focus on core functionality and getting users to the "Aha" moment

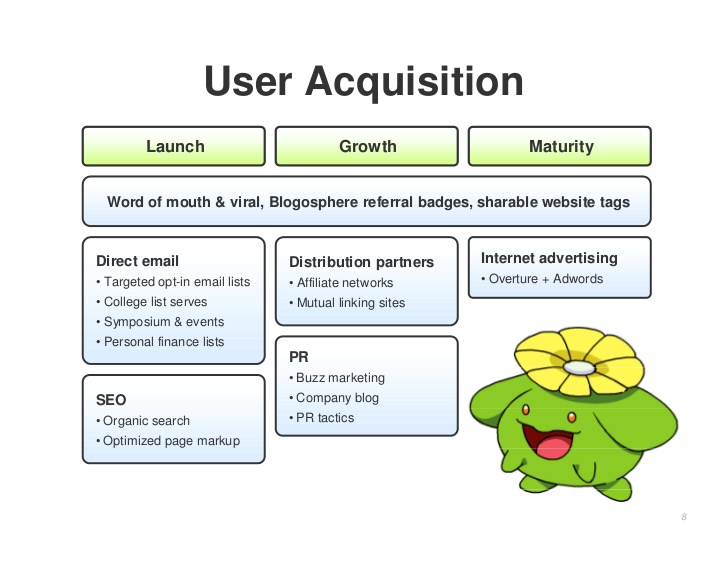

3/ Creating Buzz

@noahkagan said Mint had more traffic than all of their competitors combined... before they even launched!

How?

The created the #1 financial blog.

They were PR machines.

AND they were doing SEM for a $1 CAC.

Plus they used a Pokemon in their deck.

@noahkagan said Mint had more traffic than all of their competitors combined... before they even launched!

How?

The created the #1 financial blog.

They were PR machines.

AND they were doing SEM for a $1 CAC.

Plus they used a Pokemon in their deck.

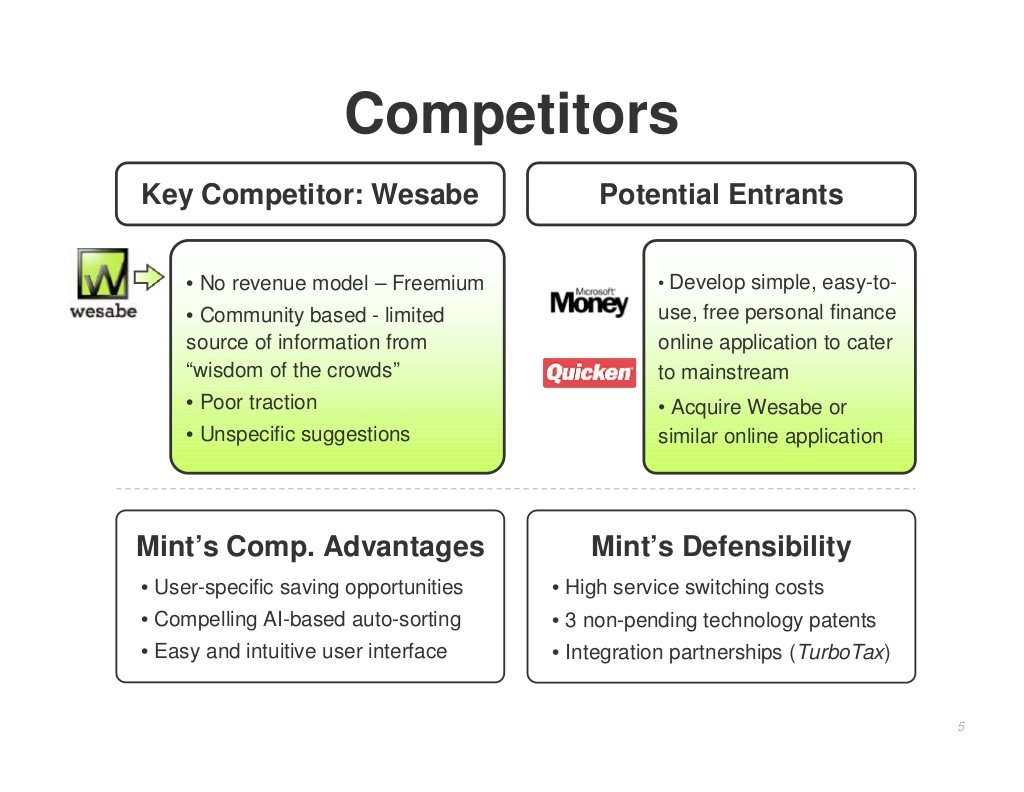

4/ Last Movers

Wesabe was first to market.

Mint was late.

Mint won because:

1. User experience

- Mint had a simple product (that worked)

2. User acquisition

- Wesabe didn& #39;t do paid marketing

- Mint grew at 5x their rate

3. Moved quick

- Mint outsourced some software dev

Wesabe was first to market.

Mint was late.

Mint won because:

1. User experience

- Mint had a simple product (that worked)

2. User acquisition

- Wesabe didn& #39;t do paid marketing

- Mint grew at 5x their rate

3. Moved quick

- Mint outsourced some software dev

5/ Plan your Win

Mint knew they wanted to be acquired.

They didn& #39;t need to be the next Google.

Buying Mint made sense for top of funnel acquisition for @Intuit and @Microsoft

The key to getting there was patents and user acquisition. They executed both flawlessly.

Mint knew they wanted to be acquired.

They didn& #39;t need to be the next Google.

Buying Mint made sense for top of funnel acquisition for @Intuit and @Microsoft

The key to getting there was patents and user acquisition. They executed both flawlessly.

6/ Defend  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏡" title="Haus mit Garten" aria-label="Emoji: Haus mit Garten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏡" title="Haus mit Garten" aria-label="Emoji: Haus mit Garten">

This is a great slide to have in your deck.

In every investors head is 5 reasons why something won& #39;t work.

Say the reasons first AND what you& #39;re doing to mitigate them.

Mint knew saying they were taking on Microsoft sounded crazy. Maybe they were... but it worked

This is a great slide to have in your deck.

In every investors head is 5 reasons why something won& #39;t work.

Say the reasons first AND what you& #39;re doing to mitigate them.

Mint knew saying they were taking on Microsoft sounded crazy. Maybe they were... but it worked

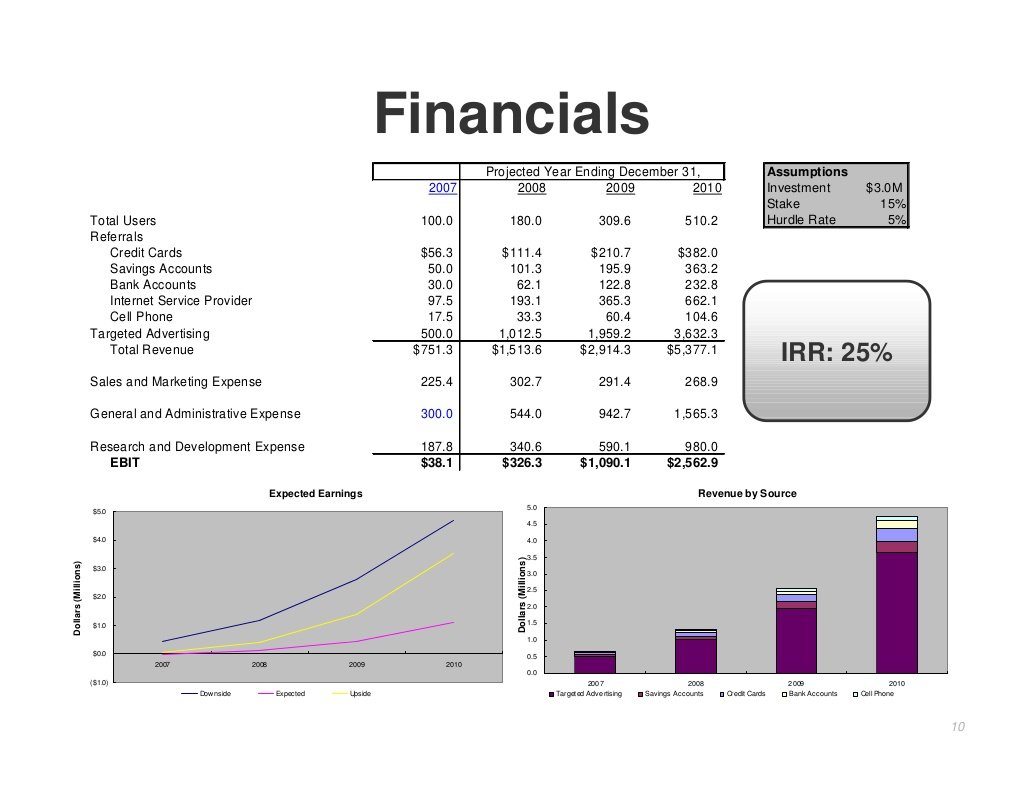

7/ Where the Rubber Meets the Road

Most of Mint& #39;s revenue was coming from advertising.

@NerdWallet is doing $150M from referral deals.

Mint could have drastically scaled their referral program.

P.S. That 3M investment for a 15% stake became a 8.5X return in 2 years.

Most of Mint& #39;s revenue was coming from advertising.

@NerdWallet is doing $150M from referral deals.

Mint could have drastically scaled their referral program.

P.S. That 3M investment for a 15% stake became a 8.5X return in 2 years.

If you& #39;re also not a first mover, that& #39;s good, it& #39;s not too late to follow me: @Adam_Ha_Yes

Every Monday and Wednesday I& #39;m tweeting breakdowns like this.

Thanks for reading! RT are greatly appreciated https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Gefaltete Hände" aria-label="Emoji: Gefaltete Hände">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Gefaltete Hände" aria-label="Emoji: Gefaltete Hände">

Every Monday and Wednesday I& #39;m tweeting breakdowns like this.

Thanks for reading! RT are greatly appreciated

Read on Twitter

Read on Twitter https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="In September 2007 Mint took on Microsoft.2 years later Mint sold to Intuit for $170M and Microsoft shut down their Mint competitor.Here& #39;s Mint& #39;s pitch deck and how you could tell they would be a smashing successhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="In September 2007 Mint took on Microsoft.2 years later Mint sold to Intuit for $170M and Microsoft shut down their Mint competitor.Here& #39;s Mint& #39;s pitch deck and how you could tell they would be a smashing successhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

This is a great slide to have in your deck.In every investors head is 5 reasons why something won& #39;t work.Say the reasons first AND what you& #39;re doing to mitigate them.Mint knew saying they were taking on Microsoft sounded crazy. Maybe they were... but it worked" title="6/ Defend https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏡" title="Haus mit Garten" aria-label="Emoji: Haus mit Garten">This is a great slide to have in your deck.In every investors head is 5 reasons why something won& #39;t work.Say the reasons first AND what you& #39;re doing to mitigate them.Mint knew saying they were taking on Microsoft sounded crazy. Maybe they were... but it worked" class="img-responsive" style="max-width:100%;"/>

This is a great slide to have in your deck.In every investors head is 5 reasons why something won& #39;t work.Say the reasons first AND what you& #39;re doing to mitigate them.Mint knew saying they were taking on Microsoft sounded crazy. Maybe they were... but it worked" title="6/ Defend https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏡" title="Haus mit Garten" aria-label="Emoji: Haus mit Garten">This is a great slide to have in your deck.In every investors head is 5 reasons why something won& #39;t work.Say the reasons first AND what you& #39;re doing to mitigate them.Mint knew saying they were taking on Microsoft sounded crazy. Maybe they were... but it worked" class="img-responsive" style="max-width:100%;"/>