"Make 25%+ yield risk-free by trading Bitcoin futures!"

Is this free money??

In this thread:

- How commodities futures work

- What& #39;s unique about Bitcoin as a commodity?

- "Why doesn& #39;t everyone do this??"

Here& #39;s how the $BTC basis/carry trade seems too good to be true:

Is this free money??

In this thread:

- How commodities futures work

- What& #39;s unique about Bitcoin as a commodity?

- "Why doesn& #39;t everyone do this??"

Here& #39;s how the $BTC basis/carry trade seems too good to be true:

Let& #39;s starting with a toddler explanation of futures: the promise to exchange something in the future.

Contrast this to a spot trade, which happens right now ("on the spot").

Simple example: "I promise to buy 100 barrels of oil from you in December 2021 @ $50/bbl."

Contrast this to a spot trade, which happens right now ("on the spot").

Simple example: "I promise to buy 100 barrels of oil from you in December 2021 @ $50/bbl."

Why is there value to taking or promising delivery of oil later? Why would the price change between now/then?

It& #39;s all about locking in price certainty in the face of:

- FX risk

- Weather/seasonality

- Unforeseen supply/demand spikes

- Storage ("carry") costs

It& #39;s all about locking in price certainty in the face of:

- FX risk

- Weather/seasonality

- Unforeseen supply/demand spikes

- Storage ("carry") costs

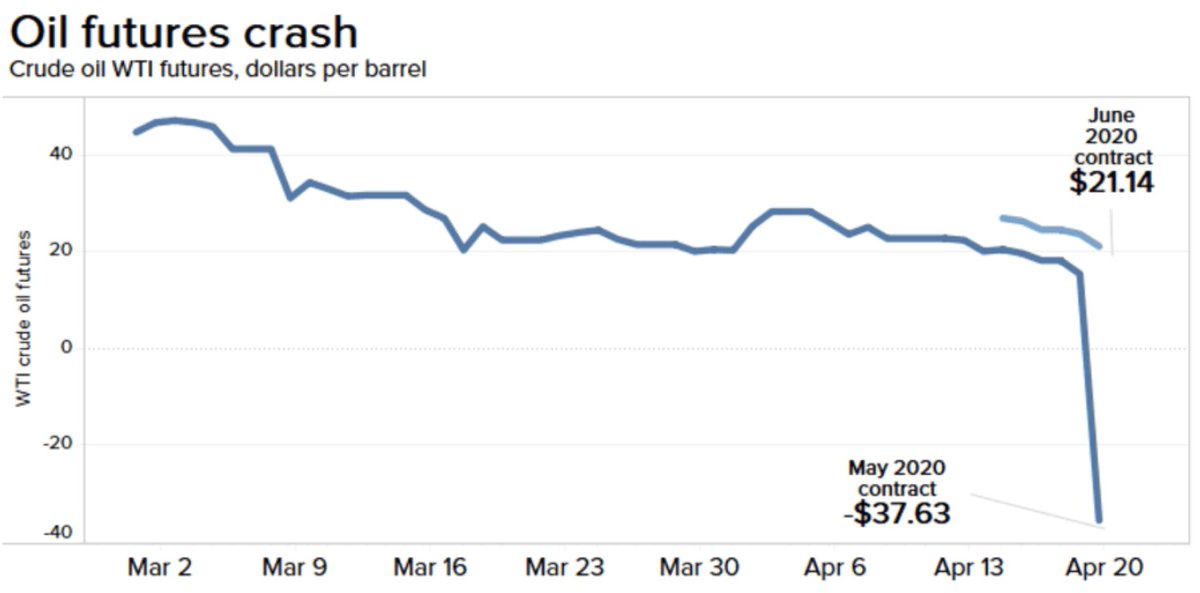

Fun example: almost exactly a year ago, the May WTI crude oil contract went negative.

People were *paying you* to take oil--derricks were pumping but COVID caused demand to halt and storage to fill up.

Storage became impossible, so people started paying to get rid of oil.

People were *paying you* to take oil--derricks were pumping but COVID caused demand to halt and storage to fill up.

Storage became impossible, so people started paying to get rid of oil.

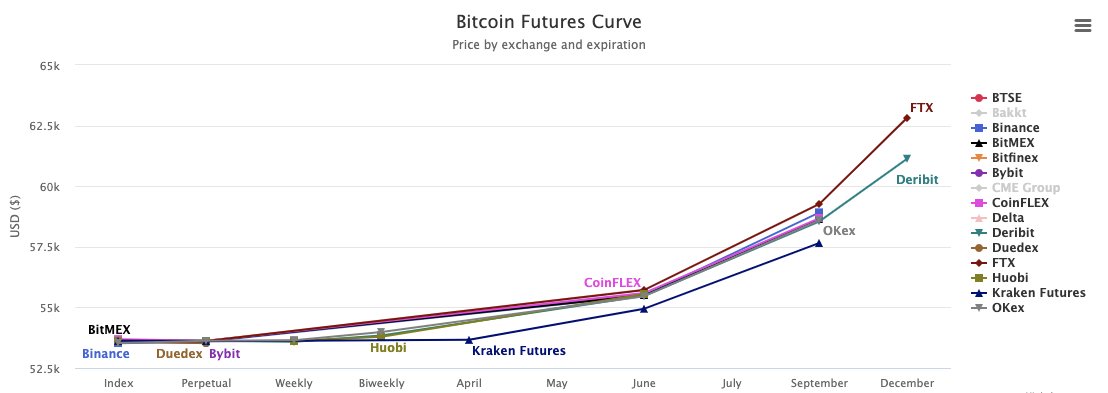

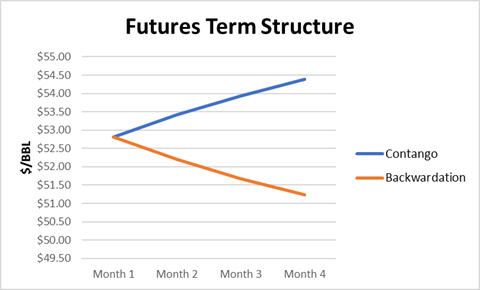

As we look out, we see different settlement prices at various future contract dates--these comprise the "futures curve."

The shape of the curve captures price expectation:

- Positive expectation: market in contango https://abs.twimg.com/emoji/v2/... draggable="false" alt="🕺" title="Tanzender Mann" aria-label="Emoji: Tanzender Mann">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🕺" title="Tanzender Mann" aria-label="Emoji: Tanzender Mann"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="💃" title="Tanzende Frau" aria-label="Emoji: Tanzende Frau">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💃" title="Tanzende Frau" aria-label="Emoji: Tanzende Frau">

- Negative expectation: market in backwardation https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙃" title="Auf den Kopf gestelltes Gesicht" aria-label="Emoji: Auf den Kopf gestelltes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙃" title="Auf den Kopf gestelltes Gesicht" aria-label="Emoji: Auf den Kopf gestelltes Gesicht">

The shape of the curve captures price expectation:

- Positive expectation: market in contango

- Negative expectation: market in backwardation

Now let& #39;s talk about Bitcoin.

In this bull market, the Bitcoin futures curve (w/ the exception of a minute last weekend) has nearly always been in contango.

Because Bitcoin has no carry costs, the curve reflects our expectation of continuous number-go-up.

In this bull market, the Bitcoin futures curve (w/ the exception of a minute last weekend) has nearly always been in contango.

Because Bitcoin has no carry costs, the curve reflects our expectation of continuous number-go-up.

So here is the simple carry trade:

If Bitcoin is trading at $53K spot and $55K for June delivery, I get a risk-free $2K by buying spot Bitcoin and promising to sell it for $55K in 2 months.

*No matter what happens to spot BTC price in the interim I& #39;ve locked in $2K profit.*

If Bitcoin is trading at $53K spot and $55K for June delivery, I get a risk-free $2K by buying spot Bitcoin and promising to sell it for $55K in 2 months.

*No matter what happens to spot BTC price in the interim I& #39;ve locked in $2K profit.*

April: Buy spot BTC on CME @ $53K

May: Carry BTC; sip pina coladas

June: Fulfill contract to sell BTC @ $55K, pocket $2K

$2K / $53K = 3.8% over two months = 24.9% annualized

May: Carry BTC; sip pina coladas

June: Fulfill contract to sell BTC @ $55K, pocket $2K

$2K / $53K = 3.8% over two months = 24.9% annualized

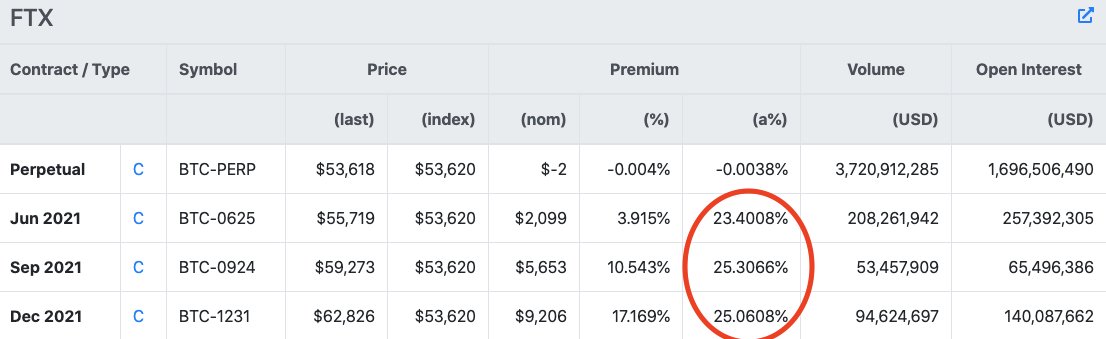

Of coursed annualizing June can be misleading...the shape of the curve could flatten (price expectation may go down) once we find ourselves in June.

However it just so happens right now that annualized premiums are about the same for Jun/Sep/Dec settlement dates on FTX.

However it just so happens right now that annualized premiums are about the same for Jun/Sep/Dec settlement dates on FTX.

As an aside: why would this be? If I can lock 25% thru Dec, why just get it thru Sep?

This implies a *meta-expectation* that the curve will steepen (higher future price expectation/more contango) in coming months.

This implies a *meta-expectation* that the curve will steepen (higher future price expectation/more contango) in coming months.

Tradfi bro: Lol no way risk-free 24.9% gtfo, y wouldn& #39;t every1 just lever up w/ 0% cost of borrowing and print money & profits get competed away crypto what a scam

Me, patiently: let& #39;s think about who can participate in this trade--someone who has the mandate to hold spot BTC.

Me, patiently: let& #39;s think about who can participate in this trade--someone who has the mandate to hold spot BTC.

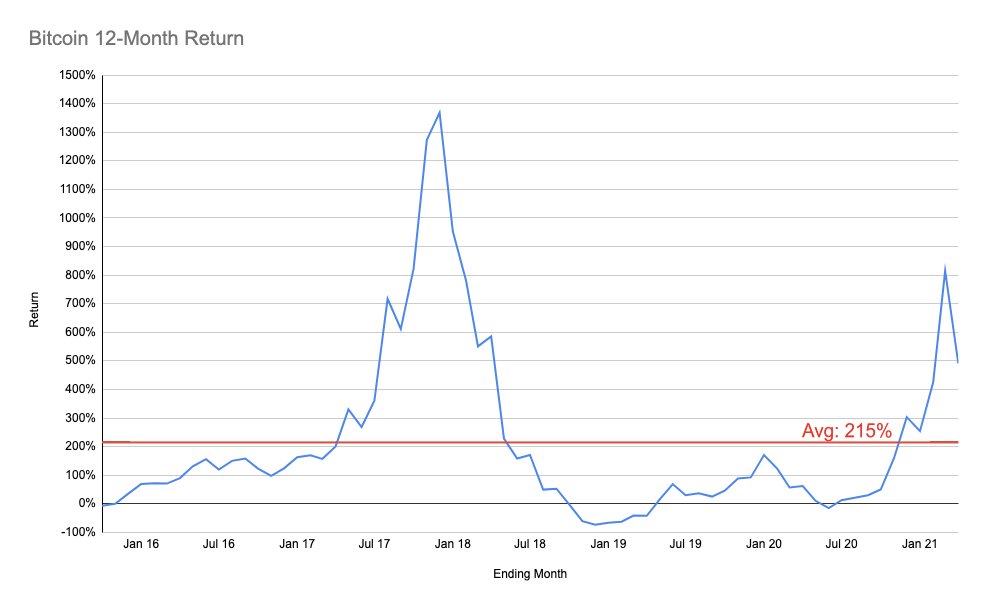

And if you have the mandate to hold spot, why the **fuck** would you commit to selling it later this year??

Since 2014, BTC has returned 15,200% with an average 12-month return of 215% and only 10 such periods with return <0%.

Since 2014, BTC has returned 15,200% with an average 12-month return of 215% and only 10 such periods with return <0%.

Only bull markets have high, consistent contango to support rolling this trade fwd, and when the market is this exuberant most folks just wanna get as long BTC as possible.

And is there actually capital looking to lend against long spot / short futures? Not enough, to quote @SBF_Alameda: https://twitter.com/SBF_Alameda/status/1380284657820782595">https://twitter.com/SBF_Alame...

Finally, it& #39;s not *entirely* risk-free.

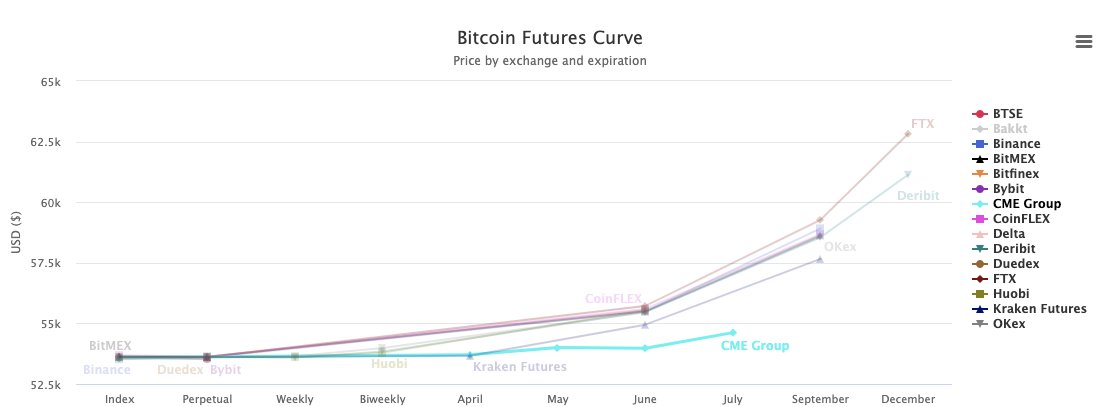

Adding CME futures, you can see the curve is much flatter.

Therefore a lot of CEX future curve steepness reflects exchange counterparty risk (do you trust FTX, Binance?).

Adding CME futures, you can see the curve is much flatter.

Therefore a lot of CEX future curve steepness reflects exchange counterparty risk (do you trust FTX, Binance?).

Finally as @zhusu explains on @uncommoncore, the implied yield is a core primitive for the bull market ecosystem:

**Basis trade yield is Defi& #39;s risk-free rate.** #t=1m21s">https://www.youtube.com/watch?v=TJ6MQsjOS0I #t=1m21s">https://www.youtube.com/watch...

**Basis trade yield is Defi& #39;s risk-free rate.** #t=1m21s">https://www.youtube.com/watch?v=TJ6MQsjOS0I #t=1m21s">https://www.youtube.com/watch...

Two takeaways:

#1

If you& #39;re getting <25% fiat-denominated yield with no underlying upside exposure (i.e. farming stable coins), you& #39;re essentially giving away money.

(Conveniently, M2 is also growing at ~25% annually, in case you need another benchmark hurdle.)

#1

If you& #39;re getting <25% fiat-denominated yield with no underlying upside exposure (i.e. farming stable coins), you& #39;re essentially giving away money.

(Conveniently, M2 is also growing at ~25% annually, in case you need another benchmark hurdle.)

#2

Everything exists for a reason.

When you see something you don& #39;t believe, dig 1" deeper.

"Why doesn& #39;t everyone just do this??" --> go try to do it!

It& #39;s likely there are structural risks, monetary/regulatory bottlenecks, or protocol design at work.

Otherwise https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐵" title="Affengesicht" aria-label="Emoji: Affengesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐵" title="Affengesicht" aria-label="Emoji: Affengesicht"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔫" title="Wasserpistole" aria-label="Emoji: Wasserpistole">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔫" title="Wasserpistole" aria-label="Emoji: Wasserpistole"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="😈" title="Lächelndes Gesicht mit Hörnern" aria-label="Emoji: Lächelndes Gesicht mit Hörnern">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😈" title="Lächelndes Gesicht mit Hörnern" aria-label="Emoji: Lächelndes Gesicht mit Hörnern">

Everything exists for a reason.

When you see something you don& #39;t believe, dig 1" deeper.

"Why doesn& #39;t everyone just do this??" --> go try to do it!

It& #39;s likely there are structural risks, monetary/regulatory bottlenecks, or protocol design at work.

Otherwise

Thanks to some of the goats who informed this thread:

@zhusu

@SBF_Alameda

@cmsholdings

For publishing their thinking and enabling anyone with a brain + internet connection to get up the curve on this insanity.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Gefaltete Hände" aria-label="Emoji: Gefaltete Hände">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Gefaltete Hände" aria-label="Emoji: Gefaltete Hände">

@zhusu

@SBF_Alameda

@cmsholdings

For publishing their thinking and enabling anyone with a brain + internet connection to get up the curve on this insanity.

Read on Twitter

Read on Twitter

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💃" title="Tanzende Frau" aria-label="Emoji: Tanzende Frau">- Negative expectation: market in backwardation https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙃" title="Auf den Kopf gestelltes Gesicht" aria-label="Emoji: Auf den Kopf gestelltes Gesicht">" title="As we look out, we see different settlement prices at various future contract dates--these comprise the "futures curve."The shape of the curve captures price expectation:- Positive expectation: market in contango https://abs.twimg.com/emoji/v2/... draggable="false" alt="🕺" title="Tanzender Mann" aria-label="Emoji: Tanzender Mann">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💃" title="Tanzende Frau" aria-label="Emoji: Tanzende Frau">- Negative expectation: market in backwardation https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙃" title="Auf den Kopf gestelltes Gesicht" aria-label="Emoji: Auf den Kopf gestelltes Gesicht">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💃" title="Tanzende Frau" aria-label="Emoji: Tanzende Frau">- Negative expectation: market in backwardation https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙃" title="Auf den Kopf gestelltes Gesicht" aria-label="Emoji: Auf den Kopf gestelltes Gesicht">" title="As we look out, we see different settlement prices at various future contract dates--these comprise the "futures curve."The shape of the curve captures price expectation:- Positive expectation: market in contango https://abs.twimg.com/emoji/v2/... draggable="false" alt="🕺" title="Tanzender Mann" aria-label="Emoji: Tanzender Mann">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💃" title="Tanzende Frau" aria-label="Emoji: Tanzende Frau">- Negative expectation: market in backwardation https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙃" title="Auf den Kopf gestelltes Gesicht" aria-label="Emoji: Auf den Kopf gestelltes Gesicht">" class="img-responsive" style="max-width:100%;"/>