1/ Thread on the Terra $LUNA ecosystem.

Imagine if every time USDT, USDC, DAI or any other ETH based stable coin was minted it required an equal amount burned in ETH?

Welcome to LUNA’s tokenomics, a fascinating design that has burnt >100m (~22%) Luna over the past 3 months.

Imagine if every time USDT, USDC, DAI or any other ETH based stable coin was minted it required an equal amount burned in ETH?

Welcome to LUNA’s tokenomics, a fascinating design that has burnt >100m (~22%) Luna over the past 3 months.

2/ 1$ worth of UST minted equals $1 worth of Luna burned.

So let’s try to contextualize UST demand and the 100m Luna we have burned over the past few months.

Check out @SmartStake for the awesome dashboard.

So let’s try to contextualize UST demand and the 100m Luna we have burned over the past few months.

Check out @SmartStake for the awesome dashboard.

3/ Terra is a PoS layer 1 that currently has 2 main protocols.

A savings account through Anchor $ANC (20% fixed yield) and an investment account through Mirror $MIR (synthetic equities).

I will write about $MIR and $ANC in a separate thread for now we will focus on $UST.

A savings account through Anchor $ANC (20% fixed yield) and an investment account through Mirror $MIR (synthetic equities).

I will write about $MIR and $ANC in a separate thread for now we will focus on $UST.

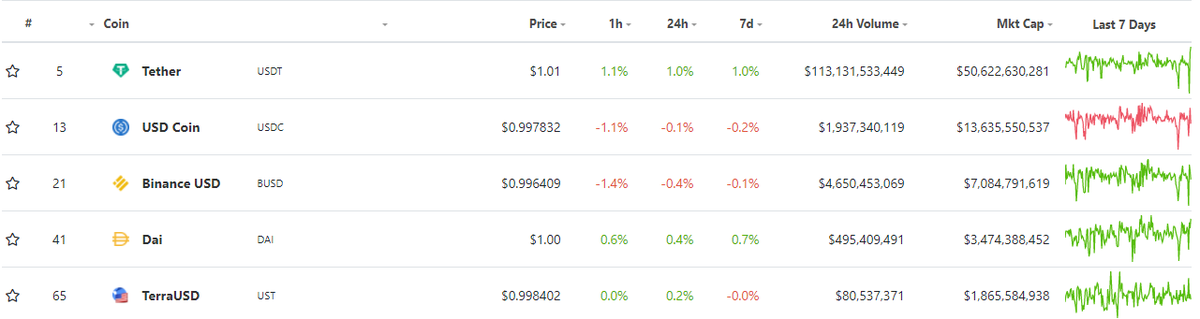

4/ UST is currently the 5th largest stable coin with a mcap over $1.87b and ~$100m daily trading volume, it has done this with only 7 exchange listings.

The Luna ecosystem has generated massive demand for UST with no major listings, this indicates clear product market fit.

The Luna ecosystem has generated massive demand for UST with no major listings, this indicates clear product market fit.

5/ In the past 90 days we have seen an explosion of UST demand, growing from $250mm to $1.87b an average of $18m UST/day being minted and thus $18m worth of Luna being burned.

I expect this to accelerate with more protocol releases and cross chain composability with Columbus-5

I expect this to accelerate with more protocol releases and cross chain composability with Columbus-5

6/ Thinking about these numbers they are insane. Luna’s current circulating supply is 376m coins (254m of which are staked) leaving the liquid supply to be 122m.

Even at Luna’s price today of 17.50, based on the 90 day average 1.02m Luna would be burned per day...

Even at Luna’s price today of 17.50, based on the 90 day average 1.02m Luna would be burned per day...

7/ 1.02m/122m = .83% burn per day of liquid supply and 1.02/376 = .27% of circulating supply.

Companies like Apple and Exxon, renowned for their share buyback programs have bought back ~20-25% of their shares over 5-10 years!

Luna is doing those same numbers in 100-125 days.

Companies like Apple and Exxon, renowned for their share buyback programs have bought back ~20-25% of their shares over 5-10 years!

Luna is doing those same numbers in 100-125 days.

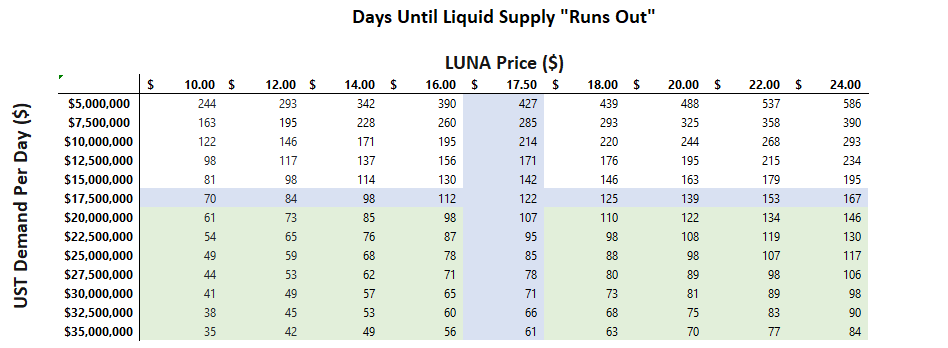

8/ Applying the daily average demand we can get a sensitivity table showing us the hypothetical days until “liquid coins” would run out.

In our case with the 90 day average demand of $18m at $17.50/Luna we have a 122 days before Luna must go up (assuming all else equal).

In our case with the 90 day average demand of $18m at $17.50/Luna we have a 122 days before Luna must go up (assuming all else equal).

9/ We are currently minting around 7-8m UST/day (past two weeks), we expect this to pick up as new protocols are launched + Anchor & Mirror integrations.

@d0h0k1 expects UST market cap to be $10b by EOY implying an average UST demand of 32m/day for the rest of the year.

@d0h0k1 expects UST market cap to be $10b by EOY implying an average UST demand of 32m/day for the rest of the year.

10/ Showing a similar table but now looking at EOY UST market cap. If UST does indeed reach @d0h0k1 goal of $10b we get some interesting price possibilities.

For instance Luna at $50 given this 32m/day burn rate would make the days until we “run out of liquid supply” only 188.

For instance Luna at $50 given this 32m/day burn rate would make the days until we “run out of liquid supply” only 188.

11/ We would need an acceleration in UST growth to reach these numbers, but it does seem possible.

During March due to the Anchor release 30.2m UST/Day was minted so to think that we could reach those numbers again with the release of new protocols seems reasonable.

During March due to the Anchor release 30.2m UST/Day was minted so to think that we could reach those numbers again with the release of new protocols seems reasonable.

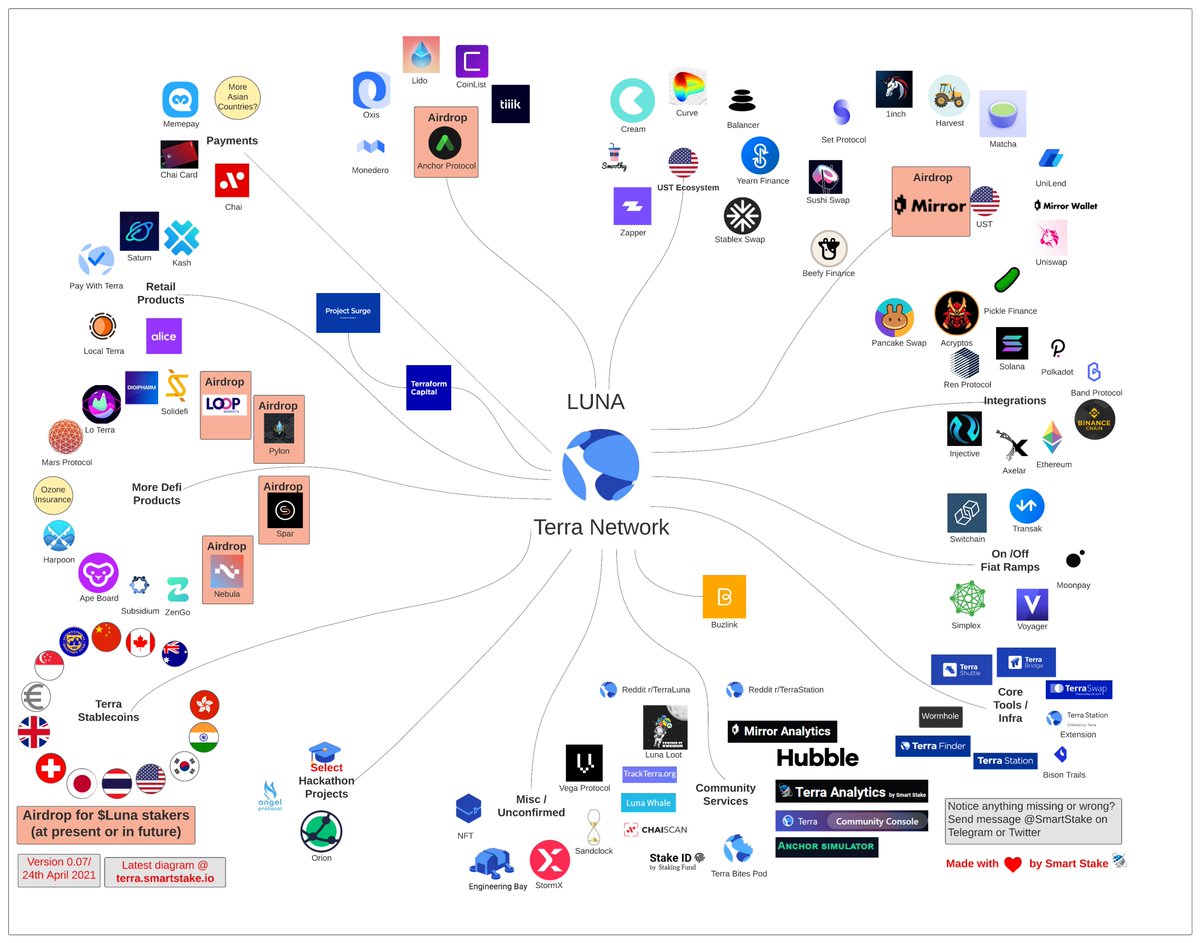

12/ We are very excited about all the projects being developed on Terra, Do Kwon has voiced rapid growth from third party developers, take a look at what is coming soon.

Remember, everything in the Terra ecosystem ultimately flows back to Luna as all of the protocols use UST.

Remember, everything in the Terra ecosystem ultimately flows back to Luna as all of the protocols use UST.

13/ By understanding UST dynamics the Luna investment thesis can be narrowed down to the following:

Increase in UST demand = more Luna burn = Luna price appreciation.

This is also not even factoring in the ~15% APR Luna currently yields from staking rewards + airdrops.

Increase in UST demand = more Luna burn = Luna price appreciation.

This is also not even factoring in the ~15% APR Luna currently yields from staking rewards + airdrops.

14/ Closing Thoughts:

The Luna ecosystem has just really started with only 2 major applications, yet this has caused the creation of over 1.5b UST in the past 3 months.

As Luna continues to attract developers, new protocols and UST demand will explode, we are still early.

The Luna ecosystem has just really started with only 2 major applications, yet this has caused the creation of over 1.5b UST in the past 3 months.

As Luna continues to attract developers, new protocols and UST demand will explode, we are still early.

15/ UST market cap has grown to 1.87b with only 7 exchange listings (biggest of which being KuCoin).

Most of the top stable coins have 4-5 times more listing on bigger exchanges.

Liquidity is key in DeFi, a UST listing on an exchange like Binance would be a massive catalyst.

Most of the top stable coins have 4-5 times more listing on bigger exchanges.

Liquidity is key in DeFi, a UST listing on an exchange like Binance would be a massive catalyst.

16/ TLDR

Luna is burning .80% of its liquid supply daily, this dwarfs any stock buyback program equity markets have ever seen.

If UST demand continues with Luna at $17.50 we will “run out” of liquid Luna in ~122 days, all else equal - price must go up.

Luna is burning .80% of its liquid supply daily, this dwarfs any stock buyback program equity markets have ever seen.

If UST demand continues with Luna at $17.50 we will “run out” of liquid Luna in ~122 days, all else equal - price must go up.

/END

Thank you for reading and follow for more DeFi content. Threads on Mirror and Anchor coming soon.

*Not Financial Advice DYOR*

Thank you for reading and follow for more DeFi content. Threads on Mirror and Anchor coming soon.

*Not Financial Advice DYOR*

Read on Twitter

Read on Twitter