Great piece by @davies_will on the centrality of the housing market to the UK’s political economy. https://www.theguardian.com/commentisfree/2021/apr/26/boris-johnson-tories-economy-rising-house-prices-wages">https://www.theguardian.com/commentis...

This bit is spot on. The housing market has nothing to do with wealth creation and everything to do with wealth redistribution. As the pandemic has shown, it’s perfectly possible for these dynamics to continue or even accelerate without economic growth. It’s a zero sum game.

When house prices rise, this isn’t a cost-free windfall— it’s pure economic rent. It’s a transfer of wealth from those who don’t own property to those who do. As I say here, “this wealth has come straight out of the pockets of those who don’t own property” https://neweconomics.opendemocracy.net/time-call-housing-crisis-really-largest-transfer-wealth-living-memory/">https://neweconomics.opendemocracy.net/time-call...

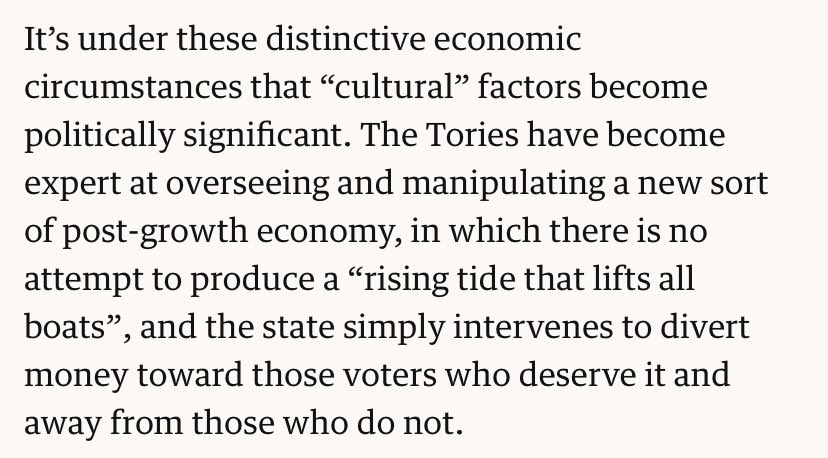

So instead of asset owners reaping the benefits of economic growth while everyone else stands still, asset owners are prospering *at the direct expense* of non-owners, who are being left materially worse off.

One thing I’d add: Will says that rising house prices don’t provide a commensurate improvement to quality of life to rising incomes. This is true, but I think it’s also worth stressing that housing wealth can and does materially improve living standards, in various ways.

One reason is that the relationship between wealth and income has been blurred by equity release products. The amount of equity withdrawn by homeowners has skyrocketed in the last decade, and totalled £5bn in 2019. This is a lot of purchasing power.

Another reason is that housing equity provides collateral to access credit and buy more property (or make other investments). And so housing wealth opens up new income streams through access to leverage.

I wrote about some of these dynamics, and how we might go about addressing them, in my @Politics4Many chapter here: https://politicsforthemany.co.uk/the-new-foundations-a-future-built-on-democracy/">https://politicsforthemany.co.uk/the-new-f...

Read on Twitter

Read on Twitter