1/11: Yet another new all-time high in EUAs this morning (€47.73/t) so seems like a good moment to offer a reminder on the new pricing paradigm we have entered and how underlying fundamentals justify the market& #39;s bullishness ( @CarbonBubble, @CarbonPulse, @RedshawAdvisors).

2/11: The EU will very soon have a legally binding target for net zero by 2050, and the EU-ETS is the principal policy tool for delivering this public-policy objective. Meanwhile, the introduction of the MSR in 2019 has made the market much more confident the EU-ETS can deliver.

3/11: The European Commission states that we cannot get to net zero by 2050 without green hydrogen playing a significant role in the final energy mix. I wrote an article for the FT on the implications of this for EUA prices back in October: https://www.ft.com/content/ecdeabd5-e013-44e1-b885-0b7264923e29">https://www.ft.com/content/e...

4/11: I also set out these arguments in much greater detail in an in-depth report that was also published last October: https://investors-corner.bnpparibas-am.com/markets/green-hydrogen-is-set-to-be-a-key-pillar-of-the-eus-sustainable-development-and-emissions-reduction-plans/">https://investors-corner.bnpparibas-am.com/markets/g...

5/11: TLDR: If net zero requires green hydrogen at scale, then the EU carbon price will have to rise to the level required to make green hydrogen competitive, first with grey hydrogen for use as a feedstock, and subsequently as a direct energy carrier to compete with oil and gas.

6/11: So, to solve for the carbon price that delivers net zero, we need the carbon price that makes green hydrogen competitive with grey hydrogen in 2030 (which is the Commission& #39;s target date for producing 10Mt pa of green hydrogen).

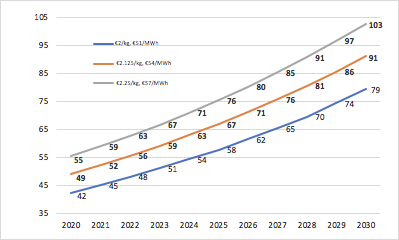

7/11: There are obviously a lot of assumptions you need to make to estimate that carbon price, but my range is €79/t-€103/t, with a base case 2030 EUA price of €91/t. This is therefore the price consistent with a trajectory to net zero by 2050.

8/11: To calculate fair value today, you then need to discount back to 2021 at the appropriate discount rate. If you assume a discount rate of 6% (average WACC of EU-ETS companies) then you get a fair value range for Dec-21 EUAs today of €45-€59/t (i.e. the range we are now in)

9/11: BUT, in the zero-interest rate world we are currently living in, the market is not discounting back the future value of any asset at 6%, so why would it be any different for EUAs?

10/11: CONCLUSION: EUAs have entered a new pricing paradigm based on making green hydrogen competitive by 2030 and so putting EU on a net-zero 2050 trajectory. Fair-value for Dec-21 is €42-€59/t but with current interest rates market could overshoot upper end of this range.

11/11: POSTSCRIPT: Yes, we will probably get a bit of a correction in May once last-minute 2020 compliance buying is out of the way but we are now definitively in a new pricing paradigm and with the EU presenting its climate package in June risk will revert to the upside in H2.

unroll @threadreaderapp

Read on Twitter

Read on Twitter