$AFRM Thread....

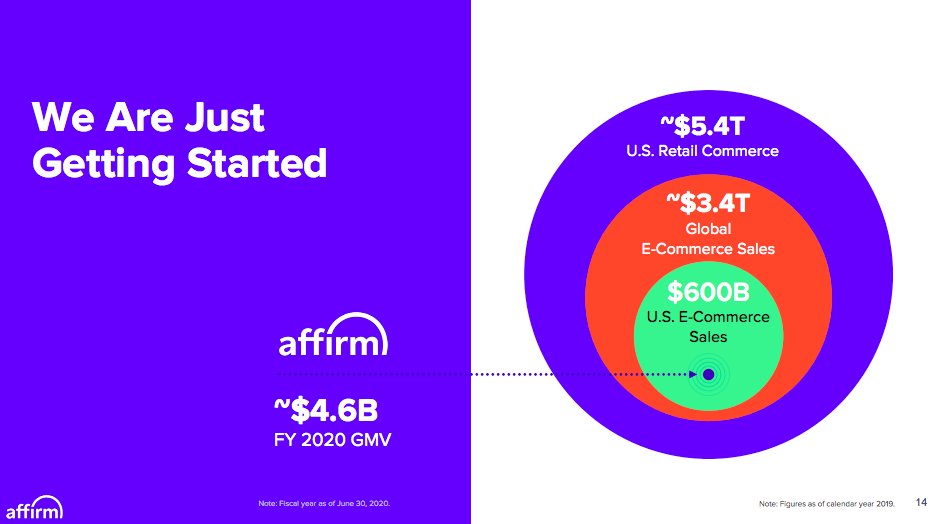

According to $AFRM S-1, in North America, “buy now pay later” market share is expected to triple to 3% of the e-commerce payments market by 2023.

Let& #39;s dive into $AFRM....

According to $AFRM S-1, in North America, “buy now pay later” market share is expected to triple to 3% of the e-commerce payments market by 2023.

Let& #39;s dive into $AFRM....

Founded in 2012.

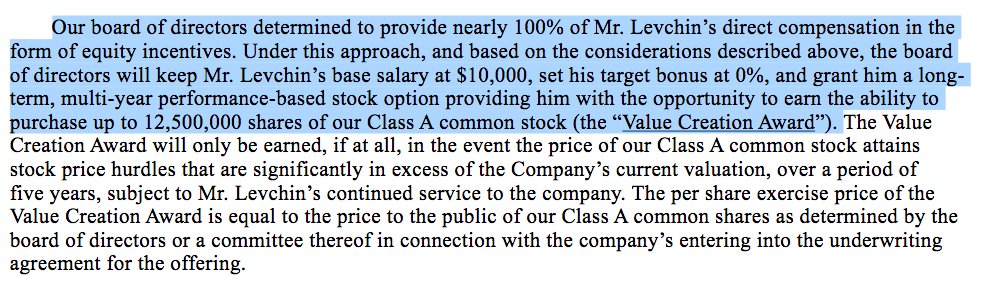

Max Levchin (one of Paypal mafia) is a founder and CEO. He owns 13.1% in the company. According to S-1, almost 100% of Levchin& #39;s total compensation is in equity incentives (Talking about skin in the game...)

Max Levchin (one of Paypal mafia) is a founder and CEO. He owns 13.1% in the company. According to S-1, almost 100% of Levchin& #39;s total compensation is in equity incentives (Talking about skin in the game...)

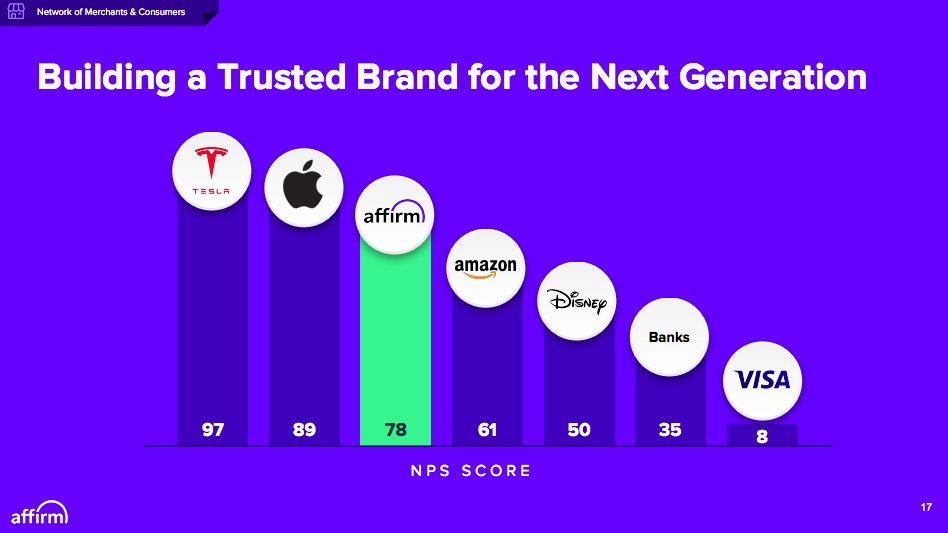

$AFRM is a point-of-sale BNPL solution that offers no hidden or late fees. They offer 0% APR option and customers know up-front how much interest they will get charged. This explains their high NPS score of 72

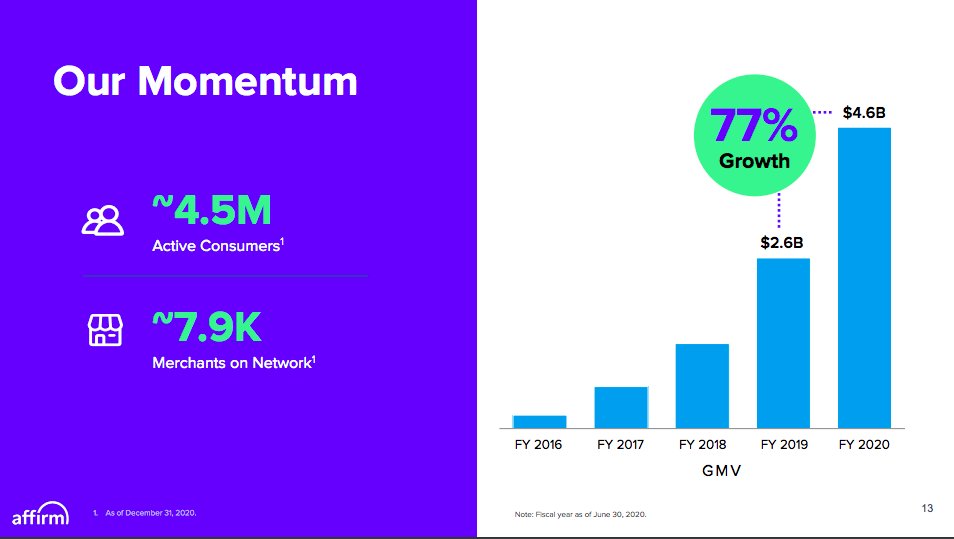

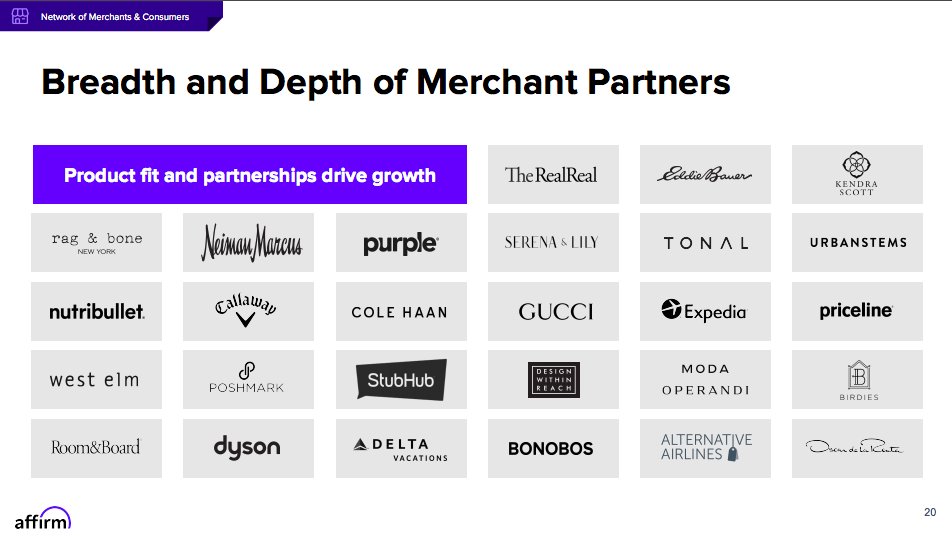

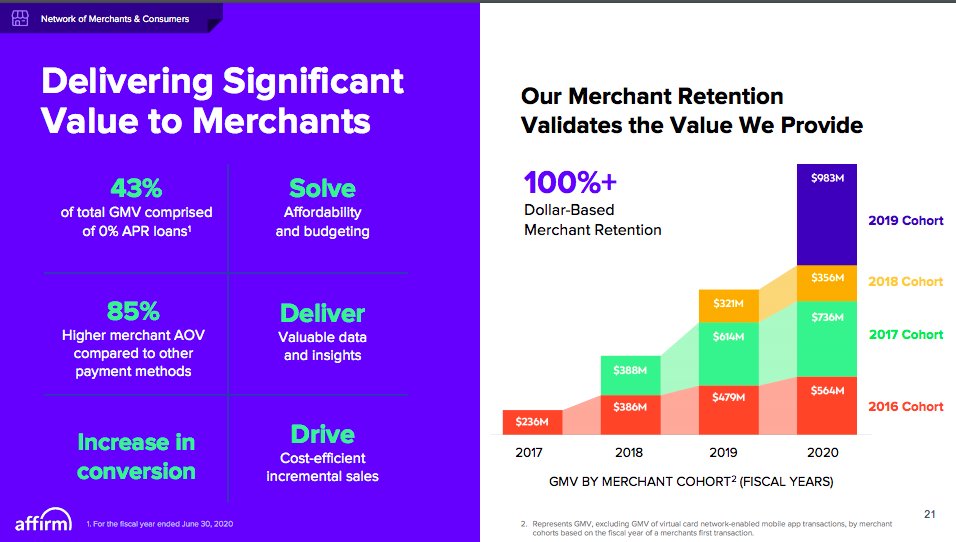

Currently, $AFRM has $4.5 million active customers and 7,900 merchants as of December 2020. They also have exclusive partnership with Shopify. According to $AFRM S-1, their customers consist of Millenials (48%), Gen-X (32%), Baby boomers (12%) และ Gen Z (7%)...

Competitive edge:

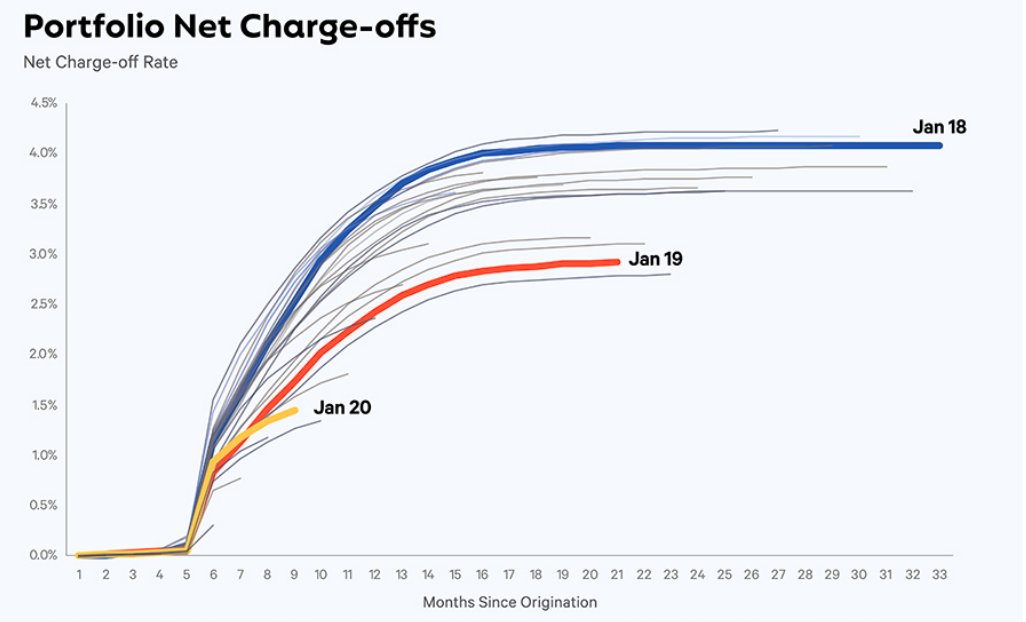

$AFRM uses AI/ML to create risk model which allows the company to have higher approval rate + lower fraud rate than traditional credit underwriting model. (20% higher according to S-1). This also allow their delinquency rate to improve over 66% from almost 3%

$AFRM uses AI/ML to create risk model which allows the company to have higher approval rate + lower fraud rate than traditional credit underwriting model. (20% higher according to S-1). This also allow their delinquency rate to improve over 66% from almost 3%

in 2019 to 1.1% in 2020. The portfolio Net Charge-offs provided in S-1 also shows that the model is working and is constantly improving....

$AFRM GMV mix includes wide range of industry. However, they have a high concentration risk from $PTON which comprises 30% of their GMV mix and 50% of their merchant revenue....

$AFRM flywheel

More customers -> larger ecosystem -> more merchants -> more products -> more transactions -> better model -> better experience

More customers -> larger ecosystem -> more merchants -> more products -> more transactions -> better model -> better experience

Risks -

$PTON revenue concentration risk

Lots of competitions in the BNPL space...seems like $AFRM is moving slower than $AFTPY as $AFTPY is currently having over 10k merchants compared to 7k merchants of $AFRM...

$AFRM GTM strategy seems slow...can someone please explain why?

$PTON revenue concentration risk

Lots of competitions in the BNPL space...seems like $AFRM is moving slower than $AFTPY as $AFTPY is currently having over 10k merchants compared to 7k merchants of $AFRM...

$AFRM GTM strategy seems slow...can someone please explain why?

In terms of valuation, $AFRM is currently trading at $19 B in market cap while $AFTPY is $27.34 B (as of April 23, 2021). EV/Sales (NTM) of $AFRM is 23.8x while $AFTPY is $28.7x. $AFTPY has better stock performance than $AFRM as well....

(Credit: chart from Koyfin)

(Credit: chart from Koyfin)

Read on Twitter

Read on Twitter